BUSINESSHIGHLIGHTS

UK

Further Balfour Beatty

profit warning

Thirdprofitwarning infivemonths as abuyer is

found for ParsonsBrinckerhoff and the chairman

announces plans to stepdown

B

alfour Beatty has announced its third profit warning in five months.

It says it now expects a UK£ 75 million (US$ 125 million) profit

shortfall in itsUKConstruction Services business.Trading across the

rest of the company is said to remain in linewith expectations.

The Group has appointed KPMG to undertake a detailed independent

review of theConstruction ServicesUK contract portfolio. It said the review

will focus on commercial controls, on ‘cost to complete’ and contract value

forecasting and reporting at project level. KPMG is expected to report back

to theBoardby the endof the year.

Executive chairman Steve Marshall said, “This latest trading statement is

extremely disappointing. There has been inconsistent operational delivery

across some parts of theUK construction business and that is unacceptable.

Restoring consistencywill take time and it has our full focus.”

The company also said Mr Marshall has announced plans to resign as

chairman from the Balfour Beatty board. He said he will step down when

there is a newCEO in place – the appointment of which is said to be “at an

advanced stage” – and a newnon-executive chairmanhas been identified.

Parsons Brinckerhoff sale

In other news, the company has said it will sell its US-based professional

services division, Parsons Brinckerhoff, toWSPGlobal forUK£820million

(US$ 1.37 billion). Balfour Beatty said in May that it planned to sell the

business, following its first profitwarning.

The deal will seeUK£ 200million (US$ 335million) returned to Balfour

Beatty’s shareholders through a share buy-backprogramme.

MrMarshall said, “The board believes the sale price of UK£ 820million}

(US$1.37billion)deliversbothasignificant returnonouroriginal investment

and a compelling level of value creation for shareholders -which remains the

key focus of the board.”

BalfourBeatty acquiredParsonsBrinckerhoff in2009 forUS$626million.

INDIA

Cement

divestments

Indian conglomerate Jaiprakash

Associates (Jaypee) has agreed to

sell a 1.5 million tonnes per year

cement grinding plant inPanipat to

ShreeCement.Thedeal,worth INR

360 Crore (US$ 60 million) is the

latest ina seriesofdivestments in the

cement sector by Jaiprakash.

Its biggest sale in this area was

announced a year ago, when it

agreed to sell a facility in Gujarat

state comprising a 2.4 million

tonnes per year cement plant and

2.4million tonnes per year grinding

plant to UltraTech for INR 3,800

crore (US$625million).

Jaypee has also agreed to sell its

74% stake inBokaro JaypeeCement

Limited, a cement joint venture

with the steel Authority of India to

DalmiaCement for INR 6.9 billion

(US$115million).

GERMANY

Bilfinger distress

Bilfinger has issued its third profit

warning in three months, as it

faces competition within a growing

sustainable energy sector. The

statement follows Roland Koch’s

resignation as its Executive Board

chairman amid previous profit

downgrades resulting in former

head, Herbert Bodner, being

appointedCEOon an interimbasis.

Its forecast earnings before tax for

this year are€270million (US$350

million), against€419million (US$

545million) in2013.

UK

Hanson spin-off

Heidelberg Cement has moved

ahead with its plan to sell part of

its building products business, with

steps that could lead to an initial

public offering (IPO) in Hanson

BuildingProducts.

Heidelberg has filed a registration

statement with the US Securities

and Exchange Commission (SEC)

for a potential IPO of ordinary

shares. At this stage the number of

shares to be offered and the price

range have not been announced.

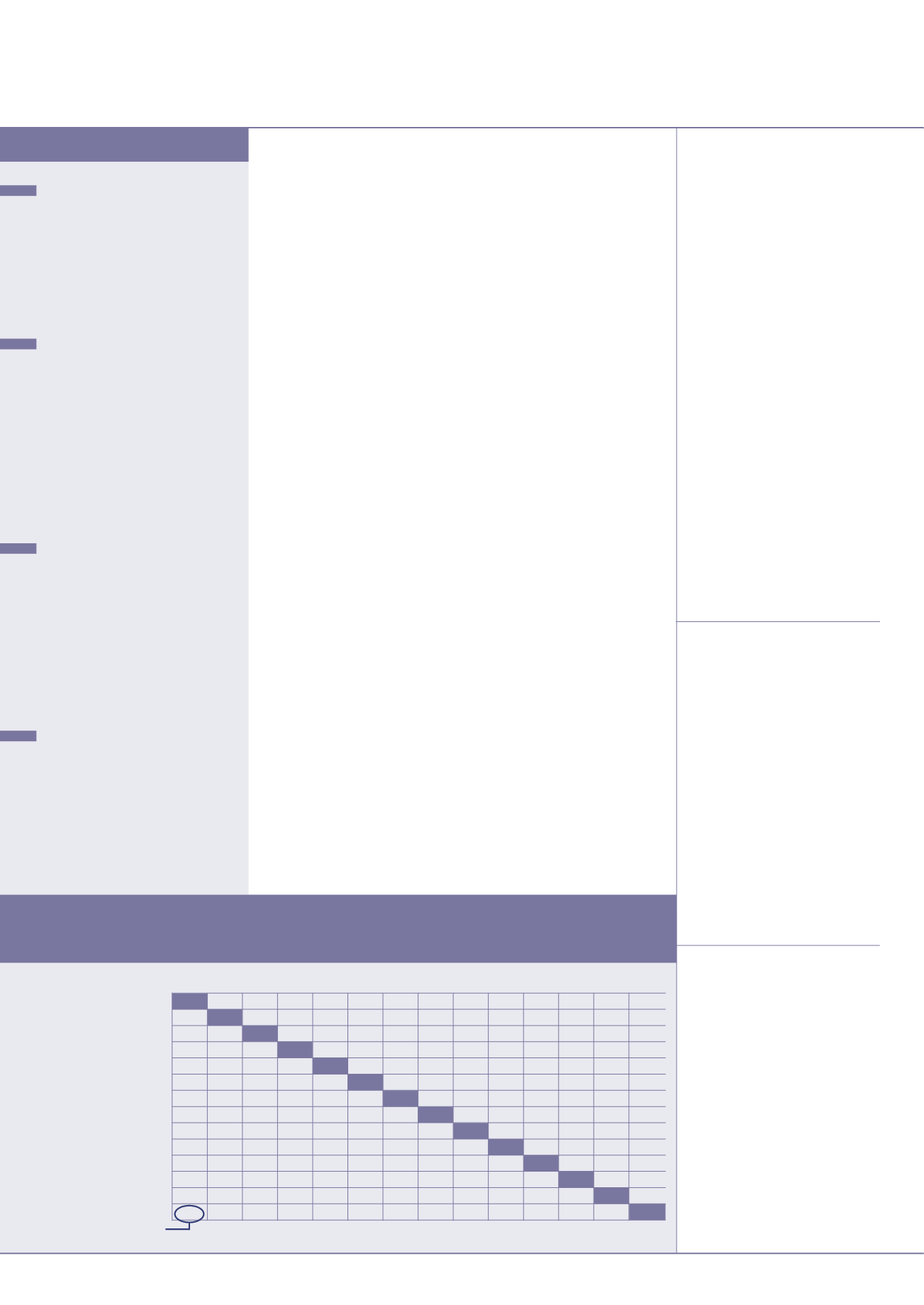

VALUEOF 1:

Symbol AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

AustralianDollar

AU$

0.47 0.540 5.39 0.691 53.9

96

11.84 34.6

3.29

9.91

927 0.834 0.877

BrazilianReal

BRL

2.12

0.255 2.54 0.326 25.4

45.2

5.58

16.3

1.55

4.67

437 0.393 0.413

BritishPound

UK£

1.85

3.93

10.0

1.28

99.8

178

21.9

64.1

6.09

18.3

1716 1.54

1.62

Chinese Yuan

CNY

0.185 0.393 0.100

0.128 10.00 17.8

2.20

6.42 0.610 1.837

172 0.155 0.163

Euro

€

1.45

3.07

0.78

7.80

78.0

139

17.1

50.1

4.76 14.34 1341 1.21

1.27

IndianRupee

INR

0.019 0.039 0.010 0.100 0.013

1.8

0.220 0.642 0.0610 0.184 17.2 0.0155 0.0163

Japanese Yen

YEN

0.010 0.022 0.006 0.056 0.007 0.562

0.1233 0.361 0.0343 0.1032 9.7 0.0087 0.0091

MexicanPeso

MXN

0.084 0.179 0.046 0.456 0.058 4.56

8.11

2.93 0.278 0.837

78

0.070 0.0741

RussianRuble

RUR

0.029 0.061 0.016 0.156 0.020 1.56

2.77 0.342

0.095 0.286 26.8 0.0241 0.0253

Saudi Riyal

SAR

0.304 0.645 0.164 1.640 0.210 16.400 29.187 3.600 10.533

3.01

282 0.254 0.267

SouthAfricanRand ZAR

0.101 0.214 0.055 0.544 0.070 5.442 9.686 1.195 3.496 0.332

94

0.084 0.088

SouthKoreanWon KRW

0.0011 0.0023 0.0006 0.0058 0.0007 0.0582 0.1035 0.0128 0.0374 0.0035 0.0107

0.00090 0.0009

Swiss Franc

CHF

1.20

2.54

0.65

6.47

0.83 64.67 115.09 14.20 41.54 3.94 11.88 1111

1.052

USDollar

US$

1.14

2.42 0.616 6.15 0.788 61.5 109.5 13.5

39.5

3.75

11.3

1057 0.951

For exampleUS$ 1=AU$ 1.14

Exchange rates: September 2014

GERMANY

Daimler has exercised

a put option to sell its 50% interest in

Rolls-Royce Power Systems (RRPS) to

Rolls-Royce for

€

2.43 billion

(US$ 3.16 billion). RRPSwas previously

known as Tognum andmakes engines

for construction equipment applications

under theMTU brand.

CHINA

Revenues at ChinaRailway

Constructionwere up+10.9% in the

first half of the year toCNY 262 billion

(US$ 42.6 billion). The contractor’s

net profit was up+2.3% toCNY 4.65

billion (US$ 755million) for a 1.8%

margin. The company’s backlog as

of the end of June 2014 stood at CNY

1,798 trillion (US$292 billion), and the

company's order intake for the first half

was CNY 390 billion (US$ 63.4 billion).

SPAIN

The EuropeanCommission

has given clearance for Cemex’s

acquisition of Holcim’s Spanish

operations. The assets include a range

of aggregates, quarrying and cement

production facilities. The decision

follows an investigation launched in

April intowhether effectively removing

Holcim fromSpainwould adversely

affect competition in the country.

RUSSIA

Lafarge has sold its

UralCement business toBuzzi

Unicem’swholly-owned subsidiary

Dyckerhoff for

€

104million (US$

135million). The business comprises

a 1.1million tonnes per year cement

plant inKorkino, 40 km in the south of

Chelyabinsk. Lafarge sold the business

to reduce debt.

international

construction

october 2014

BUSINESSNEWS

10