28

CONSTRUCTION EUROPE

SEPTEMBER 2013

TURKEY

demand for graders and mini excavators, and

also our wheeled loaders are selling well.”

Mr Eren added that demand for construction

machines in Turkey was currently greater than

Liugong’s growth rate. “We need to close the

production gap and are currently looking at

our options,” he said.

AFTER-SALES

Meanwhile, Caterpillar customer Serkan Aydin

from mine operator Cift Ay said after-sales

support was crucial in the Turkish market.

“We produce revenues of around €189

million a year, and if we ever have a problem

or need a part we know to contact Borusan

[Caterpillar’s dealer] and get it sorted,” Mr

Aydin said.

“The main reason for Caterpillar’s success

in Turkey is the service, spare parts and

technician network – protecting machine

uptime is what we need.”

Sitech, which has been a Caterpillar

distributor in Turkey since 1994, also reports

an increasing interest in telematics and

machine control technology in the country.

Sitech Eurasia Teknoloji sales and marketing

manager Reha Imer said, “Uptake of

technology started three years ago when we

trialled an initial integration with a contractor

called Eken. They resisted for a year and

eventually agreed to the trial, and three

months later placed 18 orders.”

Mr Imer said the added accuracy and

reduced manpower needed when using

grade control technology, for instance, was a

clear advantage – increasing productivity and

shortening project times.

“All the contractors are watching each other,

and they can see the competitive edge the

technology provides. We expect a much

higher uptake of machine control technology

in Turkey by 2015 – increasing 50% per year.”

Volvo CE is also interested in Turkey, and

Ebru Nihan Celkan, marketing manager from

its local dealer, ASC Turk, said demand in the

machine was important. Now, we find interest

in new options, and there is a clear market for

fuel efficiency. Fuel is a major cost for lots of

our customers,” he said.

K Volkan Kalender, from Doosan’s Turkish

dealer Sanko, also felt the Turkish market was

maturing.

“Diesel economy is very important. Next

year, for instance, we will introduce a Stage IV

engine to our backhoe loaders. We showed a

prototype machine last year with this Perkins

engine,” he said.

Mr Kalender also said demand was

broadening for new types of equipment. “We

started selling telescopic handlers in Turkey

five years ago, when there was a very small

market. It is growing slowly,” he said.

But some also voiced concern about

competition. Betonstar, which manufactures

concrete pumps and placing equipment, is

increasingly targeting export markets as a

result of strong competition at home.

>

market for machines in the mining industry,

as well as backhoe loaders and excavators,

was increasing “dramatically.”

“We saw a 25% increase in construction

equipment sales during the first quarter of

2013,” Ms Celkan said, “and 10% of that was

from Volvo CE alone. We think we are going

to sell over 1,000 units by the end of the year.”

But running construction equipment in

Turkey comes at a cost. The country has some

of the highest prices for diesel in Europe – at

€1.73 per litre, it is higher than any European

country.

“In Turkey, fuel consumption is very

important,” Ms Celkan said. “Customers

are willing to pay a higher price in the first

instance for an efficient machine that they

plan to run for years and years.”

This was echoed by Reyahn Uĝurlu Yücel,

marketing and business development director

at Hyundai’s Turkish dealer, HMF.

“Some years ago, only the price of the

Caterpillar customer Serkan Aydin from

mine operator Cift Ay said after-sales

support was crucial in the Turkish market

Sitech Eurasia Teknoloji sales and marketing

manager Reha Imer said uptake of technology

on Turkish machines was gradually increasing

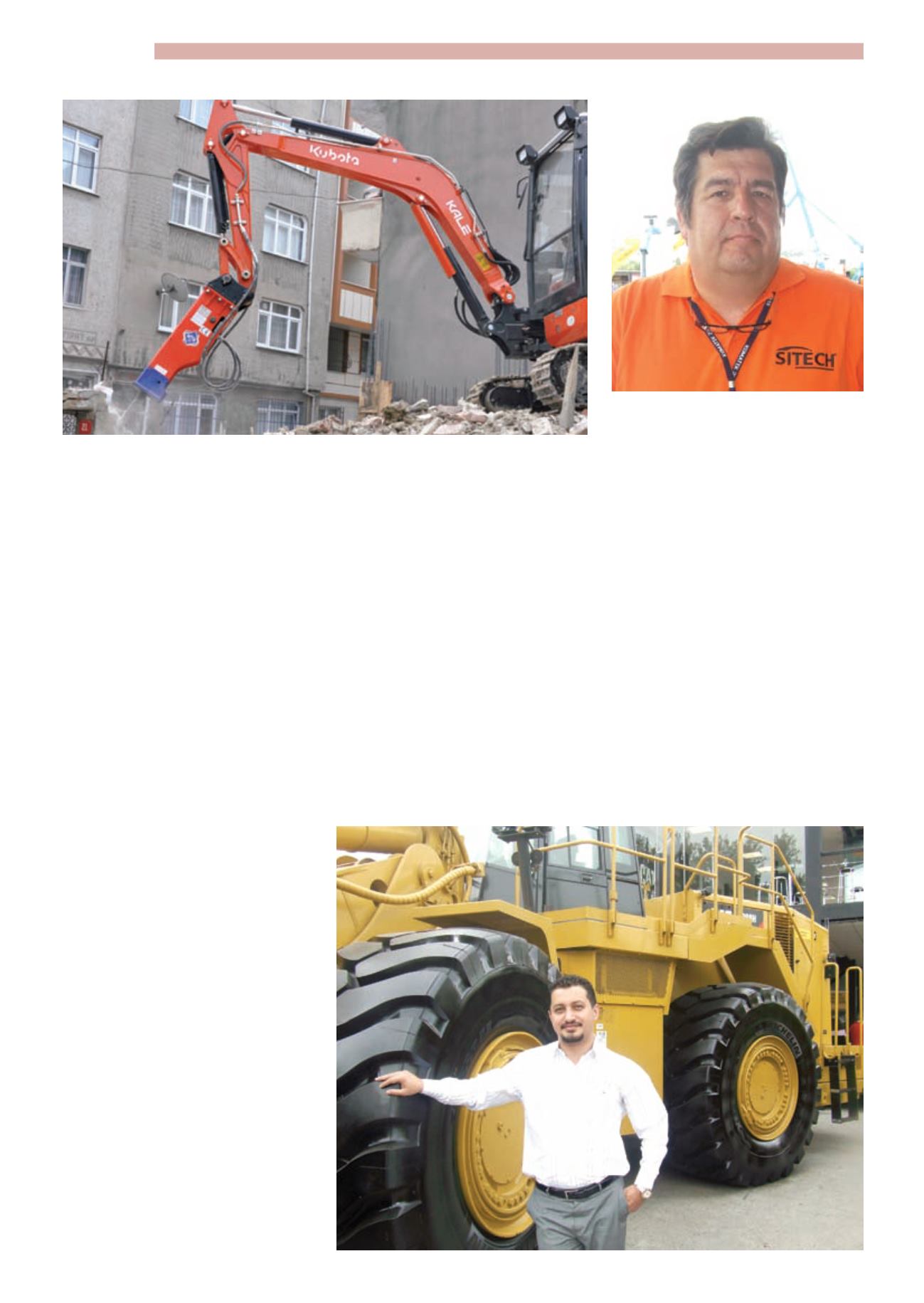

A €303 billion,

20-year demolition

drive is being

undertaken to

replace up to 6.5

million buildings

across Turkey.

Pictured is an MTB

breaker at work

from Inan Makina