This data is from the 2013 reports.

IPAF: RENTALSTUDIES

The US aerial platform rental

market chalks up double-

digit growthwhile there are

mixed signals in Europe.

IRN

reports on the latest

market studies undertaken

by the International Powered

Access Federation (IPAF).

IRNAPRIL-MAY 2014

The European mobile elevating work platform

(MEWP) rental market remained stable in 2013,

continuing the trend in 2012. However, strong

differences exist among the 10 countries under

study: Denmark, Finland, France, Germany, Italy, the

Netherlands, Norway, Spain, Sweden and theUK.

Some countries achieved positive growth:

Germany, Norway, Sweden and the UK saw their

rental revenue increase by around 5%. The UK

MEWP rental fleet appears to have reached its pre-

recession levels.

However, rental companies remained cautious and

kept an unchanged split between construction and

non-construction applications.

In Germany, both fleet size and rental rates

increased slightly and the trend towards non-

construction applications is continuing. In Sweden,

meanwhile, fleet size and rental revenue increased

while rental rates were maintained at a relatively

stable level.

Other countries such as Denmark and France saw

the MEWP rental market remain flat or decrease

slightly. Despite a slight increase in the French fleet

size, overall rental revenue did not increase, due

to a decrease in utilisation rate and rental rates.

In Denmark, neither the fleet nor the rental rates

increased.

Fallingmarkets

Marking the contrasts across Europe, the MEWP

rental market decreased in Finland, Italy and the

Netherlands, anddecreased strongly in Spain.

Trying to counter this negative trend, rental

companies de-fleeted and also kept reducing their

rates. Only Finland, which experienced positive

growthduring thepreviousyears, kept expanding the

rental fleet.

Overall, growth is expected in the European

MEWP rental market in 2014, but the report predicts

growth marked by contrasts among countries.

Germany and the UK should lead the growth,

while Italy and Spain are hoping for a stabilisation

in 2014.

IRN

T

he latest results from IPAF’s annual rental

market research indicate that the US aerial

work platform rental market is rebounding,

with stellar growth of around 10% in 2013. IPAF’s

2014 Powered Access Rental Market Reports

reveal

that the European market remains stable, although

marked by stark differences across different

countries.

Interviews conducted with rental companies in

the US confirm forecasts made in last year’s report,

even surpassing the growth rates predicted. Rental

companies expect the market to follow similar

growth trends in 2014 and 2015.

US hits pre-crisis levels

As predicted in the 2013 report, the US AWP rental

fleet expanded strongly (5 to 10%) in 2013 and has

now reached pre-recession levels. This rebound

is flanked by two factors – a slight increase in new

machine investment coupledwitha reduction in fleet

sell-offs. Similar fleet growth is expected in 2014.

While the US AWP fleet has returned to its pre-

recession size, rental companies didnot increase the

share of their business in construction applications.

Instead, companies increased their rental operations

in other sectors such as industrial, maintenance,

utilities, leisure, events, etc. This shows that rental

companies have become more cautious over the

years and are keeping a good level of diversification

to avoidpotential business risks.

Average utilisation rates increased slightly in 2013,

as did rental rates.

“The signs are that the US AWP rental market is

striking back and returning to its glory days, but the

industryhas learnt from theexcessesof thepast and

is banking on cautious optimism and solid growth

strategies,” said IPAF CEO TimWhiteman.

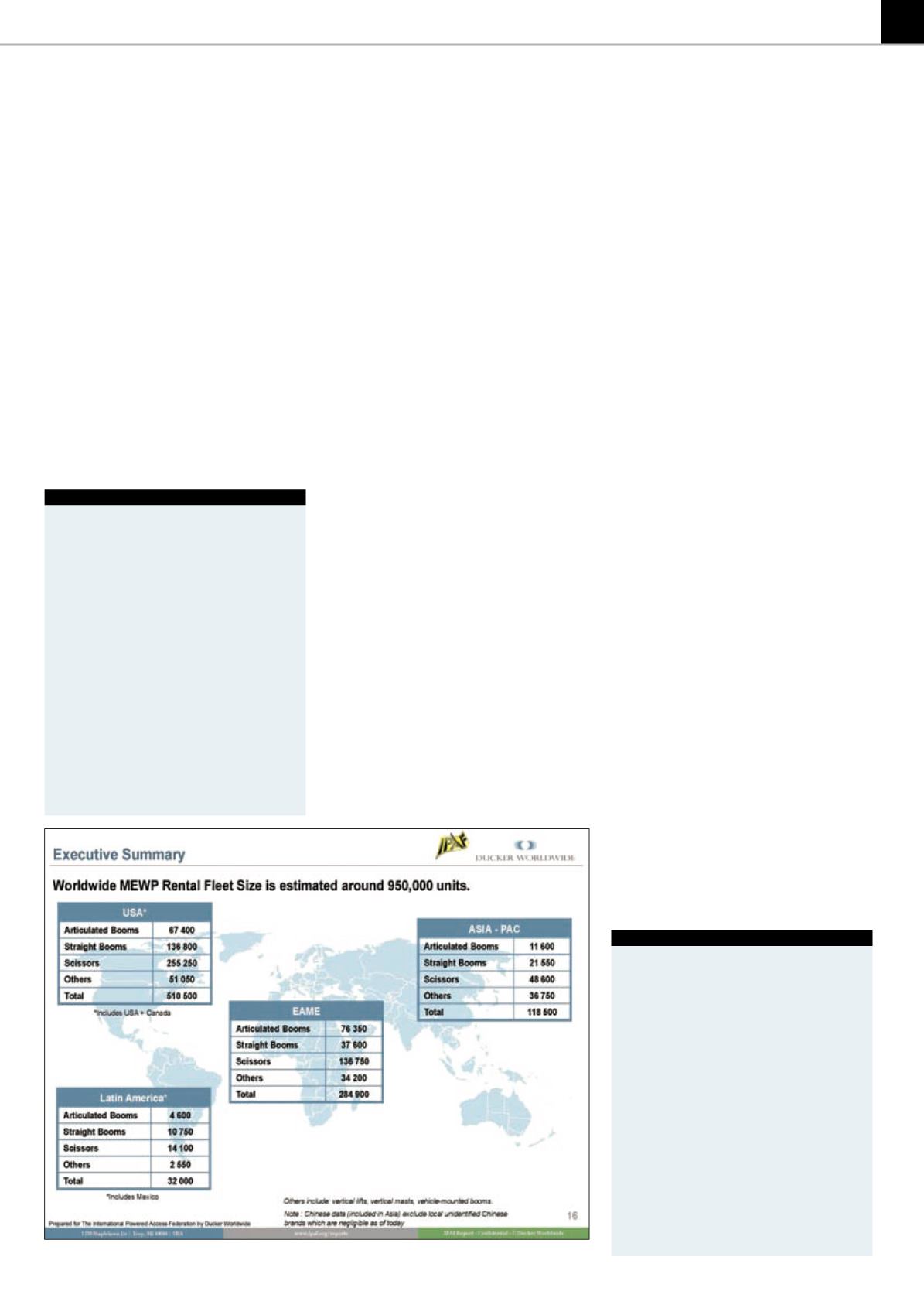

Liftnumbers

IPAF reports

IPAF’sUSandEuropeanPoweredAccessRental

Market Reports 2014werebeing finalisedas this

issueof

IRN

was going topress.

Both reports include forecasts for growthand

fleet composition in the coming years, andan

estimateof the sizeof theaerial platform rental

fleetworldwide, withabreakdownby region

andbymachine type. TheUS report also covers

Canada.

The studieswere conductedbyDucker Research

using the sameapproach tobuildon the

reports fromprevious years. New for 2014 is an

introduction into theAWP rentalmarket inChina.

■

Get the full figures andpurchase these

publications atwww.ipaf.org/reports

China research

For the first time, IPAFhas commissioned

research into theChinesemarket. Witha low

number ofmachines, Chinahas beena fast

growingmarket since 2009, with 15 to 20%

annualmarket growth. This growth is expected

to continueat a similar pace in thenext three to

five years.

Most aerial platforms in theChinese rental

market are locallyproduced. Therearenomore

than 100 rental companies inChina, witha few

generalist rental companies dominating. Scissors

represent by far the largest shareof themarket

due to their size, flexibilityand lower price.

Moredetails canbe found in the IPAFmarket

studies.

61