23

ECONOMIC OUTLOOK

African potential

july-august 2014

international

construction

>

African potential

Sub-Saharan African construction markets offer some of the highest growth prospects in

the world. This often comes with greater risk and more volatility than in other areas, but in

many countries it is getting easier to do business.

Scott Hazelton

reports.

T

he construction outlook for sub-Saharan

Africa is generally positive, although there

are wide swings in growth prospects across

countries depending on individual political and

economic policies.

The key driver for growth is commodity exports,

and this dependence translates to economic

vulnerability. The current situation of a sustained

recovery in the US and Western Europe emerging

from recession is a mixed blessing for the region.

While stronger markets increase export demand,

they also compete for capital. Since developed

economies are less risky than emerging markets,

they siphon away funds needed for infrastructure

and industrial expansion in the developing world.

Another factor is that Chinese manufacturing

and export growth is weakening, limiting

its demand for raw materials and stagnating

commodities prices.

Expanding domestic markets, income gains and

regional integration will support economic growth

of +5% - +6% in sub-Saharan Africa this year,

which is second only to Asia (excluding Japan) for

growth globally. Macroeconomic management is

improving in most countries, poverty is declining

and foreign direct investment is rising.

Growth in Africa’s middle class will create

opportunities for consumer markets and improved

housing. On the minus side, poor infrastructure

(especially power generation), political instability

and corruption remain obstacles to economic

development.

In some countries, there is also terrorism or civil

war. On balance, the outlook is positive, but it

could be better.

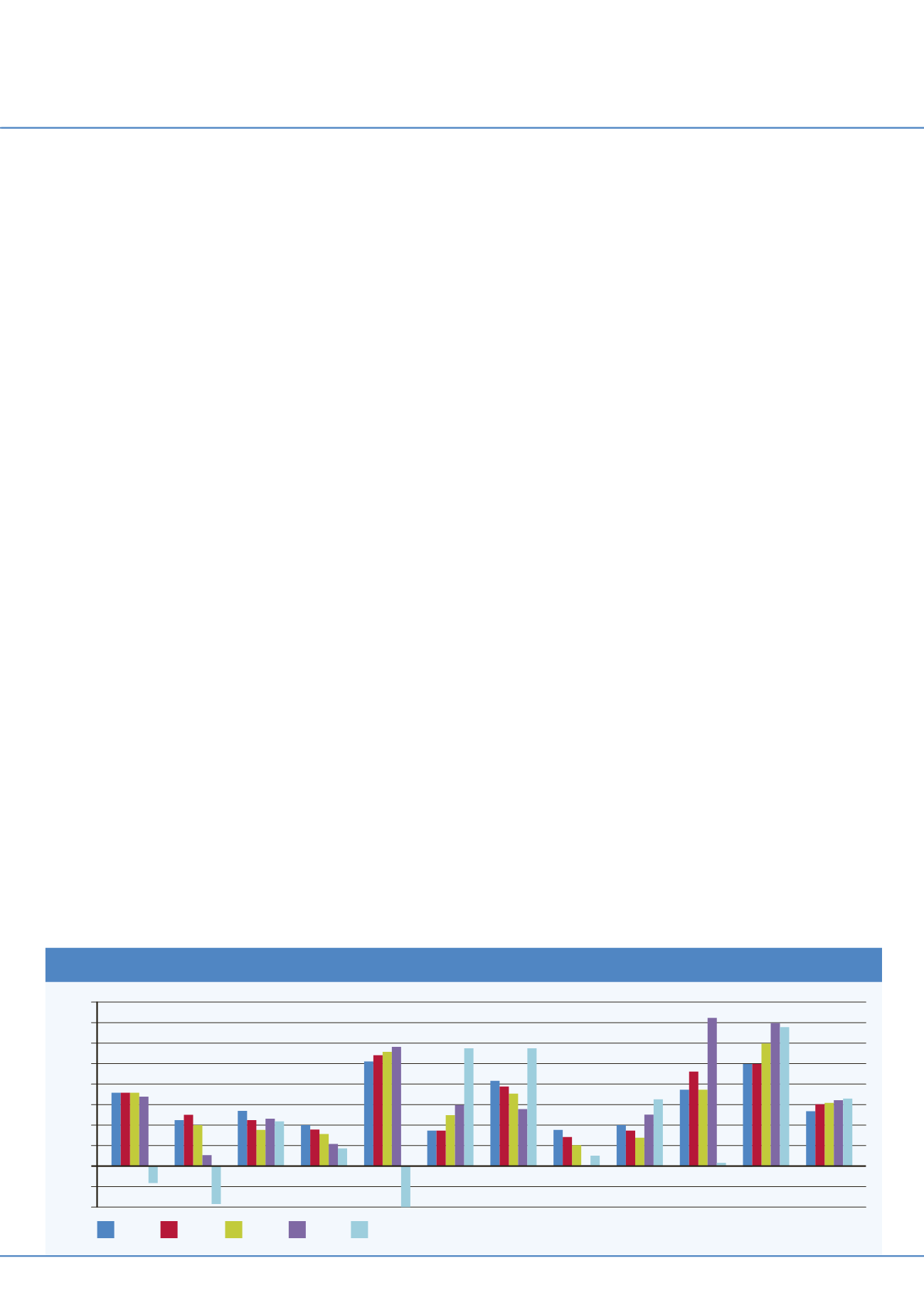

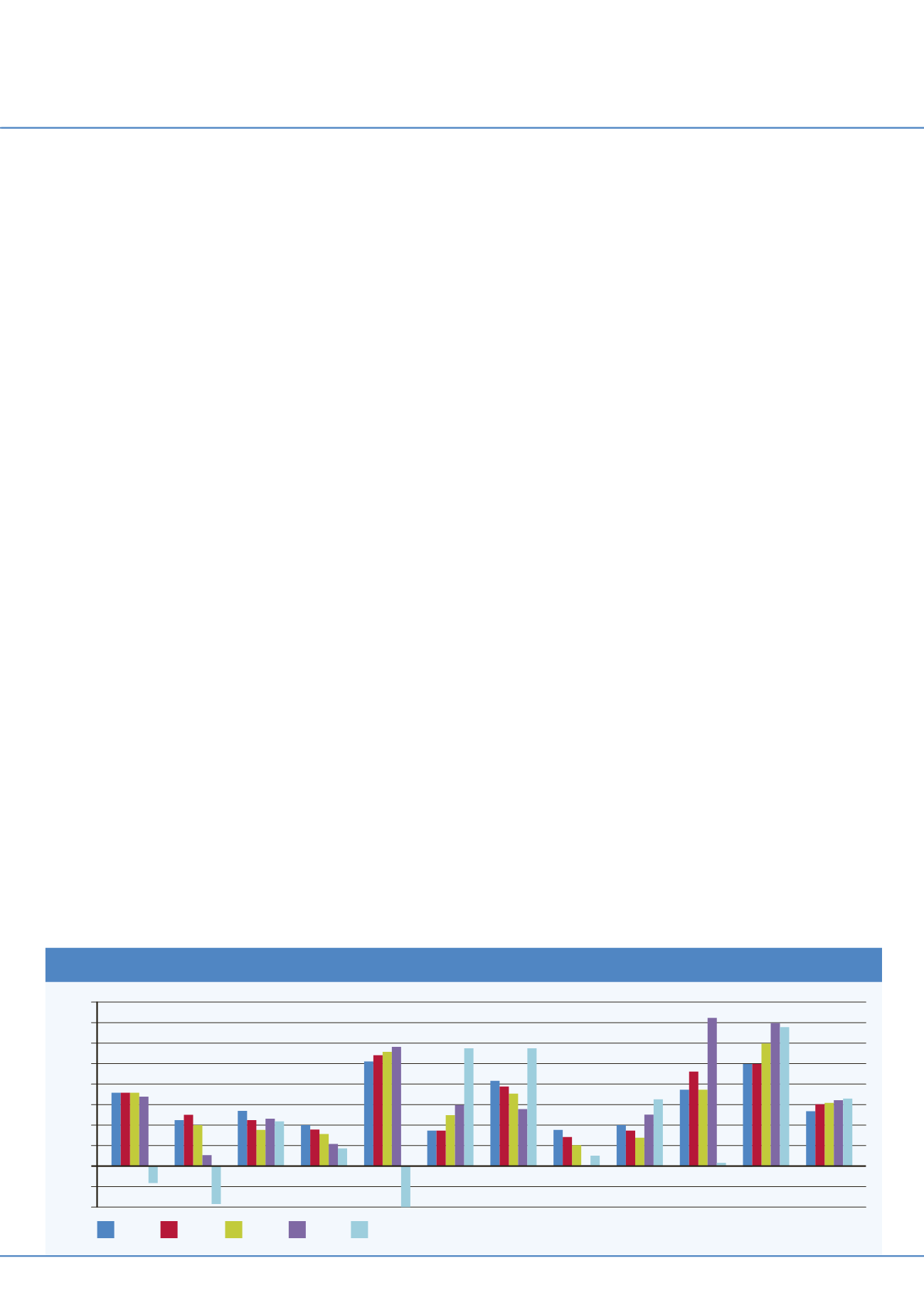

There are also data challenges with Sub-Saharan

Africa, which makes construction forecasting

difficult. With limited historic information,

indicators like fixed investment have to be used

to gain an insight into the construction market,

and this is a reliable proxy. The graph illustrates

this data.

By country

Angola’s economic growth will continue to be

driven by oil production and infrastructure.

The nation’s oil production has the potential to

increase to 2 million barrels per day (mbd) from

1.5 mbd, a critical development as this sector

accounts for over half of GDP.

Angola plans to diversify its economy, using oil

revenues to support non-oil industries and an

ambitious infrastructure building programme.

New investment is occurring in refining and

smelting while transportation infrastructure

upgrades are being made in part to advance the

agricultural sector. A US$ 9 billion liquefied

natural gas pipeline will add to growth.

Early signs of economic diversification are

appearing. Angola now exceeds the lower bound

of a middle-income country, creating demand for

residential and commercial construction. Tourism

is also developing, although in addition to hotel

construction, Angola also needs to clear landmines

and rebuild transport and communications

infrastructure.

In contrast to Angola, Cameroon is constrained

by weakness in the hydrocarbon sector as oil

production is declining and reserves are dwindling.

However, new discoveries in the Rio del Rey,

Douala Krini-Campo and Longone-Buni basins

may alleviate the problem in the medium-to-long

term, and create construction opportunities.

Cameroon has used international aid programs

to reduce its external debt by 50%, freeing up

revenue for infrastructure and development

spending. Infrastructural improvements in the

energy sector are expected to improve supply, and

the water sector will also benefit as the government

aims to double agricultural production.

Cote d’Ivoire will spend US$ 4 billion in

agriculture development by 2015, including

storage facilities and the rehabilitation of roads

and irrigation infrastructure.

Infrastructure is also a problem for the

Democratic Republic of the Congo (DRC),

compounded by a mining sector hampered by

lower copper prices. Debt forgiveness allows

the DRC to fund infrastructure, but disputes

with foreign oil and mining companies have

exacerbated concerns about the business climate.

Rising aid and investment is a positive trend,

and increased capacity in the energy sector could

satisfy both domestic and regional power demand.

For example, the Congolese and South African

governments are moving ahead with the Inga III

project to produce 4.8 GW of hydropower.

Progress on funding has been made with the

Sino-Congolese Co-operation Agreement, which

Annual fixed investment growth

Sub-

Saharan

Africa

South

Africa

Senegal

Nigeria

Namibia

Kenya

Guinea

Ghana

Democratic

Republic

of Congo

Botswana

Angola

2011

2012

2013

2014

2015

16%

14%

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

Zimbabwe