17

january-february 2014

international

construction

ECONOMIC OUTLOOK

Roaring again?

>

Roaring again?

T

he Chinese economy and construction

sector will continue to be guided by the

government’s growth-support policies in

the near future. The policy shift that took place

in mid-2013 has rejuvenated infrastructure

investment in particular.

The main construction story for China is

a rejuvenation of infrastructure, particularly

within transportation. For example, Guangdong

province will invest US$ 16 billion in

transportation projects, with over 70% devoted

to expressways. The remaining funds will go

to other road construction as well as ports and

waterways.

This intensive campaign will complete eight

expressway projects, begin eight more and

continue another 30 road projects in 2014, and

is part of an official program to build nearly

2,500 km of expressway from 2014 to 2017.

This is noteworthy because even though

Guangdong constructed 5,724 km of expressway

up to 2013, ten counties have yet to be linked to

the network (an issue to be completed by the end

of 2015), and the transport network linking the

eastern, western and Pearl River Delta (the core

area) portions of the province are not sufficiently

developed relative to growing demand.

In addition, the current waterways in

Guangdong are not able to meet the

requirements of economic growth without

further construction, suggesting that sustained

high levels of transportation infrastructure are

likely for at least the next five years.

Railways and metro systems will also see an

infusion of funding. Beijing, troubled by severe

traffic congestion, will add an additional four

subway lines in 2014, to augment the existing

17 lines that transport an average of 8.8 million

people per day. By the end of 2016, 94 km of new

track will be laid.

Underground capacity

The trend of exploiting underground space will

continue as a way of solving problems with the

city’s high urban density, and more importantly,

will be followed by other first- and second-tier

cities with increasing density issues, such as

Guangzhou and Hangzhou.

Shenyang and Wuhan have recently been

approved for new metro lines. According to

the Ministry of Railways, metro lines will grow

from 2,000 km in 2012 to 6,000 km by 2020,

requiring up to US$ 650 billion in investment.

Intercity rail has also seen tremendous

investment to enable trade flows. Such spending

has been exclusively in the government domain,

and the national railway corporation is nearly

CNY 3 trillion (US$ 495 billion) in debt as a

result.

Needing a new means of financing rail projects,

China is promoting reforms to fully open railway

construction to the private sector, although no

majority private ownership will be allowed.

Railway development funds will be established,

and new types of railway securities issued. Indeed,

Sichuan will allow private capital to hold shares

in two state-owned railway companies.

While national regulations on what kinds

of private companies are qualified to invest,

how they can invest and become controlling

shareholders still remains to be worked out. Still,

railway reform is a highlight of the 12th Five-Year

Plan, and mixed ownership of railways is likely to

begin in other regions of China.

Financing reform combined with new project

announcements indicate that China will

maintain railway investment of about CNY 700

billion (US$ 115 billion) over the next couple of

years, roughly the same level as in 2009, when

railway investment was ramped up as part of the

stimulus program.

Anhui province alone has announced plans to

construct a large railway network of 14 inter-

city passenger lines and five lines carrying both

passengers and freight. The network will be

centred on Hefei and will link 11 major cities in

the province with 1,485 km of rail.

Residential

Residential construction has been another

linchpin of Chinese construction. While there

remains concern over excess supply in parts of the

market, there is a renewed focus on the neglected

lower end of the sector - essentially shantytowns

and slums.

There is a need to improve the living conditions

of the poorer urban residents who live in crude

housing that does not meet safety standards.

Between 2013 and 2017, ten million housing

units will be refurbished, with about eight

million of those in cities. To reach this goal,

China will need to renovate between two and

three million homes per year at an annual cost of

US$ 49 billion. Such renovation could add three

percentage points per year to investment growth

over the next five years.

Rail and housing construction are elements of

China’s urbanisation strategy, and that strategy

continues to evolve.

Among 144 of China’s prefectural-level cities,

there are plans to expand or establish more than

200 urban areas. Within these areas, there are

local plans to build national level financial centres,

education centres and cultural centres, which

would place these cities in direct competition

with well-established centres among tier-1 cities

such as Beijing or Shanghai.

The concern is that the rate of urban expansion

is exceeding demand by a large margin, with

one city with a population of 300,000 having as

many as 100,000 housing units entering supply,

Growth support policies are helping to drive the Chinese construction sector, but care will be needed

not to repeat the mistakes of the past.

Scott Hazelton

reports.

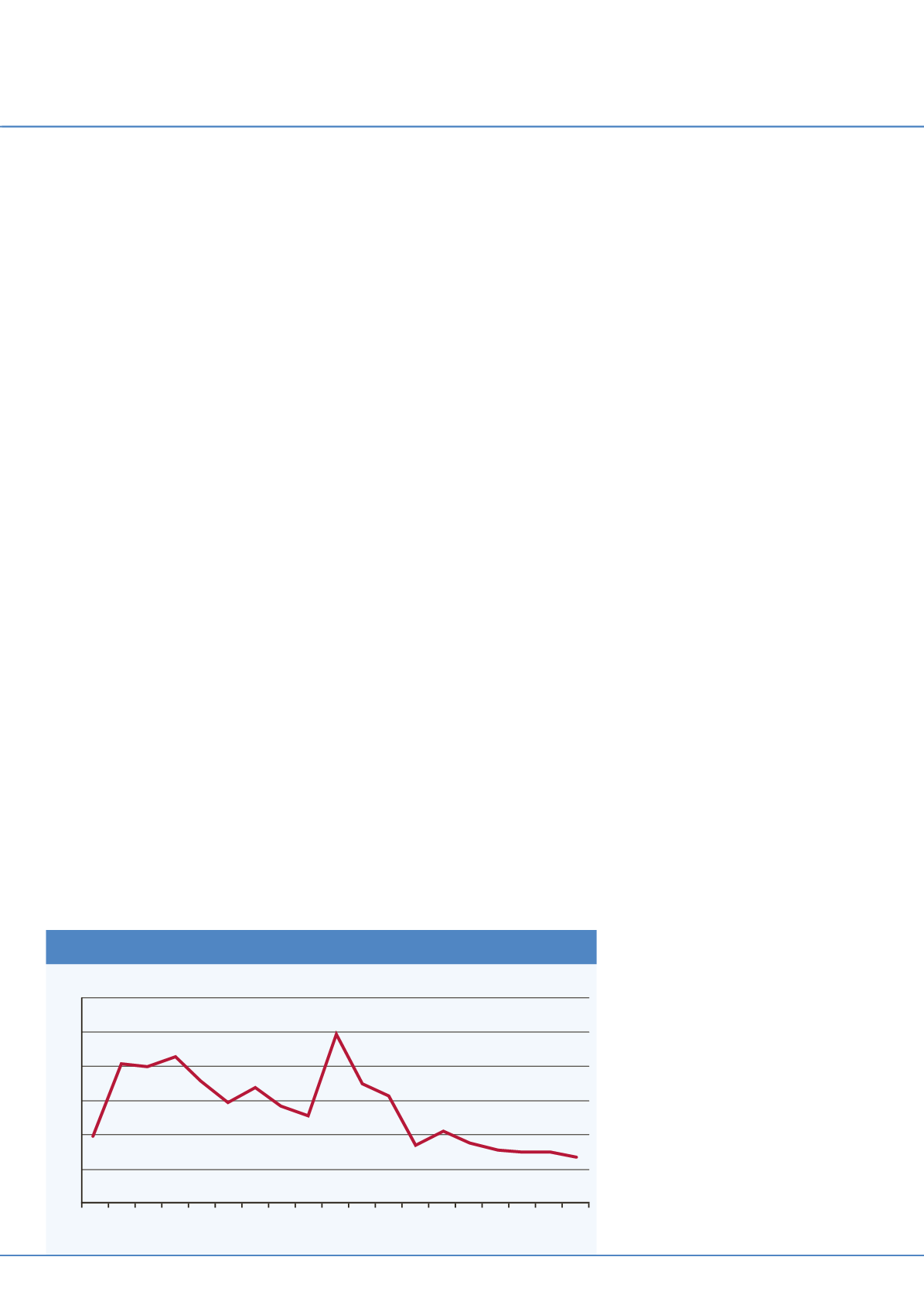

Historic and forecast Chinese construction growth

30%

25%

20%

15%

10%

5%

0%

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018