T

he 2014 league table of global contractors is based on

revenues achieved in 2013

. These came to U

S$

1,6

25

billion,

a record total, and the twelfth straight year the Top 200 has

grown.

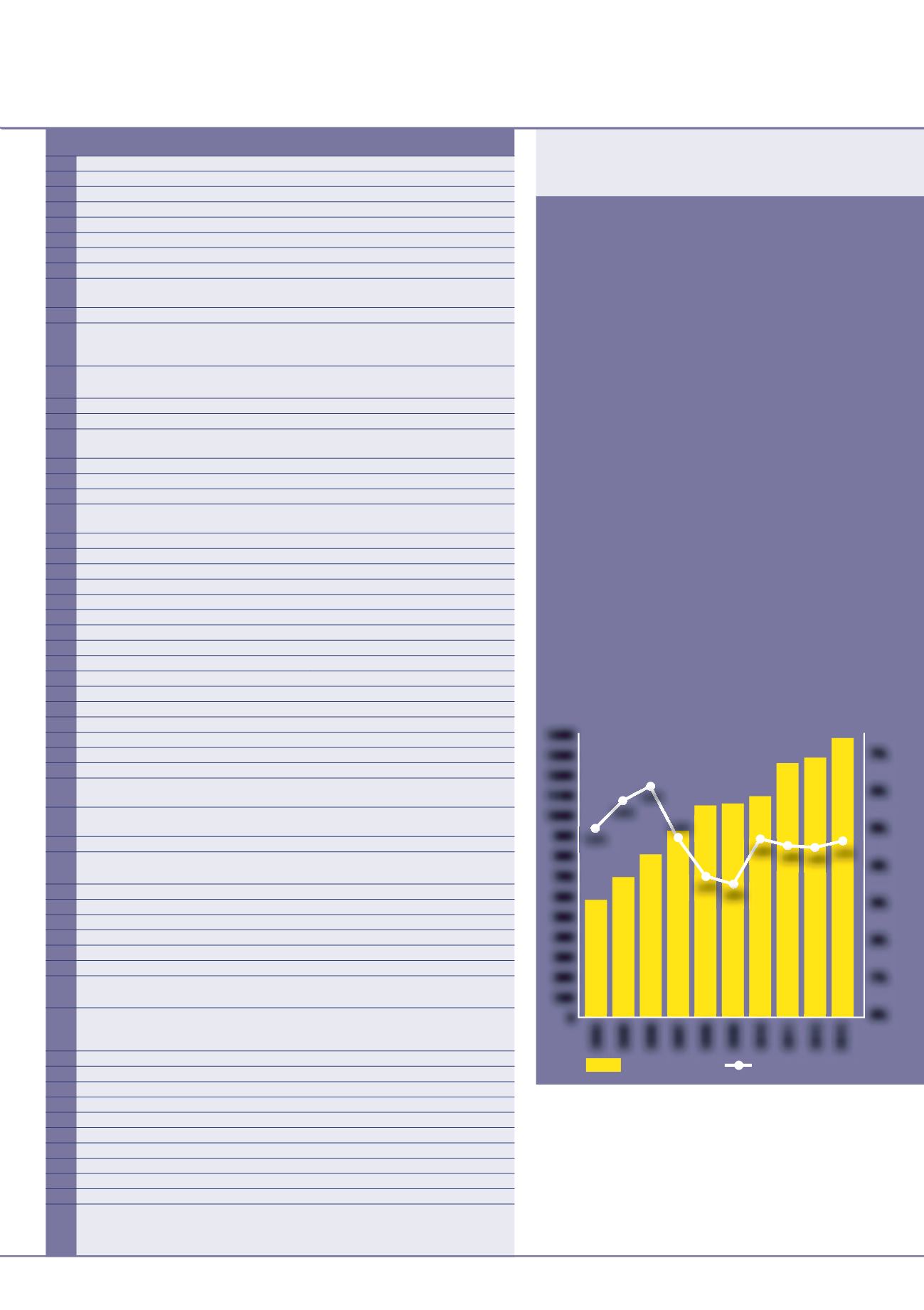

The graph illustrates the revenue and profitability trend for the Top

100 going back a decade. This year the group had revenues of

U

S$

1,3

8

6

billion, and a margin of 4.7

%

. Although the revenue trend

has always risen throughout the 12-year history of the Top 100,

this year’

s growth of some +

7

.3

%

has been the most pronounced

for two years. The last similar leap –

in the 2011 figures, based on

2010 revenues –

was driven by the Chinese stimulus boom.

This points to a surge in global activity, as does the improvement

in margin to 4.7

%

from last year’

s figure of 4.4%

. W

hile the ebbs

and fl

ows of the global industry seem to be indicated by the siz

e

of the leap in the Top 100’

s revenues, as the graph illustrates,

profitability moves more directly with activity levels.

B

oth the revenue rise and increase in profitability point to an

improvement in industry fortunes last year.

This is not just an indicator. The Top 200 account for a big slice

of the market, so the trend could be taken as a direct refl

ection of

conditions. Global construction output is anywhere between U

S$

7

,5

00 billion and U

S$

8

,5

00 billion per year, so the Top 200 account

for at least 20%

of world-wide activity.

B

ut as ever, this also points to the fragmented nature of the

industry. As vast as top-placed contractor CSCEC has become, at

best it has a 1.4%

market share of the global sector. It is difficult to

think of another area of economic activity where the no.1 player –

and a U

S$

100 billion+

per year company –

would command such a

small slice of the pie.

Global trends

U

p- turn in profitability and revenues

>

15

july-august 2014

international

construction

NEW

S R

EPOR

T

The global top 200

*

=

estimate

1400

1300

1200

1100

1000

900

800

700

600

500

400

300

200

100

0

7%

6%

5%

4%

3%

2%

1%

0%

Sales (US$ Billions)

Operating Margin

2013

1385

2004

2005

2006

927

2007

2009

1096

1242 1291

2011

2012

2010

1048

2008

5.2%

5.8%

6.2%

4.8%

3.7%

579

695

807

3.6%

4.8% 4.5% 4.4% 4.7%

1054

But perhaps the most noticeable gain among a US construction

company in this year’s Top 200 was the 33-place gain for

Chicago Bridge & Iron (35). This was due to its acquisition of

Shaw Group in a deal that was approved at the end of 2012 and

completed in February last year. This added almost a full year of

Shaw’s US$ 5.9 billion per year business to Chicago Bridge &

Iron, driving it up the table.

Another acquisition to note is the merger of two large Italian

Sales

(

U

S$

million)

Company

Country 2013 Change Website

57

655

0

Enka

Turkey 6

5

8

58

6

417

Emcor Group

U

S

5

6

2

59

6333

Petrofac

U

K

6

3

4

60

6

147

D R Horton

U

S

8

4

24

61

6

059

Spie

France 6

9

8

62

6

018

Haseko

J

a pan 5

3

9

63

598

2

VolkerWessels

Netherlands 5

7

6

64

59

44

Lennar

U

S

9

0

26

65

593

0

Guangsha Construction

Group*

China 6

7

2

66

56

01

Pulte Group

U

S

7

7

11

67

5576

Consolidated

Contractors Company

(CCC)*

Greece 6

0

7

68

53

47

Aveng

South

Africa

7

3

5

z

a

69

5

268

Kinden

J

a pan 6

0

9

70

5

213

Carillion

U

K

7

0

Â

71

5

06

0

Whiting-Turner

Contracting*

U

S

9

2

21

72

489

2

Obrascon Huarte Lain

Spain 7

1

1

73

4735

Fayat Group

France 8

3

10

74

4699

Boskalis Westminster

Netherlands 9

1

17

75

4655

Orascom Construction

Industries

Egypt

7

8

3

76

4599

Toda

J

a pan 5

9

17

77

457

0

Chiyoda

J

a pan 7

2

5

78

4485

Kandenko

J

a pan 6

6

12

79

4421

Nippo

J

a pan 7

6

3

80

4363

Misawa Homes

J

a pan 7

5

5

81

425

0

Clark Construction*

U

S

8

1

Â

82

4249

Isolux Corsan

Spain 5

2

3

0

83

4216

NVR

U

S 111

28

84

4176

Tutor Perini

U

S

8

9

5

85

4101

Gilbane Building*

U

S 114

29

86

4098

Ed Züblin

Germany 9

7

11

ueblin.de

87

4077

Barratt Developments

U

K

103

16

88

407

0

Sacyr Vallehermoso

Spain 7

9

9

89

405

1

Maeda Corporation

J

a pan 8

0

9

90

403

0

Walsh Group

U

S 100

10

91

3953

Sigdo Koppers

Chile 13

2

41

92

39

20

Sumitomo Mitsui

Construction

J

a pan 8

6

6

93

39

04

Penta-Ocean

Construction

J

a pan 7

4

19

94

38

02

Hazama Ando

J

a pan 141

47

z

ama.co.jp

95

378

1

Lotte Engineering &

Construction*

South

K

o rea

104

9

96

3779

Tecnicas Reunidas

Spain 102

6

97

3683

Veidekke

Norway 106

9

98

366

4

Mostotrest

R

ussia 115

17

99

3635

Nexity

France 9

4

5

100

359

1

Taylor Wimpey

U

K

123

23

101

3578

Porr

Austria 119

18

102

3575

Murray & Roberts

South

Africa

8

5

17

103

35

05

China State

Construction

International Holding

Hong K

o ng 13

9

3

6

104

3

43

0

Interserve

U

K

13

0

26

105

3395

DEME

B

elgium 144

3

9

106

3369

Kumagai Gumi

J

a pan 109

3

107

3359

Jaiprakash Associates

India 9

9

8

108

33

41

Arcadis

Netherlands 108

Â

109

33

23

PanaHome

J

a pan 9

5

14

110

33

06

Foster Wheeler

U

S 101

9

111

3

297

Implenia

Switz

erland 126

15

112

3

277

Morgan Sindall

U

K

117

5

113

3

263

Persimmon

U

K

140

27

114

3

223

Nishimatsu

Construction

J

a pan 113

1