15

APRIL 2014

ACT

BUSINESSNEWS

AUTHOR:

CHRISSLEIGHT

is

one of theworld’smost

internationally renowned

construction businesswriters,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’smarket-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

After the wobble

linked to the end

of QE, the stock

markets have

rediscovered their

confidence.

Chris

Sleight

reports.

T

he first fewweeks

of 2014were a little

uncertain for the

stockmarkets, as thehuge

rallyof 2013was punctured

by thenews that theFed

wouldbephasingout its

quantitative easing (QE)

policy this year. But February

and earlyMarchhave seen

investors getting into a buying

mindset again, with the tech-

heavyNASDAQ Indexdoing

particularlywell.

The announcement of

the taperingofQEhad

an immediate impact on

U.S. equities, albeit in a

roundaboutway. It droveup

yields on low risk investments

at home, whichmade them

more attractive to investors

that hadpreviouslyput their

money in riskier emerging

markets.

Themigrationof funds

back toU.S. shores drove

downmanydeveloping

world currencies, forcing

their central banks tohike

interest rates.While this

proppedup their currencies,

higher interest rates are of

course bad for business and

economic growth as they are a

disincentive to invest.

Itwas these effects that

took themarkets down in

January andFebruary, but

since then investors seem

tohavedecided theworld is

not such ableakplace after

all. TheDowhas returned to

close to the recordhighs seen

a fewmonths ago, and the

NASDAQ is threatening to

over-top its all-timehigh, set

at theheight of the “dot.com”

boom in late 1999.

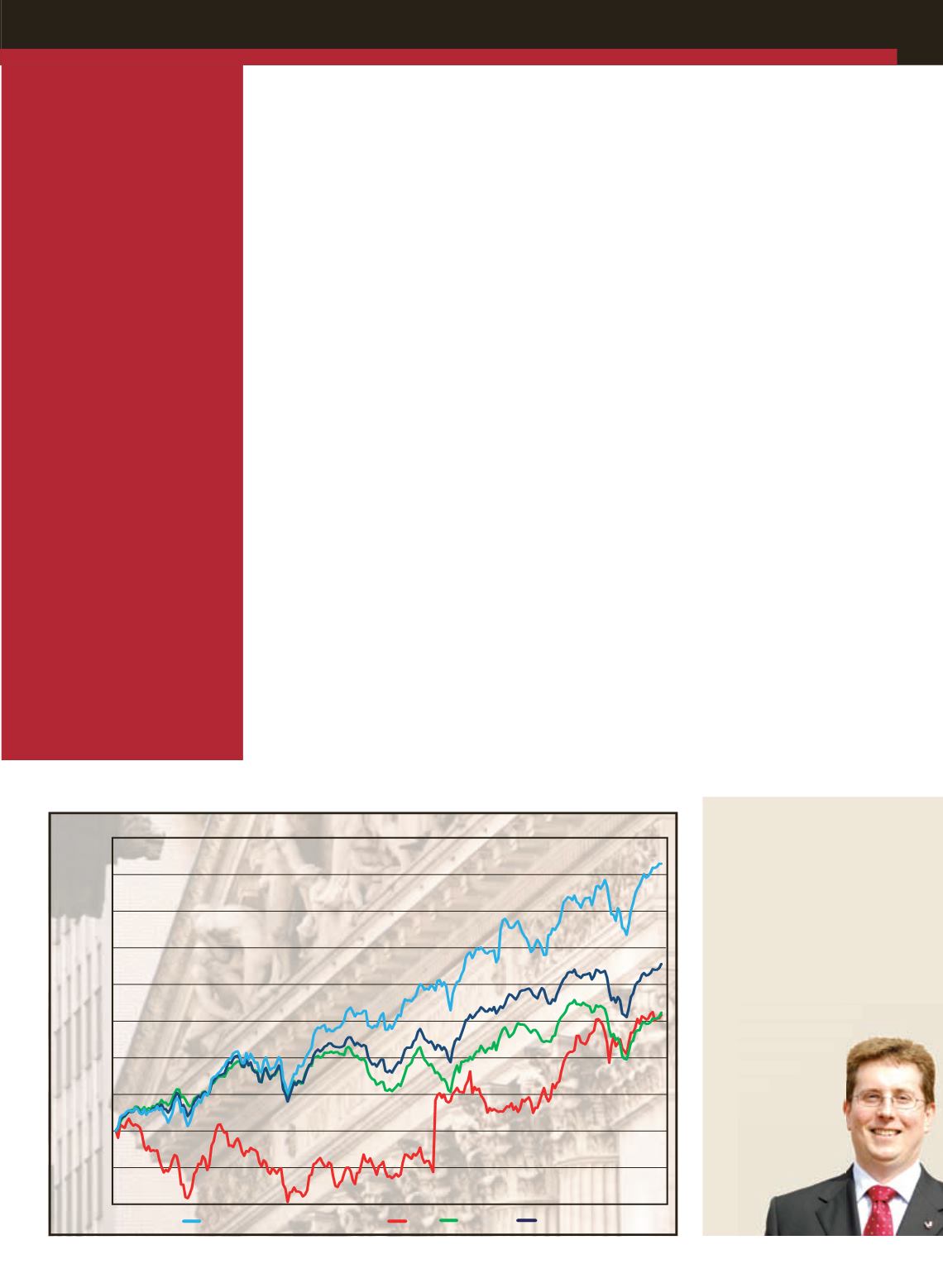

Consequences

One of the interesting things

about this latest rally is that

this time theheavy equipment

sector has joined the party. As

our graph illustrates, the

ACT

HEI has tracked the growth

in theDow fairly closely since

October (the sharp jump

in the

ACT

HEI, triggered

by the formationofCNH

Industrial fromCNH andFiat

Industrial). From that point

to thepresent day, the

ACT

HEI andDowhave grownby

a similar percentage.

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P500

40%

35%

30%

25%

20%

15%

10%

5%

0%

5%

-10%

% change

52weeks toMarch 2014

This augerswell for the

general industryoutlook.

As regular readers of this

columnwill know, the rally

of 2013was not necessarily

about economic growth, but

the fact that indexes like the

Dowwere one of the few safe

havens available at the time.

This iswhy themainstream

indicators rocketed last year,

while smaller individual

stocks – such as those that

makeup the

ACT

HEI – stood

still in the face ofweak global

growth.

The fact that the

ACT

HEI

and the blue-chip indices are

nowmoving together seems

to indicate that there is solid

economic growth (or at least

optimism about the economy)

behind the latest rally.

It is certainly the case that

construction industrypundits

expect 2014 tobe a good year

for the sector. Residential

construction is expected to

keepon climbing, and the

non-residential sector is

expected to finally return to

growth after a long anddeep

recession.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’smost

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Real world rally