17

NOVEMBER 2014

ACT

BUSINESSNEWS

AUTHOR:

CHRISSLEIGHT

is

one of theworld’smost

internationally renowned

construction businesswriters,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’smarket-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

Due to a weakening

outlook for their

products, heavy

equipment

manufacturers’

share prices took a

tumble as the third

quarter closed.

Chris Sleight

reports.

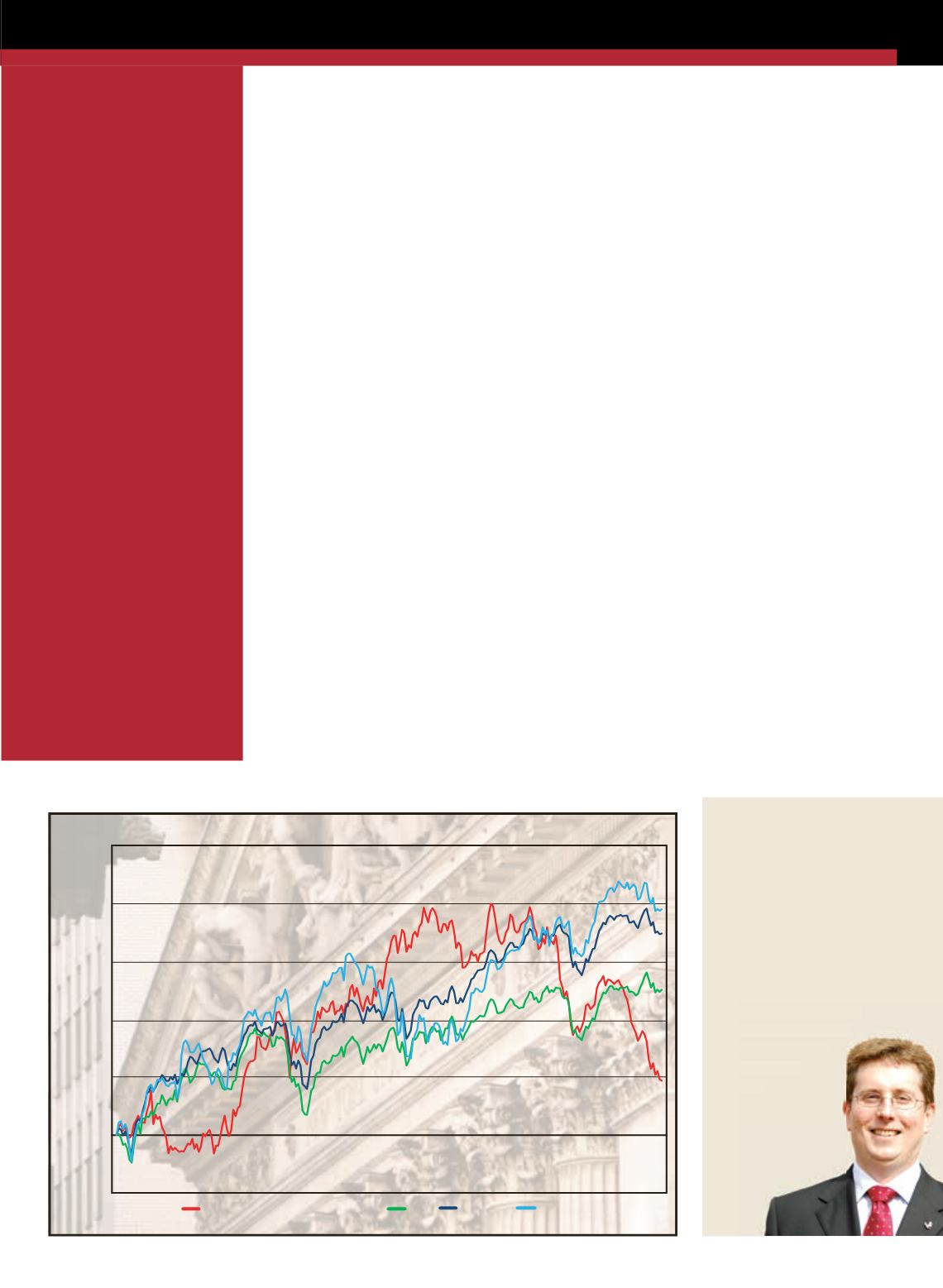

S

tockmarkets

ingeneralwent

througha few

wobbles in the latterpart of the

summer, but by lateSeptember

and earlyOctobermanykey

indexeshad regained some

ground. TheDowbounced

around the17,000pointmark

formost of September and

earlyOctober, havingbeen in

themid16,000s inAugust, and

therewas a similar rebound for

theS&P500.

Most impressiveof all the

major indexeshoweverwas

theNASDAQ,which surged

inSeptember to thekind

of highs thatwere last seen

during thedot.comboom

of 2000.Although its all-

time recordof 5,132points,

established in that era, looks a

distant prospect right now, the

4,500-point high-tidemark it

achieved inSeptember is the

best this indexhasbeen for

more than14years.

In contrast, equipment

manufacturers, as represented

by the

ACT

HeavyEquipment

Index (HEI) fell furtherwhile

themainstream indicators

rebounded. The first blipof the

yearwasdue togeneralmarket

forces– the failureofBanco

EspiritoSanto inPortugal,

turmoil in theMiddleEast, the

West’s strained relationswith

RussiaoverUkraine, etc.

Industry specific

However, the continued

decline for the equipment

sectorwasdue to some

industry-specific factors.

Terex, for example, said that

crane sales inparticular

were lookingweaker than

previously expecteddue to

weakness inmany emerging

markets. Theseproblemshad

emergedover JulyandAugust,

andTerexadded that one

of the issues for customers

indeveloping countries

was adifficulty in securing

financing.

Whenonemanufacturer

makes a statement like this, it

tends to rippleout across the

whole stockmarket sector,

particularly if it isbacked

byotherdata. Thatwas

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P500

25%

20%

15%

10%

5%

0%

-5%

% change

52weeks to October 2014

arguably the casehere,with

economicgrowth in some

emergingmarkets known tobe

weakening.

Another general factor in

theheavy equipment sector

is that theglobalmining

industry still looksweak, and

that is something that impacts

Caterpillar inparticular.As

by far thebiggest construction

equipmentmanufacturer in

theworld,Caterpillar acts as

somethingof abellwether for

the sector, soagainbadnews

fromone company tends to

pull thewhole industrydown.

Nodoubt thepicturewill

be clearer as the thirdquarter

financial results seasongets

into full swing– the first

companies toannounce their

resultswere scheduled todo so

as

ACT

went topress.

The results announcements

will not onlyprovide anupdate

on themost recent quarter’s

trading, butmany companies

will alsoprovideguidance, and

it is thiswhichwill be closely

watched for cluesofwhere the

market isheading.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’smost

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Equipment dip