14

HIMOINSA INTERVIEW

IRN NOVEMBER-DECEMBER 2013

Europe strategy

Francisco Inglés, Himoinsa’s sales manager for

Europe, says the company had to completely

change its strategy when the crisis hit its sales

to Europe’s rental sector.

In the boom years, rental was a key market

for the manufacturer, with standby power

applications representing little more than 20%

of its business. Now, that non-rental market

accounts for 60-65% of its business in Europe.

“We were focused on rental, prime power”,

he says, “but we had to convert to standby. The

crisis taught us that we have to become more

flexible, try to find new niches, niches that

existed but we didn’t pursue.”

He is adamant that rental remains a

cornerstone for Himoinsa in Europe. “We have

not forgotten rental at all – we developed the

PowerCube for rental, and extended our rental

range up to 660 kVA.”

Mr Inglés, who has spent almost 15 years with

Himoinsa, says there are signs that Europe is

improving, although he remains realistic about

growth prospects.

He says the company performs best where

it has its own subsidiary, a fact that has led

the company to create a UK subsidiary, led

by former SDMO sales manager Clive Dix. The

business will be fully operational at the start of

2014, adding to the existing Himoinsa companies

already operating in Germany, Poland, France

and Italy.

He is also optimistic about the previously

mentioned 500/600 kVA PowerCube; “It’s

not very well known yet, but it will be very

interesting to rental companies because its

small – which makes it easy for stacking – and

has low noise levels.”

says Mr Inglés, “We will make it competitive.”

Although the target market for the gensets will

be Asia Pacific Himoinsa said it would consider

requests for the units from other markets where low

emission engines are not required, such as South

America.

The range, which will be in production by January

In addition to its compact rental generator sets

Himoinsa makes large containerised generators. It has

also begun cooperating with German company Frerk on

large sets using heavy fuel oils (HFO).

the standby market.”

Perhaps even more important is the plan to expand

its US operation, based in Kansas. An investment of

around US$25 million will see the company open a

sheet metal fabrication facility that will increase the

local content – canopies are currently imported to

the US – and increase production capacity by around

seven or eight times. It will also make its gensets

more competitive, says Mr Gracia. That facility

should be up and running by 2015.

North America and its high-spending rental sector

is already a major market for Himoinsa – accounting

for around a fifth of all revenues – and Mr Gracia

says it has the potential to be much bigger and is a

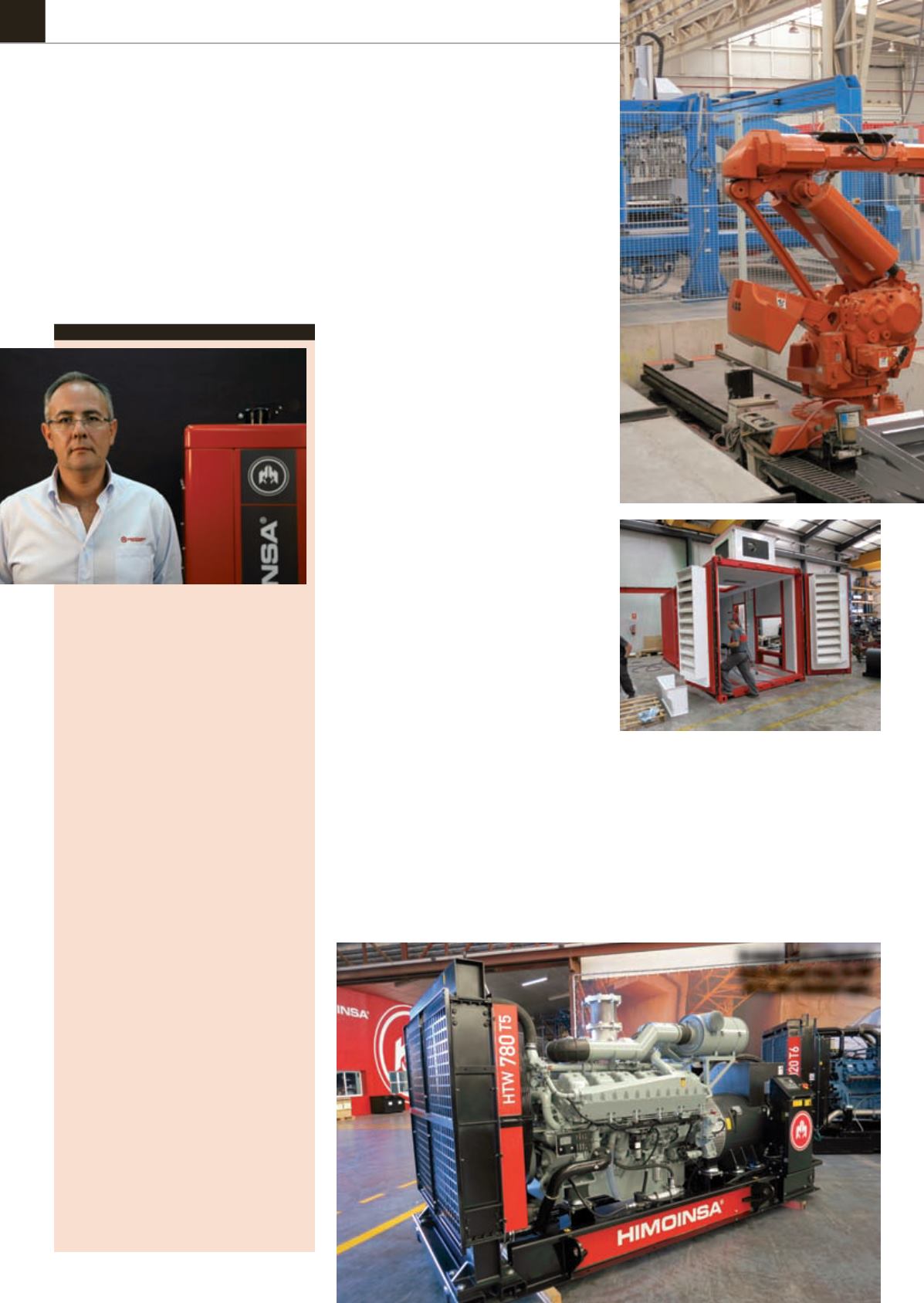

An example of one of Himopinsa’s

heavy duty engine range, the HTW

780 T5, with a Mistubishi engine.

very “strategic market”.

With Europe likely to be flat over the coming

years and African growth still gradual rather than

dramatic, it is North America and Asia Pacific

that Mr Gracia says represent “the meat on the

barbeque. All markets are important, but we think

we can grow faster in these two areas.”

Currently Europe, the Middle East and Africa

represent 55% of Himoinsa’s sales, with the

Americas at 30% and Asia Pacific and India and

15%. Mr Gracia says an equal third share between

the three regions is what he would prefer within five

years, meaning that Asia Pacific needs to expand.

In that same period the company aims to double

revenues to €500 million.

The company hopes that working with good

distributors in Asia will help it grow, although the

competition from low cost Chinese suppliers makes

it difficult. Himoinsa has some strong partners,

such as the RMA Group in Thailand and Myanmar –

a business that now has its own rental operations

– and Tuyet Nga Co Ltd (TNC) in Vietnam, a sales

and rental company. In Australia it has respected

distributors in Crommelins Machinery (for the west

of the country) and Generator Power (in the east).

One important element of the Asia Pacific

strategy is the launch of a new range of gensets

using engines made by Wuxi Diesel, a subsidiary of

Chinese automotive and truck manufacturer FAW

Group.

This is a departure from its usual strategy, and

Himoinsa is careful to emphasise that the new

range will not compete with its existing Chinese

built gensets – produced at its plant in Changzhou

- but will address the 30% of the Asia Pacific genset

market that uses lower cost engines produced by

Chinese suppliers. Himoinsa says it cannot currently

compete in this segment.

Chinese-made engines

The company said it has looked long and hard at

the Wuxi Diesel operation and says the gensets,

although cheaper, will be subject to the same

degree of testing and quality control that it applies

to all its products.

“We need to enter this 30% of the market to

maintain sustainable growth”, says Manuel Inglés,

managing director of Himoinsa China. The engines

will be branded Himoinsa and will be supported and

serviced by the company in the same way as with its

other gensets.

“We are talking about a two-digit price reduction”,

Francisco Inglés.