BUSINESS HIGHLIGHTS

EUROPE

Lafarge and Holcim list

assets for sale

Major materials businesses to be divested as

industry giants seek merger approval

H

olcim and Lafarge have released a list of the most significant assets that

will be put up for sale to help the two companies allay competition

concerns over their proposed merger.

The largest disposals are planned for Europe, where both companies have

a substantial presence, and include most of Holcim’s French businesses, all

of Lafarge’s German activities, and Lafarge’s UK footprint, which is through

the Lafarge Tarmac joint venture with Anglo American. Anglo American has

agreed to sell its 50% stake in the business. A Lafarge cement plant in Austria

and the company’s assets in Romania will go up for sale as well as Holcim's

businesses in Hungary and Serbia.

Outside Europe, Holcim’s assets in Canada and Mauritius will also go up

for sale. In the Philippines, the two companies are looking at combining their

businesses with some divestments. Meanwhile in Brazil, Holcim and Lafarge

said they would put a proposal to the regulator, Conselho Administrativo de

Defesa Econômica (CADE). The situation is complex due to a set of fines

and forced divestments previously announced by CADE for alleged market

abuses.

AUSTRALIA

Leighton plan

Leighton Holdings has outlined a

new strategic plan which will see

the contractor establish a single,

dedicated construction business,

alongside mining, public private

partnership (PPP) and engineering

divisions. The company said it

was considering the future of its

services, property and John Holland

businesses.

The news came as chairman

and non-executive director, Bob

Humphris, retired from his post.

The role of chairman has now been

taken by CEO Marcelino Fernández

Verdes from parent company

Hochtief. He has been CEO since

March when Hochtief dismissed

the existing Leighton management

and launched a bid to increase its

stake in Leighton from 58.77% to

73.82%.

PORTUGAL

London listing

Mota-Engil Africa, a subsidiary of

Portuguese contractor Mota-Engil

SGPS, is to seek a listing on the

London Stock Exchange. Existing

shareholders in Mota-Engil will

have preferential access to the Initial

Public Offering (IPO) of Mota

Engil Africa equity.

Mota Engil SGPS said it was

looking to float at least 25% of

its African subsidiary, which has

revenues of € 1 billion (US$ 1.35

billion) and a backlog of € 1.7

billion (US$ 2.3 billion). Mota-

Engil Africa has been active in Sub-

Saharan Africa since 1946 where it

employs 14,600 people.

GERMANY

Approval granted

Holcim has received approval

from the European Commission

for its proposed acquisition of

Cemex’s businesses in western in

Germany. The deal is one in a series

of transactions between Holcim

and Cemex in Europe, the Spanish

component of which is still awaiting

Commission approval.

Holcim’s transactions with Cemex

are separate from its intention to

merge with Lafarge.

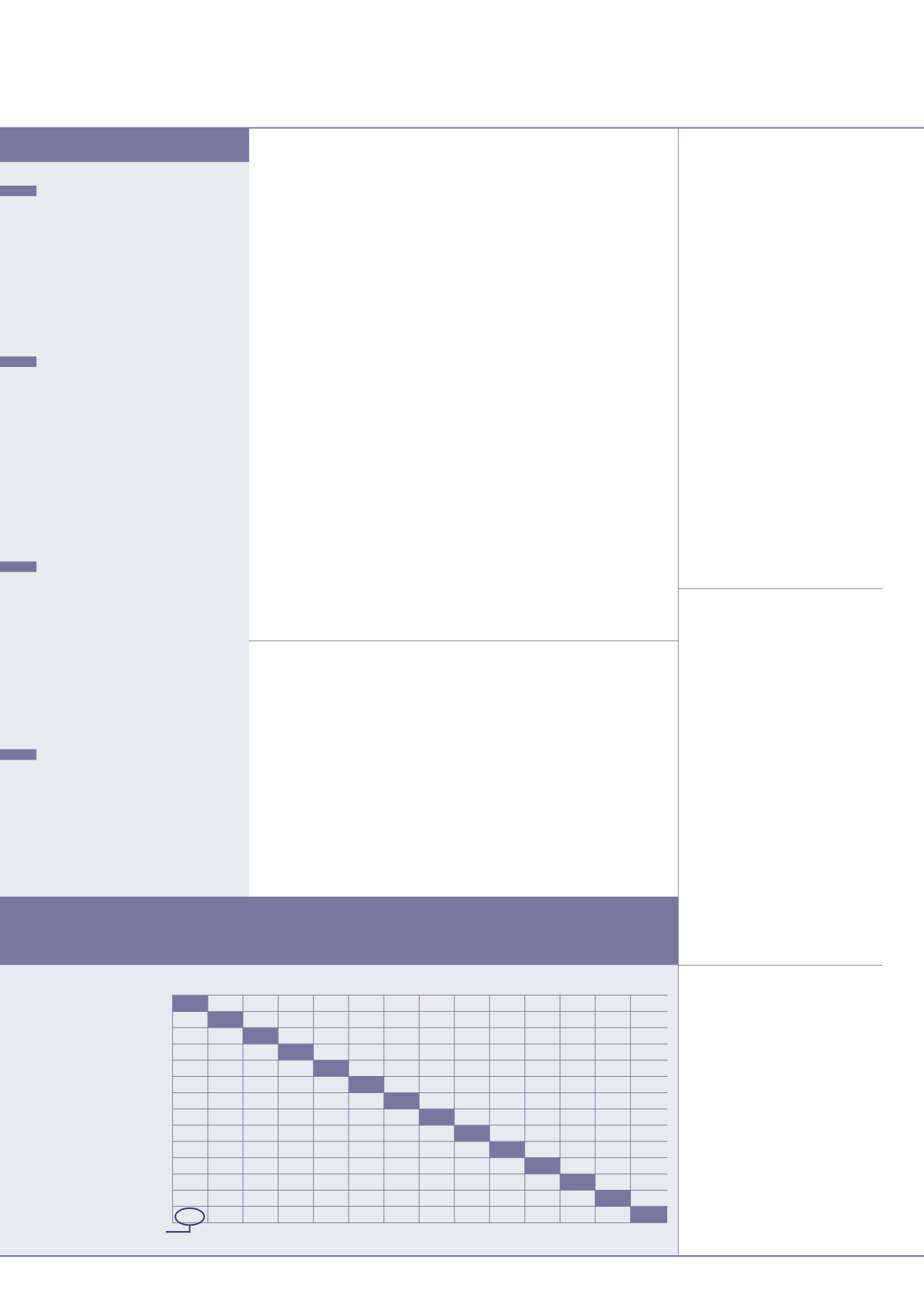

VALUE OF 1:

SYMBOL AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

Australian Dollar

AU$

0.48

0.5

46

5

.7

9

0.687

5

6

.1

9

5

12.14 3

2.1

3

.5

0 10.07

9

45

0.8

3

6

0.9

3

5

Brazilian Real

BRL

2.07

0.263

2.79

0.33

1

27

.0

45

.9

5

.8

5

15

.5

1.6

9

4.8

6

45

6

0.403

0.45

0

British Pound

UK£

1.83

3

. 8

0

10.6

1.26

102.7

17

4

22.2

5

8

.9

6

.42

18

.5

17

3

2 1.5

3

1.7

1

Chinese Yuan

CNY

0.173

0.3

5

8

0.09

4

0.119

9

.6

8

16

.4

2.10

5

.5

5

0.6

05

1.7

3

9

16

3

0.144 0.16

1

Euro

€

1.46

3

. 02

0.79

8

. 44

8

1.6

13

9

17

.7

46

.8

5

.10 14.6

7

13

7

6

1.22

1.3

6

Indian Rupee

INR

0.018

0.037

0.010 0.103

0.012

1.7

0.217

0.5

7

3

0.06

25

0.18

0 16

.9

0.0149

0.016

7

Japanese Yen

YEN

0.011 0.022 0.006

0.06

1

0.007

0.5

8

9

0.127

6

0.3

3

8

0.03

6

8

0.105

9

9

.9

0.008

8

0.009

8

Mexican Peso

MXN

0.08

2

0.17

1 0.045

0.477

0.057

4.6

2

7

.8

4

2.6

5

0.28

9

0.8

3

0

7

8

0.06

9

0.07

7

0

Russian Ruble

RUR

0.03

1

0.065

0.017

0.18

0 0.021 1.7

4

2.9

6

0.3

7

8

0.109

0.3

13

29

.4 0.026

0 0.029

1

Saudi Riyal

SAR

0.28

5

0.59

2

0.156

1.6

5

3

0.19

6

16

.000 27

.147

3

.46

4 9

.17

3

2.8

7

27

0 0.23

8

0.26

7

South African Rand ZAR

0.099

0.206

0.05

4

0.5

7

5

0.06

8

5

.5

6

6

9

.443

1.205

3

.19

1 0.3

48

9

4

0.08

3

0.09

3

South Korean Won KRW

0.0011 0.0022 0.0006

0.006

1 0.0007

0.05

9

3

0.1007

0.0128

0.03

40 0.003

7

0.0107

0.0008

8

0.0010

Swiss Franc

CHF

1.20

2.48

0.65

6

. 9

4

0.8

2 6

7

.11 113

.8

7

14.5

3

3

8

.48

4.19

12.06

113

1

1.119

US Dollar

US$

1.07

2.22 0.58

4

6

. 2

0.7

35

6

0

101.8

12.9

9

3

4.4

3

.7

5

10.7

8

1011.3

0.8

9

4

For example U

S$

1 =

AU

$

1.07

Exchange rates: July 2014

QATAR

QDVC, a 5

1%

Qatari Diar,

49%

Vinci Construction Grands Projets

subsidiary, has won the

€

7

5

0 million

(U

S$

1 billion)

contract for the final

phase of the light rail system (

LR

T)

in

Lusail, Qatar. It comprises construction

of a depot and 25

stations, with

architectural, electro-mechanical and

project management packages.

US

A joint venture between Skanska

and Traylor B

r others has been won

the U

S$

9

18

million contract from

Los Angeles County Metropolitan

Transportation Authority to construct

the R

e gional Connector, an

underground light rail link in downtown

Los Angeles, U

S. It comprises the

design and construction of a 3

km

double track light rail line and three

new stations.

TURKEY

Liebherr has won an order

from Tü

r kiye Devlet Su I

.

s¸

leri (

DSI )

–

the Turkish government’

s Ministry for

W

ater R

e sources –

for 13

0 PR

7

5

4

Litronic doz

ers. The 40 tonne class

machines will be delivered throughout

the remainder of 2014 and 2015

. DSI

is the primary Turkish state agency

responsible for utilisation of the

country’

s water resources.

US

CNH Industrial has announced it

will close its plant in Calhoun, Georgia,

U

S in the third quarter of next year. The

construction equipment factory makes

doz

ers and excavators. The company

said the closure was necessary as it

adjusted its construction equipment

business to current market demand.

international

construction

july-august 2014

B

U

SINESS NEW

S

10

UK

SNC-Lavalin to acquire Kentz

Canadian contractor SNC-Lavalin

has reached an agreement to acquire

UK-based oil & gas engineering

services Group Kentz for UK£ 1.2

billion (US$ 2 billion). The deal has

been approved by the Kentz board.

Kentz has 14,500 employees and

operates in 36 countries around

the world. The acquisition would

increase SNC-Lavalin’s headcount

to some 44,500 employees, 18,500

of whom will be in the oil & gas

division.

The company added that it

expected to achieve annual savings

of CA$ 50 million (US$ 48 million)

in the first full year following the

acquisition. It will also take SNC-

Lavalin’s total backlog to some CA$

4.9 billion (US$ 4.7 billion).