21

APRIL 2015

ACT

BUSINESSNEWS

AUTHOR:

CHRISSLEIGHT

is

one of theworld’smost

internationally renowned

construction businesswriters,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’smarket-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

Heavy equipment

manufacturers

shares have

bounced back

a little, but they

are far from

setting pulses

racing in the way

themainstream

indicators are.

Chris Sleight

reports.

A

bit of life in the

Euro-zone economy

drove stock

markets around theworld to

somenewhighs inFebruary

andMarch. TheEuropean

Central Bank’s (ECB’s) long

overduedecision in January

to launch aquantitative

easing (QE) programhas put

someoptimismback into the

regional economy andboosted

exporters’ prospects thanks to

theEuro’s depreciation.

Add to this the continued

lowoil price, and theglobal

economy is lookingbrighter

than itwas in the early fall.

A lowoil price isn’t good for

everyoneof course– it isbad

news forbig exporters like

OPEC–but fornet importers

like theU.S. andEurope, it

amounts toauseful pieceof

economic stimulus.

Thishelpedpush some

key indexes tonewhighs in

February. TheDow set anew

record, butwehavegot used to

that over the last 18monthsor

so.Arguablymore significant

was theUK’sFTSE100hitting

itshighest levels since the

height of the techbubble in

1999. Similarly, theNikkei in

Japanachievedanew15-year

higharound the same time.

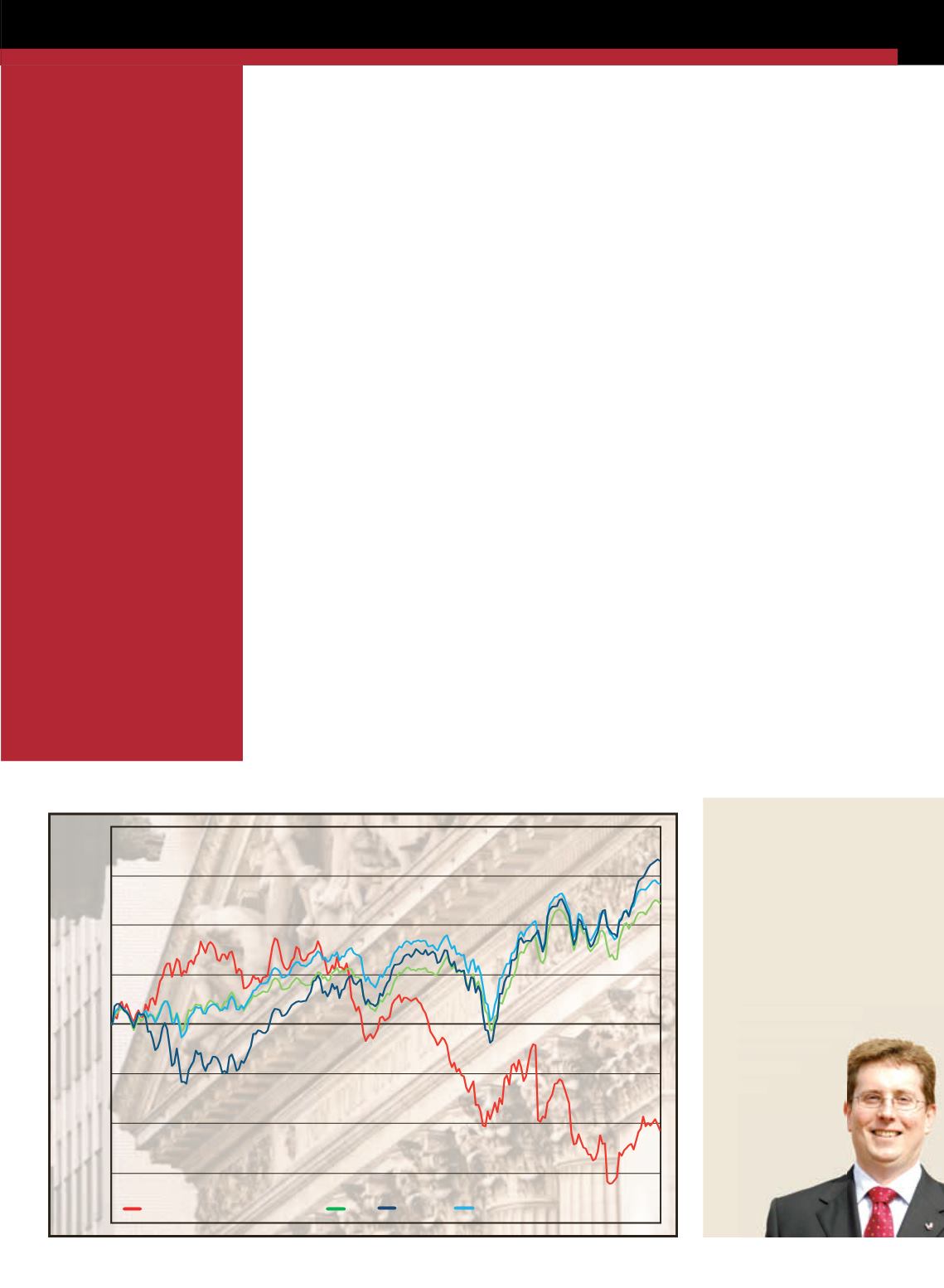

Not so rosy

Thepicture isnot quite

the same foroff-highway

machinerymanufacturers’

shareshowever, as represented

by

ACT

’sHeavyEquipment

Index (HEI) of shareprices.

Although therehasbeenan

up-tick in the sectorover the

last fourweeksor so, as this

month’s graph illustrates, the

sector is still about 10percent

lower than itwas ayear

ago,while themainstream

benchmarks areupbyabout

15percent.

As reported lastmonth,

part of theproblem is the

gloomyoutlookCaterpillar

postedwhen it announced its

full-year results in January.

It expects about a10percent

fall in revenuesdue towhat it

sees as aweakglobal economy,

combinedwith continuing low

commodityprices.

-10%

-5%

-15%

-20%

10%

15%

20%

5%

0%

% change

52weeks to April 2015

Cat is an industrybellwether,

andothermanufacturers’

shares tend to track it. But they

arenot necessarilydrivenby

the same factors. Yes, emerging

markets remainweak, and

whileEurope is growingbetter

than it has, it isnot posting

excitingGDP figures.On that

level,Caterpillar is right – the

global economy ispickingup,

but is arguablynot healthy.

Caterpillarhasmuchgreater

exposure to commodity

prices thanother equipment

manufacturers. It relieson

themining industryand the

oil andgas sector for abig

sliceof its revenues. This is

not necessarily the case for

other construction equipment

makers, particularly those

at the lighter endof the

spectrum.

While investorsmaybe a

littledownon companies

within theHEInow, there is a

chance theywill get apleasant

surprise if the improving

economic conditions can

stimulate equipment sales in

Europe andNorthAmerica.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’smost

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Trailing the pack

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P500