INTERNATIONAL ANDSPECIALIZED TRANSPORT

■

JANUARY 2015

34

CRANE CONFIDENCESURVEY

For 2015 the outlook is similar, and

53.5 % of respondents forecast that rental

rates for 100 tonne capacity wheeled

mobile cranes, for example, will remain

the same. For the tower crane sector,

64 % of respondents forecast that rental

rates for 100 tonne-metre rated tower

cranes, for example, will also remain

the same. Fortunately, only 9.3 % are

forecasting that current rental rates for

tower craneswill decrease.

Global differences

Rental rates around the world vary widely.

In the USA, for example, the rental market

is getting stronger, andprices are improving

(some above the 2008 peak). “We see an

improvement in rental utilisation for large

300 US ton crawlers and rough terrain

cranes in the 90 and 110 ton capacity

classes,”one respondent told

IC

.

Results from this year’s survey show that

rates throughout North America in most

The annual

IC

crane confidence survey offers a

snapshot of theglobal crane rentalmarket and

whatmay lie ahead.

IC

reports

T

he overall trend reflected in this

year’s Crane Confidence Survey

is that market demand for lifting

services is increasing but rental rates are

not increasingat the same level.

Results from this year’s survey suggest

that overall, the crane rental market in

2014 improved, with 61.9% of respondents

stating that business activity increased,

while 23.8% noted it was stable. For 2015,

49.2 % of respondents feel that business

conditions will improve, while 33 % feel

that conditionswill remain the same.

According to nearly half of respondents,

utilisation rates are also forecast to improve

over the next 12 months, while a further

41.7 % expect utilisation to remain stable.

Despite a rise in utilisation, however, rental

rates are not expected to increase at the

same pace. In South Africa, for example,

crane rental is increasing, while profits

are not. For areas of Asia, one respondent

explained how contractors are buying their

own equipment so, even though utilisation

rates arehigh, rental revenue is lower.

“In Singapore, the crane rental market

is very competitive,” one respondent

explained, “Government projects aredrying

up and [we are] mainly relying on private

sectorprojectsnow.”

“There are too many cranes, fewer

projects and fewer crane operators,”

another respondent added. “Thebigplayers

in Singapore do not have many of their

cranes rented out, and will reduce their

rental price so they can secure the contract.”

Stagnant or falling rental rates are being

experienced across the sector. Over the

last 12 months, for example, only 27.3 %

of respondents recorded a rise in rental

rates for 100 tonne capacity wheeled

mobile cranes. Similar responses were also

noted for 70 tonne capacity crawler cranes

and 100 tonne-metre tower cranes, with

only 26.9 % reporting higher rental rates

compared to theprevious year.

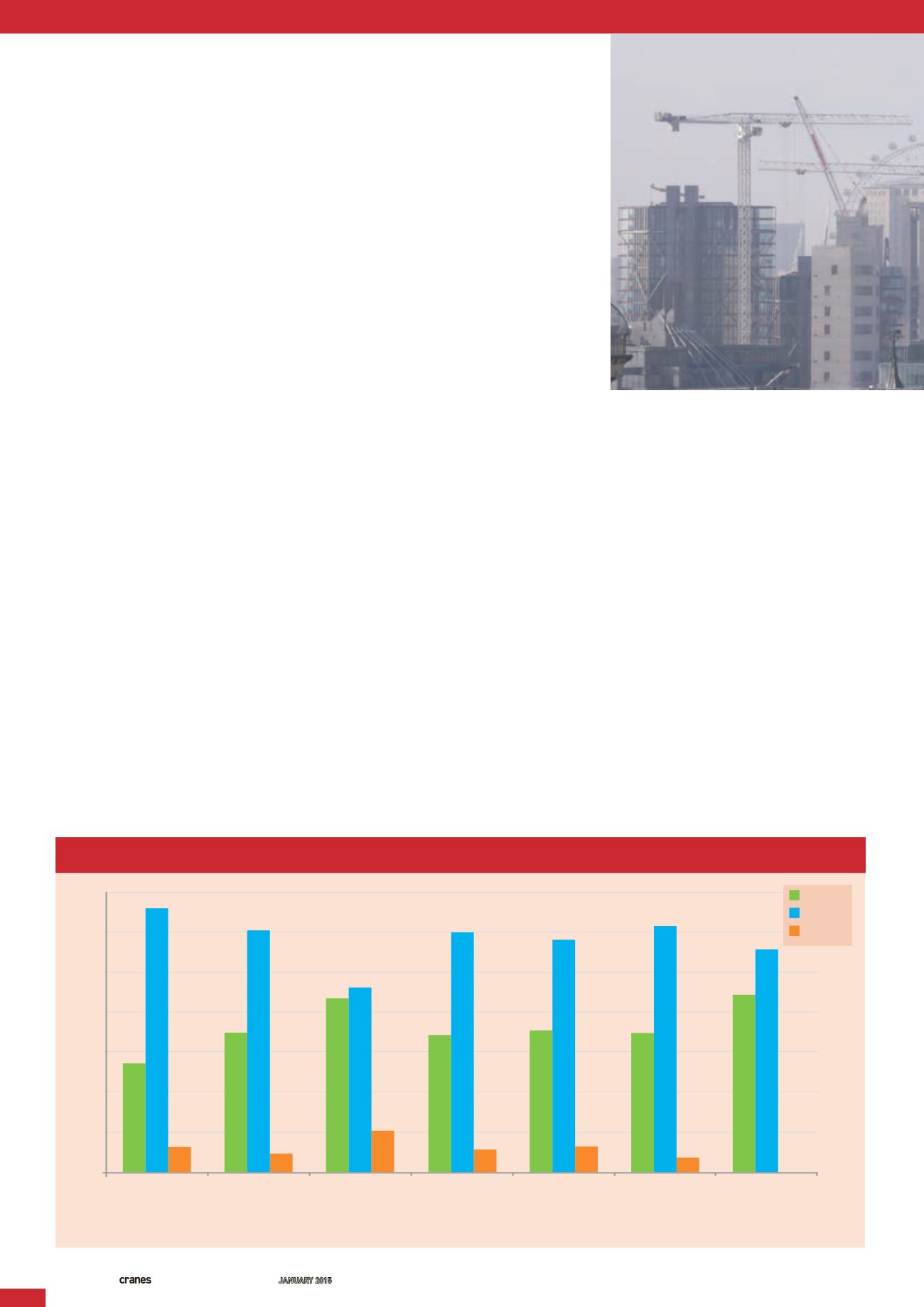

Supplyand

demand

2015

FORECASTFORCHANGE INUTILISATIONRATES

70

60

50

40

30

20

10

0

50 tonne

capacity

wheeledmobile

crane

100 tonne

capacity

wheeledmobile

crane

150 tonne

capacity

wheeledmobile

crane

70 tonne

capacity

wheeled

crawler crane

150 tonne

capacity crawler

crane

100 tonne-

metre tower

crane

300 tonne-

metre tower

crane

Percentageof respondents

Higher

Same

Lower