INTERVIEW

12

access

INTERNATIONAL

MARCH-APRIL 2014

but recently it’s become more-and-more of an

issue, so something like a push around scissor

lift or a mast is something that’s growing in

popularity.”

The market for mainstream products like

self propelled booms and scissor lifts is also

unsaturated, which means all the rental

companies are doing well.

Mr Landsberg estimates there are around

4000 AWPs in South Africa, with an annual

market of 500 – 600 machines. “The country

could, in theory, have 40000 machines.

“Growth is on our side, in just over two years

we have grown from zero to a fleet of 500 and

we can double that fleet in the next two years.

That’s the type of growth happening in this

market.

He adds, “With crawlers and mini-access

it’s something new, so there is a lot of

development work to be done and it’s going

to take some time before there is real traction.

We have been supplying Teupens for 14

months and we are happy with the progress

but we don’t sell them by the dozen.The same

is true with PB narrow scissor lifts, they take a

little selling.”

However, the market potential is being

hampered by the economic climate. “Demand

is there and growth is there but the sale

of new products is being curtailed by our

exchange rate. We have had a weakening

in our currency of over 50% in the last

18 months; so we are paying double for

a machine, and that’s without the price

increases,” explains Mr Landsberg.

As a result there has been a proliferation

of badly maintained used equipment coming

into South Africa. “Unfortunately, a lot of it

is extremely old. We have machines that are

12 to 15 years old coming in and it’s really a

dumping ground for the European markets.

There is no requirement for maintenance

reports or anything.

Goscor is working hard to bring the

industry up to scratch. “Through the industry

bodies we have tried to control the quality of

machines coming in, but to date that has not

been particularly successful. But we do believe

there will be regulation coming in.

“Obviously, that creates opportunities for

people in the parts and maintenance side.

So, even though we haven’t been involved

with selling those products into the market,

we have been doing a lot of support for the

companies that did buy those machines.”

Southern Africa

Goscor High-Reach is also growing its

distribution network outside South Africa.

“We have representatives in Botswana,

Namibia, setting up in Mozambique, as well

as expanding in South Africa.”

Safety is also stepping up in the country,

thanks to the Institute for Working at Height

(IWH), recognised by local authorities as the

professional body for the industry.

Recently IPAF had a meeting with

the IWH. Goscor High-Reach has itself

undergone an IPAF audit and had four of its

employees trained as instructors. “We will be

the first IPAF accredited training centre in

Southern Africa, all that will be completed in

next couple of weeks.

Outside South Africa the market for AWPs

is much smaller. Last year Botswana was

the biggest external market, while Namibia

was second with sales of 20 machines in the

country, that however, is changeable year-to-

year.

“In Mozambique there is a lot of

development around gas, but it’s starting from

a very small base, so it will be years before

there is a viable market for powered access.

The company also covers the Democratic

Republic of the Congo in the north west of

Southern Africa, along with Zambia in the

east, and islands like Madagascar, Mauritius

and the Seychelles. Customers outside South

Africa are all end users - there is no rental at

all – and account for just 10% of total sales.

Another export market with great potential

is Angola. “It’s very difficult to do work there,

and it has a specific dealer, so we do not touch

that,” explains Mr Landsberg.

Mr Landsberg says, “Demand on the rental

side is huge, more so than the sales side

because of our currency being so bad at the

moment; a lot of people don’t want to invest.

The currency might come back and they might

be able to pick it up cheaper in six months’

time. “

Turning to utilisation rates, Mr Landsberg

says they typically stand at 50% to 70%

worldwide, while in South Africa they are

around 85% to 95 %. “That’s because of the

current economy but there is also a lot of

growth to be had.”

Rental in the country didn’t get started until

the late 1990s, before that there was very little.

According to Mr Landsberg it was JLG that

led the way by effectively giving small rental

companies machines, and then taking a large

percentage of the takings, (around 70%).

“Five companies were set up with that

concept. We decided not to go down that

route and the only one that was slightly

different at that time. It has grown from

originally 100 machines between those

companies, if that, to where many of those

companies still exist, the smallest with about

40 machines now.”

Mr Landsberg adds, “We are excited about

the market, from rental and end users.The

rental rates are good, not spectacular, but

better than markets like Europe where you

typically find a lot more competition, although

there are other factors too.”

Another factor in which South Africa

differs from European countries is transport.

“The distances are greater and the working

environment is a bit harsher. It’s a very dry,

dusty environment sometimes. You might pick

up machines and take them 1800 km. In the

UK the proximity means the repair response

time can be minutes; if you work in South

Africa that’s not going to happen.

“When we look at rates compared to

Europe you also have to bear that in mind.

We rely on manufacturers’ quality control.

We can’t send a machine up to Zambia and

have it break down. So we are interested in

quality machines that are simpler and easy to

maintain, with hydraulic controls.”

AI

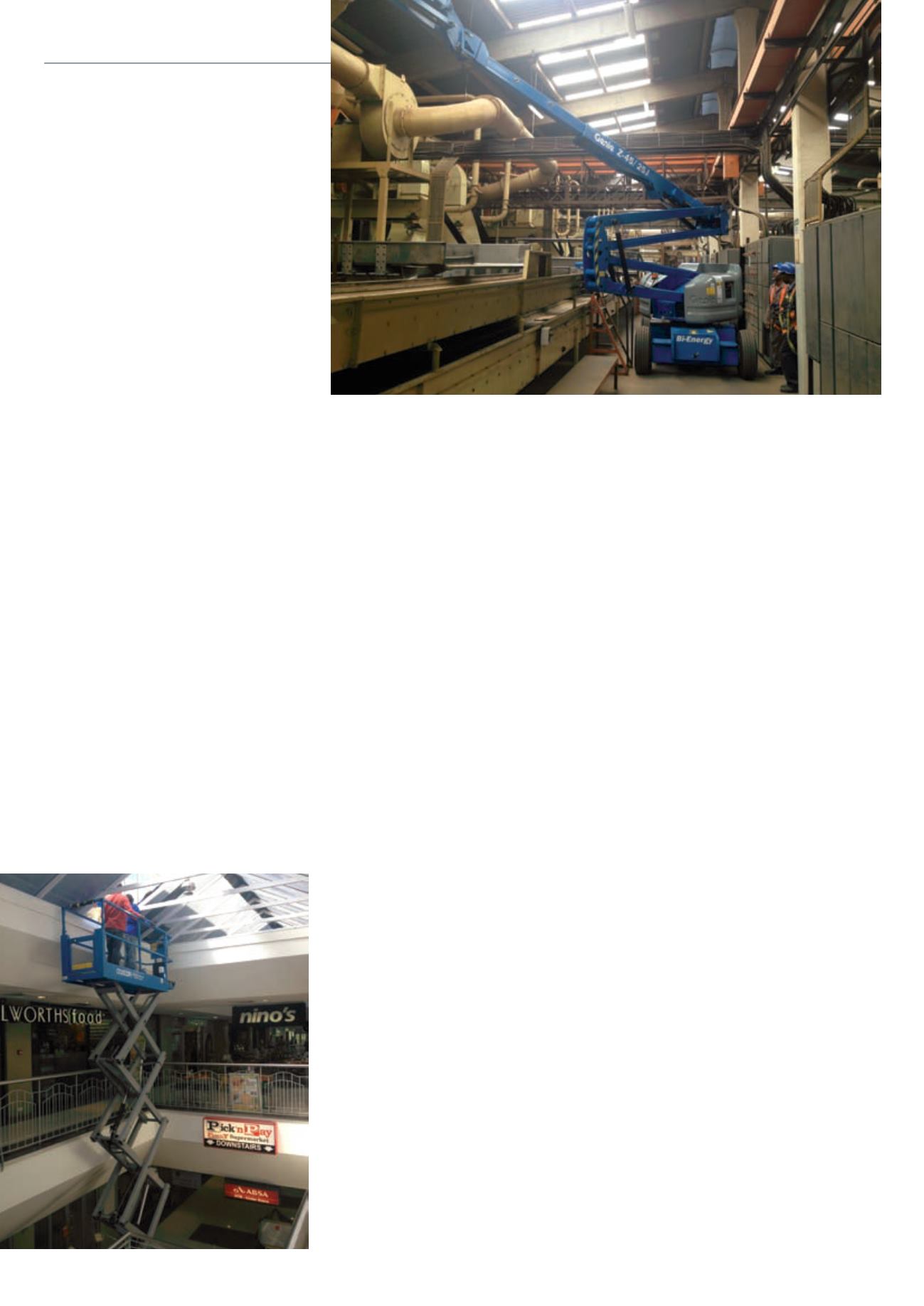

Inustrial application for an

articulating boom

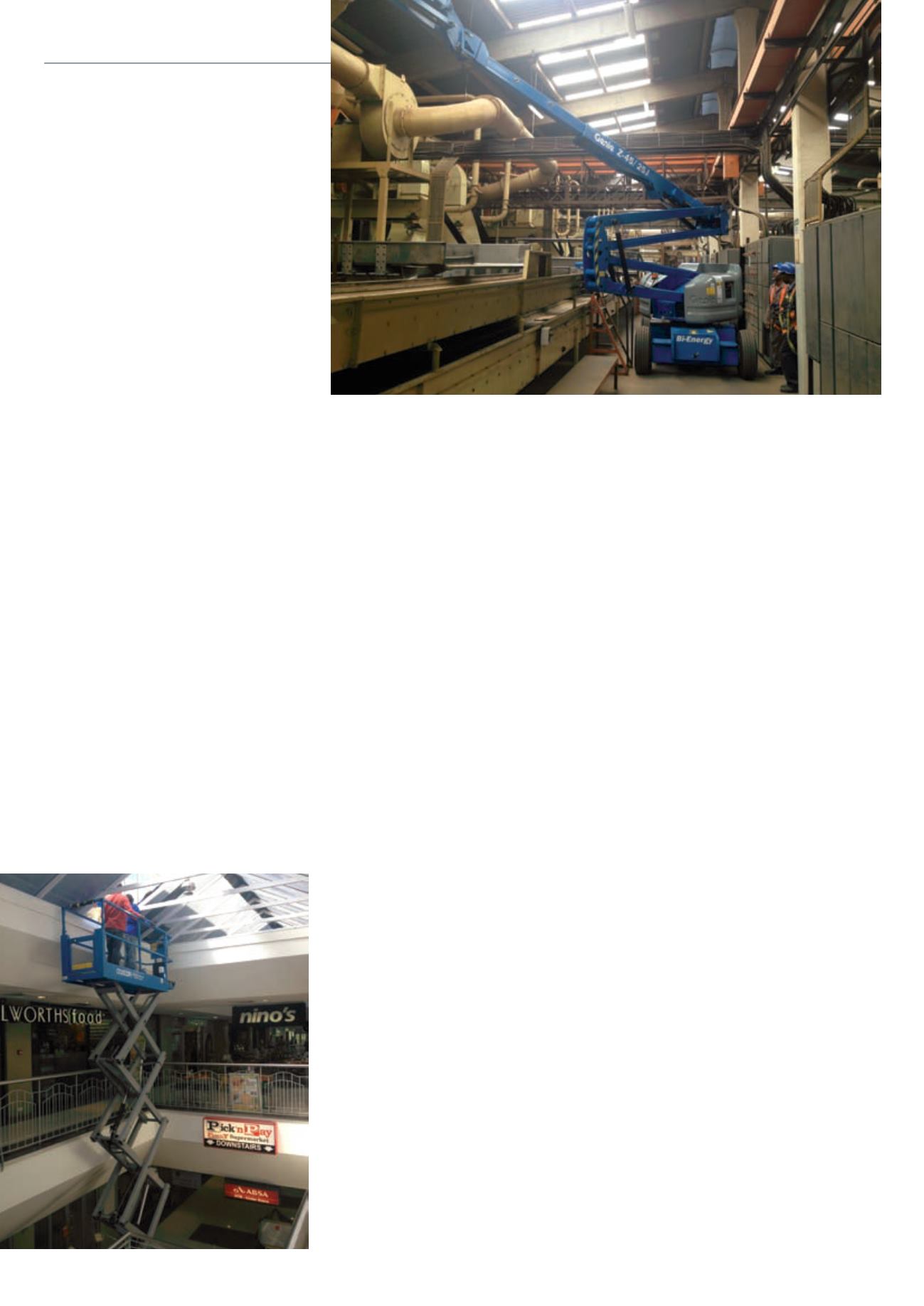

Scissor in routine

retail application