access

20

18

access

INTERNATIONAL

MAY-JUNE 2013

Further up the table in sixth place Aichi

Corporation suffered similarly with a 17.8%

fall following the conversion to dollars, despite

an increase in turnover – last year the company

came third.

This shouldn’t detract from the achievement

of this year’s top five companies, however.

At the top of the table stand JLG (first) and

Terex AWP (second).The pair have seemed

immovable over the years and tower over their

closest rivals in terms of turnover.The nearest is

Skyjack, in third place, with a $487.76 million

turnover compared to Terex’s £2104.6 million.

Despite its hold on the top spot, JLG said

sales of aerial work platforms in the fourth

quarter of 2012 were almost flat year-on-year,

at $330 million, while sales of telehandlers rose

from $169.1 million to $248.9 million.

At Terex, North America accounted for 69%

of its 2012 revenues, with Western Europe

falling to 13% from a high of 28% in 2007.The

full year figures reveal the growing importance

of developing markets, with sales in Asia

representing 9% of the total and those in South

America 7%.

So, there have been success stories this year,

but there are also a few warning signs for the

months ahead.The same is true for the next

two companies under discussion.

Skyjack’s impressive 47% increase in

turnover meant it hopped from sixth in last

L

ooking down the table we see some

impressive rises, continuing the positive

trend started in 2010, which followed a

couple of tumultuous years for the

access

20

as the credit crises hit the worldwide economy.

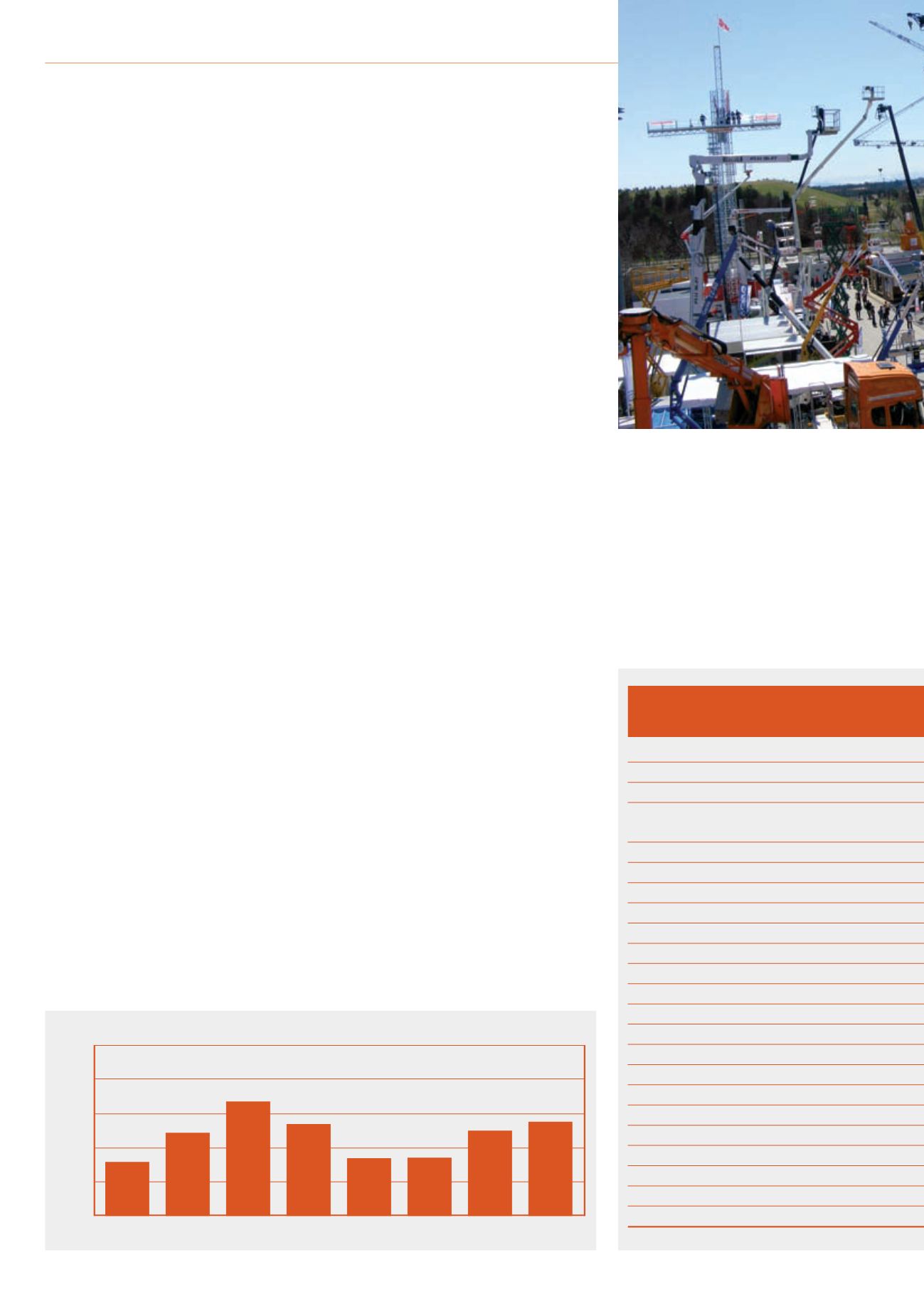

This year’s figures are based on turnover for

the 2012 financial year. Overall, they are not

quite as impressive as last year, when the listing

showed a 49% year-on-year rise in turnover

across the top five companies.This time the top

five have a 13% rise between them.

Of course, with Europe, the world’s

second biggest market for powered access,

still suffering the effects of a long and tough

recession, uneven results from year-to-year can

only be expected.

In a listing like this, in which US currency is

used as the measure, the exchange rate is also

a major factor. A notable example lies with the

Japanese Yen and the two companies in the

access

20

that use that currency. One of

them, Tadano, had a 9% rise in turnover during

its 2012 financial year. But that translated into

an 18.3% drop when converted into dollars

and saw the company fall from 10th to 12th

position in this year’s listing.

As a Tadano spokesman explained, “Japan’s

economy showed signs of a recovery, due in

part to a bullish stock market and devaluation

of the Yen that began around the time the new

government took office.”

year’s table to third this year.The company

said it had improved its margins on increased

sales volumes, as well as enjoying a stronger US

dollar and Euro and lower start-up costs at its

energy business.

Its ascendance saw it jump over Haulotte,

which remains in fourth position. Haulotte

also had a turnover increase, with its 13% rise

reflecting almost exactly the 13.1% increase

between the top five companies. Looking to

the future, a company spokesman added, “The

Steady grip

There are some interesting developments in this year’s

access

20

listing of the world’s biggest aerial work

platform manufacturers, including a handful of potential

warning signs, but the overall story is one of growth

access

20

YEAR-ON-YEAR TOP 5 JOINT TURNOVER/US$ MILLION

2012

10000

8000

6000

4000

2000

0

2005

3593

4941

+37.5%

6735

+36.3%

5410

-19.7%

3361

-37.8%

3406

+1.3%

5088

+49.%

5753

+13.1%

2006 2007 2008 2009 2010 2011 2012

RANK

2012 2011 COMPANY

1

1

JLG

2

2

Terex AWP

3

6

Skyjack

4

4

Haulotte

5

5

Altec

6

3

Aichi Corporation

7

7

Alimak Hek

8

8

GJJ

9

9

Time

10

11

Bronto Skylift

11

15

Palfinger Platforms

12

10

Tadano

13

12

Ruthmann

14

20

Manitou

15

13

Niftylift

16

19

Dingli

17

14

Teupen

18

13

Tanfield

19

17

Geda

20

18

Multitel Pagliero

21

21

Socage

22

16

CTE

23

22

Oil & Steel

*Time Group (not associated companies) ** Broker’s estimate

access

20