48

IRN

100

IRN JUNE 2014

TURNOVER

TYPEOF

RANK

(€MILLION)

AREASOF

RENTAL

NUMBEROF

14 13 COMPANY

13/14 12/13

HEADOFFICE

OPERATION

COMPANY

DEPOTS STAFF

CONTACTDETAILS

73

68

Rent Corp

127

133

Japan

Japan, Thailand

Construction

60

652

+81 54 238 7000

equipment

74

62

Onsite Rental Group

125

EST

150

EST

Sydney, Australia

Australia

Construction

–

–

+61 28814 3200

equipment

75

73

SKRental Group

122

117

Santiago, Chile

Chile, Peru,

Construction

25

600

+56 2837 3500

Brazil, Colombia

equipment

76

65

General de Alquiler

121

140

Madrid&

Sp, Port, Morocco,

Construction

93

1100

+34985 732 273

deMaquinaria (GAM)

Oviedo, Spain

Rom, Bulg, Pol, Mexico, equipment

Panama, Brazil, Peru,

Chile, Colombia

MiddleEast, Iraq,

77

64

Hewden

120

120

Manchester, UK

UK

Construction

36

900

+44 (0)84560 70 111

rentals

78

79

Shanghai Pangyuan

112

101

Shanghai, China

China

Construction

30

4000

+86 21 321 80088

Construction

equipment, tower/

Equipment Rental Co., Ltd

crawler cranes

79

78

Ring Power

110

EST

103

EST

St Augustine,

USA

Construction

14

–

+1 904 737 7730

FL, USA

equipment

80

91

Madisa

109

84

Monterrey,

Mexico

Construction

50

3000

+5201 80092623472

Mexico

equipment

81

63

Holt Cat

108

1

148

SanAntonio,

USA

Construction

19

–

+1 210648 1111

Texas, USA

equipment

82

=80

Cleveland Brothers

106

1

100

EST

Murrysville, PA

USA

Construction

21

–

+1 866551 4602

Equipment Co

equipment

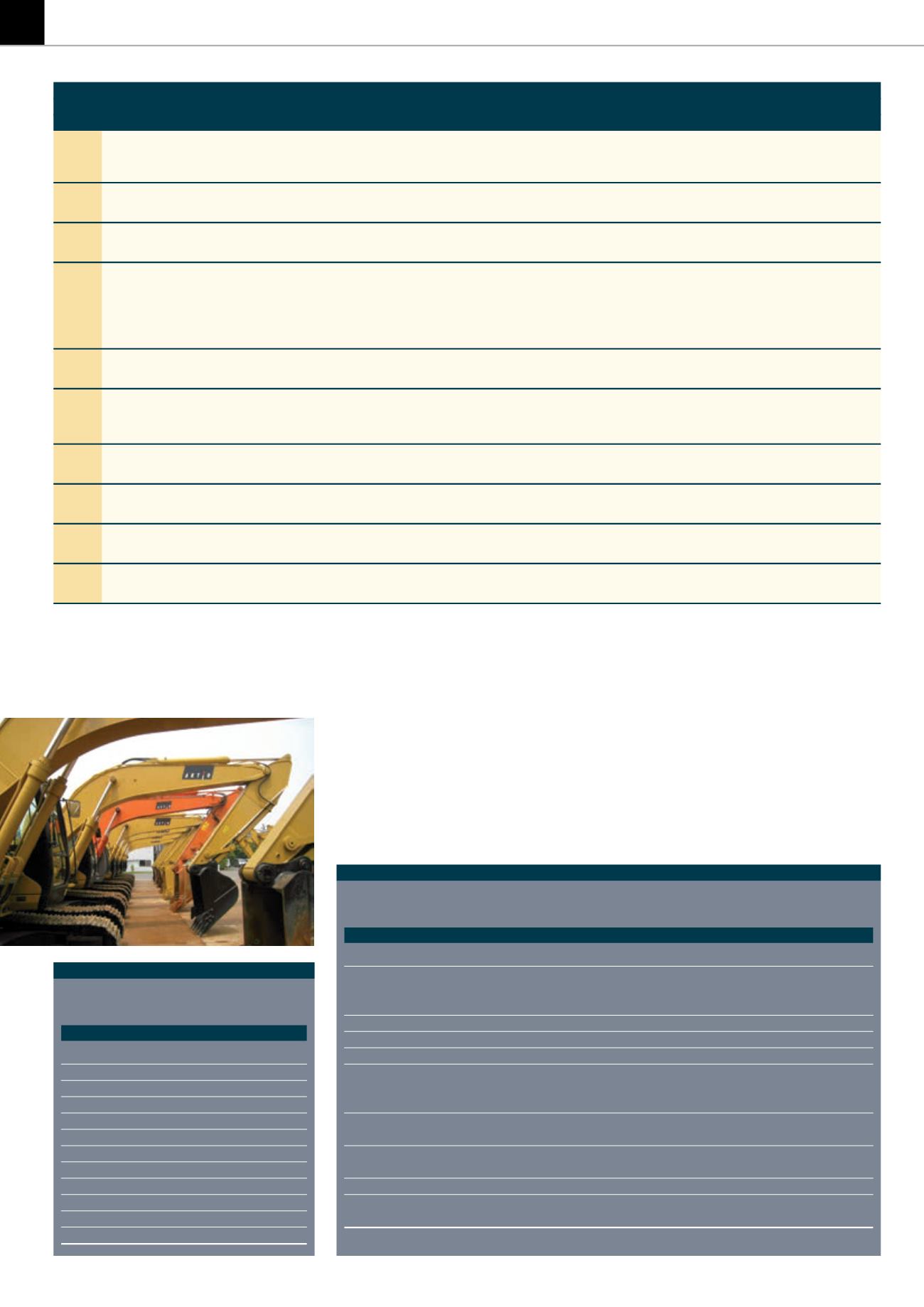

TABLE6

IRN

100

Top 10 ‘Global’ players

RANK COMPANY

REVENUES ( €MILLION) NOTES

1

Aggreko

1441 UK, US

2

Ashtead Group

1302 More than 37 countries inEurope,

NorthAmerica, MiddleEast, Brazil,

Australia/NZandAsia

3

Algeco Scotsman

1017 US, Canada, France, Spain, China, Saudi Arabia

4

Hertz Equipment Rental Corp

592 58 countries globally

5

Sarens

406 UK& Ireland, Middleeast, NorthAfrica

6

SpeedyHire

308 US, Canada, South&Central America,

SouthAfrica, Iraq, Afghanistan,

Philippines, Australia

7

AMECO

301 Singapore, Australia, China, Indonesia,

Vietnam, Malaysia, Thailand

8

Tat Hong

290 Germany, Austria, Czech/SlovakianRepublics,

Russia

=9

EmecoHoldings

284 Australia, Canada, Indonesia, Chile

=9

Lavendon Group plc

277 Netherlands, Belgium, Germany, Luxembourg,

Czech, Slovakia, Austria, Poland, Italy.

Note:

‘Global’ definedas companieswith rental activities inmore thanone continent

TABLE5

IRN

100

Growth league

COMPANY

%GROWTH

1 Algeco Scotsman

49.7%

2 Madisa

29.8%

3 Solaris Equipamentos E Servicos 25.8%

4 Aktio Corp

23.8%

5 GAPGroup Ltd

19.5%

6 HSSHire

17.9%

7 H&E Equipment Services

16.8%

8 United Rentals

11.4%

9 APR Energy

10.9%

10 Ainscough Crane Hire Ltd

9.2%

11 Neff Rental

8.1%

12 Ahern Rentals

6.0%

ten spenders, and the top three, have most of their

operations inNorthAmerica,where fleet replacement

andgrowthhasbeenheavy for several years.

Last year also saw significant merger and

acquisition activity in the rental industry. There was

Algeco Scotsman’s acquisition of US company Target

Logistics Management; while the year ended with

private equity company Platinum Equity’s move to

purchase Volvo Rents for €800 million – a business

that it has renamedBlueLineRental.

And therewereplentyof smaller deals inbetween –

May sawAshtead Group acquire UK-based temporary

trackway and events rental company Eve (formerly

EveTrakway) for £35million; July saw tools specialist

HSS Hire Services Group acquire UK Platforms,

Haulotte Group’s UK rental business; while the

Kiloutou Group also moved in July to acquire the

rental divisionof fellowFrench companyTrefoulet.

In August, Netherlands-based Riwal moved into

Belgium by acquiring the aerial work platform

business of crane company Sarens Belgium, and

Portakabin acquired Oecon Mobilraum GmbH, a

manufacturer anddistributor ofmodular buildings in

Germany; and over in Australia, Coates Hire acquired

the general rentals business assets of Force Group

Aktio Corpwas the highest-ranking Japanese rental company

in the

IRN

100

concerned, the top 25 spenders invested €5.9 billion

in their fleets last year, down a little from last year’s

figure of €6.3 billion. Overall, the top 25 spenders

invested at a proportion equivalent to around a

third of their revenues last year. Five of the top