20

RENTAL SURVEYS

In each country there were more companies

reporting worsening conditions than were seeing

improvements. The Benelux region also remains

subdued, although at least with a +13% balance of

opinion on business conditions.

Benelux companies are among the most

cautious on fleet investment next year, along

with France and Spain, and were least confident,

after Spain, about business prospects for 2014,

with less than a third of companies anticipating

an improvement. That compares to 49% for all

respondents.

The Nordic region remains one of Europe’s

most buoyant areas. Three quarters of

respondents from the region are expecting

further improvements next year; there was a

+26.1% balance of opinion on current business

conditions; and half were seeing improving fleet

utilisation levels.

However, companies in the Nordic region

remain cautious on investment, with just

29% expecting to increase spending by

more than 10% next year – which is almost

the same as the average for Europe as a

whole.

Confident multinationals

Multinational companies remain among the

most confident, and are more likely to be reporting

Europe:

Year to date

IRN NOVEMBE-DECEMBER 2013

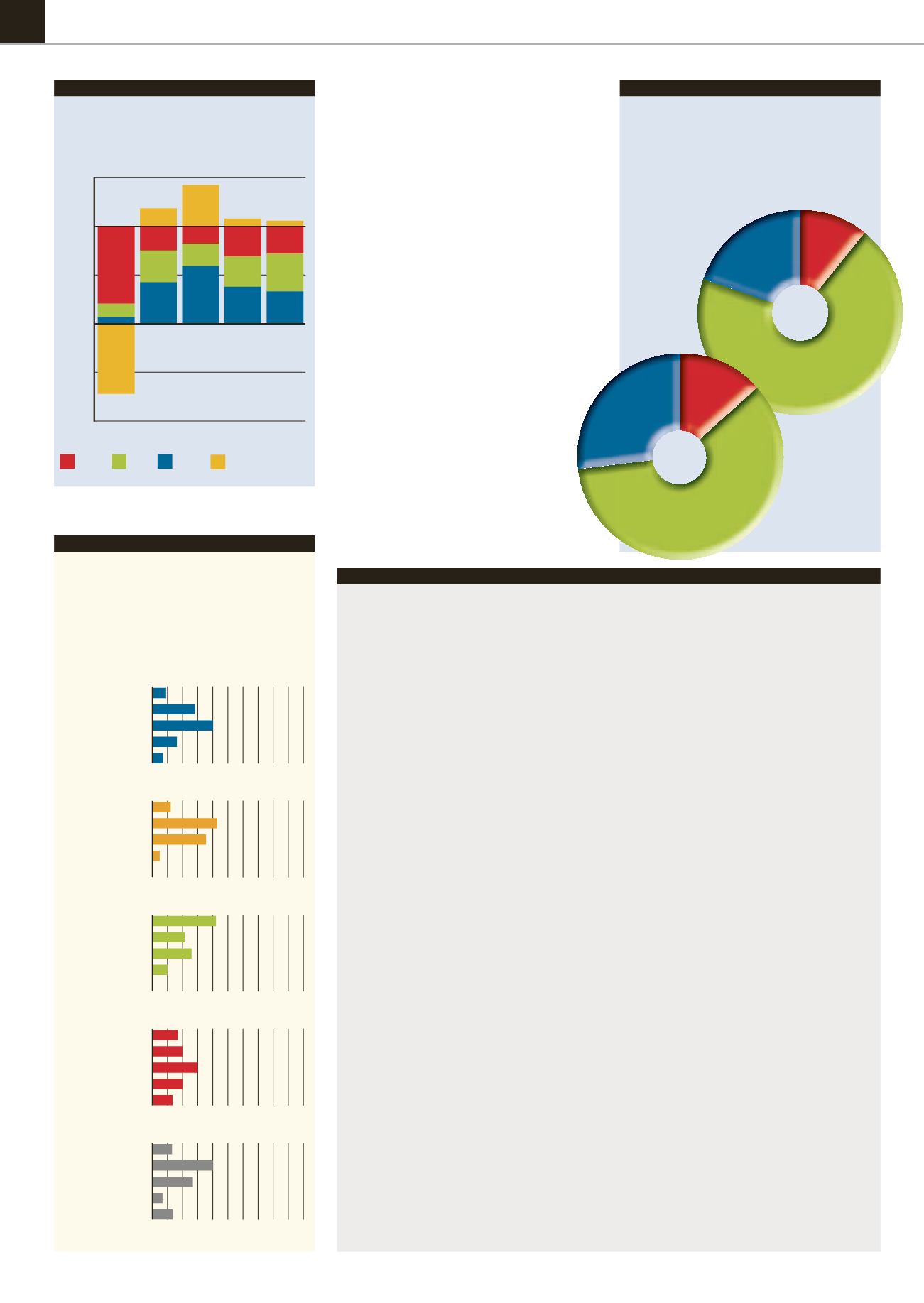

FIGURE 4

150%

100%

50%

0%

-50%

-100%

Worse

Balance of opinion

Same Better

Europe:

Next quarter

employment

intentions

FIGURE 5

Q

3-12

Q

3-13

Q

3-10

Q

3-09

Q

3-11

79.6%

12.2%

8.1%

+42.8%

17.0%

23.2%

59.8%

+7.9%

30.5%

31.1%

38.4%

+5.9%

27.7%

38.6%

33.7%

-71.5%

24.4%

32.9%

42.7%

+18.3%

Rest of the World

It is not surprising that by almost every measure, rental companies outside Europe are reporting better

business conditions than their counterparts in Europe. We had 120 responses from the ‘rest of the world’

area, including 40 from North America, around 20 from South America, 15 from the Middle East and Africa,

and 35 from Asia, which includes India, Japan, Australia and New Zealand.

In terms of current business conditions, only Asia ranked lower than Europe, with the China slowdown

and Australia’s cooling natural resources sector both having an impact. Rental companies in North and

South America were the most happy with current business conditions, beaten only by UK respondents.

In all the rest of the world territories, a healthy proportion were reporting higher year-on-year

revenues for the third quarter - 70% in the case of South America. That compares to the 36% average

for Europe. Some 44% of rest of the world business were expecting to employ more staff in the final

three months of this year - that’s double the Europe figure. Only Russians were more upbeat on their

recruitment plans.

The essential difference between the regions is illustrated by views on revenue expectations for the full

year 2013. While 37% of all Europeans were anticipating increased sales this year, the same statistic for

North America was 55%, in South America it was 63%, and in Middle East and Africa it was 53%. Asian

rental businesses were closer here to their European counterparts, with 37% forecasting higher revenues.

A good proportion of these respondents are from Australia, where business has fallen off from a natural

resources investment boom.

Improving utilisation

Given that rental businesses in the rest of the world have been enjoying a more favourable business

environment than in Europe for some time, it is perhaps surprising that many are still reporting

improvements in utilisation rates. Companies in the Middle East and Africa were most likely to report

rising utilisation rates in the third quarter - 77% did so - while the average for all rest of the world

companies was 51%, compared to 39% for Europe. In this measure, rental companies in the UK, European

multinationals and Nordic firms, equalled their counterparts elsewhere.

Planned investment rates this year and next tell a similar story, with 44% of rest of the world companies

reporting at least a 10% increase in fleet spending this year (it was 28% in Europe). The figures for 2014

are more interesting, and reveal that 43% will increase investment by at least 10%, again, higher than the

European 30%.

Those with the most ambitious spending plans are companies in the Middle East and Africa, followed

by South America. North American rental companies were less likely to be increasing spending – almost

a third will increase investment by at least 10%, just below the European average - but the context is

different, with many North American businesses having already spent at a high level for several years.

Overall the survey paints a picture of a still growing South American rental sector; continued reasonable

conditions in North America and a similarly upbeat environment in the Middle East/Africa. Only in Asia,

with the complications of China and Australia, is there a more subdued environment.

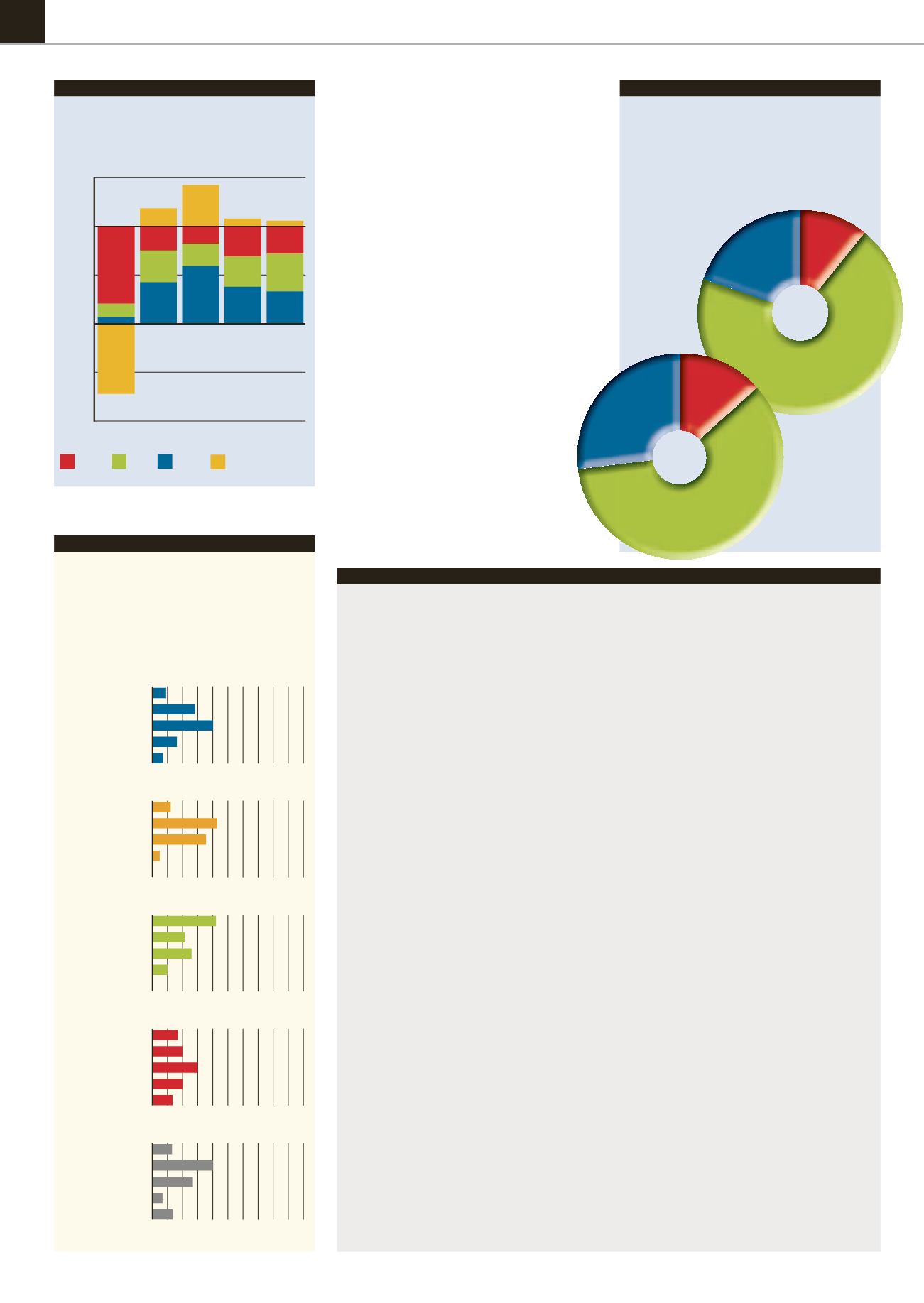

Worldwide: Revenue

expectations – 2013

against 2012

TABLE 1

EUROPE

>10% higher

9

+5% to +10%

28

Stable

40

-5 to -10%

16

>10% lower

7

NORTH AMERICA

>10% higher

12

+5% to +10%

43

Stable

36

-5 to -10%

4

>10% lower

0

SOUTH AMERICA

>10% higher

42

+5% to +10%

21

Stable

26

-5 to -10%

10

>10% lower

0

ASIA

>10% higher

17

+5% to +10%

20

Stable

30

-5 to -10%

20

>10% lower

13

MIDDLE EAST/AFRICA

>10% higher

13

+5% to +10%

40

Stable

27

-5 to -10%

7

>10% lower

13

0 10 20 30 40 50 60 70 80 90 100

0 10 20 30 40 50 60 70 80 90 100

0 10 20 30 40 50 60 70 80 90 100

0 10 20 30 40 50 60 70 80 90 100

0 10 20 30 40 50 60 70 80 90 100

EMPLOY MORE

19.5%

EMPLOY LESS

10.9%

NO CHANGE

69.6%

Q

3-13

Q

4-13

EMPLOY MORE

22.5%

EMPLOY LESS

11.8%

NO CHANGE

65.7%