37

Going, going, GONE!

The used equipment market for auctioneers isn’t as hot as it has been. As less equipment rolls

in from rental houses, supply has weakened and prices are up.

Lindsey Anderson

reports.

many rental companies had focused on

refleeting, but for the first time in years, the

T30 shows signs of rental growth as large and

mid-sized companies push 2013 telehandler

numbers to 2008 levels.

“We’re seeing less telelehandlers at

auctions,” Siddle says. “Dollar wise and

population wise, we’re tracking close to what

we saw last year, but telehandlers have a little

bit more of a range as far as who picks them up

and who owns them for their second life.”

But at IronPlanet, Hendrix says the opposite is

happening.

“At auctions we are seeing more telehandlers,

scissor lifts and telescopic booms,” he says.

I

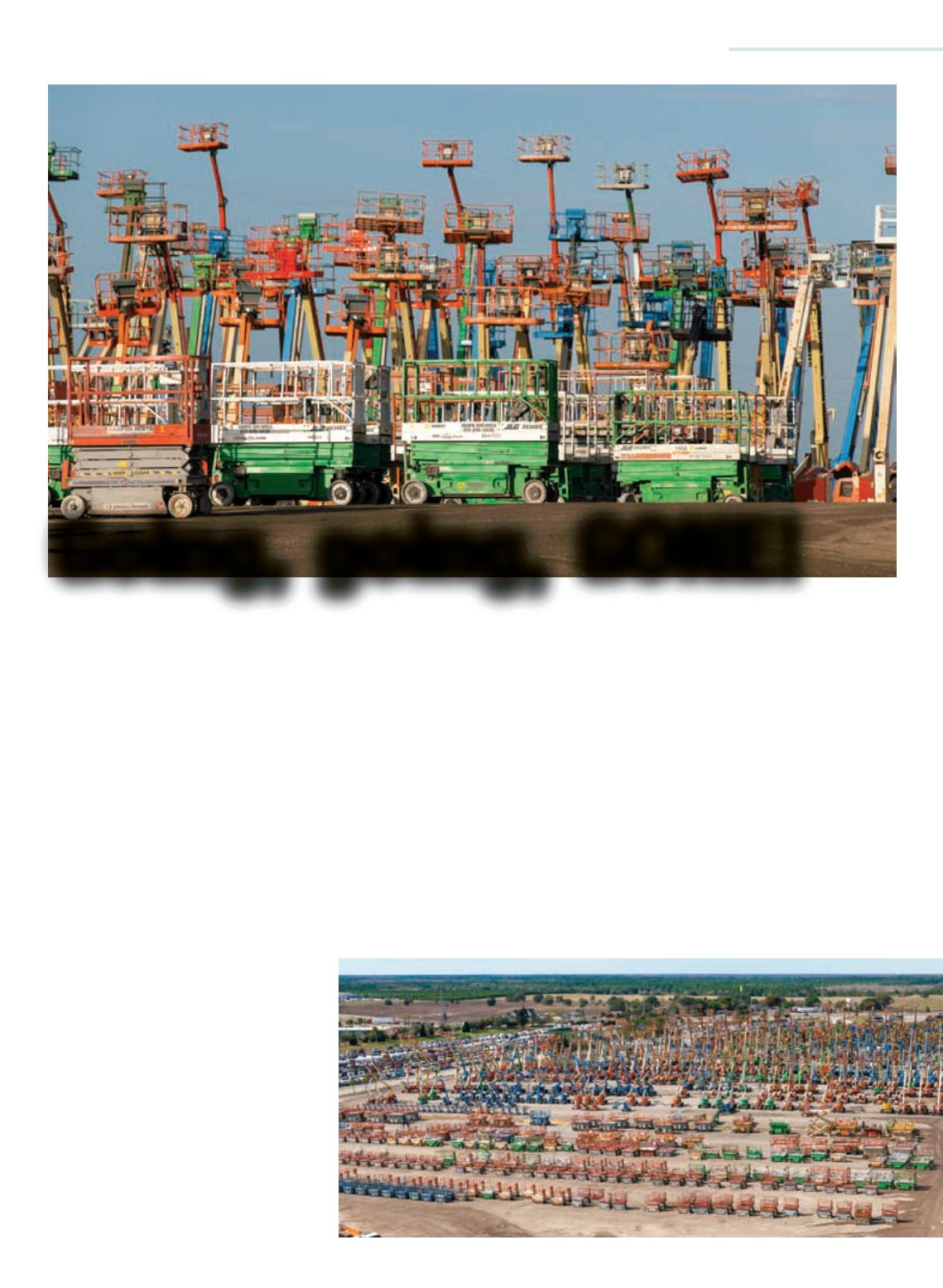

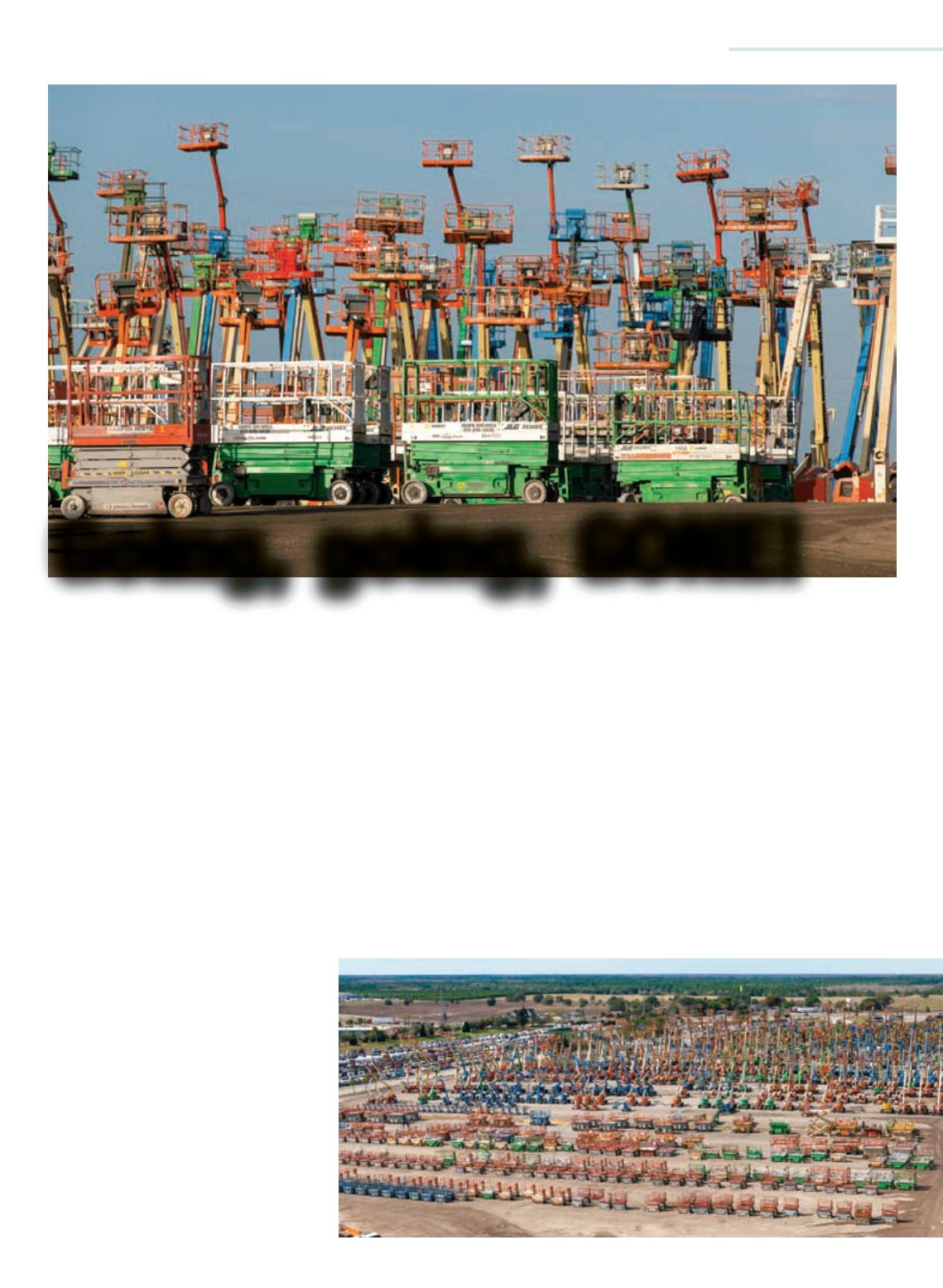

t’s all about supply and demand. At auctions

across the U.S., buyers are finding slightly

higher prices due to less equipment at sites.

“With the downturn, we witnessed rental

companies extending their cycle times longer

on certain pieces of equipment because the

values came down quite a bit,” says Dean

Siddle, senior valuation analyst at Ritchie Bros

Auctioneers. “As a result, rental companies

have fewer pieces of equipment to put in the

marketplace as they order new equipment.”

For auctioneers, this means stronger

equipment values.

“Pricing is trending higher now than it was

last year,” says Paul Hendrix, equipment pricing

analyst with online auctioneer IronPlanet. “As

rental companies replace fleet and place orders

with manufacturers for new aerial equipment,

manufacturers have gotten behind with orders

because demand is so high. They can’t deliver

the equipment to rental companies immediately.

This delay in deliveries has created a higher

market for used equipment.”

Looking at this year versus last year, Ritchie

Bros have seen a decline in telehandler

numbers at auctions, but says scissor lifts

are still pouring in. “This is probably more so

because of the fact that there are more scissor

lifts in the market,” Siddle says. “If you look at

the population of boom lifts, scissor lifts and

telehandlers, we are seeing scissors the most

these days.”

Telehandlers have made a resurgence in

the last few years, with manufacturers upping

production to meet demand. In the most recent

Access, Lift & Handlers’

TELEHANDLER

30

toplist, which ranks North America’s

telehandler-owning rental companies by

number of units, the market gained 6.7 percent

over 2012 with a total number of units amongst

our listed companies resting at 36,153 (from

33,454 in 2012).

Since the merge and purge days of 2008,

USED EQUIPMENT

During 2013’s first quarter, Ritchie

Bros conducted 36 unreserved

industrial auctions in 12 countries.

Looking at this year versus last year, Ritchie Bros have seen a decline in

telehandler numbers at auctions, but says scissor lifts are still pouring in.

JULY-AUGUST 2013

ACCESS, LIFT & HANDLERS