INTERNATIONAL ANDSPECIALIZED TRANSPORT

■

JANUARY 2015

35

CRANE CONFIDENCESURVEY

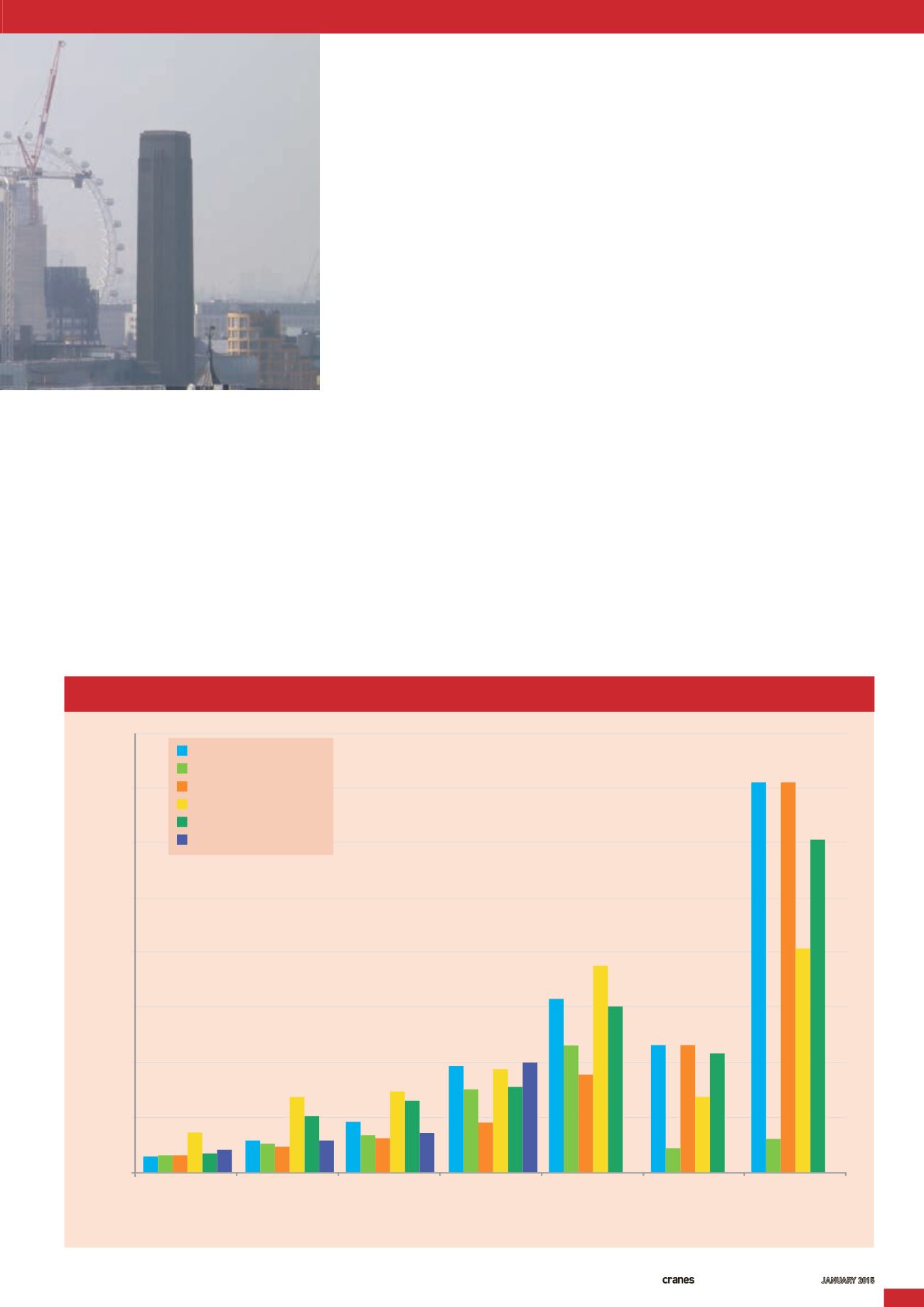

crane sectors are the highest compared to

other areas of the world. Average rental

rates for a 100 tonne capacity mobile

crane, for example, are around $920 per

day in the Middle East, while in North

America, rates can reach $2,730 per day.

Similar differences have beennoted for 150

tonne capacity crawler cranes, with weekly

charges ranging from $3,550 in theMiddle

East to$7,495 inNorthAmerica.

For tower cranes, rental rates in Europe

are the lowest, with rates averaging at $860

per week for a 150 tonne-metre tower

crane. In the Middle East, this rises to an

In Indonesia, however, respondents

remain positive, stating that the market

is improving and, although it is currently

on hold after the presidential election, the

expectation is for improvement next year.

The market in Central and South America

is also growing. Some areas, for example,

Brazil, remainunstable.

Future growth

Despite higher utilisation rates the

depressed economy and static rental

rates will continue to negatively limit

new growth, expansion and upgrades

throughout the industry in 2015. Only

39.1 % of respondents, for example,

are looking to increase their capital

expenditure on fleets in 2015 compared to

2014, while around 15.6 % of respondents

are looking to decrease expenditure. The

number of employees is, however, expected

to increase, with 61.9 % of respondents

expanding their workforce, while only

6.3%are expecting to reducenumbers.

“Despite a positive outlook, regulation

and economic uncertainty will continue

to limit investment in additional equipment

throughout the industry,” one respondent

told

IC

. “These factorswill continue tohelp

rental companies show increased growth

on the bottom line revenue and improved

utilisation for their existing fleets.”

■

average price of around $4,620 per week.

Europe also has the lowest rental rates for

300 tonne-metre rated tower cranes, with

figures around $1,200 per week, compared

with prices inAsia, for example, which can

top$14,000perweek.

In other areas of Europe, Turkey and

CIS, the picture isn’t as strong. Ireland,

for example, is experiencing an unstable

market, according to a respondent. “I think

that one of the biggest problems facing the

crane industry is going to be getting people

to do the job,” a respondent from Ireland

said. “The hours and the low pay rates is

not very inviting for new people to start in

this industry.”

Italy is also facing problems, as another

respondent explained, “The crane rental

market is flat as projects in Italy during

the last five years have been dramatically

decreased. We hope that in 2015 the

situationwill change.”

In theNetherlands, construction activity

is low and there is high pressure on rental

rates. In France the picture is similar, and

construction activity is very low. Problems

in the UK are focusing around supply and

demand, as one respondent told

IC

, “There

has been noticeable increase in the lead-in

times required to procure cranes. The UK

has a shortageof tower cranedrivers,which

ismaking the situationworse.”

AVERAGERENTALRATES INUSDOLLARS

16000

14000

12000

10000

8000

6000

4000

2000

0

50 tonne

capacity

wheeledmobile

crane

100 tonne

capacity

wheeledmobile

crane

150 tonne

capacity

wheeledmobile

crane

70 tonne

capacity

wheeled

crawler crane

150 tonne

capacity crawler

crane

100 tonne-

metre tower

crane

300 tonne-

metre tower

crane

Percentageof respondents

AsiaPacific

Europe/Turkey/CIS

MiddleEast

NorthAmerica

SouthAsia

Central/SouthAmerica