The global top 200

17

july-august 2014

international

construction

NEWS REPORT

groups to form Salini Impregilo (123). This deal only took effect

last year, so its impact on the company’s ranking is likely to be

more pronounced in the 2015 edition of the Top 200.

Other acquisitions that played a part in changes to the

rankings this year included Daiwa House’s (11) acquisition of

fellow Japanese company Fujita, which was placed 93rd in the

2013 edition of the Top 200. Although Fujita had revenues of

some US$ 3.5 billion per year, this did not make as significant

a change to the standings at the top of the table as the Shaw

acquisition did for mid-ranking Chicago Bridge & Iron.

It did however see the Japanese house builder overtake Fluor

(12) for 11th place, and once again underlined the unusual

market situation in Japan where specialist house builders like

Daiwa and Sekisui House (17) are larger in revenue terms than

general contractors.

The highest-placed Japanese general contractor in this year’s

ranking was Obayashi (20), which overtook the previous

highest-placed Japanese generalist in last year’s ranking, Kajima

(24).

This also raises the interesting point that despite the Japanese

‘Abenomics’ monetary policy to stimulate the national economy,

Japanese construction companies had a poor showing in this

year’s Top 200. Of the 29 listed, 26 lost places, with only three

moving up the rankings.

Compare this to the 2013 edition of the Top 200, where there

were 32 Japanese companies listed, some 27 of which improved

on the previous year. Two such pronounced moves for a national

grouping of contractors is unusual in the Top 200, but it may

be related to a surge in work in 2012 related to reconstruction

following the 2011 earthquake and tsunami. This could well

have boosted standings in the 2013 edition of the Top 200,

before seeing them retreat this year.

Japanese companies made up 30% of the companies that lost

places in the standings this year. However, the biggest faller was

Finnish company YIT (145). This was not due to a performance

issue, but was related to the company’s demerger of its Building

Systems business, which is now called Caverion, and which falls

outside the scope of the Top 200 ranking.

This division previously contributed some € 2.8 billion (US$

3.8 billion) to YIT’s revenues. Add these back in and YIT would

have been ranked no. 61 in this year’s Top 200 – the same

position as in last year’s edition.

There was no clear pattern among the other heavy fallers, with

them spread across different geographies and disciplines within

the construction industry.

In terms of newcomers to the Top 200, there were 11 new

entries in this year’s Top 200, the highest of which was Parsons

Corporation (127) of the US, followed by resurgent UK house

builder Berkeley Group (135). The addition of Parsons to the

Top 200 was as the result of additional research by

iC

to make

the Top 200 as accurate and inclusive as possible. Another

company to benefit from this initiative was Peru’s Grana y

Montero (152), which is listed in the Top 200 for the first time.

Next year?

It is interesting to reflect that despite a slowdown in the Chinese

construction market following the stimulus-driven boom of

2009 – 2011, the country’s largest contractors continue to

go from strength to strength in terms of their revenues. This

illustrates the fact that even ‘slow’ conditions in China still

equate to growth which contractors in other parts of the world

can only eye with envy.

Indeed, it seems that once again domestic market conditions

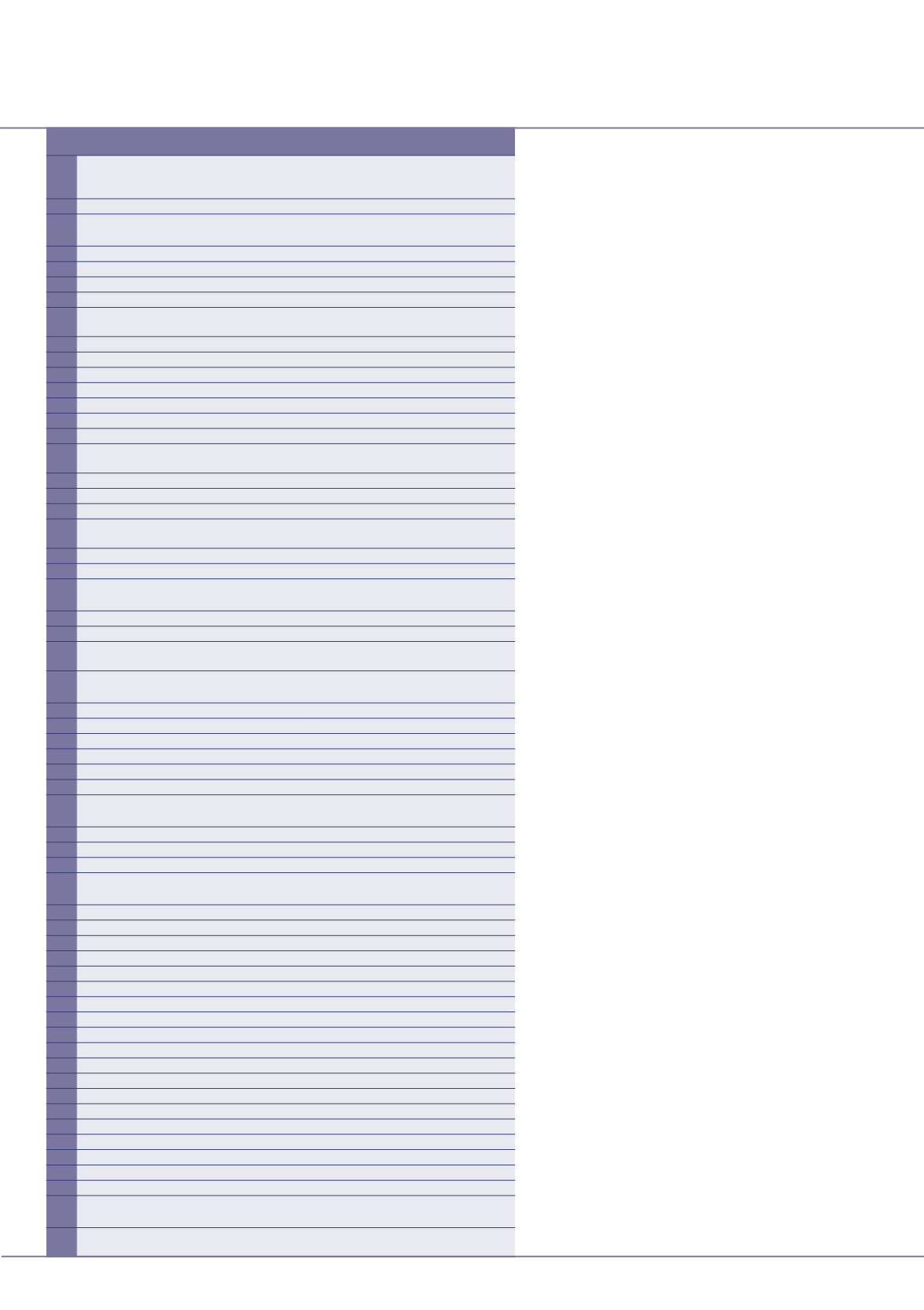

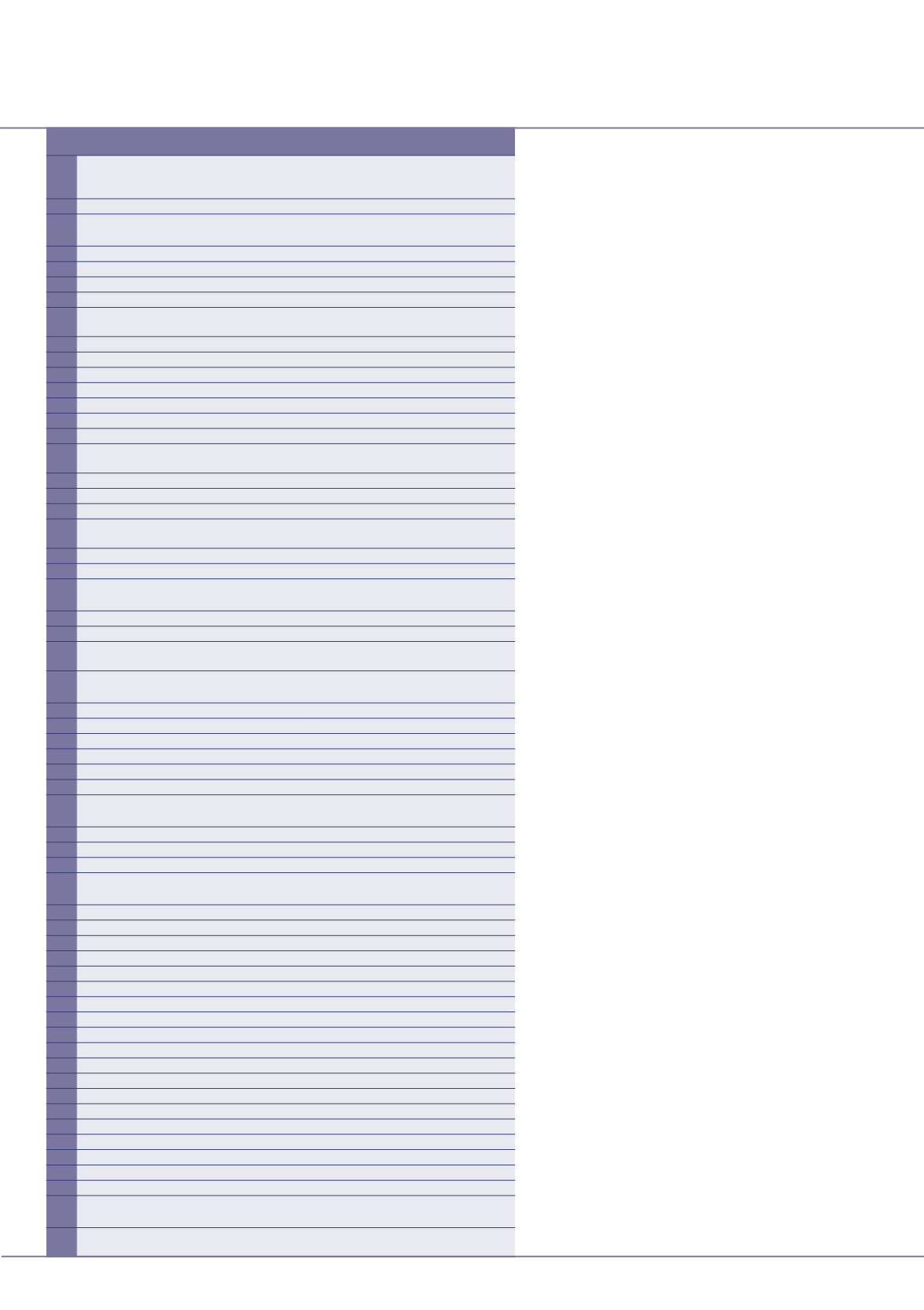

* = estimate

>

Sales

(US$ million)

Company

Country 2013 Change Website

115

3204

China Petroleum

Engineering &

Construction*

China 147

32

116

3177

Astaldi

Italy 116

Â

117

3151

Brookfield Multiplex

Australia 87

30

.

com

118

3140

Glavstroy*

Russia 136

18

119

3072

Mota-Engil

Portugal

125

6

120

3039

Kier Group

UK 121

1

121

3028

Besix*

Belgium 134

13

122

3011

Compagnie

D’Entreprises CFE SA

Belgium 145

23

123

3003

Salini Impregilo

Italy 131

8

124

2992

McCarthy Building

US 146

22

125

2979

Aecon Group

Canada 122

3

126

2945

Lemminkäinen

Finland 124

2

127

2922

Parsons Corporation

US

- NEW

128

2920

RZD Stroy*

Russia 120

8

129

2820

Jan De Nul

Belgium 110

19

130

2800

Techint Engineering &

Construction

Italy 166

36

131

2729

Heijmans

Netherlands 118

13

132

2727

Camargo Corrêa

Brazil

105

27

133

2674

Toll Brothers

US 171

38

134

2659

McDermott

International

US

98

36

135

2535

Berkeley Group

UK

- NEW

136

2464

Andrade Gutierrez

Brazil

64

72

137

2458

WBHO

South

Africa

158

21

138

2450

DPR Construction*

US 167

29

139

2357

Toyo Engineering (TEC)

Japan 128

11

140

2357

Maeda Road

Construction

Japan 137

3

141

2355

Hanjin Heavy Industries

& Construction

South

Korea

153

12

142

2316

Tokyu Construction

Japan 129

13

143

2316

ICA

Mexico 96

47

144

2316

TBI Holdings BV

Netherlands 135

9

145

2314

YIT

Finland 61

84

146

2300

Brasfield & Gorrie*

US 169

23

147

2295

Galliford Try

UK 155

8

148

2267

Granite Construction

US 161

13

com

149

2253

Homex

Mexico 156

7

150

2250

M.A.Mortenson*

US 142

8

151

2250

Keller Group

UK 170

19

152

2208

Grana y Montero

Peru

- NEW

.

com.pe

153

2200

Hensel Phelps*

US 148

5

154

2200

J.E. Dunn Group*

US 149

5

155

2179

Van Oord

Netherlands 159

4

156

2164

Teixeira Duarte

Portugal

181

25

157

2139

Salfacorp

Chile 157

Â

158

2114

Ryland Group

US

- NEW

159

2102

Strukton Groep

Netherlands 186

27

160

2097

KB Home

US 198

38

161

2091

Comsa EMTE

Spain 151

10

162

2089

Maire Tecnimont

Italy 133

29

163

2051

LSR

Russia 168

5

164

2019

Tekfen Holding

Turkey 152

12

165

2008

ISG

UK 175

10

166

2000

Black & Veatch*

US 107

59

167

1992

Max Boegl

Germany 162

5

168

1977

Okumura Corporation

Japan 143

25

169

1973

Toa

Japan 165

4

170

1943

Swietelsky

Austria 177

7

171

1942

Graham Construction*

Canada 176

5

172

1940

Standard Pacific

US

- NEW

-

chomes.com

173

1934

JM

Sweden 178

5