international

construction

january-february 2015

REGIONALREPORT

22

Hopes for growth

Timetric’s Construction Intelligence Centre, explained, the

upturn experienced in the residential sector had been driven by

government targets.

Thesewereoutlined in itsnationalNew-typeUrbanisationPlan

(2014-2020) outlining a drive towards 60% of the population

living in cities within the next five years, compared to its present

level of 54% of people.

Significantly, in January 2014, the government relaxed its one

childpolicy and this has since seennearly1million couples apply

for permission to enlarge their families.This is likely to provide

furthermedium-term stimulus to residential development.

Mr Richards said, “The market buoyancy reflects a number

of factors: continued rapid urbanisation and industrialisation,

population growth, rising household incomes and government

investment in expanding andupgrading physical infrastructure.

“There arenumerousmega-projects indevelopment in the areas

of transport infrastructure, city subways, airports, utilities and

wastemanagement, as well as power generation.

“This plan shows the need for further investment in urban

infrastructure such as new expressways and railways to link all

cities withmore than 200,000 people by 2020, and high-speed

rail services to connect cities withmore than a halfmillion.”

The analyst added that the country also needed to invest

in public-funded affordable housing projects. This includes

ambitions to provide 23% of the urban population with

affordable housing by 2020 requiring more than 4million new

housing units a year tobe built over the next five years.

Despite such policies, housing supply issues have emerged and

led to some emergingurbandevelopments such asChenggong in

SouthWest China being labelled as “ghost cities”. According to

theWorldBank, themajor new community had been a hit by a

significant portionof a schemeof 100,000 apartments remaining

unsold since its creation.

Similarly, in Kangbashi - the new city of Ordos, northern

China, remains sparsely populated, which the government is

attempting to address by inviting rural populations to take up

residence.

According to Chinese state media, there are an estimated 45

million people across the country employed in the construction

sector. It remains at the heart of the economy, with residential

schemes still ranking high in its overall contribution.

National statistics revealed that total investment in real estate

reached US$ 1.3 trillion (with residential building investment

of US$ 910 billion and commercial and office building at

US$257billion).

However, health and safety standards remain one of the main

issues facing the industry. This was highlighted by Terex China

president Ken Lousberg at the International Rental Conference

held in Shanghai last November. He said the company had

a “moral obligation” to help raise levels of construction best

practice.

Consequently, the Chinese government has announced that it

will not issue construction permits to projects without worker

insurance.

Pressure on construction companies

While conditions have been challenging within the Chinese

construction market, manufacturers remain hopeful that an

improving picturemay soon emerge in the sector.

DaveBeatenbough, vicepresident for researchanddevelopment

at Liugong, expressed his opinion that the recent construction

challenges in China had begun to “reach the bottom of the

trough” and a sense of gradual recoverywas starting to take hold.

>

He said, “Themarket inChina during 2014has beendown by

15%, whichwe have felt as everyone else has done. But we have

had some good runs in terms of excavators for the region.

“There has been some adjustment to that rapid pace that had

left a lot of excess productionof around100,000machines in the

market, though that’s something we had seen coming and taken

account of with our ownproduction levels.

“Excavators have been our biggest area of focus for us this

year and we have been working really hard on the mid sector

of around 20 tonnes, as well as ranges between 36-50 tonnes,

including the 950E.”

A similar picture emerged for other companies including JCB.

Its sales managing director Guy Robinson said it had been “an

extremely tough” year for its operations inChina.

However, he explained there had been an encouraging picture

with its excavators, which recorded anupturn inmarket share.

He said, “We expect theChinesemarket for excavators tobeflat

in2015, butwewill be addingnewmodels toour range.Having

a plant in the country has helped to raise our profile but, more

significantly, the localisation ofmanufacturing has cementedour

position as a credible construction equipment manufacturer in

China.”

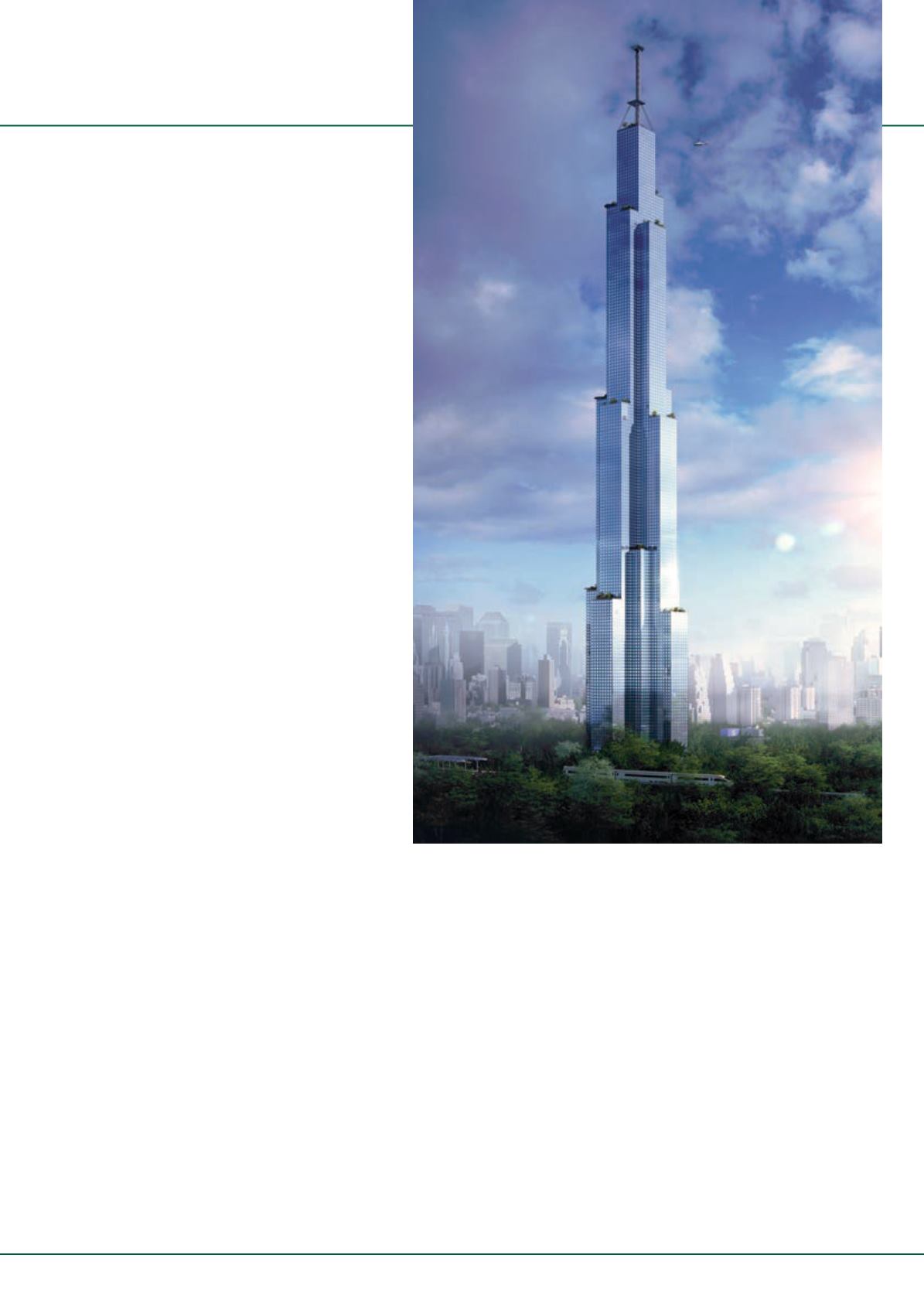

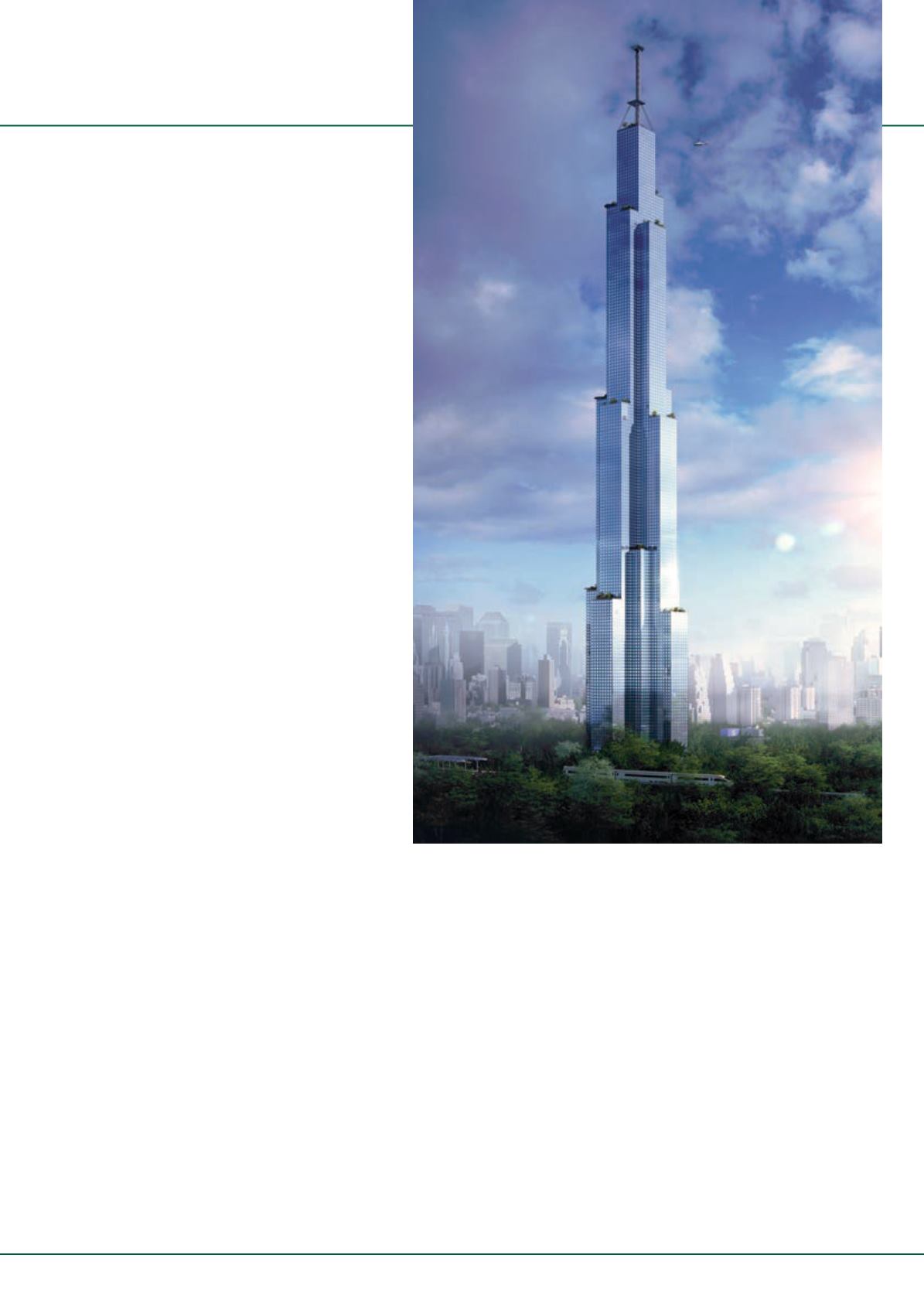

Plans are still

in progress

for Changsha’s

ambitious Sky

City tower –

which it is

claimed could

be erected in 90

days.