international

construction

january-february 2014

REGIONAL REPORT: CHINA

22

A changing environment

M

r Zhang Guofeng, from Beijing Xindadi Equipment Company, is tasked with

extracting between 1 million tonnes and 1.5 million tonnes of limestone a year from

two sites near Beijing, China.

“Since 2005, the company has used Caterpillar excavators to help with the work,” Mr Zhang

said. “We compared Caterpillar excavators side by side with another brand and found the Cat

machines to be more reliable.

“We sold eight of our old machines and want to sell the rest of the old fleet and change to

Caterpillar.”

Beijing Xindadi Equipment Company operates over 100 off-highway machines. The limestone

it removes from its quarries supports general construction and infrastructure activities in the

local area and around the country.

Caterpillar excavators currently used by the company

include the 45 tonne class 345D, 90 tonne class 390D and

49 tonne class 349D models

“Business in 2014 is looking good, we have not been

affected by the mining downturn,” Mr Zhang said, adding,

“China is still building a lot of houses.”

Fleet replacement

A quarry operator near Beijing upgrades its fleet as business improves

government is clearly committed to infrastructure development,

which provides excellent opportunities for companies in the

construction business like Volvo CE.”

Mr Luo said Volvo CE had achieved steady growth in market

share, performing well in 2013. “Since entering the market in

2002, we have developed a strong presence by implementing

localised strategies – like our dual brand strategy – and offering

diversified products that meet customers’ needs.”

Volvo’s dual brand strategy is its joint venture with Chinese

construction equipment manufacturer SDLG, while Caterpillar

has a similar arrangement with Chinese manufacturer SEM.

In fact many international manufacturers are accessing China’s

domestic market through acquisitions and joint ventures.

Meanwhile, speaking at the 2013 International Construction

Economic Forum (ICEF), which took place from 20 to 22

November in Amsterdam, Off-Highway Research European

analyst Paul Howard forecast that sales of construction

equipment in China would increase from US$ 22.6 billion in

2013 to US$ 25.6 billion by 2017.

To put this in perspective, sales of construction equipment

in China totalled US$ 37.1 billion in 2011. Mr Howard

said demand built up very rapidly between 2005 and 2010,

encouraged by massive investment and creating dangerous

bubble.

“All manufacturers had unrealistically high expectations for the

future,” Mr Howard said. “The government is now cooling down

the GDP growth rate, leading to a reduction in construction

expenditure and a sharp downturn in demand for equipment.”

This has resulted over-capacity in the domestic market.

“Capacity is now 50% too great,” Mr Howard said. “Many

OEMs now face huge liabilities, and new machines are being

repossessed. There is also a very large young machine population,

limiting new equipment sales.”

Mr Howard also said the perception of Brand China machines

as being of poor quality with little customer support was more

of a perception than reality.

and overseas ones in terms of technical

strength. Core technologies of a number

of key components are still dominated by

foreign enterprises.

“What’s more, we still lack variable

hydraulic components such as variable

pumps and variable displacement

motors required by high value-added

and high technical hydraulic systems as

well as advanced hydraulic components

of

mechanics-electronics-hydraulics

integration,” he added that these

components were still mainly dependent

on importation.

Amd Lawrence Luo, president of Volvo

CE region China, said, “Over the past

decade, China has grown at a rapid pace. Though China’s growth

has slowed, it is still a market with enormous potential. China’s

Lawrence Luo,

president of

Volvo CE region

China, said the

manufacturer had

achieved steady

growth in market

share in China,

performing well

in 2013.

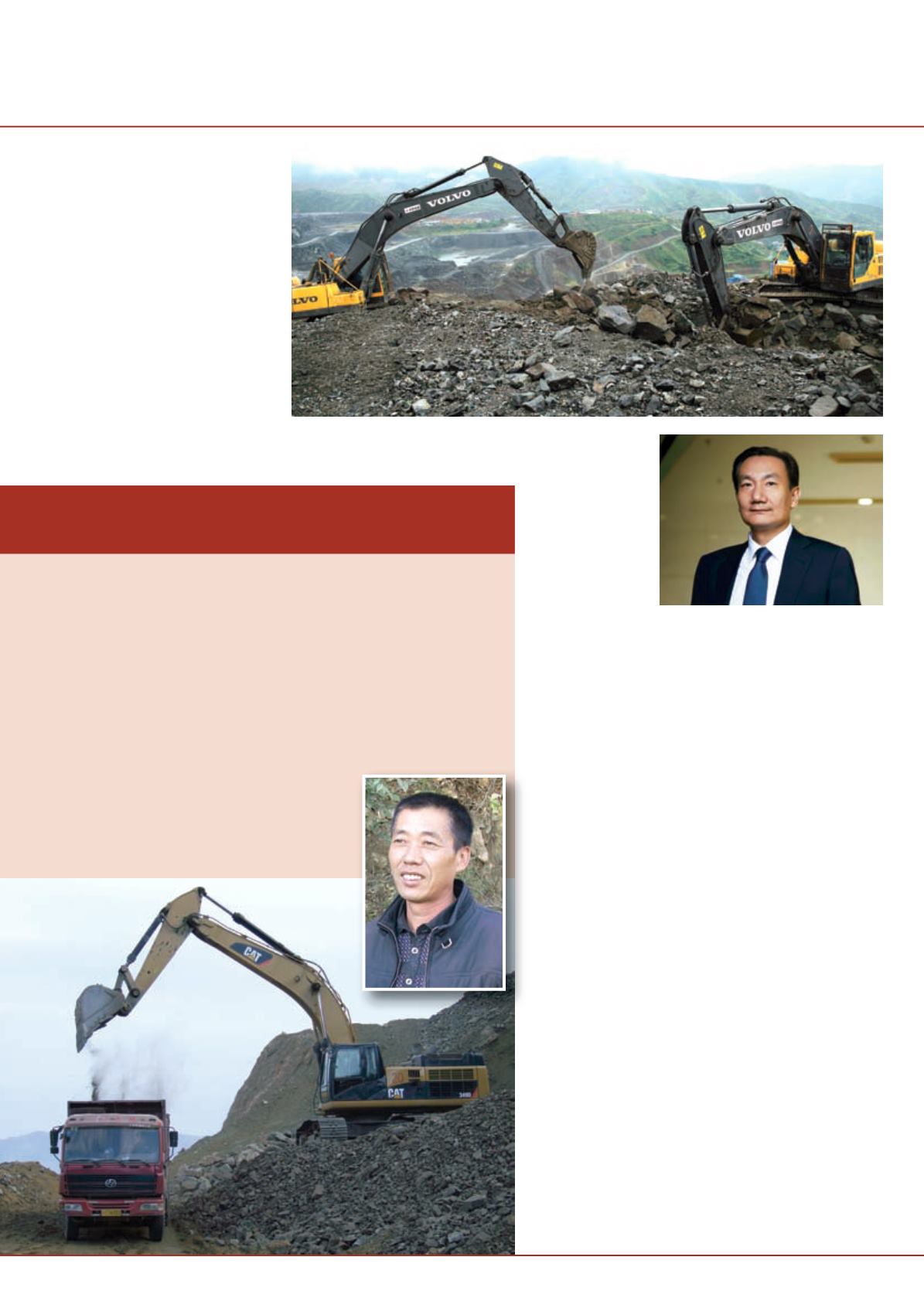

The Lomon Group operates a mine in Panzhihua and recently

purchased eight EC360 and EC460 C-Series excavators from Volvo

CE. The company now has 23 active Volvo Units and has calculated

one Volvo excavator can mine 3,500 m

3

of minerals a day.

>