BUSINESSNEWS

13

INTERNATIONAL

ANDSPECIALIZED TRANSPORT

■

JANUARY 2015

Reviewof 2014

seriesof all-timehighs, taking it

above18,000points for the first

time. TheNikkei 225was also

strong,witha9.69% increase

to take it to someof thehighest

post-crisis levels it has seen.

Unlike theUSA, however, the

economicoutlook in Japan is

poor and thismarket recovery

isunlikely tobe sustained.

Itwas amixedyear for

cranemanufacturers. Somebig

losses in shareprices started

from themiddleof theyear as

manufacturers likeManitowoc

andTerex reporteddeclining

demand inmanykey emerging

markets. The strongest

performersweremajorChinese

groups, for example, Liugong,

SanyandXCMG.AtXCMG,

the sharepricemore than

Taken as awhole,

2014was a fairly

flat year for global

stockmarkets as

growth faltered in

the secondhalf.

The resurgence

of key Chinese

manufacturers’

equities, however,

lifted the crane

industry. CHRIS

SLEIGHT reports

doubled in2014, as it andmany

of itspeerswerepulledalongby

abigacross-the-board surge in

Chinese shareprices.Whether

this remarkablegrowth is

rooted inagenuine economic

recovery inChina, or if it is the

result ofmarket speculation

remains tobe seen, but the

overall effect providedagreat

boost to

IC

’s Share Index.

The

IC

Share Indexgrew just

shyof 20% last year, despite the

losses for keyplayers, including

Manitowoc, Palfinger and

Terex. There are twowaysof

reading this:One is that there

is agenuine recoveryon the

horizon, and that crane shares

rose inanticipation. Theother

is that last year’s growthwas

about stockmarket speculation.

Given thepatchynatureof

thegrowth, and the reported

weakness in endmarkets,

speculation looksmore likely.

Currencies

The economic recovery in the

USA, quantitative easing in

Japan, and theweakeningEuro-

zone economy,meant theUS

Dollar strengthened in2014. It

wasup14.7%against theYen

and12.3%against theEuro,

withmoremoderategains

against theUKPoundand

ChineseYuan.

Those losseswill be

welcomedby exporters in

Europe and Japanbecause

theywillmake theirproducts

moreprofitable inDollar

markets.With theUSFederal

Reserve likely to start raising

interest rates in2015, those

exchange ratedifferences could

continue togrow.

■

L

ast year startedbrightly

enough for theworld’s

stockmarkets.Muchof

thegrowth in the first half of

theyear, however,waswiped-

out lateronas global economic

growth slowed.

Had it not been for a rally

in the finalweeks, driven

by theunexpected fall inoil

prices, therewouldhavebeen

indicatorsother than theFTSE

100 ending theyear innegative

territory. That drop, however,

allowedmanykey indexes

to springback, and loweroil

prices couldbe akeydriverof

economicgrowth in2015.

The stand-out performance

last yearwas for theDow,

whichgained8.22% in2014

and ended theyear settinga

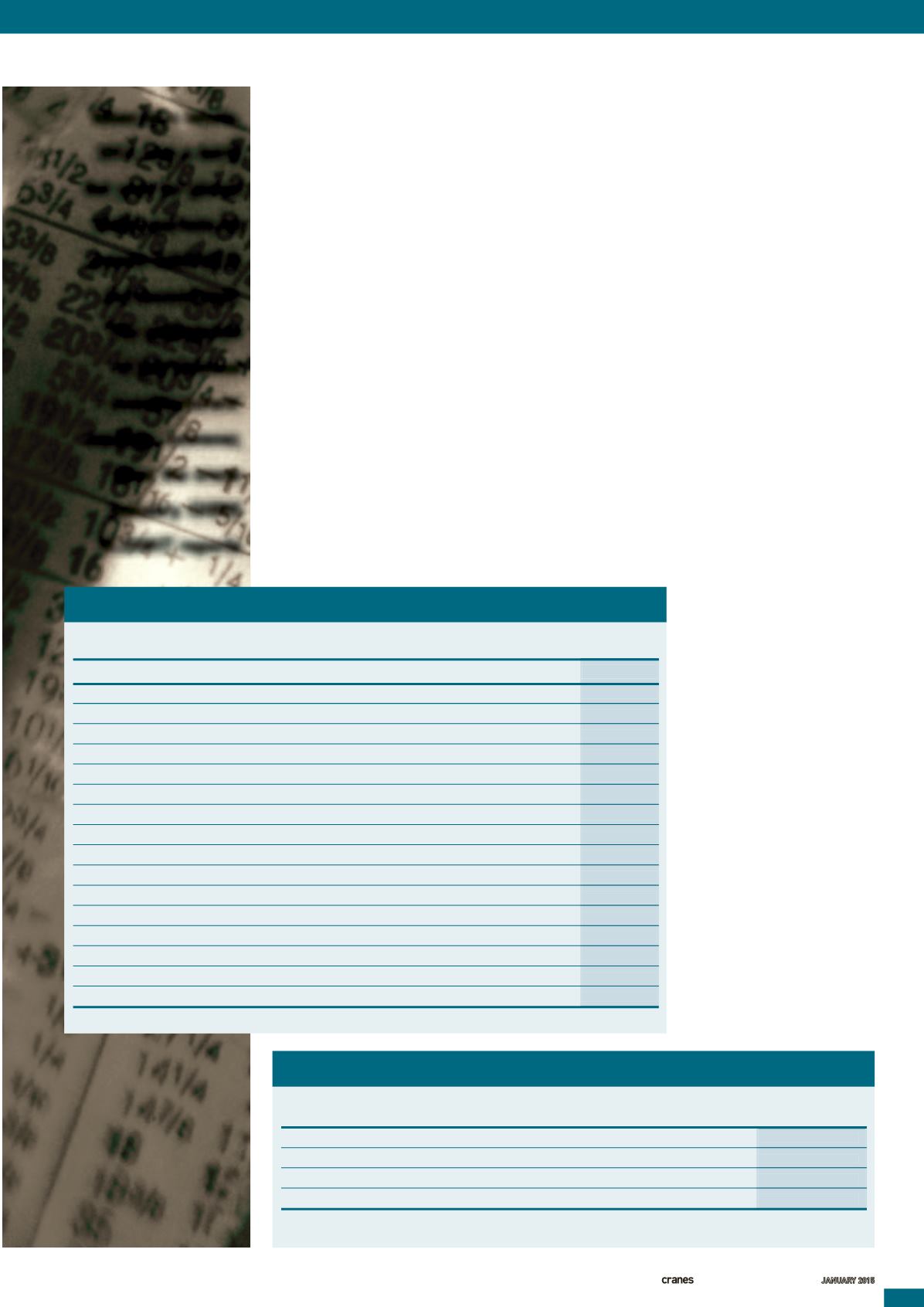

2014 ICSHARE INDEX

VALUE

VALUE

VALUE

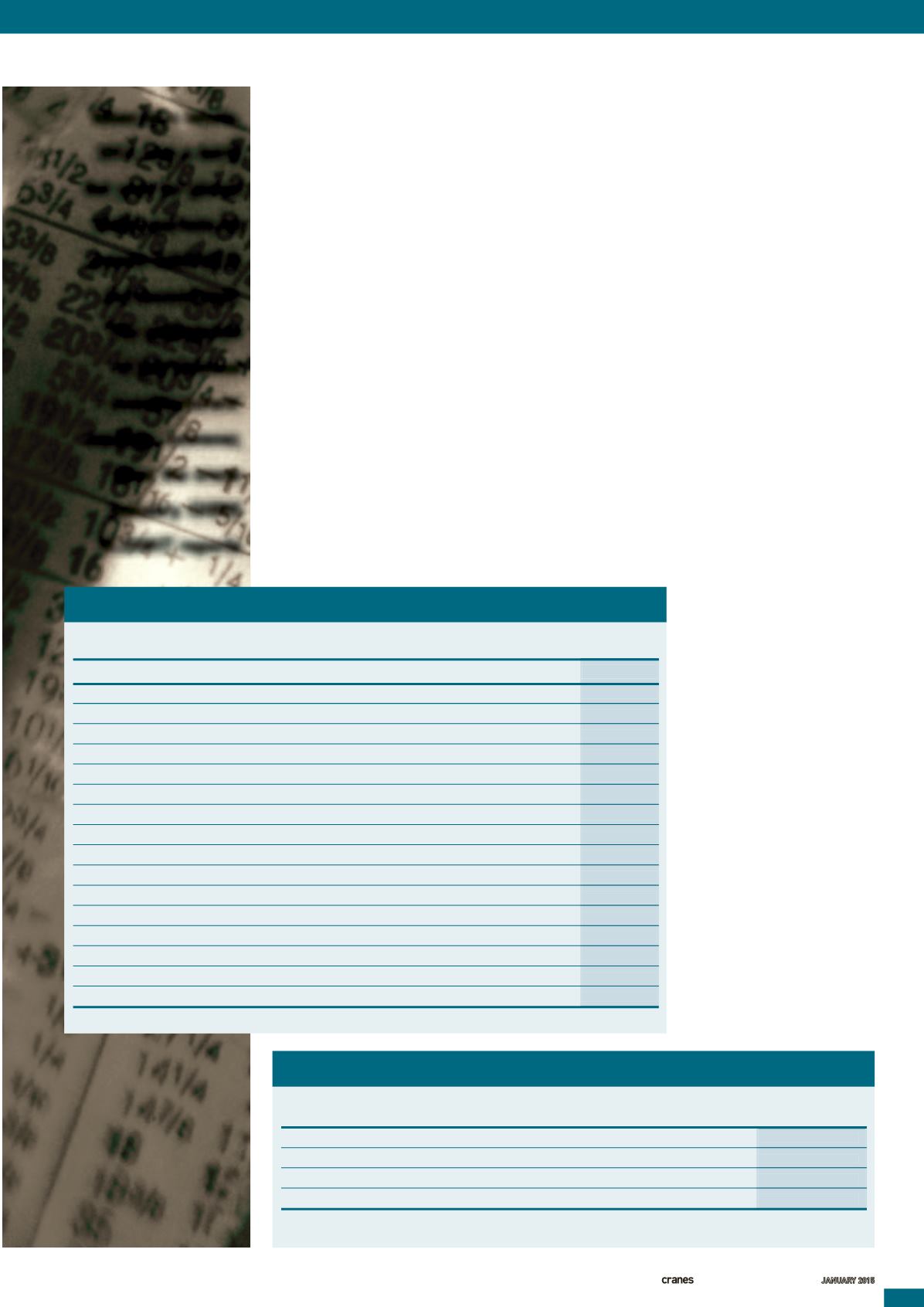

CURRENCY

ATSTART

ATEND

CHANGE

%CHANGE

CNY

6.052

6.219989

0.1680

2.78

€

0.7346

0.8250

0.0903

12.29

Yen

104.54

119.90

15.36

14.70

UK£

0.6107

0.6455

0.0348

5.69

Period:Weeks 1 to52

EXCHANGERATES – VALUEOFUS$

PRICE

PRICE

PRICE

%

STOCK

CURRENCY

ATSTART

ATEND

CHANGE

CHANGE

IC

Share Index*

65.44

78.45

13.01

19.88

Legacy ICShare Index**

395.97

348.50

-47.48

-11.99

DowJones Industrial Average

16470

17823

1353

8.22

FTSE 100

6722

6566

-156

-2.32

Nikkei 225

15909

17451

1542

9.69

Hitachi ConstructionMachinery

YEN

2182

2591

409

18.72

Konecranes

€

25.97

23.98

-1.99

-7.66

KobeSteel

YEN

179

208

29

15.92

Liugong

CNY

5.95

11.78

5.83

97.90

Manitowoc

US$

23.46

20.31

-3.16

-13.45

Palfinger

€

29.73

20.40

-9.33

-31.37

SanyHeavy Industry

CNY

6.07

10.52

4.45

73.31

Tadano

YEN

1397

1487

90

6.44

Terex

US$

41.28

27.74

-13.55

-32.81

XCMG

CNY

7.23

15.00

7.77

107.47

YongmaoHolding

SGD

0.19

0.12

-0.07

-38.50

Zoomlion

CNY

5.16

6.99

1.83

35.37

*

IC

Share Index, 1 Jan2011 = 100

**Legacy

IC

Share Index, endApril 2002 (week 17) = 100