52

IRN

100

IRN JUNE 2014

IRN

100

Nearmisses

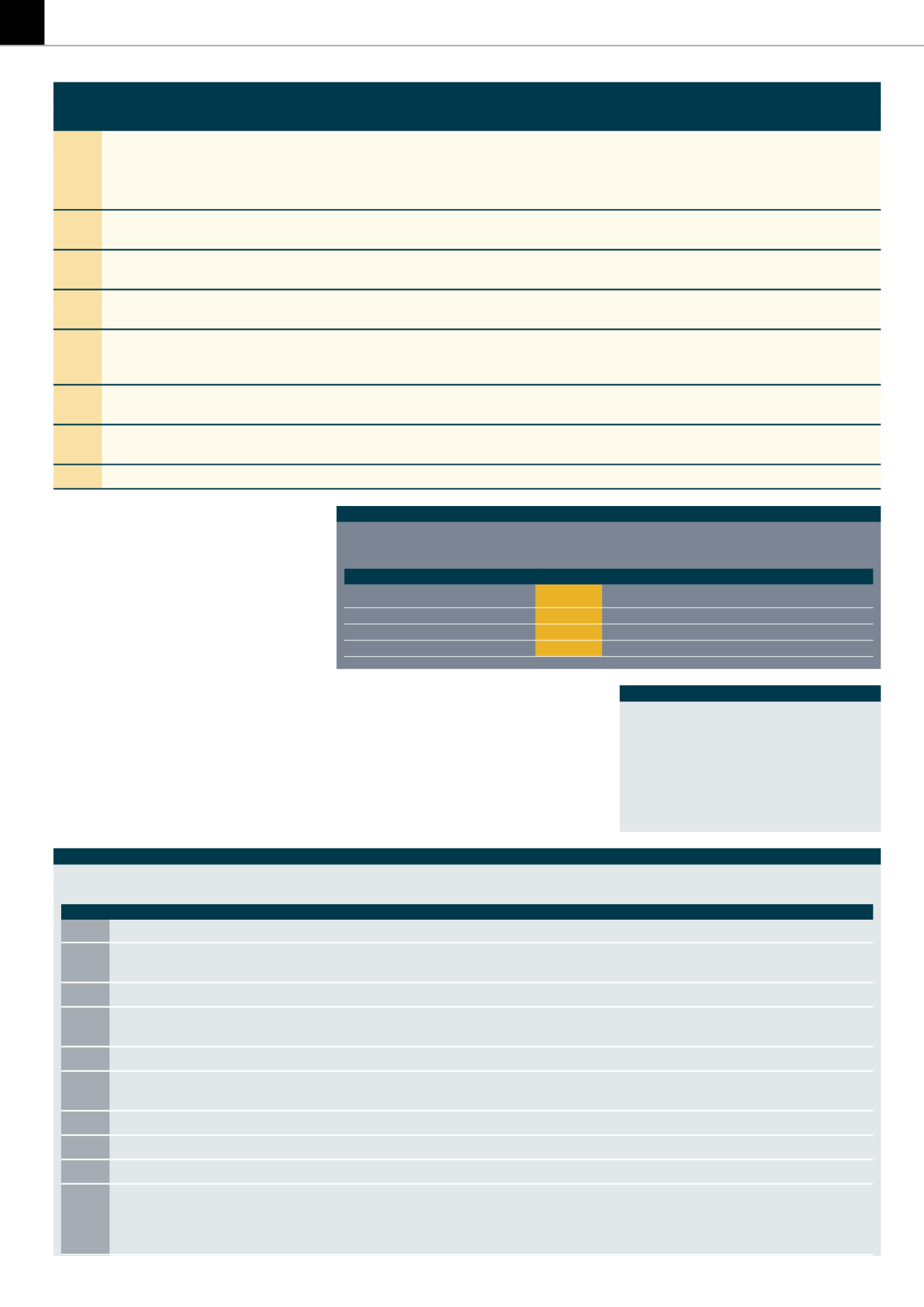

RANK

COMPANY

2013REVENUES (€M)

LOCATION

TYPEOFRENTAL

CONTACTDETAILS

101

Warren Cat

1

74

Texas, US

Constructionequipment

102

Grupo Eurogruas

EST

70

Seville, Spain

Cranes, aerial platforms,

transport

103

Ohio Cat

1

70

Ohio, US

–

104

AGeradora Aluguel deMaquinas

69.7

Salvador, Brazil

Constructionequipment,

parties andevents

105

HUNERental

68.9

Madrid, Spain

Constructionequipment

106

Salti

66

MarcqenBaroeul, France

Constructionequipment,

tool hire, parties/events

107

Komatsu Cummins Chile Arrienda

64.7

Santiago, Chile

Constructionequipment

108

SkanskaMaskin

62.7

Solna, Sweden

Constructionequipment

109

De Boer Structures

55.1

Alkmaar, Netherlands

Party/events,marquees

110

Gruppo Venpa 3

49

Dolo, Venice, Italy

Aerial platforms,

constructionmachines,

rough terrain cranes

without operator, telehandlers

TABLE 10

More information

An expanded version of the

IRN

100

, giving

additional analysis and company information,

will be available to purchase from KHL in early

July 2014. For details pleasego to:

=93

97

Byrne Equipment

85

EST

80

EST

Dubai, UAE

UAE, Oman, Qatar,

Construction

–

–

+971 44544800

Rental

Saudi Arabia

equipment, portable

accommodation,

events

95

92

Pekkaniska Group

84

83

Vantaa, Finland

Fin, Swe, Rus,

Aerial platforms

27

350

+358 106622000

Ukr, Baltics

and cranes

96

=95

McGrath Rentcorp

80.4

80

Livermore,

USA, Canada

Portable

5

466

+1 9256069200

California

accommodation

=97

89

Rental Solutions &

80

EST

85

EST

Dubai, UAE

MiddleEast, Pakistan, Power, temperature

–

–

+971 48849699

Services (RSS)

Africa, Cyprus

control

=97

94

Foselev

80

EST

81

Aix-en-Provence,

France, Congo, Gabon

Cranes, portable

–

–

+33442 245757

France

accommodation,

aerial platforms

=97

99

Briggs Equipment

80

EST

75

EST

Dallas, TX, USA

US, Mexico, UK

Construction

–

–

+1 2146300808

equipment

100

=84

Force Access

75

EST

91

Sydney, Australia

Australia

Aerial platforms

–

–

+61 29735 7600

TOTAL

31.45 bn

TURNOVER

TYPEOF

RANK

(€MILLION)

AREASOF

RENTAL

NUMBEROF

14 13 COMPANY

13/14 12/13

HEADOFFICE

OPERATION

COMPANY

DEPOTS STAFF

CONTACTDETAILS

agreed during the course of 2013, and demonstrates

the constantly changing faceof theequipment rental

industry.

New entrants

There were five new entrants to the list this year –

four of which are first-time entrants, while one,

Equipment Depot, returns after a few years out of

the list. It says a lot about the current market that

all five are from North America, including two crane

companies – TNT in theUS andNCSGof Canada – one

pump renter, National Pump, and Compact Power

Equipment Rental (CPER).

National Pump is nowownedbyUnitedRentals, but

wasan independentcompany for thewholeof2013so

is included in the survey. CPER is the company that

runs rental operations at hundreds of Home Depot

stores in the US and Canada. It does not publish its

financial data, soour €145millionestimate shouldbe

treatedwithmuch caution.

So, as is often the case, painting a simple picture

of the worldwide rental industry is impossible, with

currents in North America, Latin America and Japan

running stronger than in Europe and Australia. Best

to takecomfort fromasimple fact: theoverall growth

in adjusted

IRN

100

revenues last year was 2.6

times higher than global GDP growth. Whatever is

happening in your part of the world, you are part of

anexpanding industry.

IRN

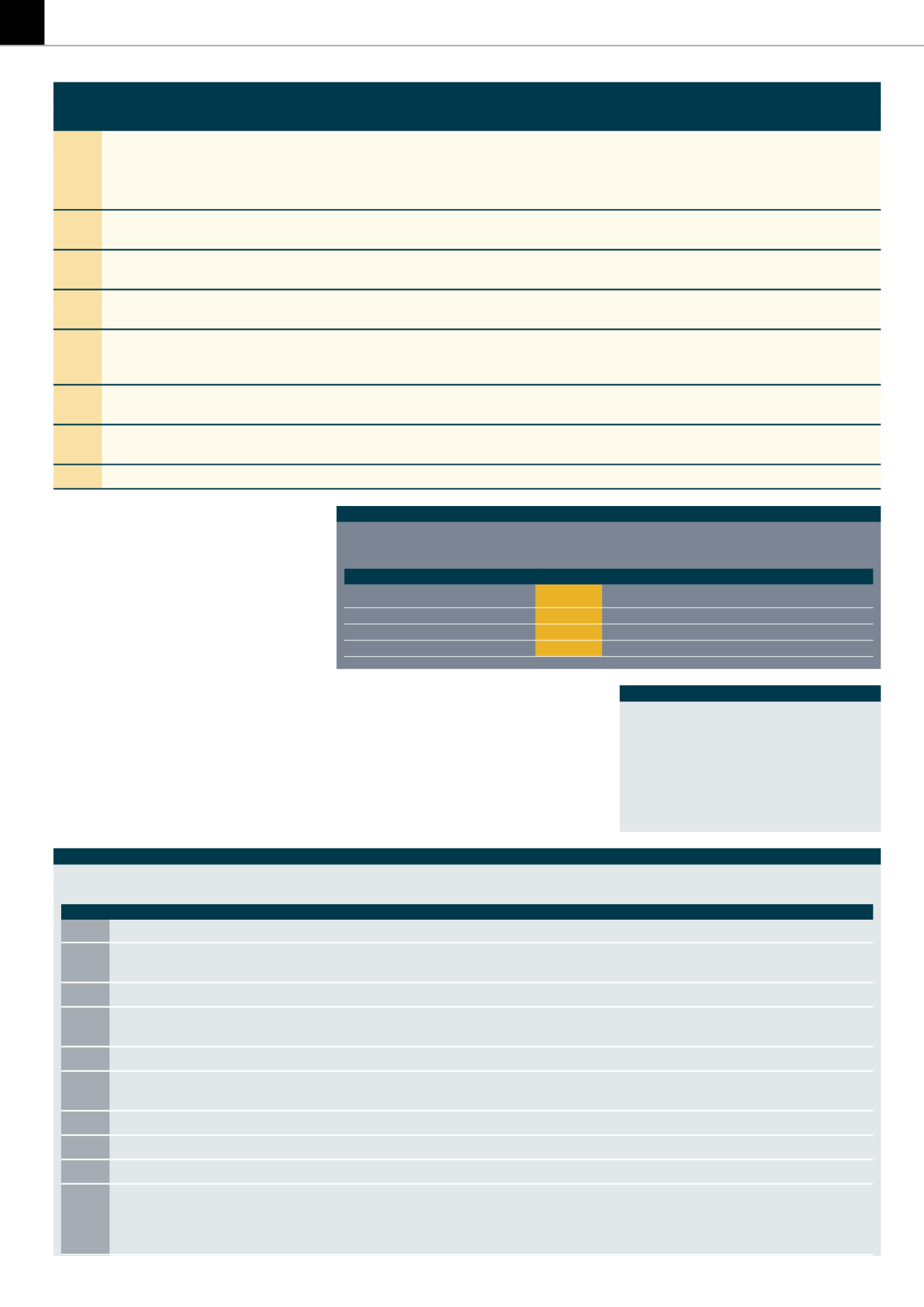

TABLE9

IRN

100

Capital expenditure trends

2013

2012

2011

2010

2009

25 biggest spenders

€5.9bn

€6.3bn

€5.7bn

€2.46bn

€1.29bn

Other 75

(Est)

€3.0bn

TOTAL

(Est)

€8.9bn

Investment rate (gross CapEx/revenues) 28%