18

international

construction

Türkiye

Ekim

2013

Dünyada ilk 200

Rapor

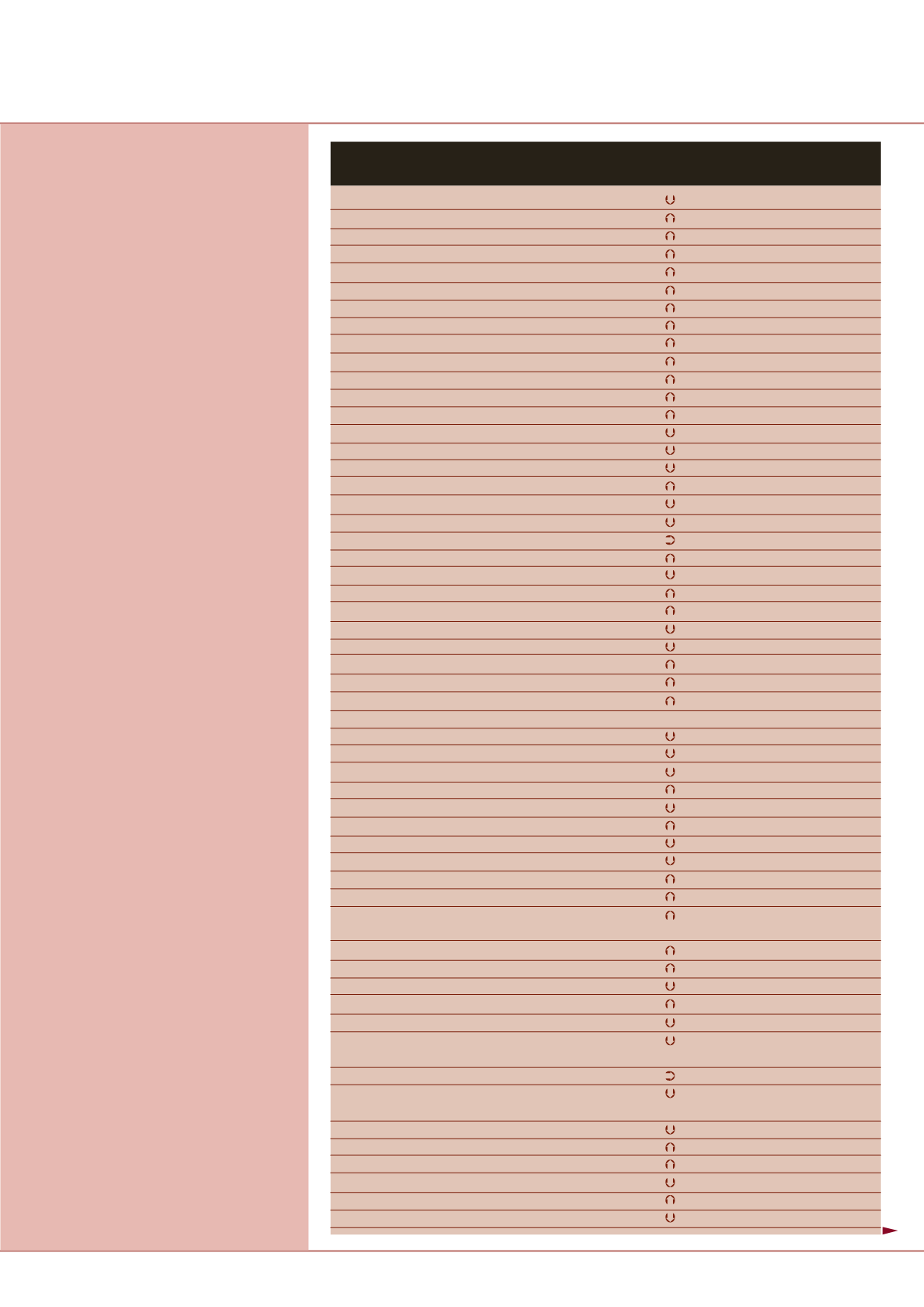

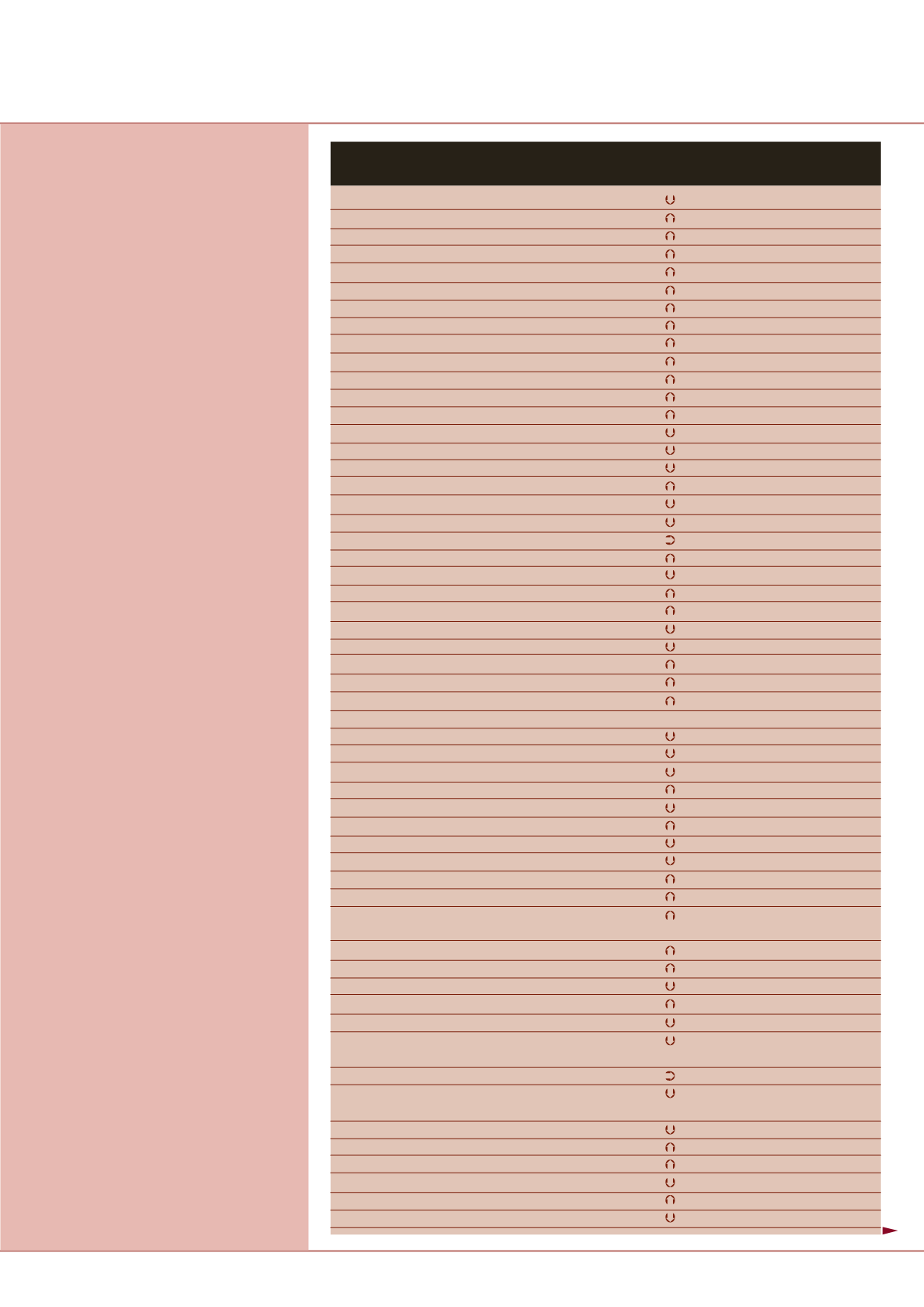

105

3366

Camargo Corrêa*

Brezilya

93 12

106

3313

Veidekke

Norveç

114 8

107

3300

Black & Veatch

ABD

150 43

108

3270

Arcadis

Hollanda

132 24

109

3265

Kumagai Gumi

Japonya

112 3

110

3199

Jan De Nul

Belçika

125 15

106

3313

Veidekke

Norveç

114 8

107

3300

Black & Veatch

ABD

150 43

108

3270

Arcadis

Hollanda

132 24

109

3265

Kumagai Gumi

Japonya

112 3

110

3199

Jan De Nul

Belçika

125 15

111

3189

NVR

ABD

135 24

112

3174

MRV

Brezilya

184 72

113

3171

Nishimatsu Corp.

Japonya

109 4

114

3100

Gilbane Building*

ABD

84 30

115

3029

Mostotrest

Rusya

107 8

116

2989

Astaldi

İtalya

117 1

117

2983

Morgan Sindall

İngiltere

101 16

118

2979

Heijmans

Hollanda

110 8

119

2975

Porr Group

Avusturya 119

120

2972

RZD Stroy*

Rusya

165 45

121

2959

Kier Group

İngiltere

106 15

122

2947

Aecon Group

Kanada

126 4

123

2942

Taylor Wimpey

İngiltere

127 4

124

2914

Lemminkäinen

Finlandiya 115 9

125

2883

Mota-Engil

Portekiz

121 4

126

2876

Implenia

İsviçre

130 4

127

2875

OAS*

Brezilya

133 6

128

2864

Toyo Engineering (TEC)

Japonya

167 39

129

2864

Toyo Construction

Japonya

-

NEW

130

2862

Tokyu Construction

Japonya

128 2

131

2854

Interserve

İngiltere

124 7

132

2828

Impregilo Group

İtalya

131 1

133

2787

Sigdo Koppers

Şili

155 22

134

2744

Maire Tecnimont

İtalya

99 35

135

2738

Besix

Belçika

138 3

136

2727

TBI Holdings BV

Hollanda

122 14

137

2720

Glavstroy*

Rusya

136 1

138

2670

Maeda Road Con.

Japonya

139 1

139

2560

Lanco Infratech

Hindistan 154 15

140

2548

China State Con.

Hong Kong 157 17

International Holding

141

2509

Persimmon

İngiltere

143 2

142

2478

Hazama Ando

Japonya

149 7

143

2470

M.A.Mortenson

ABD

142 1

144

2461

Okumura Corporation

Japonya

151 7

145

2461

DEME

Belçika

144 1

146

2440

Compagnie

Belçika

140 6

D’Entreprises CFE SA

147

2380

McCarthy Building

ABD

147

148

2375

China Petroleum

Çin

129 19

/

Engineering & Con.

149

2330

Hensel Phelps

ABD

141 8

150

2320

J.E. Dunn Group

ABD

169 19

151

2313

Salini Costruttori*

İtalya

166 15

152

2271

Comsa EMTE

İspanya

123 29

153

2264

Tekfen Holding

Türkiye

174 21

154

2264

Hanjin Heavy Ind.

Güney Kore 137 17

Satış geliri

Firma

Ülke

2012 Değişim

İnternet sitesi

(milyon US$)

English translation

Other national groups with significantly more

gainers than fallers include the US, South Korean

and Brazilian contractors. On the downside,

many European countries saw their contractors

lose more places than they gained, with the

Spanish being particularly notable with eight out

of the 10 companies listed losing ground.

It is not a great leap to say that the fortunes of

the various national groups of contractors seem

closely linked to the ups and downs of their

various domestic construction markets. Japanese

contractors have undoubtedly benefited from

reconstruction work following the 2011 earthquake

and tsunami, while in the USA the general market

rebound is clearly having a positive effect.Data from

sources such as the US Census Bureau show the

residential market is bouncing back the strongest

and again this is reflected in the fortunes of the

country’s housebuilders. From the highs of 2005

and 2006, this group of construction companies

has had a torrid time starting with the sub-prime

mortgage crisis that triggered the global recession.

However, they are finally seeing an improvement

in revenues and are improving their standings

in the Top 200 as a result. The country’s largest

housebuilder, Pulte Group was up 11 places in

this year’s rankings to no. 77. Other gainers in

the same field include D.R.Horton – up 14 places

to no. 98 - and Lennar – up 28 places to no.90.

However, it is still a far cry from the height of the

US residential construction boom in the middle of

the last decade. The 2006 edition of the Top 200

league table, for example, saw Pulte ranked no.9

globally, D.R Horton no.10 and Lennar no.12.

Elsewhere in the Top 200, there were good gains

for some of Japan’s mid-sized contractors.

Chiyoda, Penta-Ocean, TEC, Toa, Takamatsu

and Nippon Road all saw double-digit gains. In

addition, the general rise of Brazilian contractors

was reflected in the remarkable 72-place gain

for MRV, the most improved contractor in this

year’s Top 200. It is also worth noting that

Odebrecht moved up seven places last year to

no. 32, cementing its place as Latin America’s

largest construction company by a significant

margin. There were 14 new companies in this

year’s Top 200. The highest placed was Japan’s

Toyo Construction, which just missed-out on a

place in the rankings last year. However, most of

the new additions were further down the league

table, with eight in the last ten places. As with

Toyo Construction, many of these are companies

that were on the fringes of the Top 200 last year,

and which have come in and out of the rankings

over the last decade or so.

Next year?

With the US construction market continuing to

recover and the Japanese economy benefiting

from ‘Abenomics’ stimulus measures, the

2014 edition of the Top 200 could see further

improvements form construction companies

in these two countries. By the same argument,

the lack of growth in Europe could mean more

stagnation for the region’s contractors. But the

movements of the major Chinese groups will be

perhaps the most closely watched. These should

give an indication of the health of the market and

the impact of the fiscal tightening measures that

have been seen so far this year.

ICT