ECONOMICOUTLOOK

Infrastructure first

international

construction

april 2014

24

Infrastructure first

E

merging market economies have been

under pressure in recent months, and

India is among those most affected.

These economies boomed for much of the past

decade with easy monetary policy globally, the

commodities super-cycle and rapid globalisation

of trade. Inmany cases, therewas additional fiscal

stimulus to counteract the global recession.

However, while the share of global GDP

accounted for by imports increased from just

under 20% in 1995 to over 30% in 2011, it has

remained at that level into 2014.This stagnation

has limited the export opportunities that have

been crucial to emergingmarkets such as India.

Countries such as India also face an additional

challenge – when financial returns were low in

theUS andEurope, investors looked to emerging

marketswith theirpotentiallyhigh returnsdespite

higher financial risk.

With theUS in economic recovery and Europe

stabilising, developed economies offer higher

potential, as risk has grown in India and other

markets.The result has been limiting the flow of

foreigndirect investment onwhich India relies.

Most importantly, India, like many emerging

markets, failed to engage in market reforms

when the opportunity afforded itself. As a result

financial incentivesworking against India and the

unattractive business environment is reinforcing

the negative trend.

Worst is over

The worst for India’s economy may be over, but

the recovery will be shallow and protracted with

weaknesswell into the next fiscal year, at least.

The main engines of growth historically –

investment and private consumption – remain

fundamentally weak, inevitably dragging down

industrial production, manufacturing and

construction.

Infrastructure spendinghas been a bright spot –

however, the government budget deficit will limit

additional fiscal boosts togrowth.Theoutcomeof

general elections inMay should reduce political

uncertainty, opening up prospects for higher

investment and growth late in2014.

Although uncertain, India’smedium- and long-

term growth prospects are still favourable, as

expected reforms with a new government confer

significant gains in supply-side efficiency.

Boosting investment is critical to India’s

recovery. Fixed investment growth has fallen to

+2.8% per year comparedwith double digit rates

in themid-2000’s, partially due to stalled reform.

The government did manage to clear 36 big

ticket investment projects late last year worth

nearly US$ 27 billion, but the financing and

implementation of these projects may still prove

to be difficult given deteriorating public finances

and rising banking sector risks.

Favourable demographics

On the positive side, India is blessed with

favourable

demographics

and

abundant

labour, strong export potential, and growing

contributions from the service and construction

sectors. Rapid urbanisation rates will also act as

an important force of change in the long-term.

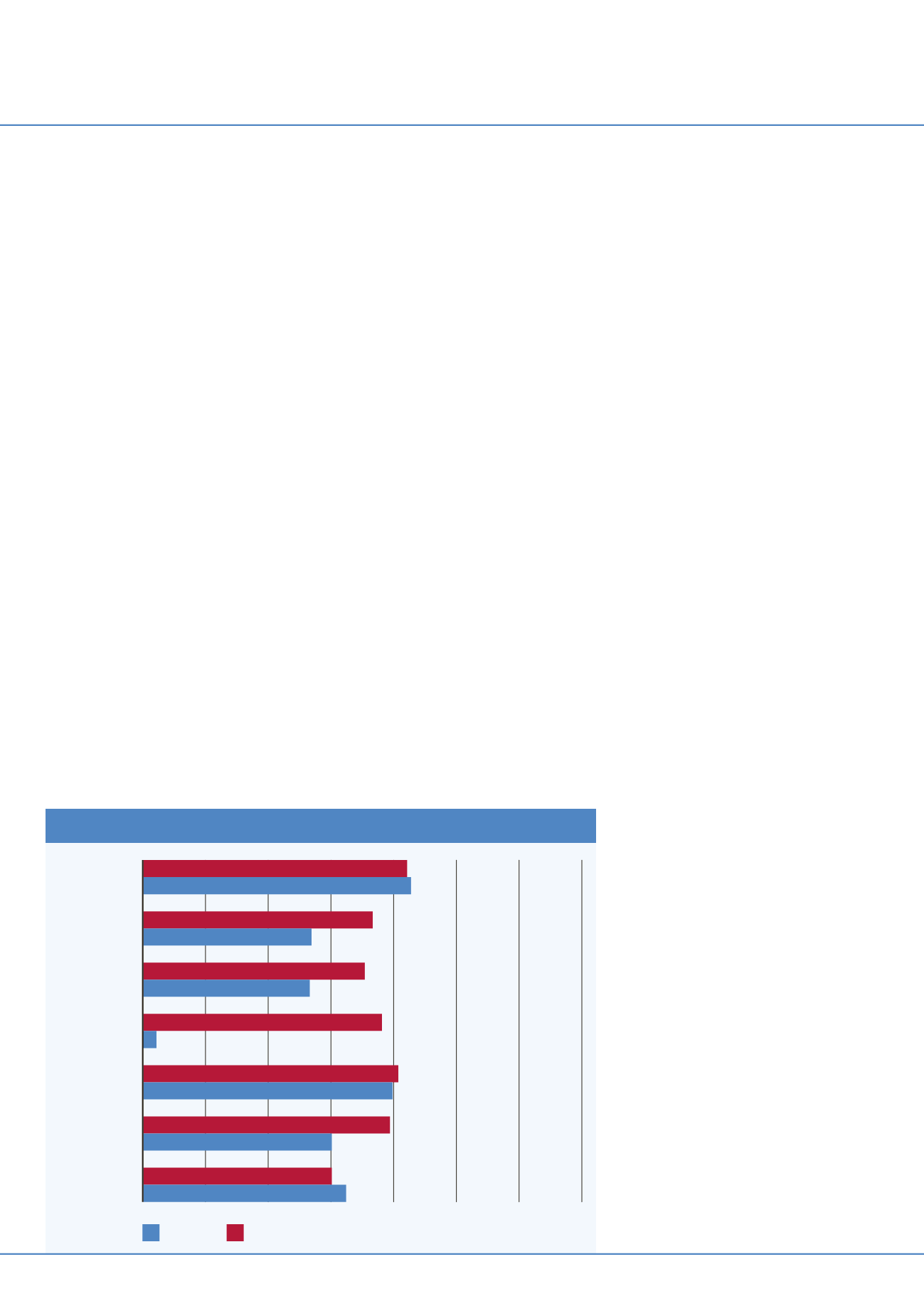

The construction outlook reflects the current

realities inIndia,whilebuildingon theexpectation

for reform. Inparticular, the forecast growth rates

are typically a full percentage point below what

was projected last year, given what will be tepid

GDP growth in the near term.

Also, forecast growth is back-loaded, assuming

that reforms materialise after the election and

take time to work through to the construction

economy. For example, construction of non-

residential structures will average compound

growth of +7.9% over the next five years, but

growth for thenext threeyearswill average+6.2%.

The average over the following years will

be +8.2%. To the extent that reforms fail to

materialise,medium to long termgrowthwill lose

considerably–potentially shaving twopercentage

points frompotential growth.

The forecast for the residential sector is relatively

weak. Urbanisation, population growth and an

emerging middle class contribute to growth,

but consumer confidence remains weak and

higher interest rates are particularly costly to this

segment. Unlike China and Brazil, India offers

limited public spending on housing, and private

demandwill be limited.

Office construction has been strong for the

past five years, driven by India’s technical services

industry.Demand from this sectorwill wane over

the forecast, but anticipated growth in financial

andbusiness serviceswill drive continuedgrowth.

The forecast for growth in industrial structures

does hinge upon market reforms to boost

India’s manufacturing industries and export

competitiveness. Reforms have already been

partially implemented for some commercial

categories, notably retail trade.

Infrastructurehasbeen the strongestperforming

segment over thepastfiveyears, and itwill remain

Indiamust invest in additional infrastructure in order tomeet even its reduced economic outlook.

Scott Hazelton

reports.

Historic and future growth

Infrastructure

Industrial

Institutional

Commercial

Office

Non-residential

Residential

0%

4%

2%

2009-2014

2014-2019

6%

8%

14%

12%

10%

8.4%

7.3%

8.5%

5.4%

7.1%

5.3%

7.6%

0.4%

8.1%

8.0%

7.9%

6.0%

6.5%

6.1%