50

ACT

APRIL 2015

PRODUCT FOCUS

SPMTS

PowerMAX and theSPMCPowerMAX.

TheAPMChas threemodes, trailer,

assist andSPMT,while theSPMC ismore

of a classic self-propelledunit. TheSPMC

system is basedon auser-friendly system

that includes a customizable remote. Each

operator canmonitor thedata that ismost

important to themby configuring the

remote theway they see fit.

The newcomer

Enerpac entered theSPMTmarket

about sevenyears ago to fill aneed in the

industry for compact SPMTs capableof

maneuvering in tight locations. Enerpac

SPMTshavebeen soldglobally and

arebeingused inbothdeveloped and

emergingmarkets. They currentlyhave

SPMTs inNorthAmerica, TheMiddle

East,Africa andEurope.

“SPMTs are such aversatile tool and

asheavy lifting and transport projects

becomemore complex, new applications

are always evolving,” saidTony Johnson,

integrated solutionsproductmanager,

Enerpac. “For example asAccelerated

BridgeConstruction (ABC) has gained in

popularity sohas theuseof SPMTs.”

TheEnerpacSPMT features a

minimizedheight and slimdesign,which

makes it easy tooperate in confined spaces

andmakes it agood solution for in-plant

applications. Enerpac’s SPMT customers

come from avarietyofmarkets including

oil&gas, power generation, infrastructure

andmanufacturing.

They recentlyupdated their Intelli-Drive

wireless control system tooffer greater

flexibilitywhen customizingSPMT

configurations, aswell asupgraded the

SPMT tomeet strict standards foruse in

nuclearpowerplants.

AlthoughEnerpac isheadquartered

inNorthAmerica, theirprimary

manufacturing facility for building

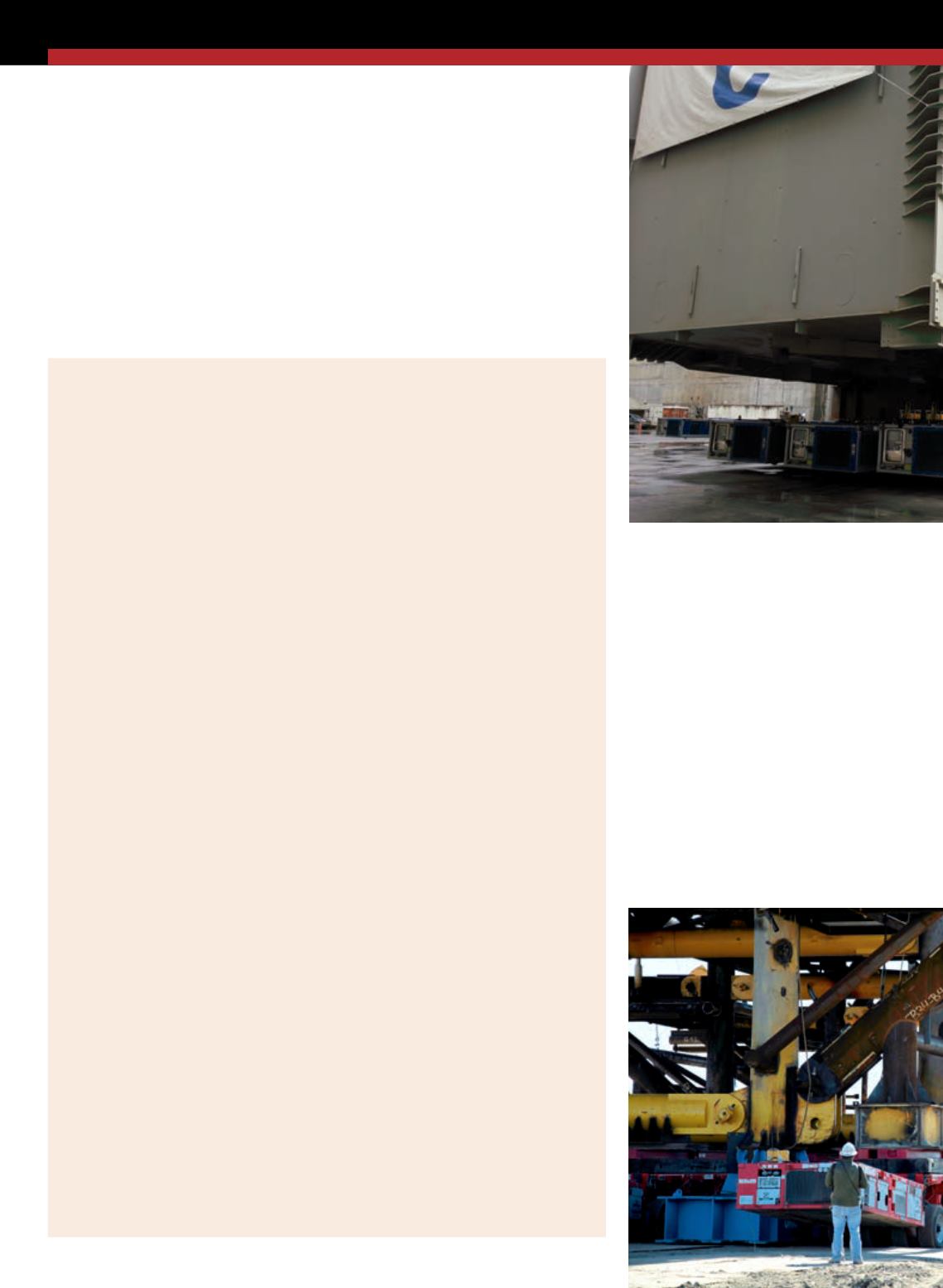

Cometto’sMSPE EVO2

60T SPMT is involved

in the Panama Canal

expansion project.

The story goes like this

Importing self-propelledmodular transporters (SPMTs) into North America hasn’t always

been a breeze. There are Customs rulings on SPMTs going back to the early 1990s.

Initially, they were classified under the heading 8709 (the first four digits of the Customs

code), the same heading as work trucks, or trucks that are not fitted with lifting or

handling equipment. As such, SPMTs were duty-free.

In the late 1990s, Canadian importers brought forth an inquiry regarding the 8709

heading to theWorld Customs Organization (WCO), specifically the bit about not being

fitted with lifting or handling equipment. SPMTs actually are fitted with lifting equipment,

and when theWCO revisited the topic they reclassified SPMTs under a new heading

labeled 8427. This is the same heading used for things like fork lifts and other trucks

fitted with lifting equipment.

SPMTs remained under the 8427 heading until 2011when once again their status was

revisited by theWCO. This time around, theWCO came to the conclusion that SPMTs

were designed tomove heavy things from one place to another, and therefore should be

under the 8704 heading, formotor vehicles for the transport of goods. Unfortunately for

anyone trying to import an SPMT, this new heading brought with it a 25 percent Customs

duty.

“This posed a particular problem because Customs is supposed to give the public

a period of notice when they change the classification of these things,” saidMichael

Snarr, attorney and partner at BakerHostetler inWashington D.C. “This came as a huge

surprise to themembers of the SC&RA. Suddenly you’ve got a small business that’s

trying to pay a $1million Customs duty on the spot without any notice it wasn’t going to

happen.”

Snarr approached Customs on behalf of his client, an SC&RAmember, to challenge the

classification of SPMTs in U.S. ports. “We told them they didn’t have the classification

right and in addition, you’re required by law to give public notice on a change in

classification,” he said.

Once Snarr and the SC&RA raised these issues, Customs basically told them they

weren’t sure what the heading for SPMTs should be but they definitely didn’t give the

proper notice for the change. For the time being they would revert back to the old, duty-

free heading until a decision could bemade.

“So I worked with Joel [Dandrea] and we got somemembers together and went to

customs to explainwhy these things aren’tmotor vehicles,” said Snarr. “We showed them

a video of how SPMTs work and I think at that meeting they really sawwhat we were

talking about.”

So two and a half years later on Feb. 4, 2015, after all the litigation, research and

rumination, Customs issued a document that spelled out their final decision. The way they

saw it, SPMTs belonged under heading 8427, the same duty-free heading as forklifts that

they were classified under for almost a decade between the late 1990s and late 2000s.

“At a time when the country was still trying to shake off some of the economic recovery

problems, it was hard to understand why the government would put this 25 percent

tax on thesemachines,” said Snarr. “The SC&RA is a lot of small business, so if you’re

supporting small businesses as the backbone of the economy, you had to get this right.”

And they did. For now.

Goldhofer’s PST/ES/E.