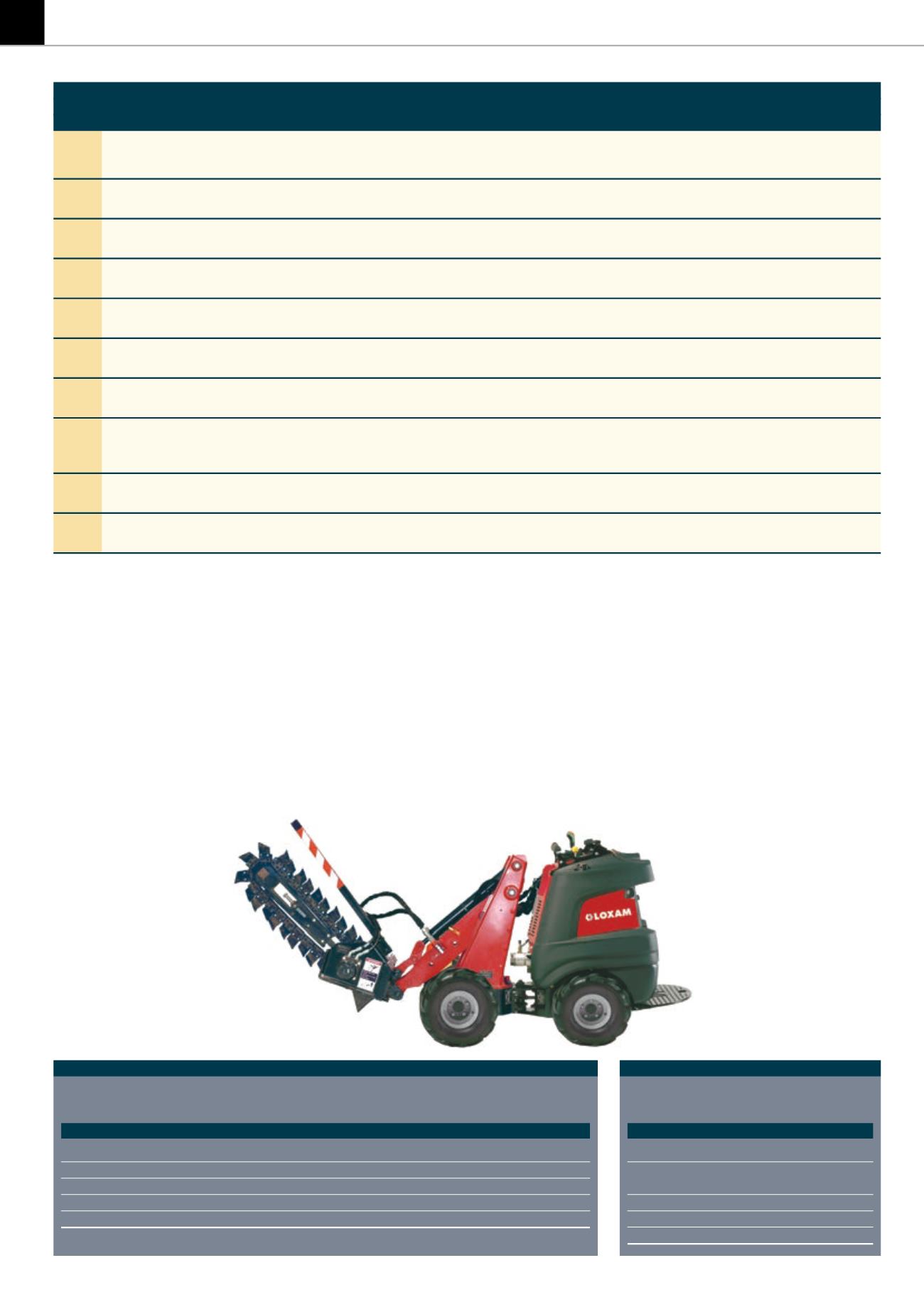

44

IRN

100

IRN JUNE 2014

=40

45

Neff Rental

226

209

Miami, FL, USA

USA

Construction

64

1050

+1 305513 3350

equipment

42

53

Solaris Equipamentos

224

178

SãoPaulo, Brazil

Brazil, Argentina

Construction rental

14

400

+55 11 21738685

E Servicos

43

47

APR Energy

223

201

Jacksonville,

Global

Power, TC

–

1000

+1 904 223 2278

Florida

44

61

Sunstate

222

157

EST

Phoenix, AZ,

USA

Construction

54

1156

+1 602 275 2398

Equipment Co

USA

equipment

45

=35

Komatsu Rental

219

268

Yokohama, Japan

Japan

Construction

118

930

+81 45 274 3337

equipment

46

32

Boom Logistics

218

275

Melbourne,

Australia

Cranes andaerial

40+

1000+

+61 398640200

Australia

platforms

47

43

MaximCrane

210

EST

220

EST

Bridgeville, PA,

USA

Cranes andaerial

31

–

+1 4125040200

USA

platforms

48

44

Mills Estruturas e

207

218

RiodeJaneiro,

Brazil

Aerial platforms,

51

2093

+55 21 21 233 700

Serviços de

Brazil

telehandlers,

Engenharia

formwork, shoring

49

38

NESRentals

206

1

245

EST

Deerfield,

USA

Construction

77

–

+1 800NESRENT

IL, USA

equipment

50

48

ADCO

200

EST

200

Ratingen,

56 countries

Portable toilets

–

–

+49 21028520

Germany

worldwide

TURNOVER

TYPEOF

RANK

(€MILLION)

AREASOF

RENTAL

NUMBEROF

14 13 COMPANY

13/14 12/13

HEADOFFICE

OPERATION

COMPANY

DEPOTS STAFF

CONTACTDETAILS

Indeed, of the 10 Japanese companies listedon the

IRN

100

, all but one either remained in the same

position as the 2012 or lost ground on the ranking

year-on-year, despite in many cases growing their

local currency revenues.

Take Aktio Corp, for instance – the highest-ranking

Japanese rental company in the

IRN

100

. Its

revenues in Euros totalled €929 million, ranking it

sixth in the list.However, if theYenhadn’tdepreciated

over the year, this would have translated to €1.18

billion, taking it to fifthplace.

Healthy growth

Adjusting for currency changes between 2012 and

2013 shows that, overall,

IRN

100

company

revenues grew by 7.5%, which is a

healthy growth rate given the

wider economic backdrop. Much

of this growth relates to North

American businesses, where

year-on-year corrected growth

was 10.7%. Japanese companies also

saw very respectable increases, with an

averageof 7.9%.

European

IRN

100

firms saw a much more

modest average growth of 2%, while companies

TABLE 3

IRN

100

Drop-outs

COMPANY

2013REVENUES (€M)

Grupo Eurogruas

70

HUNERental

68.9

SkanskaMaskin

62.7

De Boer Structures

55.1

MCCPlant Hire

(Mutual Construction Co)*

38.1

*Plant hire represented 13%ofMCCGroupactivities in the year to 30June 2013.

at the end of 2012, Algeco Scotsman acquired

Target Logistics in February 2013, a US provider of

full-service remote workforce accommodation, for

around US$625 million. It then went on to expand

in China, entering a joint venture with Beijing

Chengdong International Modular Housing Company

tomanufacture, rent and sellmodular space inChina

under theAlgecoChengdongname.

At thesame time, CoatesHirewashitbyaslowdown

in Australia’s natural resources sector, while HERC

saw growth, but not enough tomaintain its position

in the ranking.

European companies

There are 40 European companies featured in the

2013

IRN

100

, compared to 44 last year. This year’s

ERN

50

ranking of the top 50 European

companies by rental revenues totalled €10

billion, representing a slight fall against the

figureof €10.24billion recorded for 2012.

Indeed, the influence of Europe on the

IRN

100

is lesseningyearbyyearasother

regions grow at a faster rate. However,

entrants from developing markets remain

elusive – large rental companies

are still a rarity in Asia and South

America, but growth is clearly

trickling through.

Meanwhile, as far as capital expenditure is

TABLE4

IRN

100

Newentrants

RANK COMPANY

REVENUES

60

National Pump

Est

156

62

Compact Power

Est

145

Equipment rental

63

NCSG

Est

144

=64

TNTCrane &Rigging

Est

141

92

Equipme+nt Depot

Est

89

in the rest of the world were almost flat at +0.4%.

That flat result reflects the slowAustralian economy,

which has offset growth among the South American

andMiddleEast companies in the list.

Revenues for the top fivecompanieson the listwere

up 10.9% to €8.98 billion (on a ‘corrected’ currency

basis). The big three global players maintained their

2012 positions, with United Rentals remaining the

largest rental company in the world, followed by

AggrekoandAshsteadGroup.

However, therewas change at places four and five,

withAlgecoScotsman jumpingup fromseventhplace

in the 2012

IRN

100

ranking to fourth place this

year, knocking Coates Hire out of the top five and

shunting Hertz Equipment Rental Co (HERC) down

to fifth.

After completing a massive

refinancing programme

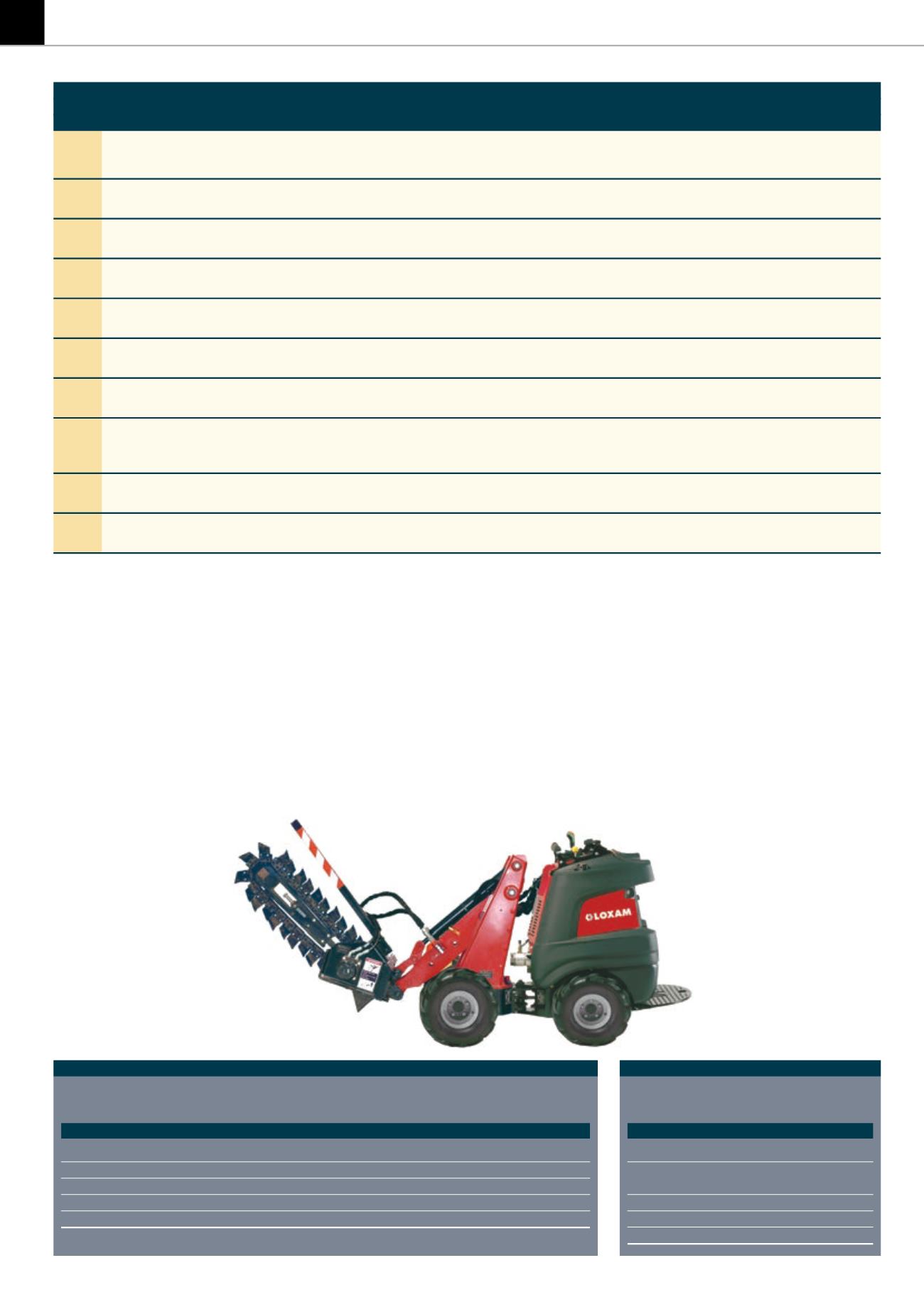

Loxam’s rental revenues slipped slightly year-on-year, but it

improved its position in the ranking by one place to seventh

¬