41

IRN SEPTEMBER-OCTOBER 2013

¬

Start transmitting

Momentum is growing for the use of telematics systems in the rental industry. How long before it

becomes a standard part of every rental companies’ fleet management procedures? IRN reports.

T

elematics is coming your way whether you

like it or not. After all, you are using GPS

machines in your car, probably, and in your

phone, perhaps, so it would be almost perverse to

resist the use of tracking systems in equipment that

is in most cases is considerably more valuable.

The manufacturers are pushing it for several

reasons. First, it’s a genuinely useful service

that they can offer their customers. Second, the

technology allows them to track machines in the

field and anticipate (and generate) after sales service

business, including replacement of parts. Third,

knowledge of how machines are being used helps

them design future machines, identify problems and

understand the behaviour of end users.

For rental companies, of course, knowledge of

where machines are, how they are operating, and

when they might be moving when they shouldn’t be,

is part and parcel of the fleet management function.

Modern telematics just allow rental companies to do

that task much more accurately than before and, of

course, in real time.

Many manufacturers are offering telematics

systems to their customers, and several have started

to do so recently. Wacker Neuson, Case, Hyundai (in

2010), New Holland, Manitou and Doosan Infracore

with its Vision GPS system are among those who have

recently added telematics to their product offerings.

(Doosan Infracore also announced a telematics link-

up with Orbcomm as

IRN

was going to press.)

New Holland Construction, for example, is now

offering its FleetForce system in two versions, each

with a three year subscription: a ‘Basic’ subscription

is available for the compact line and offers key-on,

motion detection and GPS tracking, while for the

heavy line there is the ‘Advanced’ package, which

integrates with the machine through its CAN-bus

data system to track an extensive list of operating

data.

Massimiliano Sala, New Holland’s telematics

product manager for Europe, highlights the value of

the system to rental companies in providing machine

performance data; “you can show the customer

the rental machine’s actual fuel consumption and

give him the average so he can compare it to other

models he is considering renting.”

Hyundai’s Hi-Mate is standard equipment on all its

wheeled loaders and excavators with an operating

weight of 14 t or over. It can be used over the entire

lifetime of a machine, and use of the system is free

for the first two years of ownership.

Hyundai says rental fleets will appreciate in

particular the alerts for maintenance requirements,

with the system monitoring scheduled intervals for

exchange of filters for fuel, hydraulic oil and air

intake.

SiteWatch from Case

The new Case system, SiteWatch - like New Hollands’

FleetForce - offers two options, Basic for backhoe

loaders, compact tracked loaders, skid steer loaders

and midi excavators, reporting every two hours, and

Advanced, which is supplied with dozers, wheeled

loaders, crawler and wheeled excavators, and sends

data every 10 minutes. Both subscription packages

have a three-year durations, with extensions

available through the dealer spare parts channel.

SiteWatch will be available as an option on some

models directly from the factory, or customers can

order it as a dealer-installed accessory, with specific

kits available for various model ranges.

It is worth noting that Case is also offering a

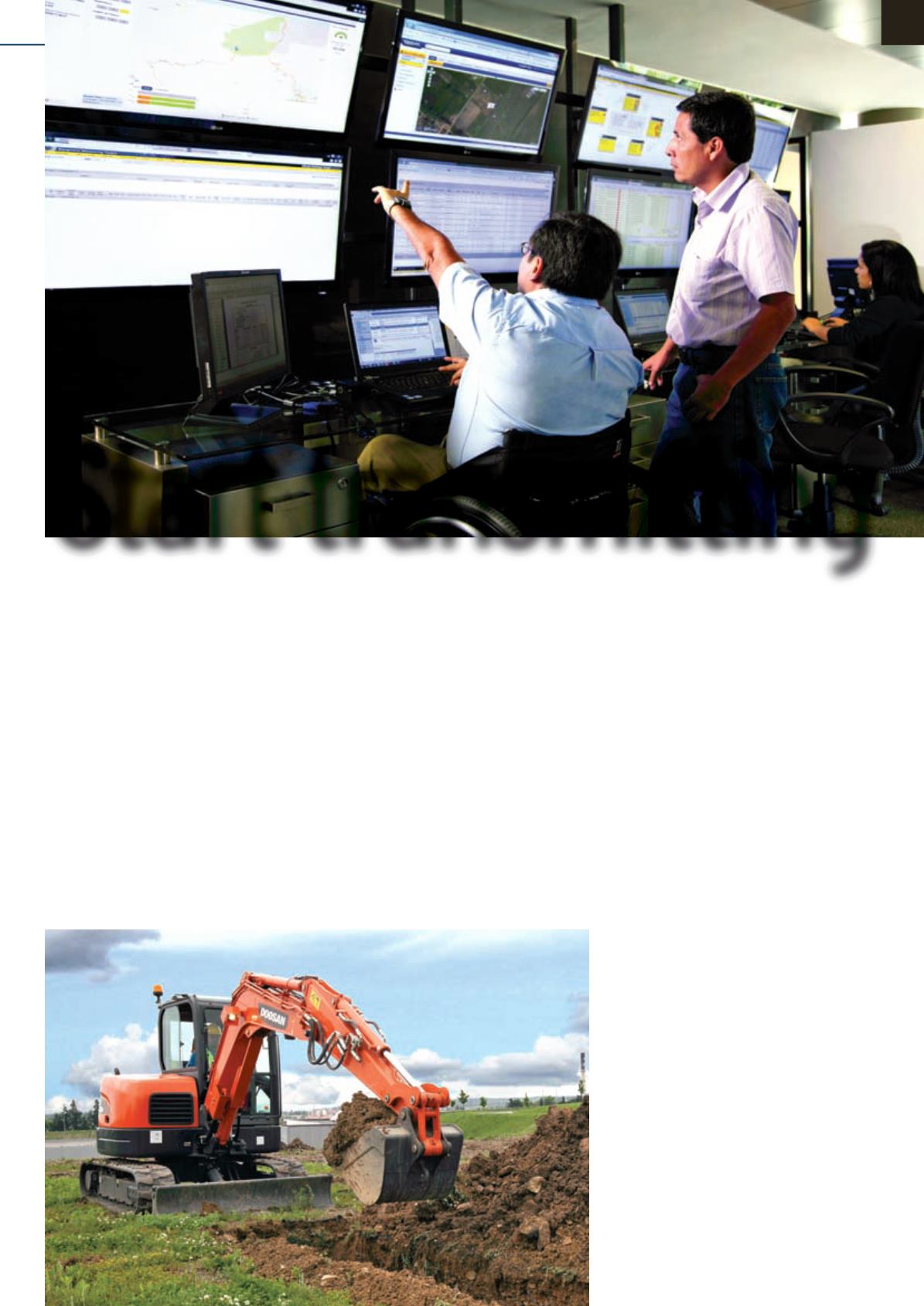

Cat dealer Ferryros in Peru, Guatemala and El Salvador

manages a fleet of 3900 machines, including around 600 units

in its own rental fleet, through Product Link. The electronic

data is combined with other monitoring elements, such as

fluid analysis and field inspections, and delivered to clients

by a contact centre, helping them manage their fleets and

preventing unexpected failures.

Customers can sign up for one, three or five year

contracts for Doosan’s Vision GPS telematics system.

ASSET TRACKING