13

JANUARY 2015

ACT

BUSINESSNEWS

AUTHOR:

CHRISSLEIGHT

is

one of theworld’smost

internationally renowned

construction businesswriters,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’smarket-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

The fall in the price

of oil inNovember

helped themarkets

to their traditional

end-of-year rally,

but once again the

heavy equipment

sectormissed

the party.

Chris

Sleight

reports.

N

ovember and

December saw

theprice of a

barrel of BrentCrude oil fall

below the $70mark for the

first time since 2008. The

expectation frommany is that

the oil pricewill stay at these

relatively low levels –or even

lower – throughout 2015, and

this prospect has provided

a significant boost to stock

markets.

A lowoil pricemeans

low energy costs, so it is a

massivepositive formany

businesses. It is anegative for

oil companies andothers of

course, but the overwhelming

impact is positive for the

economy.

This iswhy stockmarkets

shot tonew levels as 2014

came to an end. At the time of

writing inDecember, theDow

had just set a series of new

recordhighs above 17,900

points andbreaking the

18,000-point barrier looked a

real possibility.

More strikingwas the steep

growth seen in theNASDAQ

index, whichwas up in the

4,700 territory.Unlike the

Dow, thiswas not a record

high– thatwas set at 5,132

points inMarch2000.

However, the recent spurt

has still pushed the index to

more than20percent year-

on-year growth.

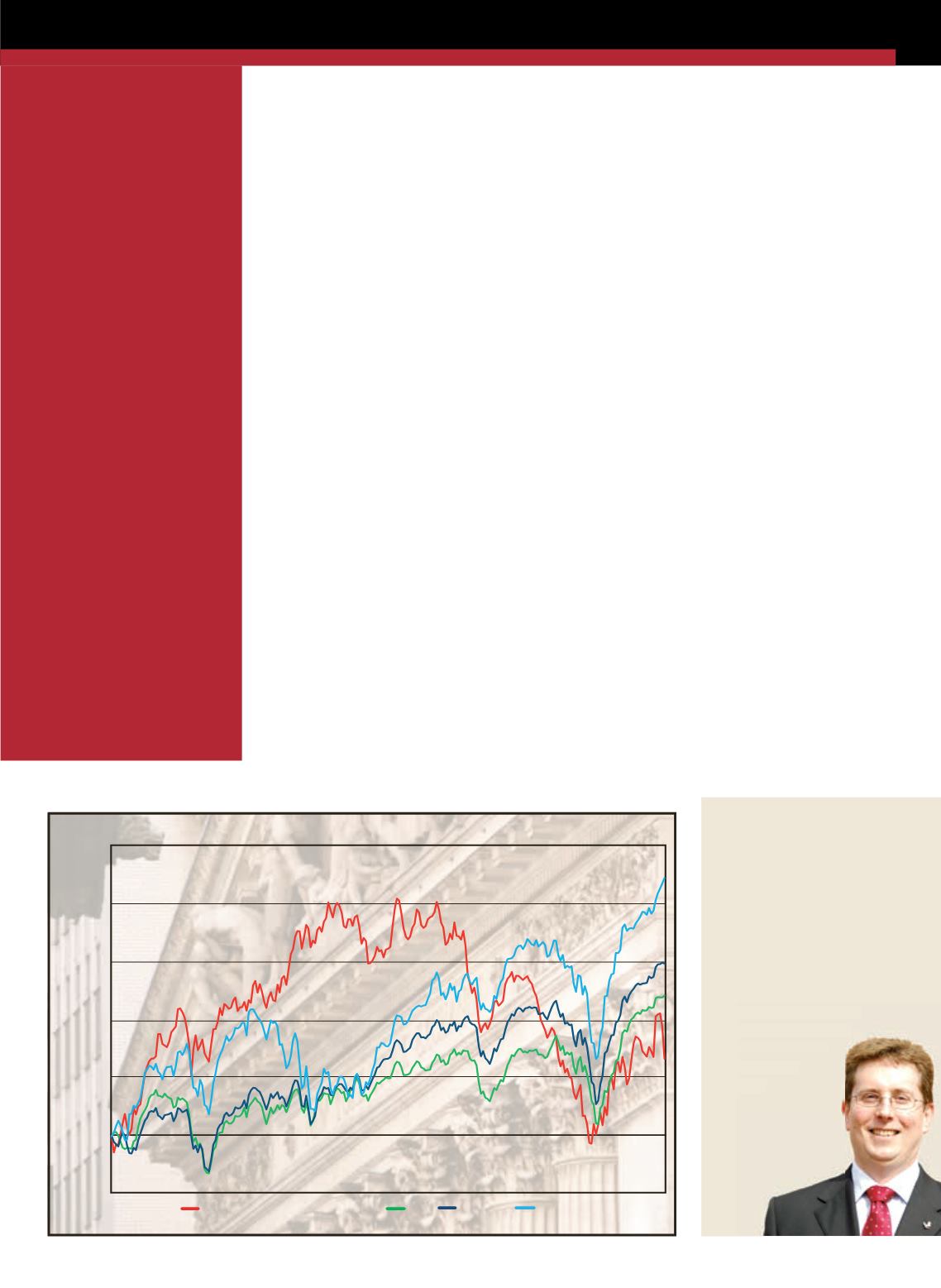

Although theheavy

equipment sector, as

representedon the graphby

the

ACT

HeavyEquipment

Index, did see someuptick

from thedrop inoil price, it

was not as strong as that of

themajormarkets.

A fall in commodityprices,

includingoil, is arguablymore

of amixedblessing for the

heavy equipment industry.

On the onehand, lower

energy costsmean it is

cheaper tomanufacture,

transport andoperateheavy

equipment.On the other

hand, the extractive industries

are amajor endmarket for

thesemachines, so a fall in

price (demand) does not

necessarilybodewell for the

sector.

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P500

25%

20%

15%

10%

5%

0%

-5%

% change

52weeks to January 2015

Outlook

The fall inoil prices in

Novemberwas triggeredby a

meetingof theOrganization

of PetroleumExporting

Countries (OPEC)which

saw this super-national cartel

decidenot to cut production

in the face ofweakening

global economic growth.

Thismarked somethingof

a reverse from theprevious

post-crisis years, whereOPEC

quotas have kept the oil price

highdespite the obvious

weakness in theworld.

Some view this action

as apricewar against the

threat of increasing shale gas

productionondemand for

oil.However, it is also the case

that additional productionof

oil has come on line recently,

particularly in theU.S. So

somewould argue it is a

simple case of excess supply

andweakdemand for oil.

Whatever the true reasons,

the outlook is for aperiodof

lowoil prices, which should

stimulatemany stocks and

economies.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’smost

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Year-end rally