15

OCTOBER 2013

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is one of

the world’s most internationally

renowned construction

business writers, with

specialist expertise in financial

markets and stock market

analysis. He is editor of KHL’s

market-leading

International

Construction

and is a regular

contributor to

ACT’

s

sister publication,

International Cranes

and Specialized

Transport

.

Chris Sleight

reports that the

stock markets

cooled over the

quiet summer as

bond yields rose

and concerns

heightened over

the end of the

Fed’s quantitative

easing program.

T

he summer period

is usually a fairly

quiet one for stock

markets. Volumes tend to

be low and prices are flat

or down-ish as a symptom

of lower activity over the

vacation period.

It is a pattern that has been

seen this year, although

perhaps for slightly different

reasons. The seasonal cycle of

the markets has been unusual

over the last 12 months.

Normally, there is a rally

that starts in the fall, ramps

up nicely for bonus time

around Christmas and New

Years, and then runs out of

steam by mid-February when

results come out. After the

readjustment there is another

flurry through to the end of

May before a second retreat

over the summer.

But 2013 has seen the

markets rally and then rally

some more. The Dow hit new

highs above 15,000 points in

May and again in July, and

it is only now showing any

respect at all for gravity.

The driver for this has

not been the usual cycle of

financial results and seasonal

factors that play into the

economy. It has been a

function of investors seeking

a safe haven at a time when

bond yields are low and gold

has been falling.

No net gains

However, these factors

weighing in favor of the

markets are now giving way

to improving bond yields

and concerns that the end

of the Fed’s Quantitative

Easing (QE) program, which

currently pumps $85 billion

a month into the economy, is

coming to an end.

Although the demise of

QE will be a gentle one – the

key word being bandied

around is “tapering” of the

money printing – there is

still concern that this will

have a negative impact

on the economy at a time

when unemployment is

still relatively high and

the recovery is only slowly

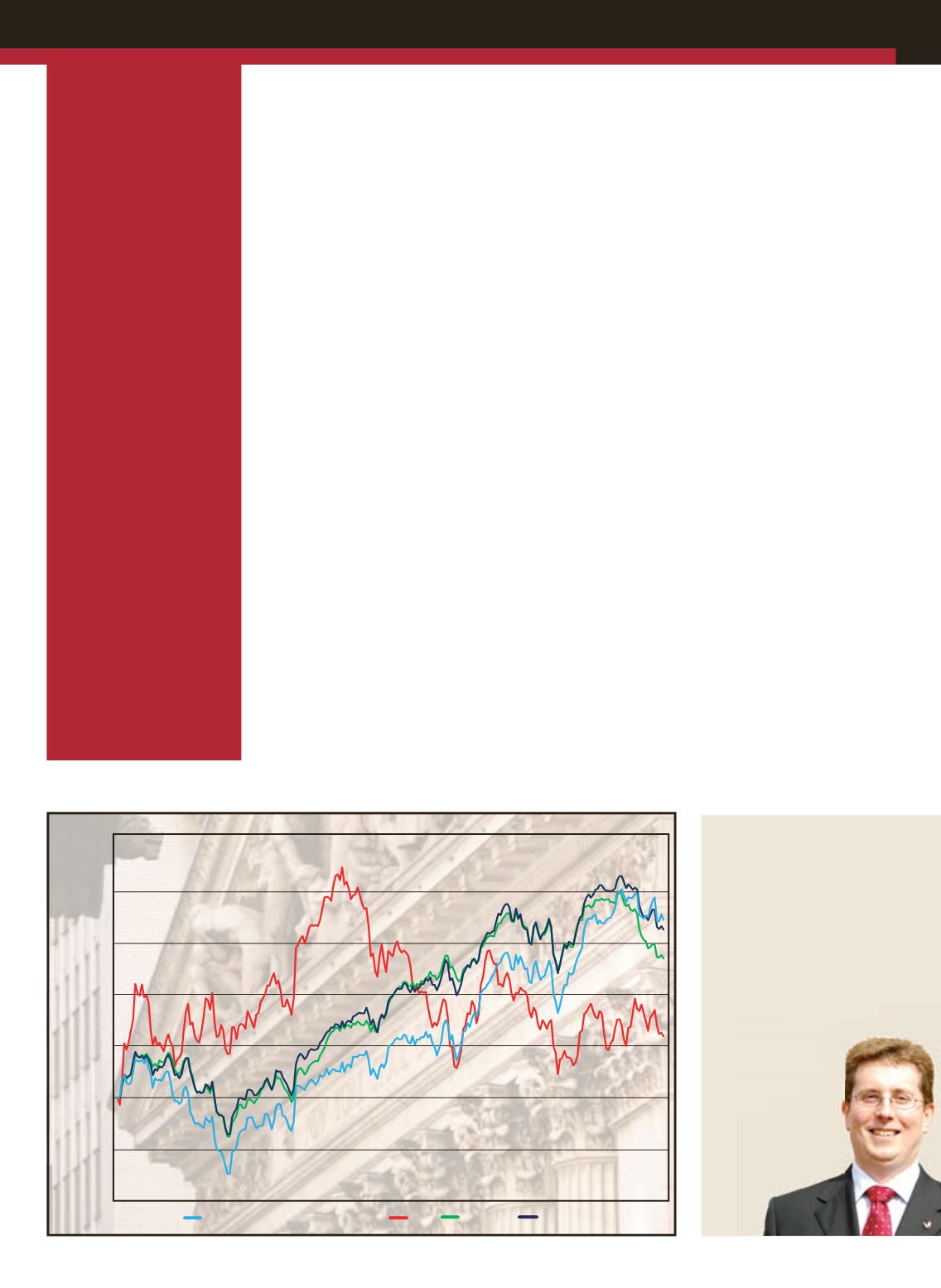

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

25%

20%

15%

10%

5%

0%

-5%

-10%

% change

52 weeks to September 2013

gathering momentum.

Indeed, as

ACT

went to

press, an announcement on

the tapering of QE was due

from the Fed. The expectation

was that it would herald the

beginning of the end for this

unconventional policy.

Having said that, monetary

policy is likely to remain

easy for the medium term

at least. QE will probably be

phased out over anywhere

between 12 and 18 months

and unemployment will have

to come down a good deal

further before there is any

thought of raising interest

rates – 2015 or even 2016

would be likely.

So while markets are coming

off an artificial high, the

impact on the real economy

from these policies is likely to

be gentle and relatively slight

on a day-to-day basis. Indeed,

as the economy strengthens,

stocks like those that make up

the

ACT

Heavy Equipment

Index (HEI) are likely to rise

as revenues and profitability

improve.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Off the boil