13

IRN SEPTEMBER-OCTOBER 2013

SANY INTERVIEW

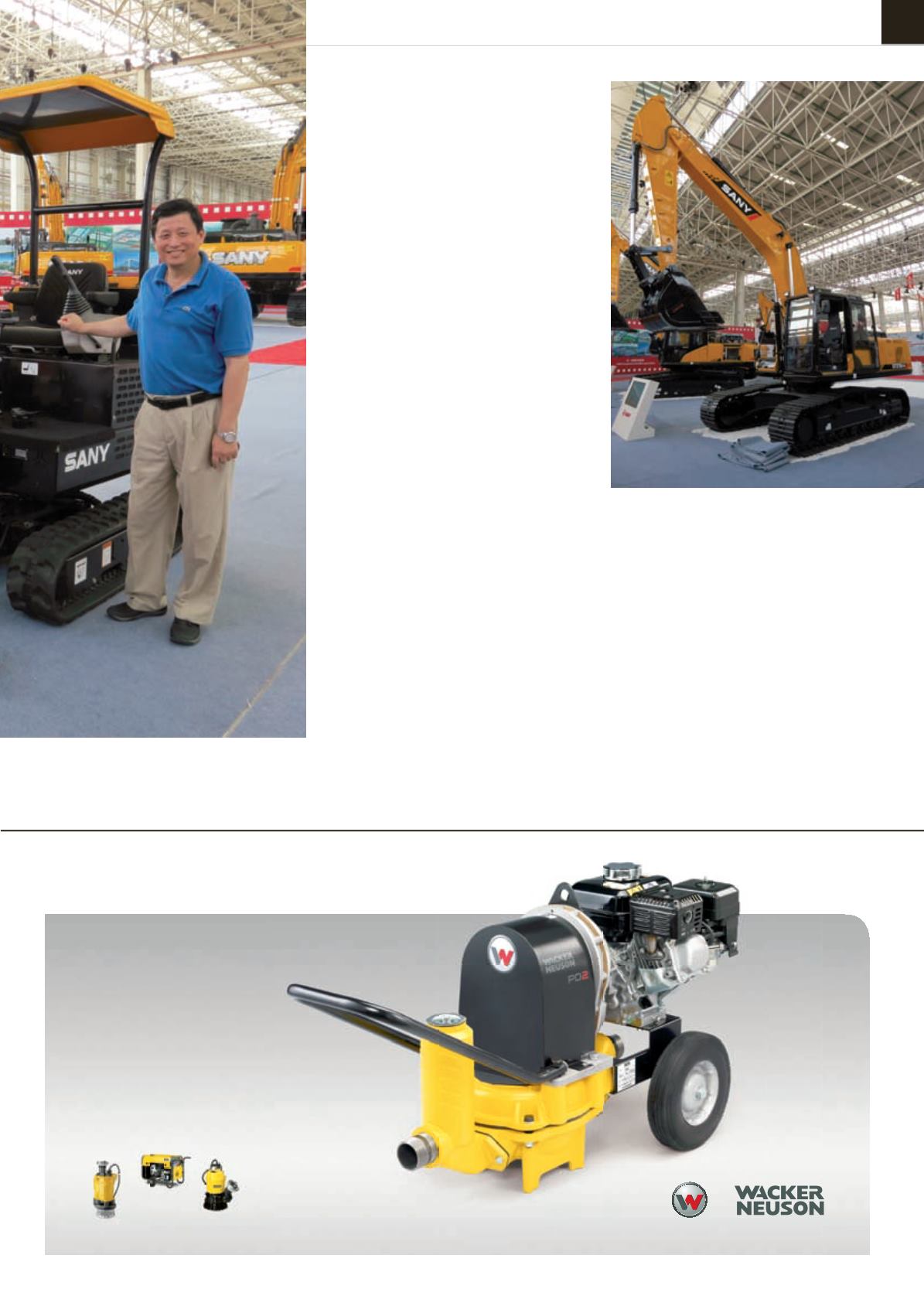

companies in Europe and North America will not

happen overnight, with the company having to

establish sales channels as well as machines

designed for these markets. In the mini excavator

sector, for example, he mentions the need to have

zero- and short-tail models as well as a range of

attachments.

The company already has a wide line-up of

excavators in its portfolio, with machines starting at

5.5 t and going up the very large mining units rated

at 195 t. However, it has just four units certified for

western Europe and North America - 7.5 t, 13.5 t, 21.5 t

and 23.5 t machines – and it has no sub-5.5 t models

at all.

That is about the change, however, with Sany

developing 1.6 t and 3.5 t minis as part of its strategy

to become a full line excavator manufacturer. The

company hopes to have the two small models ready

for launch at next year’s Conexpo-Con/Agg show in

Las Vegas.

“You’ve got to have a full portfolio over there [in

export markets], otherwise you can’t compete with

the Cats and Komatsus”, says Mr Dacheng, “If we

have the products, we can start to learn about the

rental market.”

Research & development

Sany has research and development teams in China,

North America and Europe helping to develop the

new products. Indeed, the company is distinctive

in China in spending heavily on research and

development: it invested the equivalent of more

than 5% of total revenues in R&D last year and the

heavy machinery division’s research department

employs more than 1000 people.

The export goal for the excavator business is

even more ambitious for the company than for its

other products, because China currently represents

around 90% of its excavator sales, despite the

downturn. Many of the machines that are exported

end up in Asia Pacific, Africa, India, Eastern Europe

and Latin America, with sales to western Europe and

North America still at very low levels.

If the product line needs some work, the company

is gradually ramping up its excavator manufacturing

footprint. In addition to its two (massive) facilities in

China, Sany has been making excavators at a plant

in Pune, India, for three years and more recently

started assembling some models at its Peachtree,

Georgia facility in the US, and also in Brazil, where

it also has plans to develop a ‘localised’ 20 t unit,

possibly as early as next year.

Of more immediate concern, however, is China’s

slowing market. Mr Dacheng says; “Sany is not

facing serious cash flow problems. Of course, the

sales volume has dropped, but profitability is still

there.”

The company can’t do much about a slowdown in

its home market, but it has considerable scope to

expand elsewhere in the world. And it is important

to note that Sany has a track record of rapid growth:

it produced its first tracked excavator in 2000 and

by 2008 was Chinese market leader with annual

production of more than 13000 units.

IRN

Outstanding

suction capacity

Just one click to the no. 1 choice:

Contact:

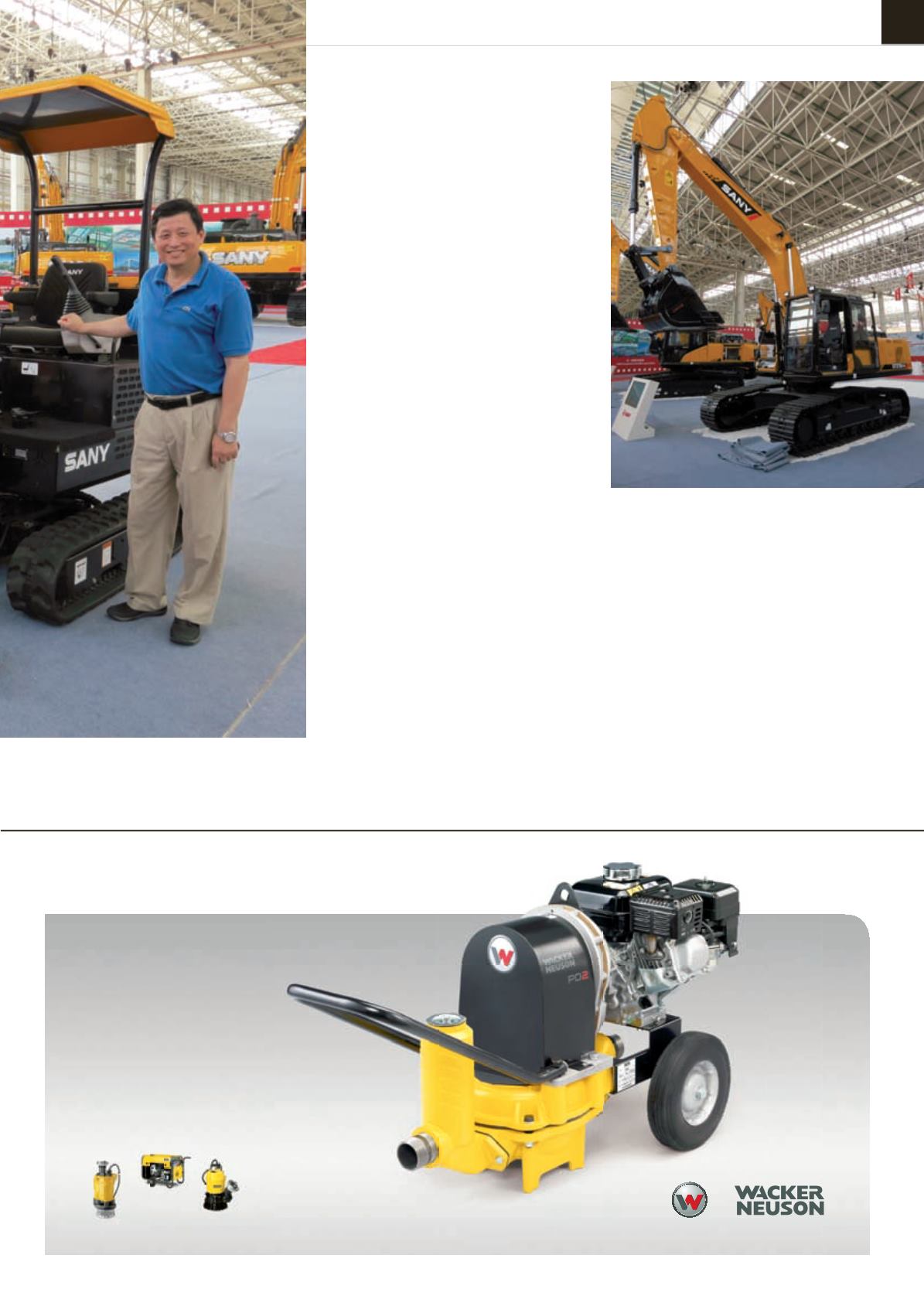

The SY215c-9 excavator, pictured at Sany’s manufacturing facility

in Shanghai. The new c-9 series, introduced this year, offers an

8% increase in production capacity and 10% decrease in fuel

consumption over the previous series.