13

NOVEMBER 2013

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is one of

the world’s most internationally

renowned construction

business writers, with

specialist expertise in financial

markets and stock market

analysis. He is editor of KHL’s

market-leading

International

Construction

and is a regular

contributor to

ACT’

s

sister publication,

International Cranes

and Specialized

Transport

.

The government

shutdown didn’t

do much to hurt

stock market

confidence, but it

will be a different

story if a debt

default follows.

Chris Sleight

reports

T

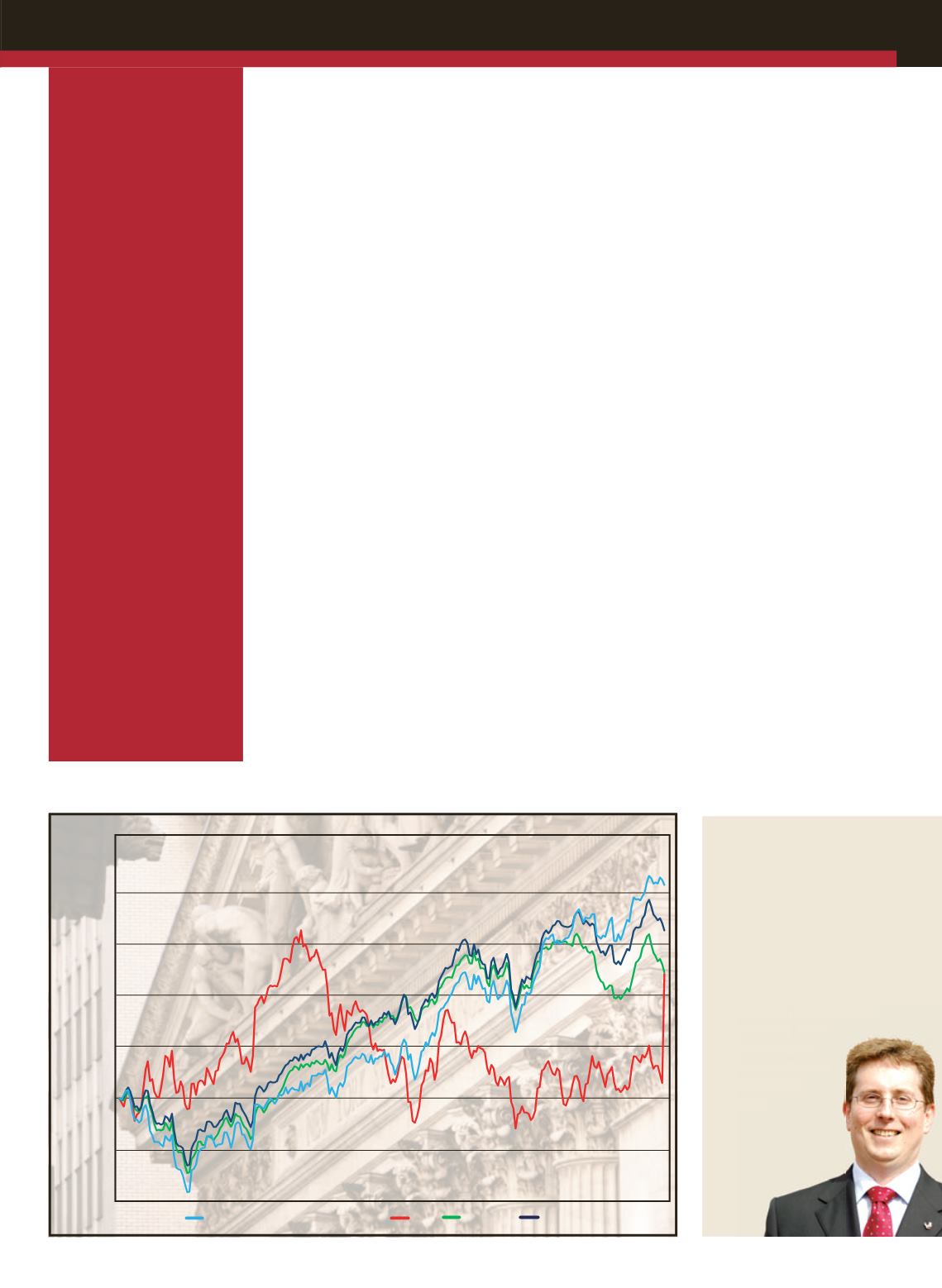

he government

shut-down in

early October

passed without much of

a reaction from the stock

markets. The Dow and other

benchmarks like the S&P

500 and NASDAQ suffered a

dip, but by the middle of the

month, as

ACT

was going to

press, they were back up at

similar levels to those seen

throughout the summer.

This was a little surprising

given the dire warnings of

the impact on the economy

from the shutdown - many

economists think it will put a

small but measurable dent in

fourth quarter GDP.

The impact on stock

markets was an initial drop

of a couple of percentage

points for a week or two.

By the third week of the

shutdown (beyond the scope

of our graph), the Dow was

back above 15,000 points and

it pretty much looked like

business as normal.

There were two factors at

play here. First was that the

markets had already priced

the shut-down into their

calculations –if it had been

avoided, there might have

been an up-tick.

Second, the impact is not

expected to be too serious.

If there is continued failure

to sort out America’s debt

problems, there may be

long-term deterioration in

the markets. However, with

a budget agreement being

negotiated before serious

damage was done to the

economy, there was not a

huge downturn in share

prices.

As far as the heavy

equipment sector was

concerned, again there was

not much impact. The sharp

leap in the

ACT

-HEI line

on this month’s graph is due

to the rolling-up of CNH

and Fiat Industrial into a

new corporate entity, CNH

Industrial. This combines the

construction and agricultural

equipment made by CNH

with on-highway trucks and

power train components

from Fiat Industrial to form a

broader capital goods group.

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

25%

20%

15%

10%

5%

0%

-5%

-10%

% change

52 weeks to October 2013

The new entity has

about twice the market

capitalization as CNH, hence

the jump in the graph.

Outlook

The government shut-down

may not have rattled the

markets, but the threat of a

default would be something

else. A default by the U.S.

would be catastrophic for

global financial markets, as it

would undermine confidence

in the world’s most widely

used financial instruments.

This is what forced a the

last-minute agreement that

saw government open up

again.

However, there will still be

consequences for America.

Another credit downgrade is

a real possibility as politicians

once again demonstrate that

partisan posturing is more

important to them than

running the country.

And the latest agreement

was just a postponement.

The underlying issues with

America’s debt have not been

resolved.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

What shutdown?