19

june 2014

international

construction

REGIONALREPORT: ASIAPACIFIC

Pace-settingAsia

>

not get off the ground. Last year they included two electricity

generation projects inPakistanworthmore thanUS$ 1 billion,

for example.

However, the ADB says the region is falling short of what

it should be spending to meet development goals. It says the

infrastructure segment alone needs investment of US$ 800

billion per year to 2020 to drive economic growth by providing

access to markets, making cities cleaner and easier to navigate,

and creating jobs.

Michael Barrow, the ADB’s deputy director general in its

private sector operations department said, “The infrastructure

deficit inAsia is so enormous that we can’t expect either private

investors or the public sector to take on the challenge alone.We

need collaboration between private and public placers tomake

things work.”

According to theADB, part of the solution todevelopingmore

public-private partnerships (PPPs) in the region lies in getting

the right laws and regulations in place. However, projects can

still fail if they are not developed in a professional manner, it

said.

Key projects

Infrastructure is a catch-all word that covers roads, railways,

ports, water& sewerage, energy and communications networks,

and even housing by some definitions, so it is difficult to

generalise about it. However, one common theme in Asia

Pacific is the prevalence of tunnelling schemes.These feature in

many difference types of infrastructure projects – particularly

transportation and water – and often provide a solution where

The Asia-Pacific region is arguably the

most dynamic constructionmarket in

theworld and home to some of the

industry’smost ambitious projects.

Chris Sleight

reports.

Pace-setting Asia

T

he Asia Pacific region has long been one of the most

attractive anddynamic constructionmarkets in theworld,

with high growth, large individual economies and no

shortage of ambition when it comes to planning infrastructure

andbuildings.

As Scott Hazelton writes in this month’s Economic Outlook

(see p.15), there are a few bumps in the road this year, with

global investment moving away from emerging regions like

Asia-Pacific, back to theUS as yields there improve. In addition,

there are the perennial issues of the pace of public sector reform

– a common theme for many emerging markets around the

world – and disruption form political events, be they expected,

like the elections in India and Indonesia, or more serious, like

themilitary coup inThailand.

But the outlook for the region is still fairly bright. According

to the International Monetary Fund (IMF) GDP growth

among developing Asian nations will be +6.7% this year, up

from +6.5% last year. This is well above growth rates of other

regions of theworld.Thenearest rival is sub-SaharanAfricawith

its projected +5.4% economic growth this year, and the world

average is put at +3.6%.

One of the key institutions in the region as far as the

construction sector is concerned is the Asian Development

Bank (ADB), which financed more than US$ 21 billion of

construction projects in the last year.

Although this is notmuch in the context of total construction

output, which runs into trillions ofDollars per year across Asia,

the key point about the ADB and other development banks is

that they get involved in the larger projects that otherwisemight

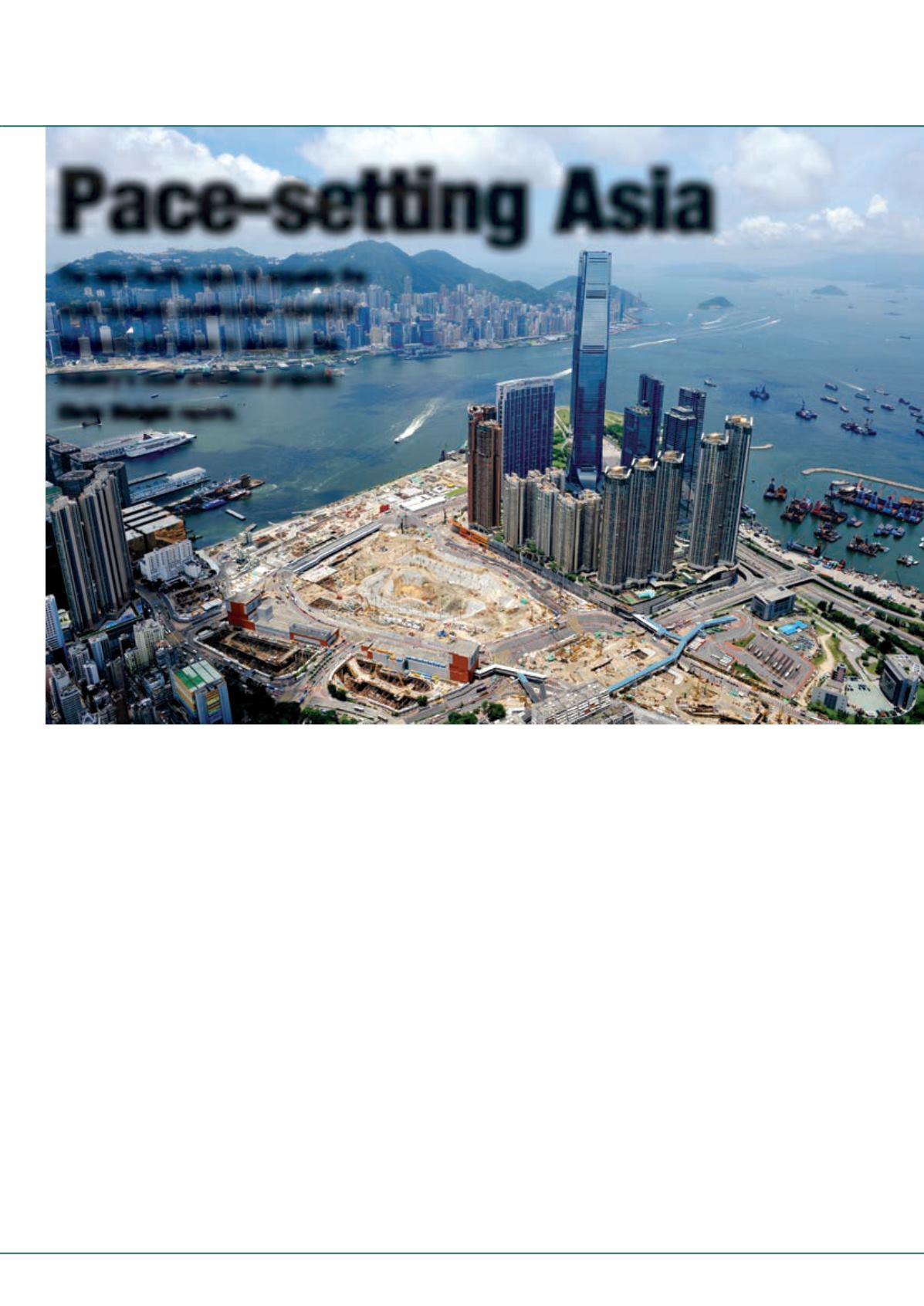

The site of the

West Kowloon

Terminus Station

(North) in Hong

Kong, where

RMDKwikform is

supplying shoring

and formwork

for the complex,

high-tolerance

construction of

the station roof

by a Leighton-

Gammon

joint venture

contractor.