Yellow Table

15

april 2014

international

construction

NEWSREPORT

Equipment top 50

The slowdown in

China, difficulties in the

mining industry and

the depreciation of the

Yen led to a reshuffle in

the global construction

equipment industry last year.

R

evenues for the world’s 50 largest

construction equipment manufacturers

fell -10% last year to US$ 163 billion,

as a variety of factors impacted on this cyclical

industry.

The most profound came from a downturn in

theglobalmining industry,whichpulledrevenues

down for equipment manufacturers around the

world. Although the Yellow Table attempts to

measure revenues from construction equipment

sales, and excludes companies that serve only the

mining industry, it is inevitable that a downturn

inminingwill impact onmany of the companies

in the league table. This is due to the blurred

margins between the two industries and thewide

varietyof different equipment used formining in

different parts of theworld.

For example, it was the downturn in mining

that was the main driver for the near US$ 10

billion decline in first-placed manufacturer

Caterpillar’s equipment revenues in 2013,

compared to 2012. Indeed, this was a factor for

all of the lone-line manufacturers in the top 10,

all of which saw their revenues decline inDollar

terms last year.

However, the greatest impact from the

downturn inmining last year was felt by drilling

equipment specialist Boart Longyear, which fell

eight places from its position in 2012 to no. 49

in this year’s ranking.

But aside from this decline for a heavily

mining-dependent manufacturer, the downturn

seems to have hit companies in the broad

earthmoving equipment industry harder than

manufacturers in niche areas. As well as seeing a

fall in revenues in 2013 – the year that rankings

in this year’s Yellow Table are based on – half

of the companies in the top 10 have seen their

share of total revenues decline since last year’s

study. For example, Caterpillar’s share is down

to 19.0%, compared to 21.8% in last year’s

YellowTable, Komatsu has fallen to 10.8% from

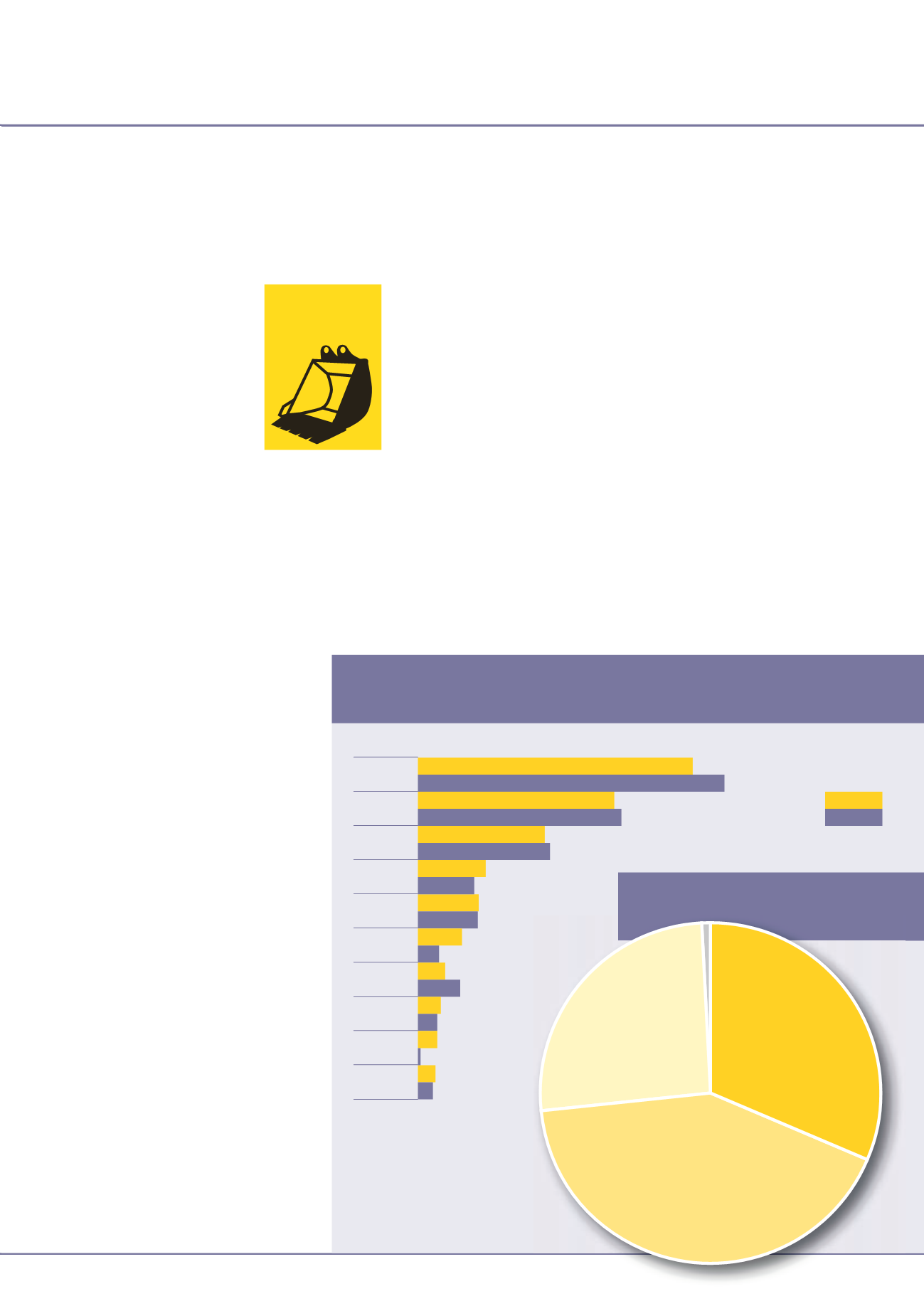

By country

By region

US

Japan

China

Germany

Sweden

SouthKorea

Finland

UK

Italy

France

34.8%

31.2%

22.3%

23.1%

14.4%

15%

6.9%

6.8%

7.7%

6.4%

5.0%

2.4%

3.2%

4.9%

2.6%

2.2%

2.2%

2.0%

0.3%

1.7%

This year

Last year

11.3%. Hitachi, Zoomlion and Sany

also saw their shares fall.

Despite some small gains for the

other five companies in the top 10,

the net result was that these large

companies accounted for 62.8% of

the top 50’s revenues in this year’s

study, compared to 66.5% in last

year’s edition of the Yellow Table.

This was the lowest the proportion

has been since 2010, when a surge

for several mid-sized Chinese manufacturers

squeezed themarket shares of the larger players.

The Chinese market also had a part to play in

this year’s edition of the YellowTable, with the

country’s continued slowdown in construction

and the high population of young machines

available from the 2009/10 stimulus boom

depressing revenues for domesticmanufacturers.

This saw the likes of Zoomlion and Sany lose

places within the top 10, and Lonking, XGMA

andChenggong also fall further down the table.

However, XCMG, Liugong and Sunward held

their ground, while Shantui moved up two

places.

But the net result was that the share of the top

50’s revenues claimed byChinesemanufacturers

fell to 14.4% in this year’s Yellow Table,

compared to 15.0% last year and a high-tide

mark of 16.9% in the 2012 edition, based on

2011 revenues.

In absolute terms, the Chinese manufacturers

in the Yellow Table had total revenues of

US$ 23.5 billion last year, compared to US$

30.6 billion at the peak – about a -23% decline

in the space of two years.

Currency effects

Another key factor in this year’sYellowTablewas

the depreciation of the Japanese Yen over the

course of 2013. In calculating revenues in US

Dollars for the YellowTable,

iC

uses the average

PERCENTAGE SHARE

>

YELLOW

TABLE

NorthAmerica

31.5%

Europe

26.0%

Asia

41.9%

RoW

0.6%