17

ECONOMICOUTLOOK

Investment growth

october 2014

international

construction

>

Investment growth

High oil prices are driving construction growth in theMiddle East, and there is a strong forecast for

the region despite conflicts and geopolitical instability.

Scott Hazelton

reports.

T

he economic outlook for the Middle East

is clouded by regional political instability,

including the Islamic State’s attacks in Iraq,

the Israeli-Palestinian conflict and Syria’s long

civil war.

On thepositive side, Iran’seconomy is stabilising

after two years of contraction, despite ongoing

sanctions on the energy andfinancial sectors.

The region depends on oil revenues and the

construction market is even more attuned to oil

prices than the overall economy.The continuing

boom in US oil production, combined with a

cooling Chinese economy, is restraining prices,

and crude oil prices are likely todecrease in2015.

However, global spare capacity will remain

tight, with little cushion to absorb additional

disruptions. Also, while North American supply

growth is strong, other potential new sources

(Iraq, Brazil, andKazakhstan) face hurdles.

Geopolitical tensions, not only in Iraq and

Syria,but alsoUkraine,Libya,Venezuela,Nigeria,

SouthSudanandYemen, continue topose further

upside price risks.

The overall effect in theMiddle East will be for

solid growth in regional GDP growth. Indeed,

the slowing growth of many emerging markets

means theMiddleEast is set tobe the third fastest

growing region, behind Asia (excluding Japan)

and sub-Saharan Africa. The Middle East also

offers a bigger market and less investment risk

than sub-SaharanAfrica.

Within theMiddleEast, the linkbetweenhigher

per capita income and lower investment risk

holds. The highest risks are in poorer countries

like Syria, Lebanon and Jordan, while the richer

countries, such as SaudiArabia and theUAEoffer

investment riskon a parwithwestern economies.

SaudiArabia, the largest economy in the region,

will sustain+4.5%GDPgrowthover thenextfive

years, as oil revenues support strong government

spending and investment.TheUAEwill perform

nearly as well, with GDP growth accelerating

modestly in both economies as oil prices slowly

rise.

Regional stability

For most of the region’s economies, plans for job

creation, economic diversification and greater

competitiveness will aid construction markets,

and is crucial to regional stability over the

medium term.

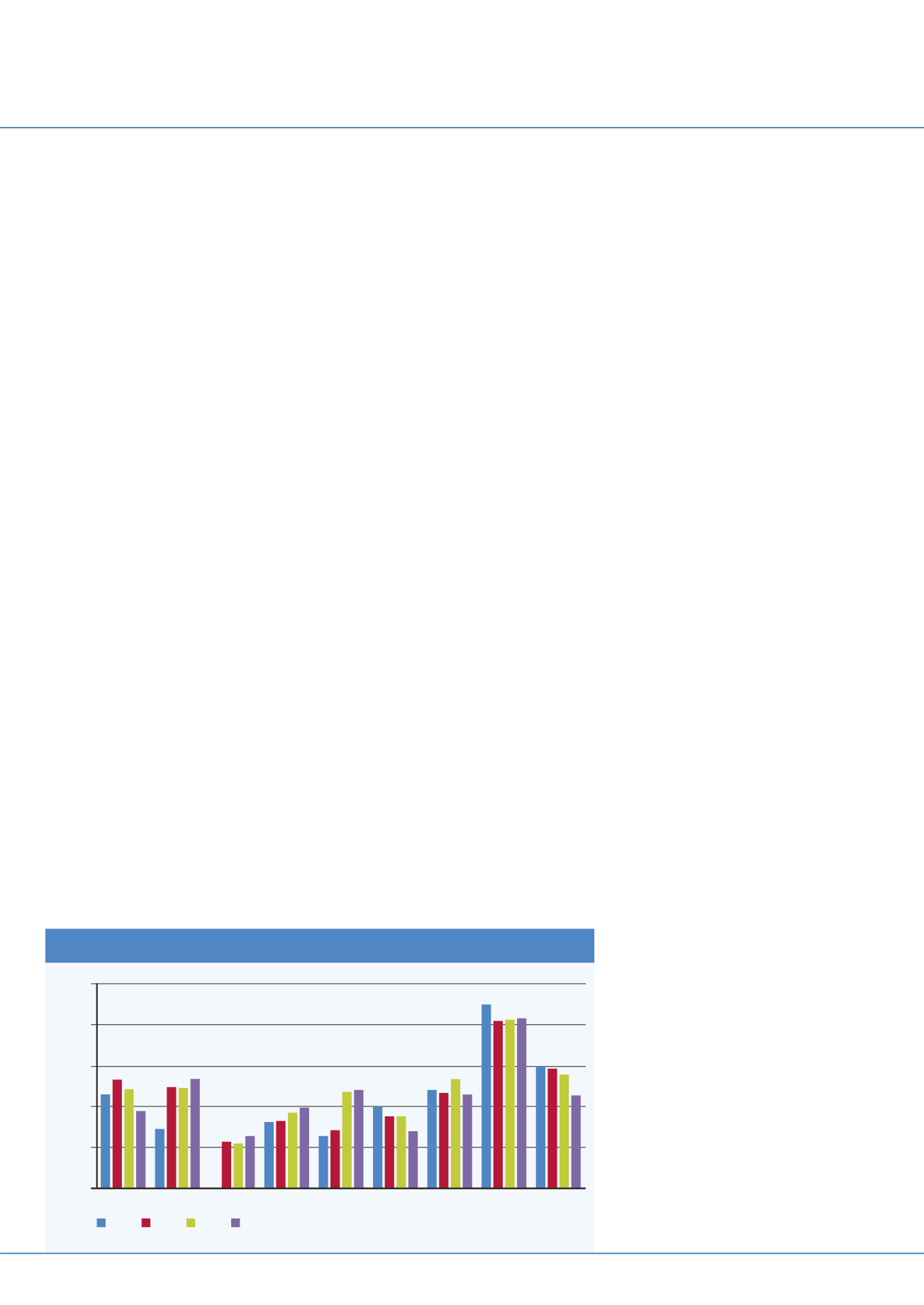

The graph for total construction indicates the

effect of a recovering regional economy and stable

oil prices. In general, 2014 is looking better

than 2013, and 2015 offers more potential than

2014. Flat oil prices will hold regional growth

steady, but the historically weaker markets, such

as Bahrain and Jordan, will improve while the

stronger markets such as Saudi Arabia andQatar

see somedecelerationbut remain regional leaders.

Over the next five years, total construction

spending in the Middle East will increase at an

annual rate of about +4.5% in real terms.

This is quite similar across structure types for

the region, with residential markets performing

lesswell and infrastructure faringbetter, although

there is more significant variation within

individual countries.

Over the next five years, Qatar offers the

strongest construction market growth at +7.1%

in real terms. SaudiArabia is a close secondwith a

rate of +6.0%, but its construction sector is twice

the size ofQatar’s.

This strong growth for Saudi Arabia represents

a slight slowing from the past five years, where it

had accelerated housing and similar programs to

mitigate unrest from theArab Spring.

Saudi positivity in themedium term is oriented

toward infrastructure. A key driver of this is the

US$ 22.5 billion metro project in Riyadh over

the next five years.Work has started on a system

that includes 85 train stations on sixmetro lines

totalling 176 km.

Growth inQatar

Qatar’s growth is more remarkable in that it is

a turnaround from the previous five years when

construction spending contracted.

The need to prepare for the 2022 FIFA

World Cup will drive venue and infrastructure

construction spending on top of the country’s

ambitious energy infrastructure improvements.

The challenge for Qatar will be prioritising

projects to avoid overheating the construction

economy.Qatar lacks a significantmanufacturing

base and most building materials need to be

imported. The country also lacks the port

capabilities ofDubai,UAE, for example.

There is also competition for labour with the

other fast growingGCC countries, butQatar has

still made a strong start on stadium construction

for theWorldCup.

While this means that some stadiums will not

bebrandnew for the2022 event, ithelps level out

infrastructure investment while demonstrating

progress to those sceptical of its ability to deliver.

Hence IHS Global Insight’s view of a gradually

accelerating constructionmarket through2019.

TheUAE is also forecast to performwell.With

its economic turnaround nearly complete, Dubai

is investing in a variety of projects, including

new industrial cities, airport terminals, hospitals,

schools and thousands of newhomes.

Retail sales are performing well, and new

retail space is also being planned. Dubai Land

Development has announced plans for ‘The

Perfect City’, which is intended to be 100%

sustainable and feature 75% green space,

including 20,000 trees.

Indeed, announced projects for Dubai tend to

be more ‘horizontal’ than ‘vertical’ as developers

Total construction

UAE

2013 2014 2015 2016

Iran

Jordan

Oman

Bahrain

Israel

Kuwait

Qatar Saudi Arabia

10%

8%

6%

4%

2%

0%