19

WORLD RENTAL REPORT

IRN SEPTEMBER-OCTOBER 2013

SOUTH AFRICA

“The South Africa economy is a bit patchy”, says

George Landsberg, managing director of Goscor

Hi-Reach, a South African distributor of aerial

platforms and telehandlers that also has sister

company that rents platforms, “Our economy tracks

Europe less than the US, so we are going through

some of the pain that you find in Europe as well.”

One important element of that economic picture

is a devaluation of the Rand against the US Dollar,

which is making it more expensive for South African

rental companies to import US made products,

which is significant in an access market where

the two biggest suppliers, Terex AWP and JLG, are

US-based.

“There has been quite an increase in import costs

for rental companies – the bulk of equipment is

imported”, he says. Goscor Hi-Reach, which is part

of the well-established Goscor Group, is dealer for

Terex AWP’s Genie machines.

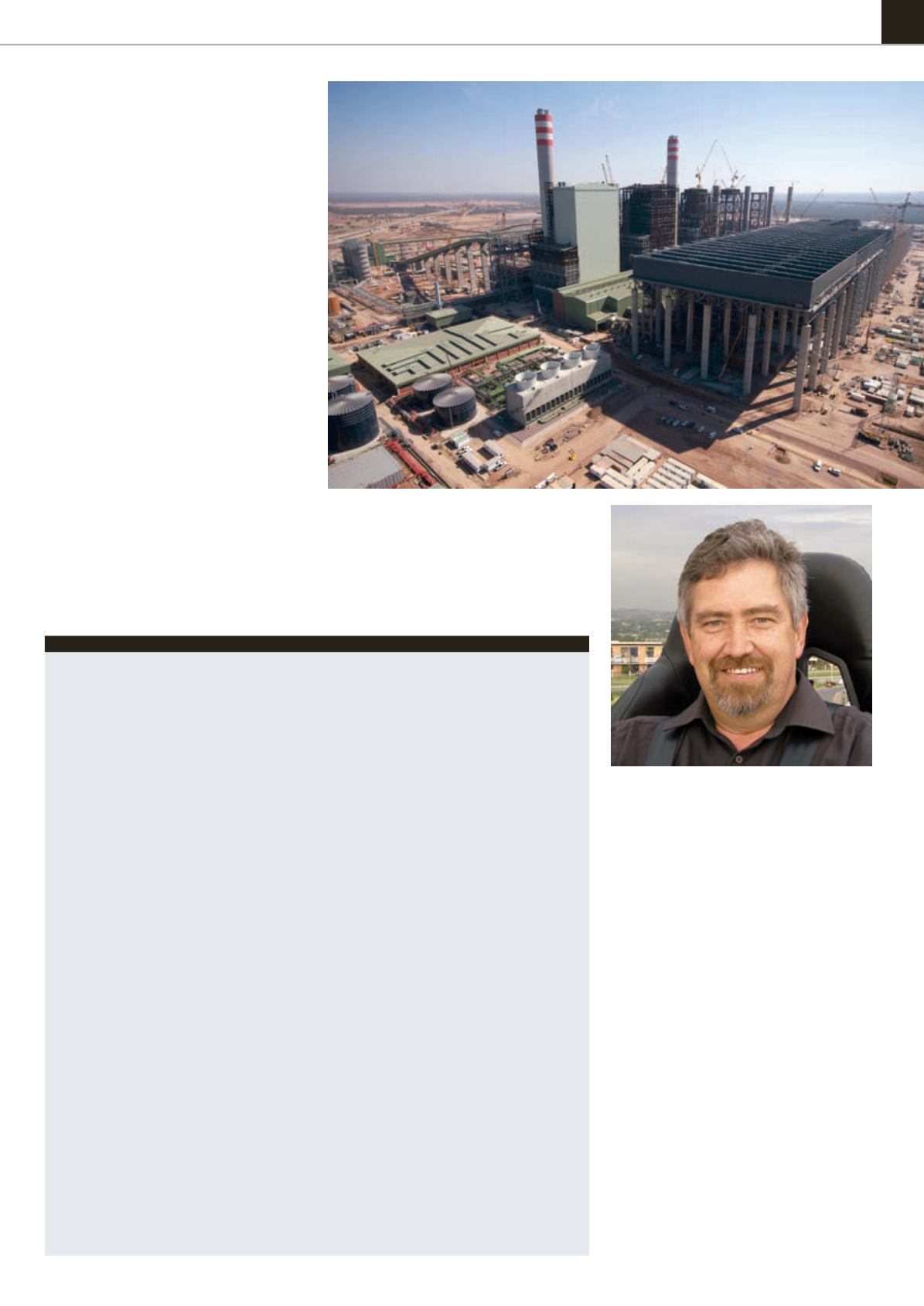

Mr Landsberg says there are particular parts

of the rental industry under strain, such as the

earthmoving sector, where work on two major power

projects –the R100 billion (€7.4 billion) Medupi Power

Station in Limpopo province and the R150 billion (€11

billion) Kusile Power Station in Mpumalanga – is now

scaling down.

“Rental companies involved in the civil works were

very busy, up to a point, but now it’s very quiet”, he

says, “For people in the small plant business, they

are doing OK, but not great.”

Performing a little better is the aerial platform

sector, says Mr Landsberg; “Overall we’re not in

a purple patch for rental, but the eastern Cape

is picking up nicely, and aerial rentals to the two

power plants is doing OK.” Work at the Medupi and

Kusile sites will continue for three or four years.

In the Northern Cape, meanwhile, Mr Landsberg

highlights the growth of the solar and wind energy

sectors. However, South Africa has still to see a

significant investment in large truck mounted

aerial platforms to help construct and maintain the

turbines, although “that will change”, he says.

The mining market has long been an important

one for South Africa, but Mr Landsberg says that

sector is “very quiet, and it is normally an industry

where you get a lot of work. Platinum and gold

prices have come down, imports are expensive, and

we’re not seeing any new mines being developed, if

anything there has been some mothballing of sites.”

Goscor’s own aerials rental business is still

managing to expand, with a fleet of 400 machines

assembled in little over 20 months and three

locations in Durban, Cape Town and Gauteng (the

province that includes both Johannesburg and

Pretoria).

“It’s really now starting to grow”, says Mr

Landsberg, who founded Johnson Access in South

Africa before selling it and moving into the Goscor

group, “we’re adding around 20 units a month.”

There are still relatively few major access rental

fleets in South Africa, but Mr Landsberg has seen

the arrival of a number of small players with small

fleets, often starting with used equipment. “In time

the dynamic will change, but in the short term it is

putting pressure on pricing.”

■

Construction of the new Medupi power

station brought lots of work for rental

companies in South Africa.

George Landsberg, managing director of Goscor Hi-Reach.

BENELUX/CENTRAL EUROPE

Andries Schouten has a good view of the Benelux and central European rental market by virtue of his

position as managing director of HDW Nederland and Gunco, two sales and rental businesses within TVH

Rental Equipment, the rental business of Belgian parts specialist TVH, which also now includes Mateco in

Germany.

Gunco rents aerial platforms throughout the Benelux and is sales dealer for JLG in Belgium and

Luxembourg, while HDW sells a wide range of aerial platform and telehandlers in 17 European countries,

including the Benelux region and eastern Europe (and represents Terex AWP/Genie in the Netherlands and

eastern Europe).

Mr Schouten says his feeling is that Belgium is currently doing slightly better than the Netherlands;

“From May last year is slowed down in the Netherlands. Now 2013 is at the same level – it’s not good. There

aren’t many new projects, and when there are, everybody jumps on them.” One consequence has been

lower rental prices in the Netherlands compared to Belgium, where there are fewer big rental players in

the access market.

He says Gunco benefits from being able to sell used machines as well as rent, and also from the strength

of its parent company TVH; “If we were only dong rental, then we could be struggling. That has always

been part of the strategy.”

Mr Schouten is, however, encouraged by a general feeling in the market “that we have reached the

bottom and are slowly going up. For the next one and a half years it will still be a challenging market –

because the market dropped the prices, and it will take a long time to get the prices back up.”

HDW’s sales and leasing activities in eastern Europe are an important part of its business, and here Mr

Schouten offers a summary picture; “the Czech Republic is doing OK for us, Poland is also doing OK, with

good utilisation, but with seriously lower prices than two or three years ago. Poland peaked in 2011 and at

the start of 2012, and it’s rather stable now.

“Romania and Hungary went very well when they joined the EU, but the market is still very, very slow. It’s

a huge struggle – prices are low, payment behaviour is terrible, and it is a difficult place to rent, with long

distances to travel and poor road conditions.”

Of Germany, where TVH owns Mateco, Mr Schouten is more upbeat; “In general it’s a lot more positive

than most European countries – still quite positive growth.” There was a slow start to the year – which was

weather impacted - but now has returned to a better level.

In terms of investment in the fleet this year, Mr Schouten says that around €50 million will be spent on

the Gunco, HDW and Mateco fleets, of which around 90% will be for replacement. Markets that will see

their fleets growing will include Poland, Hungary, Belgium and Romania, while the group’s operations in

the Netherlands and Germany will operate stable fleet sizes.

¬