11

june 2014

international

construction

BUSINESSNEWS

BUSINESSHIGHLIGHTS

ITALY

Salini Impregilo considers

issuing new capital

Italy’s largest contractor may sell new shares to

raise cash and increase its freefloat

S

alini Impregilo says it is considering issuing new shares for sale to

institutional investors. Equity equivalent to 10% of the company’s

existing capital could be issued, and at the same time majority

shareholder Salini Costruttori said it may sell some of its stake in Salini

Impregilo.

The company said it was considering the move to increase the free float

of Salini Impregilo shares – the shares in the company traded in public, as

opposed to those tied-up with controlling investors and other long-term

holders. Salini Costruttori currently owns 89.95% of Salini Impregilo, with

the remaining 10.05% - just under 45million shares – being traded as free

float.

However,SaliniCostruttori said that if itdidgoaheadwith theplan, itwould

retain enough equity to stay themajority share holder inSalini Impregilo.

Salini Impregilo is currently capitalised at around € 2 billion (US$ 2.7

billion), so the sale of new shares could raise in the region of € 200million

(US$270million.Thecompany said theproceedswouldbeused to strengthen

its capital base andpursue its business plan.

UK

GVA offer

German contractor Bilfinger has

made a takeover offer for UK

property consultant GVA Grimley.

Termsof theacquisitionof the€190

million (US$ 260million) per year,

1,500-employee company were not

disclosed.

Bilfinger said it would integrate

the company into its Bilfinger Real

Estate division, more than doubling

its current annual revenues of

€ 160 million (US$ 220 million).

Bilfinger says it is the market leader

in Germany for real estate and

facility services including design,

construction and management of

real estate.

ECUADOR

Lafarge sale

Lafarge has agreed to sell its 98.6%

share of its operations in Ecuador,

including a 1.4 million tonnes

per year cement plant, to Union

Andina de Cementos (UNACEM)

for US$ 553 million. UNACEM

is headquartered in Lima, Peru and

was formed in2012 from themerger

of Cementos Lima and Cemento

Andino.The acquisition of Lafarge’s

Ecuadorian businesses marks the

company’s first entry into the

country. In addition to its Peruvian

cement operations, UNACEM also

owns a majority stake in Drake

Cement, which is based in Arizona,

US.

FRANCE

Full acquisition

Italcementi has set an offer price

of € 79.50 (US$ 108.40) per share

to acquire the 16.2% of French

subsidiary Ciments Français that it

does not already own.The company

will finance the transaction with

an issue of up to € 500 (US$ 680

million)worthof itsownnew shares.

Italcementi said it was going

ahead with the deal to simplify its

corporate structure and strengthen

the group. It will see Ciments

Français shares delisted from the

Euronext exchange in Paris, France,

should Italcementi securemore than

95% of the company’s share capital

and voting rights.

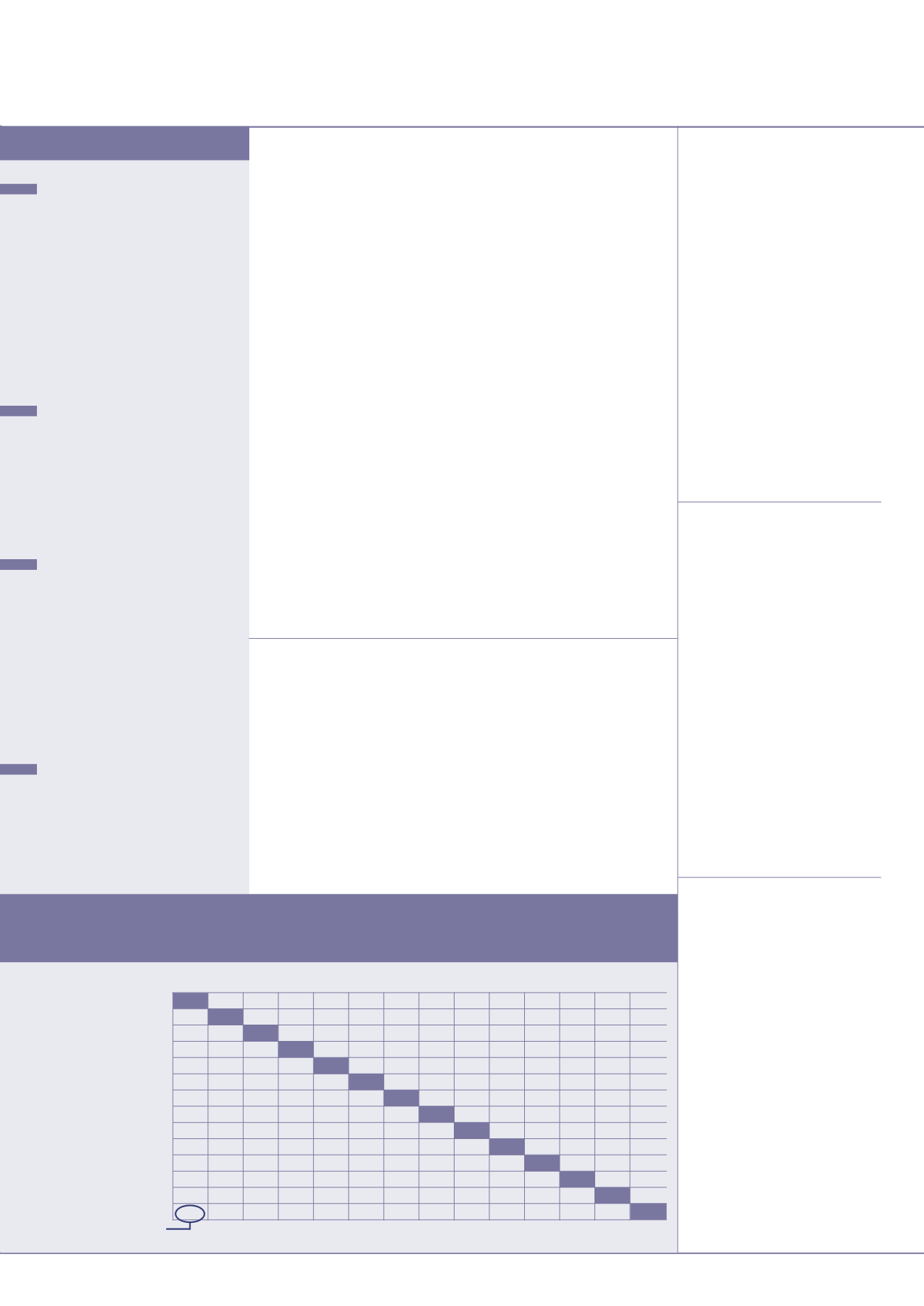

VALUEOF 1:

SYMBOL AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

AustralianDollar

AU$

0.48 0.553 5.79 0.679 55.0

95

11.96 32.4

3.47

9.93

948 0.830 0.926

BrazilianReal

BRL

2.09

0.264 2.77 0.325 26.3

45.3

5.72

15.5

1.66

4.75

453 0.397 0.443

BritishPound

UK£

1.81

3.78

10.5

1.23

99.5

172

21.6

58.6

6.28

18.0

1714 1.50

1.68

Chinese Yuan

CNY

0.173 0.361 0.095

0.117 9.50

16.4

2.07

5.60 0.600 1.714

164 0.143 0.160

Euro

€

1.47

3.08

0.81

8.53

81.0

140

17.6

47.7

5.11 14.62 1395 1.22

1.36

IndianRupee

INR

0.018 0.038 0.010 0.105 0.012

1.7

0.218 0.589 0.0631 0.180 17.2 0.0151 0.0168

Japanese Yen

YEN

0.011 0.022 0.006 0.061 0.007 0.580

0.1262 0.342 0.0366 0.1047 10.0 0.0088 0.0098

MexicanPeso

MXN

0.084 0.175 0.046 0.484 0.057 4.60

7.93

2.71 0.290 0.830

79

0.069 0.0774

RussianRuble

RUR

0.031 0.064 0.017 0.179 0.021 1.70

2.92 0.369

0.107 0.306 29.2 0.0256 0.0286

Saudi Riyal

SAR

0.288 0.602 0.159 1.668 0.196 15.840 27.307 3.445 9.336

2.86

273 0.239 0.267

SouthAfricanRand ZAR

0.101 0.211 0.056 0.583 0.068 5.541 9.552 1.205 3.266 0.350

95

0.084 0.093

SouthKoreanWon KRW

0.0011 0.0022 0.0006 0.0061 0.0007 0.0580 0.1001 0.0126 0.0342 0.0037 0.0105

0.00088 0.0010

Swiss Franc

CHF

1.21

2.52

0.67

6.98

0.82 66.29 114.29 14.42 39.07 4.19 11.96 1142

1.116

USDollar

US$

1.08 2.258 0.597 6.254 0.7334 59.4 102.4 12.92 35.01 3.75 10.72 1023.4 0.896

For exampleUS$ 1=AU$ 1.08

Exchange rates: May 2014

SWEDEN

VolvoConstruction

Equipment has closed its US$ 160

million acquisition of Terex’s UK-based

haulermanufacturing business. The

deal was announced inDecember and

will see rigid frame dump trucks added

to Volvo’s portfolio. The deal includes

a factory inMotherwell, UK and a

25.2% stake in InnerMongoliaNorth

Hauler Joint StockCo. (NHL), which

manufactures and sells rigid haulers

under the Terex brand inChina.

UK

JCB reported a -14% fall in

earnings before interest, taxes,

depreciation and amortisation (EBITDA)

toUK£ 313million (US$ 525million)

last year, on revenues down -1%

UK£2.68 billion (

€

4.54 billion). The

company said it was a good result in

2013’s challenging global conditions.

SOUTHKOREA

Hyundai Cummins

EngineCompany (HCEC), a joint

venture betweenHyundai Heavy

Industries and diesel engine

manufacturer Cummins, has completed

construction of a 78,045m

2

engine

factory inDaegu, SouthKorea. The

factorywill supply Hyundai with

engines for its construction equipment

and has a capacity of 50,000 units

per year.

UK

Caterpillar subsidiary Perkins has

produced its 20millionth engine at its

facility in Peterborough, UK, 81 years

after the brandwas established. The

company said at least 4.5million of

the engines it hasmadewere still in

service.

US

KBR to re-state 2013 accounts

KBR is to re-state its accounts for

2013. It said it now expects tomake

a US$ 135 million pre-tax loss on

seven contracts to fabricate and

assemble pipe modules in Canada,

compared to thepreviously expected

US$23millionprofit.

Theproblems stem from abusiness

in Edmonton, Canada where KBR

says a rapid expansion resulted in

increased internal and external costs.

KBR added that most of the losses

had already been incurred, however,

it said the situationwas on-going, so

the amounts involvedmight change.

The company said it would file an

amended annual report as soon as

possible, andwill not file a report for

the first quarter of 2014 until this

was done.