15

ECONOMICOUTLOOK

Prospects soften

june 2014

international

construction

>

Prospects soften

The flow of capital to the US, political uncertainty and a lack of reform are reducing the construction

growth rates in Asia. However, the region still looks one of the strongest in theworld, and some key

markets are good bets.

Scott Hazelton

reports.

M

any factors will play into Asia’s

economic performance this year. They

include themovement of capital out of

emerging markets, key elections and the pace of

domesticmacroeconomic reforms.

For example, China’s rapid credit expansionhas

created vulnerabilities in real estate, banking, and

local government with fiscal stimulus supporting

growth.Elsewhereelections inIndiaandIndonesia

shouldhelp to resolve policy uncertainties, but in

Thailand, political violence has hurt economic

performance and will diminish the country’s

attractiveness as amanufacturing platform.

On the plus side, as the global economy

improves, SouthKorea,Taiwan andVietnamwill

see faster growth, supported by rising high-tech

exports.

Chineseweakness

China’sGDP growth is slowingdue toweakening

real estate activity, tepid investment, and a sharp

deceleration inoutput of state-owned enterprises.

Construction starts (measured in floor space)

contracted -25.4% in the first three months of

2014, comparedwith +13.5% growth in 2013 as

awhole.

The construction weakness is widespread – of

China’s 31 regions, 27 reported declines in starts.

Profit growth has improved modestly in the

economy, which should support spending, given

thatmore than60%ofChina’s investment is self-

funded, and a significant portion of that is from

retained earnings.

The government’s continued efforts to rein in

the credit bubble, particularly shadow-banking,

have skewed the housing market. The apparent

housing weakness is partially a high base effect,

as home buyers rushed into the market in early

2013 before the government implemented severe

housingmarket restrictions.

Home sales soared +69% year-on-year in 2013,

so the -7.7% decline in the first quarter of 2014

must be seen in context. Fiscal stimulus will be

applied tokeepGDPgrowthabove7%, including

spending on railways, upgrades to low-income

housing, and small-business tax cuts.

Meanwhile in Japan, the sales tax increase from

5% to8% inApril is creating economic volatility.

Industrial production has been weak with many

industries keeping production at conservative

levelswhile reducing inventories.

TheBankof Japanhas counteredwithaggressive

monetary stimulus, but future growth will

dependonhow effectively theAbe administration

implements stimulus programmes and reforms

labour andproductmarkets.

On the positive side, employment has increased

at is fastest pace in more than seven years. The

depreciation of the Yen and a recovery in exports

will boost the profits and capital expenditures of

multinational companies.

In India, growth in domestic demand remains

sluggish and manufacturing is struggling as a

result. Much of the weak investment climate

was due to uncertainty ahead of the April-May

elections, and the victory of the Bharatiya Janata

Party (BJP), led byNarendraModi, should allow

for mild acceleration in the near term. A stable

government and initiation of reforms, including

a fast-track mechanism for project approvals,

should gradually revive investment.

High inflation and a chronic fiscal deficit limit

the scope for policy stimulus. Steps to liberalise

foreign direct investment are positive, but more

needs tobe done.

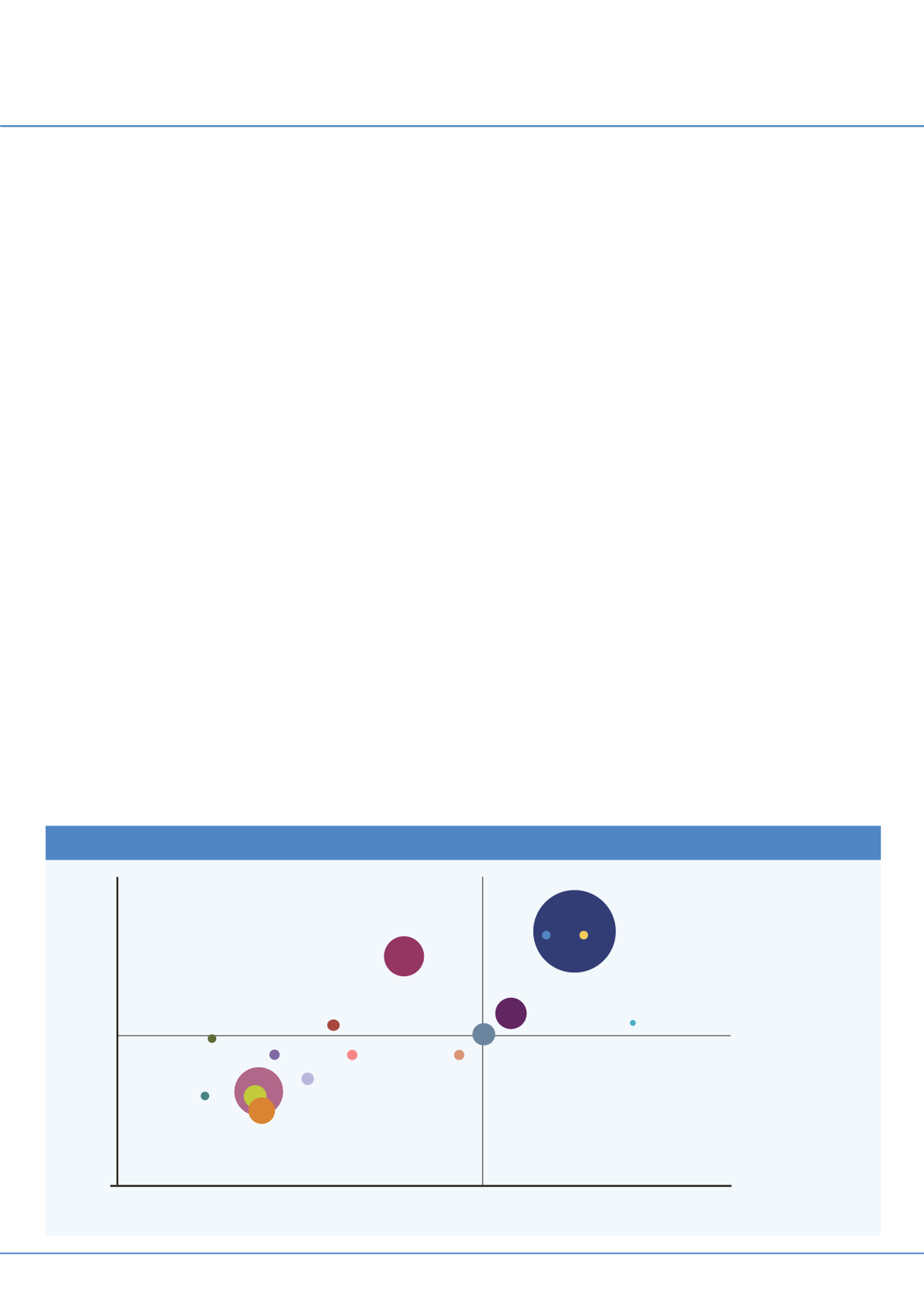

Risk vs reward

The chart puts these major constructionmarkets

Construction growth, risk andmarket sizes inAsia

●

Global Average

●

Australia

●

Bangladesh

●

China

●

Hong Kong

●

India

●

Indonesia

●

Japan

●

Malaysia

●

New Zealand

●

Pakistan

●

Philippines

●

South Korea

●

Singapore

●

Taiwan

●

Thailand

●

Vietnam

0

5

10

15

20

25

30

35

40

45

50

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

Average construction spending growth 2013-18

ConstructionRisk Score