19

access

20

MAY-JUNE 2013

access

INTERNATIONAL

positive orientation of emerging markets and

the need for fleet renewal in European rental

companies should allow Haulotte Group to

grow by around 10% of sales in 2013 and

continue to improve its operating margin.”

But recent first quarter 2013 financial results

show that revenues have dropped at both

companies, (see the News, starting on page 6),

although Haulotte CEO Alexandre Saubot

said there was nothing to worry about and

increases were expected later in the year.

Another interesting entry is Snorkel, which

makes up all of its parent company Tanfield. As

can be seen from the table, Tanfield increased

its turnover marginally over last year and fell

five positions to 18th place.

It now seems almost certain that Snorkel

will be sold and all the signs suggest it will

be to a Chinese company unconnected to

the access industry.This, Snorkel hopes, will

provide a much-needed injection in capital

and help it to become the top five player that it

strives to be.

In a preliminary statement, the company

forecasted turnover for 2012 of about £45

million and an operating loss of approximately

£15.5 million. At the time of writing the full

figures were yet to be released.

Palfinger Platforms increased 10% on

last year in its domestic currency Euros. It

has similar experiences to the others. “The

increase was driven by North American, South

American and CIS regional sales. Business

development in Europe was marked by rising

uncertainty and a decrease in enterprises’

preparedness to invest.”

Manitou saw impressive increases too,

despite informing

AI

that its 2011 financial

year figure of €72 million, appearing in last

year’s table, was higher than it should have

been, with the correct figure being €52

million.This is why the company is showing

such a dramatic percentage increase this year.

Nevertheless, Manitou’s real rise in the listing

is still impressive, following a mixed set of

results across the group in 2012, with revenue

up 12% to €1265 million but operating profit

down 12% to €45.5 million.

At the same time the results were released,

Manitou CEO Jean-Christophe Giroux

stepped down in anticipation of his term of

office expiring at the company’s AGM on 6

June, and said, “The board believes that the

new environment calls more for an operational

focus, with a better balance between

profitability and development.”

Manitou added that it expected stable

revenues and profitability in 2013.

In another anomaly in last year’s table,

Time International, manufacturer of Versalift

van mount products, said its turnover figure

for the 2011 financial year of $250 million

included revenue from associated companies,

but not direct manufacturers of powered

access.Therefore, its figure of $140 million

in this year’s table is shown as a 44% drop.

The company told

AI

that 2012 had in fact

been one of its most successful years and the

$140 million turnover reflected a sharp rise in

access-related sales.

Its decision to launch six new products at

bauma is perhaps a reflection of its success,

and at the show Per Torp, Time Export

export manager, said the exhibition had been

incredibly successful. In January this year he

told

AI

, “We have had some good years and

not suffered too much in the market, so we

had capacity and the possibilities of spending

a good deal of money on new design, and

three years ago decided we wanted to keep our

market leading positions.”

At the bottom of this year’s listing, there

are a couple of other apparently steep drops,

namely from CTE and Oil & Steel. In the

latter’s case the figure for 2011 was an estimate

and the company has kindly provided

AI

with

an actual figure this year. As for CTE, its

figure this year now represents its turnover for

powered access only, rather than other products

combined in last year’s figure.

AI

Part of access platform area at bauma 2013

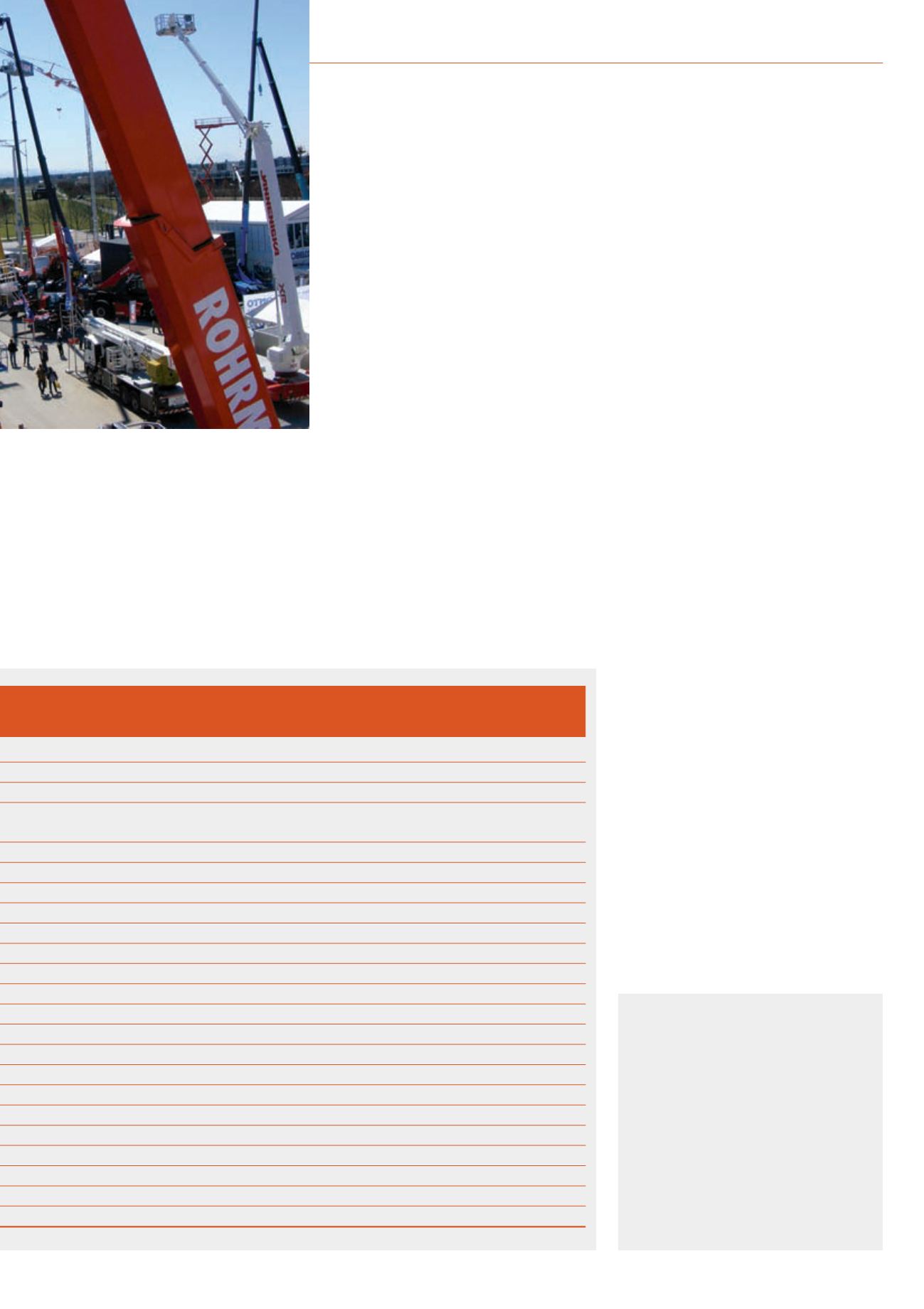

THE SURVEY

Companies were asked for their aerial work

platform related turnover for the financial year

2012. Where data is not supplied or where

company accounts do not provide complete

information,

Access International

has made its

own estimates after consulting industry sources.

Our thanks to all companies and individuals who

supplied information.

All conversions into US$ used exchange rates

on 17 May 2013.

As in previous years this is a list of powered

access manufacturers and does not include

manufacturers of non-powered access equipment

such as ladders, scaffold towers and scaffolding.

2012 TURNOVER

2011 TURNOVER

% CHANGE

US$

LOCAL

US$

LOCAL

OVER

MILLION

CURRENCY MILLION

CURRENCY YEAR

EQUIPMENT TYPE

$2282

$2282

$2052

$2052

11.2%

Self propelled/trailers

$2104.6

$2104.6

$1759

$1750

19.6%

Self propelled/truck mounts

$487.76

CN$487.76

$330

CN$326.6

47%

Self propelled

$458.3

€

355.7

$402.6

€

306.9

13.8%

Self propelled/trailers/

push around

$420

(est)

$420

(est)

$400

(est)

$400

(est)

5%

Truck mounts

$390

JPY39942

$474.64

JPY36737

-17.83%

Self propelled/trucks

$230

$230

$280

(est)

$280

(est)

-17.86%

Mast climbers

$219.7

RMB 1.35bn $254

RMB 1600

-13.5%

Mast climbers

$140

$140*

$250

$250

-44%

Truck Mounts

$134.6

€

105

$147

(est)

$147

(est)

-8.4%

Truck mounts

$128.3

€

100

$69.3

€

90

42.2%

Truck mounts

$124.4

12853 Y

$152.2

11789 Y

-18.3%

Self propelled/trucks

$121.9

€

95

$98.3

€

75.7

24.0%

Truck mounts

$92.3

€

72

$53

€

40.8

74.2%

Self propelled

$80.1

(est)

£52.8

(est)

$75

£48

6.8%%

Self propelled

$74

RMB 455

$55

RMB 350

34.5%

Self propelled/push around

$69.5

€

52

$69.5

(est)

€

52

(est)

0%

Spider specialist

$68.3

£45

**

$74.3

£48.3

-8.0%

Self propelled

$60.9

€

47.5

$65

€

50

-6.3%

Mast climbers

$60.2

(est)

€

47

(est)

$61.6

€

46.72

-2.3%

Truck mounts/spiders

$48.6

(est)

€

37.9

(est)

$44.8

€

34.5

8.5%

Trucks/tracked

$46.1

€

36

$66.1

€

50.9

-30.3%

Trucks/tracked

$25.6

€

20

$40

€

30

(est)

-36%

Truck mounts/spiders