15

AUGUST 2013

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is one of

the world’s most internationally

renowned construction

business writers, with

specialist expertise in financial

markets and stock market

analysis. He is editor of KHL’s

market-leading

International

Construction

and is a regular

contributor to

ACT’

s

sister publication,

International Cranes

and Specialized

Transport

.

The stock market

rally of the last

12 months looked

like it was starting

to gently in mid-

summer, but

the equipment

sector dropped

like a stone.

Chris

Sleight

reports.

N

ews that the Fed

was thinking

about gently

phasing out quantitative

easing (QE), the ‘money

printing’ stimulus measure

that has helped keep the

economy afloat in recent

years, was enough to knock

stock markets off the growth

path they had been on

for more than a year. Late

June and July saw the Dow,

NASDAQ and S&P 500 fall

back from their recent highs.

Whenever there is a stock

market rally, the one certainty

is that there will be a fall

back in prices afterwards. In

one sense this is part of the

definition – the fall in prices

marks the end of the growth

period, and if shares don’t

go back down then the rally

hasn’t ended yet.

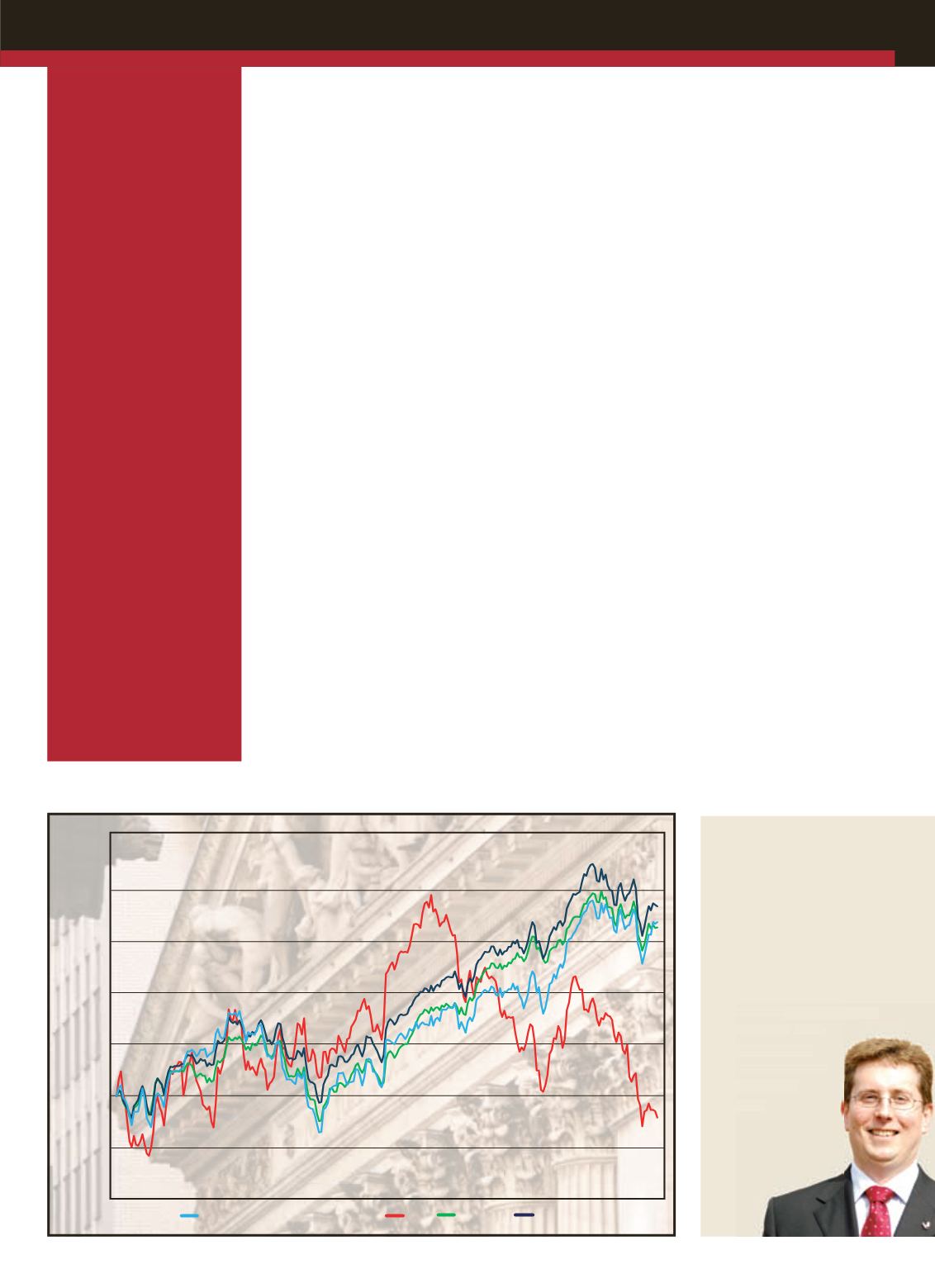

Although there was some

day-to-day and week-to-week

volatility in the markets, taken

over the longer term – our

graph illustrates a year of

stock market changes – the

downturn looked relatively

mild. All three major indexes

remained more than 15

percent ahead of where they

were 12 months ago, and after

the initial drop, there seemed

to a rebound.

Not so for the equipment

sector, as represented by the

ACT

Heavy Equipment Index.

When the major markets

turned it dropped like a stone.

Credit tightening

One of the issues for the

sector was that it had more

than just the domestic

situation to contend with.

June also saw the Chinese

Central Bank announce a

series of credit tightening

measures. It remains to be

seen how this plays out, and

China does have a good

track record of managing its

economy. However, investors

were understandably spooked

at the prospect of another

credit crunch.

Although the biggest

negative effects of this

downturn were seen on

the Chinese stock markets,

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

25%

20%

15%

10%

5%

0%

-5%

-10%

% change

52 weeks to July 2013

there was a knock-on effect

for many U.S. equipment

manufacturers, which do

significant business in China.

Another factor weighing

on the equipment industry is

the general global economic

malaise. As a cyclical business,

the sector needs robust

economic growth for sales

to take off. Although there is

growth in the world economy,

it is not strong enough to tip

the scales for the sale of big-

ticket items like cranes and

earthmoving equipment.

The knock-on effect of this

is that in such an uninspiring

environment, bad news about

the global economy seems

to weigh particularly heavily

on the industry. On the other

hand, there is not enough

good news around (or it is not

positive enough) to really lift

the sector out of the doldrums.

Hence the current situation,

where many equipment

manufacturers’ share prices

seem to be suffering the

downturns without enjoying

much of the upside.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Rally retreats