IRN NOVEMBER-DECEMBER 2013

18

RENTAL SURVEYS

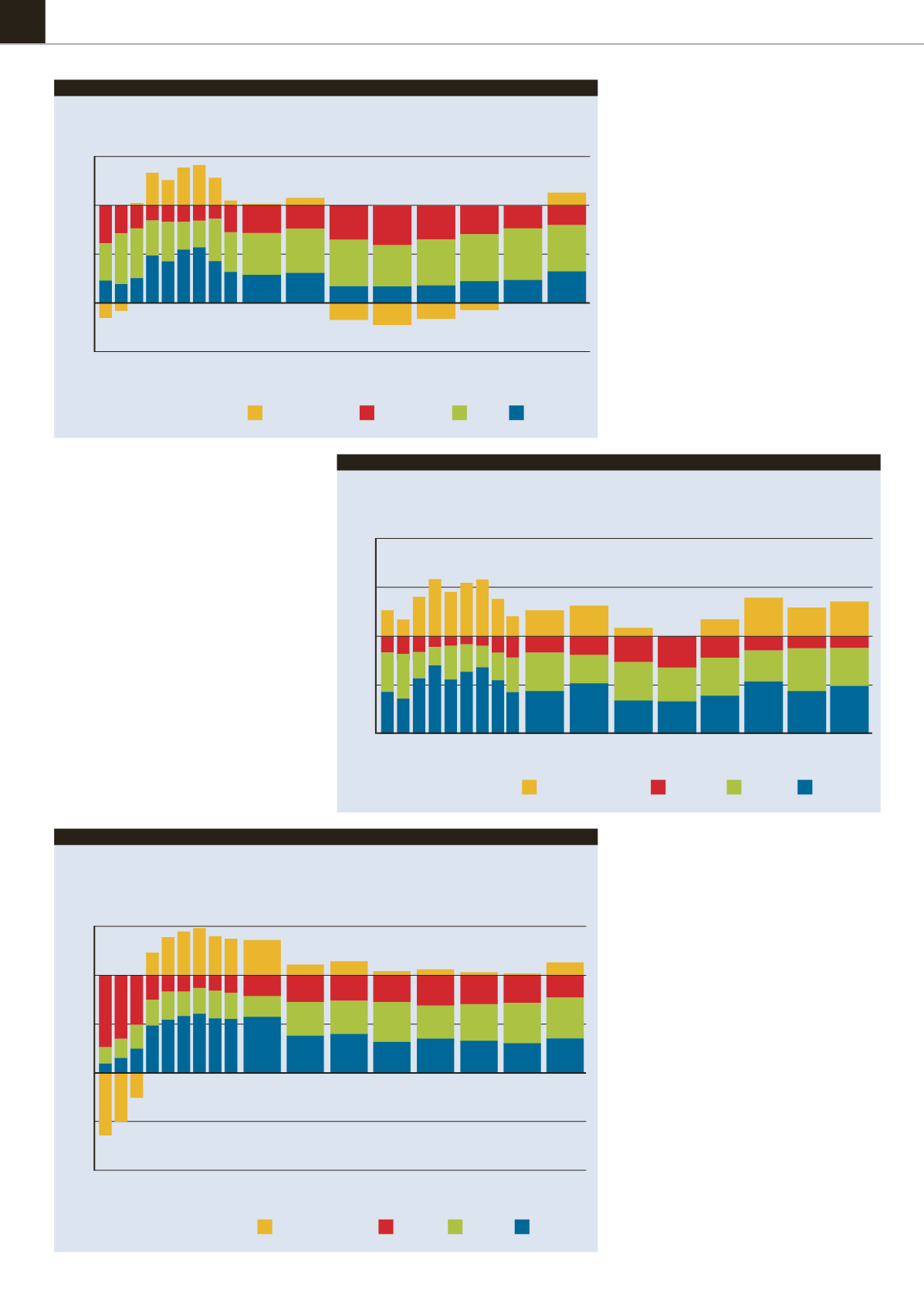

Europe:

Expectations for year from now

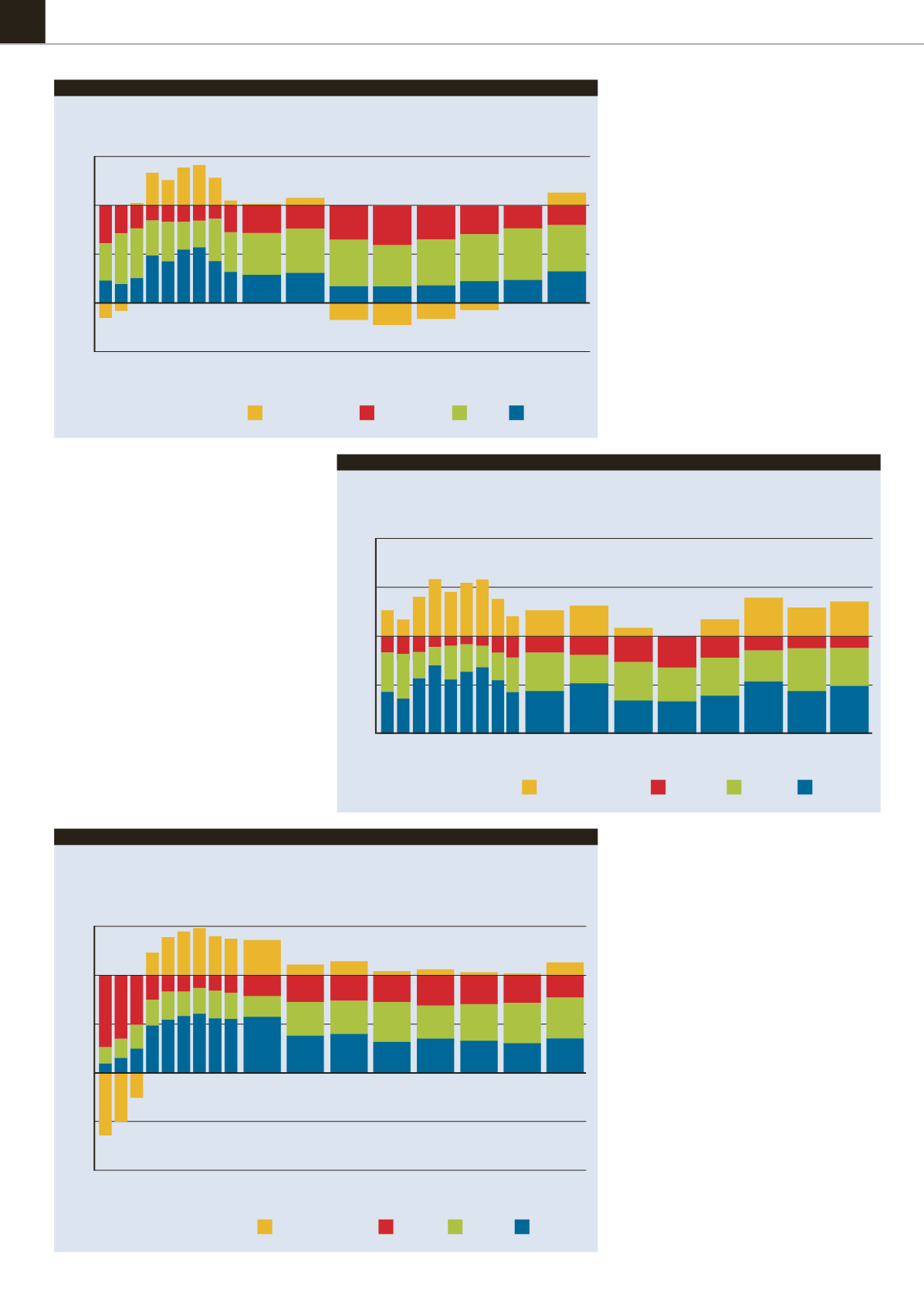

Europe:

Quarterly activity year-on-year

Europe:

Business conditions now

companies responded to

IRN’s

‘Rest of the World

Confidence Survey – see page 20.

The balance of opinion of fleet utilisation levels

almost doubled to +22.4%. Not quite 40% of

respondents reported improving utilisation and just

17% were seeing utilisation levels falling.

Higher revenues in Q3

Many rental companies were also seeing stable

or improving activity levels for the third quarter:

35.6% reported higher revenues and 42% stable,

with just 22.3% seeing lower revenues. The resulting

positive balance of opinion of +13.4% is the highest

since the second quarter of 2012.

There remains caution, however, illustrated by

the subdued findings on staff recruitment, with just

22% of businesses expecting to add staff in the final

quarter of this year. The vast majority, 65.7%, will

maintain current staffing levels, and just 12% will

reduce their workforces.

The resulting positive balance of opinion on

recruitment is +10.7%, which is slightly up on the

second quarter of the year but essentially the

same as most of the previous six quarters. You

have to go back to the final quarter of 2011 to find a

significant increase in recruitment plans.

While the aggregated figures for Europe point

to an overall improvement in business sentiment,

in truth this has been driven by certain markets

alone, notably the UK, the Nordic region and

Germany.

UK upturn

In particular, there has been a sharp upturn in

business sentiment in the UK, where there was a

remarkable +62% balance of opinion on current

business conditions – in fact, no UK company

reported worsening conditions at the end of the

third quarter (and this was even before the release

of positive GDP growth figures in the middle of

October).

UK companies were among the most optimistic

for business a year ahead – 71% expecting

improvements - and they were also among the most

likely to increase fleet investment by more than

10% next year, with 40% planning to do so.

Spain, France and Italy all reported a negative

balance of opinion on business conditions.

FIGURE 1

150%

100%

50%

0%

-50%

28.0%

43.4%

28.6%

23.8%

+7.2%

45.3%

30.9%

34.6%

-17.5%

48.3%

17.1%

40.2%

-22.3%

41.8%

17.9%

34.7%

-16.6%

47.2%

18.1%

29.5%

-7.2%

48.2%

22.3%

22.9%

54.3%

22.9%

19.4%

13.4%

47.7%

32.9%

FIGURE 2

200%

150%

100%

50%

0%

+26.9%

16.9%

39.3%

43.8%

+30.9%

19.8%

29.6%

50.6%

+8.4%

25.7%

40.2%

34.1%

+16.7%

22.6%

28.2%

39.2%

+0.6%

32.1%

35.2%

32.7%

Worse

Balance of opinion

Same

Better

Deteriorating

Balance of opinion

Same

Improving

Q

3-09

Q

4-09

Q

1-10

Q

2-10

Q

3-10

Q

1-11

Q

2-11

Q

3-11

Q

4-10

Q

2-13

Q

3-13

Q

4-12

Q

3-12

Q

2-12

Q

1-12

Q

4-11

Q

1-13

Q

3-09

Q

4-09

Q

1-10

Q

2-10

Q

3-10

Q

1-11

Q

2-11

Q

3-11

Q

4-10

Q

2-13

Q

3-13

Q

4-12

Q

3-12

Q

2-12

Q

1-12

Q

4-11

Q

1-13

Q

3-09

Q

4-09

Q

1-10

Q

2-10

Q

3-10

Q

1-11

Q

2-11

Q

3-11

Q

4-10

Q

2-13

Q

3-13

Q

4-12

Q

3-12

Q

2-12

Q

1-12

Q

4-11

Q

1-13

+39.6%

14.3%

31.9%

53.8%

+30.0%

13.2%

43.7%

43.1%

+36.2%

13.1%

33.7%

49.2%

150%

100%

50%

0%

-50%

-100%

FIGURE 3

+36.2%

21.4%

21.0%

57.6%

+11.1%

27.2%

34.6%

38.3%

+13.9%

26.1%

33.9%

40.0%

+3.7%

27.9%

41.1%

31.3%

+5.9%

30.1%

33.9%

36.0%

+1.8%

30.4%

37.3%

32.2%

+1.4%

28.8%

41.0%

30.2%

+13.4%

22.3%

42.1%

35.6%

Lower

Balance of opinion

Same

Higher

+0.6%

Multinational companies

remain among the most

confident with 50%

expecting to increase

spending by at least

10% next year (against an

average of 30% for

the whole of Europe).

¬