26

WORLD RENTAL REPORT

IRN SEPTEMBER-OCTOBER 2013

in the last three years than it did in the previous 35.

The aerial platform fleet will continue to be

established as a national business, while the

scaffolding and power generation operations will

be focused in the north east of Brazil, close to its

base. Power will eventually be expanded nationally,

but Estaf want to consolidate its knowledge of this

product before expanding, having only entered the

power market in 2010. Its fleet of 350 generators are

sourced from Caterpillar, Atlas Copco and Stemac, a

Brazilian manufacturer.

The investment from Rio Bravo has also allowed

the company to expand its footprint, with eight

current locations spread around Brazil and plans for

another four within the next 12 months.

The aerials business – with a fleet of 1000 machines

by the end of the year - is now a major focus, and

takes up the lion’s share of fleet investment.

Despite the heavy investment in aerials by

Brazilian companies - including Mills and Solaris - Mr

Lima does not see yet see evidence of oversupply;

“Even with the growing fleet in Brazil, the rental

price is still about the same.”

Estaf’s strategy is to develop a professional

approach to rental, with one aspect of this the

decision to buy only new equipment – primarily JLG

and Genie. It operates large branches, typically with

200-300 machines, and Mr Lima says the aim is to

differentiate themselves from the competition by

focusing on good after sales service.

He agrees with Mills’ predictions of a doubling of

the access rental fleet by 2020 – which would take

the fleet to close to 50-60000 units. “Yes. When you

compare Brazil to Europe, it is doable”, says Mr Lima.

The Estaf strategy is to focus on its three

specialist products, with no current plans to add

cranes or move into the general equipment market.

And, of course, it is aware of the interest that rental

companies outside Brazil have in its market. The

message from Mr Lima is clear; “We are open to

discuss joint ventures or partnerships with other

companies.”

IRN

INDIA

By some estimates the Indian equipment

rental market is growing at a compound annual

growth rate of 40%, but to suggest it is simply

a fast-growing version of the European or North

American markets would be a mistake, says Vivek

Soni, the co-CEO and CFO of Mumbai-based Gemini

Equipment And Rentals (GEAR), one of India’s

largest pure rental companies.

Mr Soni, a chartered accounted with a

background in finance, has been at the helm of

GEAR for almost four years – a period in which

the business has tripled in size – and he tells

IRN

that the Indian rental market is huge, but remains

dominated by small, poorly organised players;

“The barriers to entry are very low – anyone with

20-30 million Rupees can buy a machine and live

off the rentals. 60 to 70% of all equipment in

India is sold to people with net worth of less than

$150000. There is very little organised rental.”

In this environment, GEAR’s strategy has been

to focus on specialist areas, largely avoiding the

overcrowded earthmoving sector, typified by the

omnipresent JCB backhoe loader. That means

concreting equipment (mobile placing booms,

transit mixers and concrete pumps), road building

machines, tower cranes, construction hoists and

mast climbing work platforms. The company also

created in 2011 a division that imports, sells and

rents forklifts, including the Still brand.

“Now, earthmoving equipment represents the

low single digits on percentage of the fleet”, he

says, “There’s not much money in earthmoving.”

In contrast, concreting equipment and vertical

equipment such as hoists and cranes now

represent 55-60% of the business.

Operating in India brings with it challenges,

such as a federal structure that imposes a dense

bureaucracy and a wide variety of tax regimes. To cope, GEAR operates seven regional offices and a

further 150 customer sites where machines, operators, mechanics and spare parts are placed. Its fleet

comprises around 600 units and it has 1800 employees. Reducing the logistical burden for contractors is

seen as a major selling point for rental, says Mr Soni.

Logistics may be difficult, but GEAR – which is backed by two private equity investment firms, Cycladic

Capital and its majority owner Berggruen Holdings - manages to track the location and status of its fleet

daily, not by telematics – cell phone networks are not widespread enough – but by having a network of

contacts (operators, site supervisors, clients) who are called daily by its call centre. All machines are

rented with an operator.

Mr Soni says there are several market dynamics that favour the development of rental. India’s

bigger contractors, who traditionally preferred owning their equipment, have faced a slowdown in the

construction market and seen their equipment lie idle; “Now they see the attractions of rental. And now

capital is short, so they would rather use it on their business than in a depreciating asset.”

In addition, there is a trend for India’s larger contractors to outsource more site work to small and mid-

sized contractors who are unable to access capital to buy equipment, so look instead to rental.

In the current slowdown, however, GEAR has targeted business with the 50 largest contractors in India,

because Mr Soni says these companies are weathering the downturn better than the smaller players.

“Construction is currently going through a slight rough patch, largely because of government policy”,

he says, “The sector will pick up slowly – in one or two years construction will be back on track. The real

kick start will come after elections next year. From a rental point of view it’s a great time to be in the

business, with everybody wanting to rent rather than buy.”

GEAR has so far resisted the allure of the aerial platform market, where European players including

Riwal and Lavendon have now established Indian footholds. Mr Soni says returns in the sector remain

“sub-optimal, with lots of used assets. You can’t break even with new equipment. Legislation to deal with

health and safety and working at height has still not been rolled out in the construction sector. It will

happen, and then access equipment will be an easy bolt-on.” More interesting to Mr Soni are different

sectors, such as the rental of healthcare equipment, a market that GEAR is poised to enter.

So GEAR is ready for the upturn, and resisting the urge to import the western approach to rental, instead

creating an Indian variant that suits the market.

Vivek Soni, co-CEO and CFO of Gemini Equipment and

Rentals (GEAR).

“The real kick start will

come after elections

next year. From a rental

point of view it’s a

great time to be in the

business, with everybody

wanting to rent rather

than buy.”

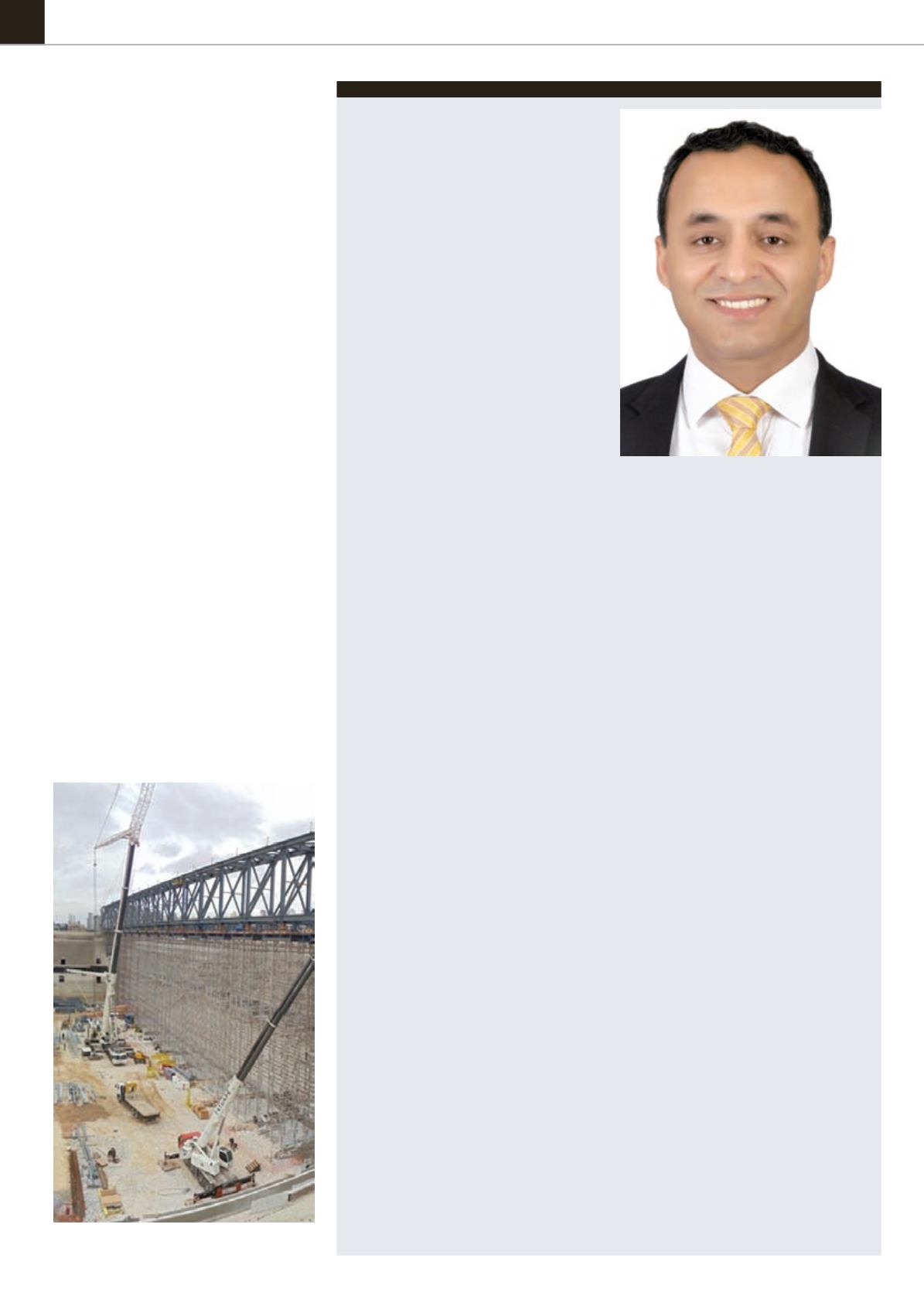

The Arena da Baixada stadium, Curitiba, has been

expanded for next year’s World Cup.