50

Life after Tier 4 Final

INTERVIEW

international

construction

april 2014

equipment or value equipment like Caterpillar that drives lower

owning andoperating costs,”MrOberhelman said.

“I think the slowdown in the last two years has really hastened

the time inwhich that customer need for productivity has come

toour businessmodel. I don’t think anyof uswouldhave guessed

10 years ago that in 2013/2014 that we would have seen the

same kind of productivity needs calling on us. But the Chinese

customers need productivity too, and that’s where our business

model is going.”

Mr Rapp said other crucial aspects to Caterpillar’s success

in China have been its supplier integration and use of locally-

sourced parts. “That puts us in a very competitive cost position,”

he said. “We’vecontinued to launchproducts targetedat customer

economics andhow theymakemoney.TheGC lineupofproduct

is an example – the 950GCwheeled loader and 312GC, 320GC

excavators arehittinghighvolumemarket segments inChina that

weweren’t addressing.

“As the industry in late 2012 and 2013 declined in China, an

areawhere our businessmodel just excelledhas been an ability to

understandhow youfinance equipment. A lot of our local China

competitors put stuff out on financing, or perhaps didn’t have

the same discipline about down payments and management of

receivables,” he added.

Dual-brand strategy

However, a complicating factor is Caterpillar’s wholly-owned

subsidiarySEM, aChineseconstructionequipmentmanufacturer

which also sells its products inChina. But both executives denied

that therewas any conflictwithin this dual-brand strategy.

Mr Rapp said SEM produced equipment for customers where

the initial purchase cost was key – what he called the utility

segment. “If you look at SEM, the utility customer in China

would like productivity, uptime dealer support and all the other

things, but he just doesn’twant topay for it.

“And that pure price play, that’s where we go to market with

the SEM brand. Our hypothesis all along has been that, as the

economy continues to develop and grow, more of that customer

base will migrate up tomachines focussed on lifecycle value and

performance. It’s one of the thingswe’re starting to see.”

Mr Rapp said Caterpillar hadn’t yet seen consolidation of

manufacturers in China, but it had started to see consolidation

within the customer base.

“As they went through the significant downturn, it’s just a

natural that you’d start to see certain smaller customers go out

of business, consolidated into large customers. And as those

customers grow, theybecomemore sophisticated in terms of how

theymake money. And in our business, youmake money when

themachine is up and running.”

Future growth

Looking ahead to the rest of 2014 and beyond,MrOberhelman

seemed confident in growth prospects for Caterpillar. He

said the manufacturer was constantly eyeing new acquisition

opportunities, butwas also self-assured about its ability to expand

fromwithin.

“AnyM&A activity we have will be around the edges – every

day we have 10 or 20 things that we’re looking at, but all very

small. We don’t have anything big out there right now that we

could go after.

“I see great organic growthopportunities in the structure of the

business aswe have it – that’s going todrive a lot of volume. And

thenwemay find some small bolt-on acquisitions that wewould

do from time to time, aswe have done in the past.”

iC

drive common best practice across our global dealer network to

raise that level of performance, because rental is here to stay.”

Mr Oberhelman agreed, and highlighted the fact that every

single one of the company’s 180dealers has a rental fleet.

“What we need to do and work on is howwe go to the rental

market with our dealers, particularly for customers that cross

territories, so they get the same look and feel.

“We are the biggest rental equipment supplier in the world

today when we aggregate all of our dealers, so we should be the

ones that reallyget thebenefit of that.But it is bothgood andbad

forus– thepressure that [rental]putson thecollectivedealers and

us financially iswhy I say that.

“As our contractors/customers push the asset up to us, itmoves

the financial pressure from the customer to the dealer, and then

ultimately to us. We’ve had good luck with that so far, but we

ought to be in a position to take advantage of that because we’re

the biggest player in the industry.”

China

Caterpillar has also become one of the biggest construction

equipment players inChina in recent years, and in fact claims to

hold the largestmarket share in thecountry formid-to-large-sized

excavators.Mr Rapp andMrOberhelman said themanufacturer

had seen rapid changes in demand in this market in the last

few years.

“I can remember 10 years ago, 12 years ago when we started

on this fairly aggressive expansion of our footprint inChina, one

of the great debates was always one between low-end, low-cost

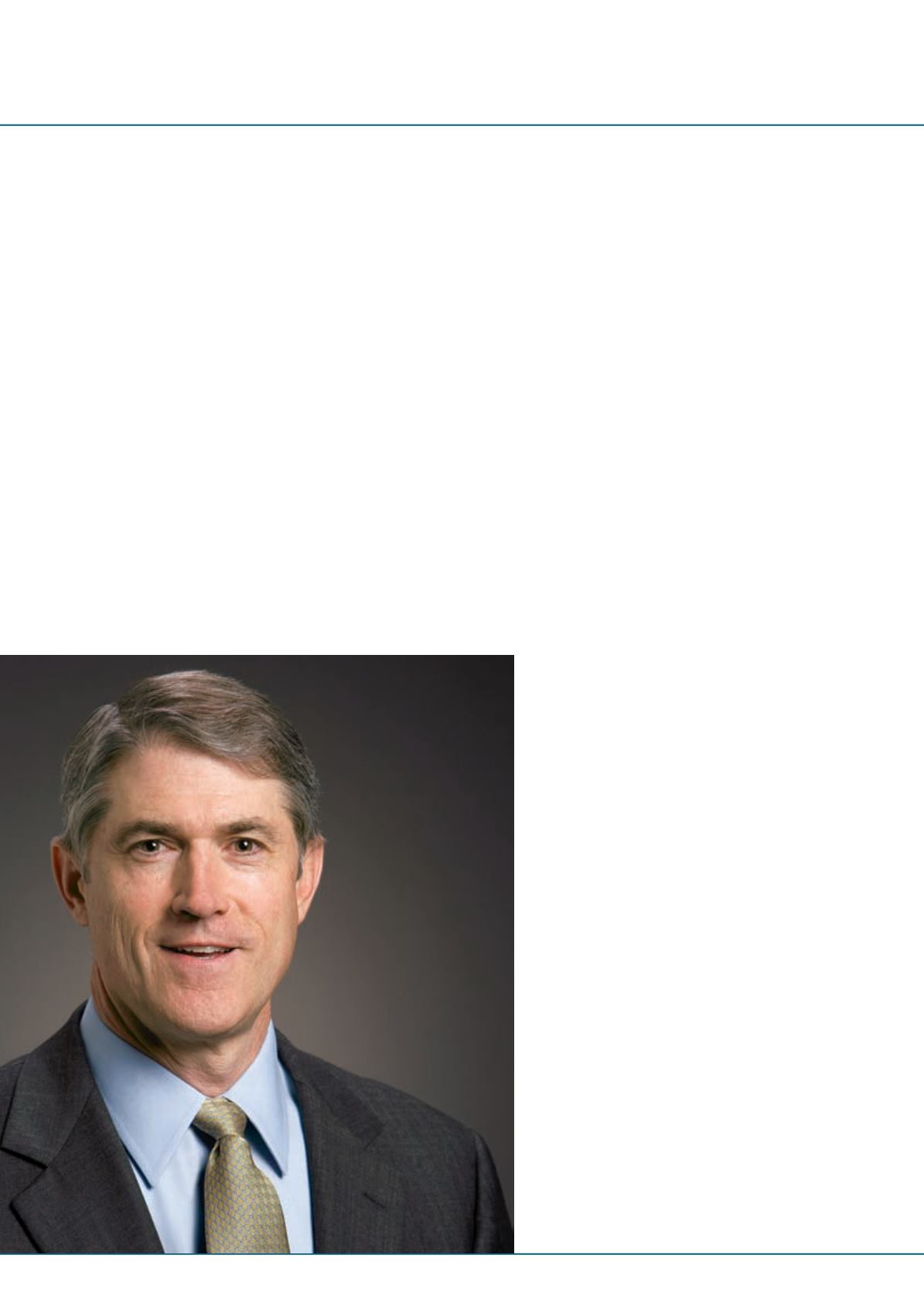

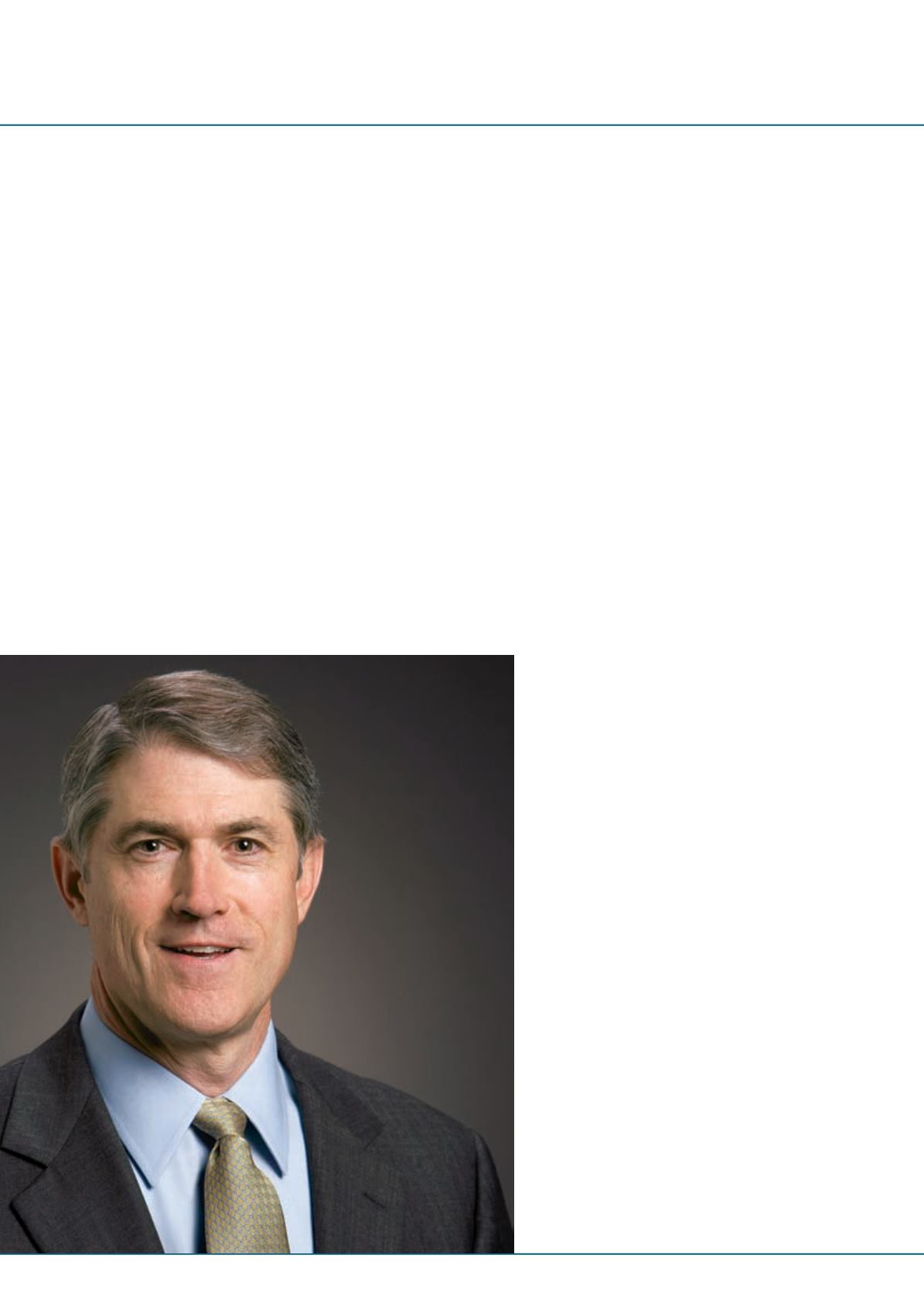

Group president responsible

for construction industries

and growthmarkets, Ed

Rapp: “As smaller Chinese

customers grow, they

becomemore sophisticated

in terms of how theymake

money. And in our business,

youmakemoneywhen the

machine is up and running.”