access

50

24

Sunbelt Rentals in the US and A-Plant in the

UK. Last year the listing showed a combined

fleet size of 51167, taking it to second place,

a position that Sunbelt has retained this year

in its own right, with a fleet size of 40332.

A-Plant comes in at 47 with a fleet size of

2091.

Overall Ashtead group is looking forward

to a strong year. Sunbelt rental revenues in the

fourth quarter to 30 April were up 23% and

up 21% over the full year, driven by a larger

fleet on rent and improving prices. Operating

profits at Sunbelt for the year were up 56% to

US$453 million on revenues of $1820 million.

Ashtead’s UK business A-Plant saw modest,

yet encouraging growth with revenues for all

its equipment up 11% to £52.7 million, and

operating profits almost doubling to £2.6

million.

That’s not to say the UK market is on a

general growth spurt, at the Vertikal Days

exhibition in the UK in June, it was all too

apparent that the market was generally flat

with some green shoots of growth.

Uncertainty in Europe

The same rings true for much of the rest

of northern Europe, partly resulting from

southern Europe’s economic woes. Spain-

based GAM has been downsizing its fleet to

reduce debt, which in financial terms has seen

it half its losses in the first quarter of 2013. As

a result there is an estimated 13% reduction

in the company’s fleet size for this year’s

access

50

listing.

Such uncertainty in the rest of Europe

is reflected across this year’s listing with an

uneven set of results for companies based in

the continent. Lavendon Group retains its

position in the top five with a modest 4%

growth. As Don Kenny, Lavendon Group plc

chief executive, explains its full 2012 financial

year saw a 2% rise in operating profit, buoyed

by revenue growth from its French and Middle

East businesses.

Further down the table Finland-based

Cramo moved up one place to 10th position,

despite a 1% drop in its rental fleet size

compared to last year. Loxam and Riwal, on

the other hand, fared slightly less well, with

-9% and -6% fleet reductions respectively,

bringing them both just outside the top 10.

For other European companies there were

rises, particularly from HSS Hire, which has

just acquired UK Platforms - Haulotte Group’s

UK rental business, (see News).The deal makes

it the second largest provider of powered access

equipment in the UK and brings it to 20th

place in the table, up from 28th position last

year. In other results, Netherlands-based Boels

Rental’s fleet was up 5% on last year, AFI-

Uplift in the UK saw an impressive 22% rise,

and Salti in France increased its fleet by 9%.

Another notable entry is THV Group,

which bought Germany-based Mateco from

Odewald & Compagnie in November 2012,

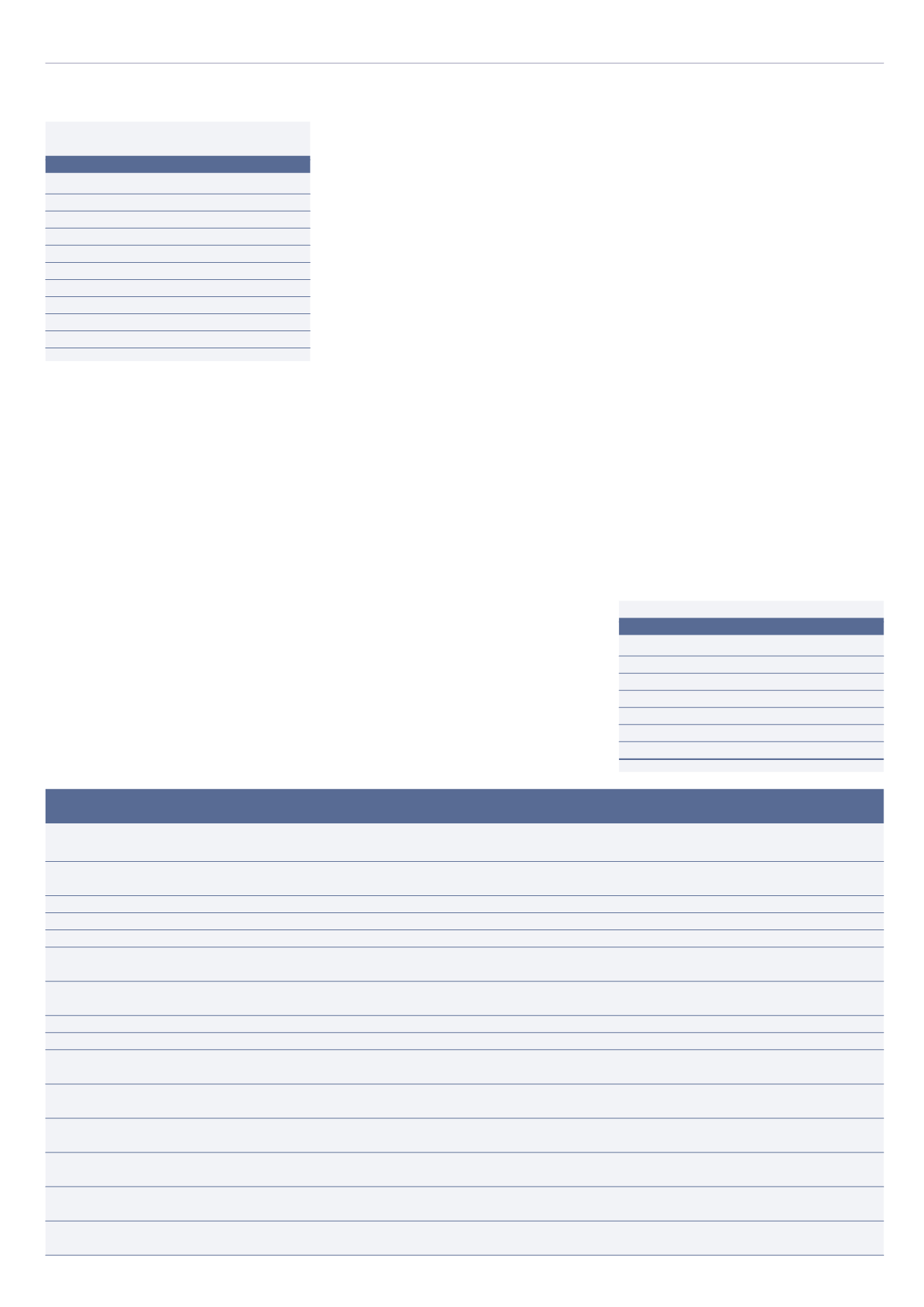

RANK

FLEET SIZE

FLEET DETAILS

AREAS OF

HEAD

2013 COMPANY

2013 2012

%*

(SEE KEY) BRANCHES OPERATION

OFFICE

WEBSITE

16

13

Ramirent

11004

11282 -2.5

S,B,M,T,H

334

Scandinavia

Sweden

Eastern Europe

17

15

SystemLift

9300

10000

-7

S,B,T,M,H

82

Germany, Austria,

Germany

(approx)

Switzerland

18

17

ABKS PartnerLift

7827

7400

6

S,B,T,

140

Europe

Germany

19

18

Kiloutou

7800

7400

5

S,B,T,M

414

France

France

20

28

HSS Hire Services

6730

4224

59

S,B

250

UK

UK

ww.hss.com

21

19

Pekkaniska

6500

7000

-7

S,B

27

Scandinavia, Eastern

Finland

(approx

Europe, Russia

22

20

Coates Hire

6350

6750

-6

S,B,T

220

Australia,

Australia

(est)

Indonesia

23

22

Boels Rental

5550

5291

5

S,B,T,M

308

Europe

Netherlands

24

27

AFI-Uplift (inc. Hi-Reach)

5492

4500

22

S,B

25

UK

UK

25

34

Hune

5459

3200

-

S,B,T

41

Europe

Spain

(est)

26

35

Kanamoto

5300

3200

-

S,B,T

165

Japan

Japan

(est)

27

23

Sumisho Rental Support

5250

5000

5

S,B

7

Japan

Japan

(est)

(est)

28

21

GAM

4610

5300

-13

S,B,T,M,H

100

Europe, North Africa,

Spain

(est)

(est)

(est)

Middle East, S. America

29

26

Acces Industrie

4488

4589

-2

S,B,T,M,

32

Southern Europe,

France

Morocco

30

31

Mills Estruturas e

4292

3488

23

S,B,M

43

Brazil

Brazil

Srvicos de Engenharia

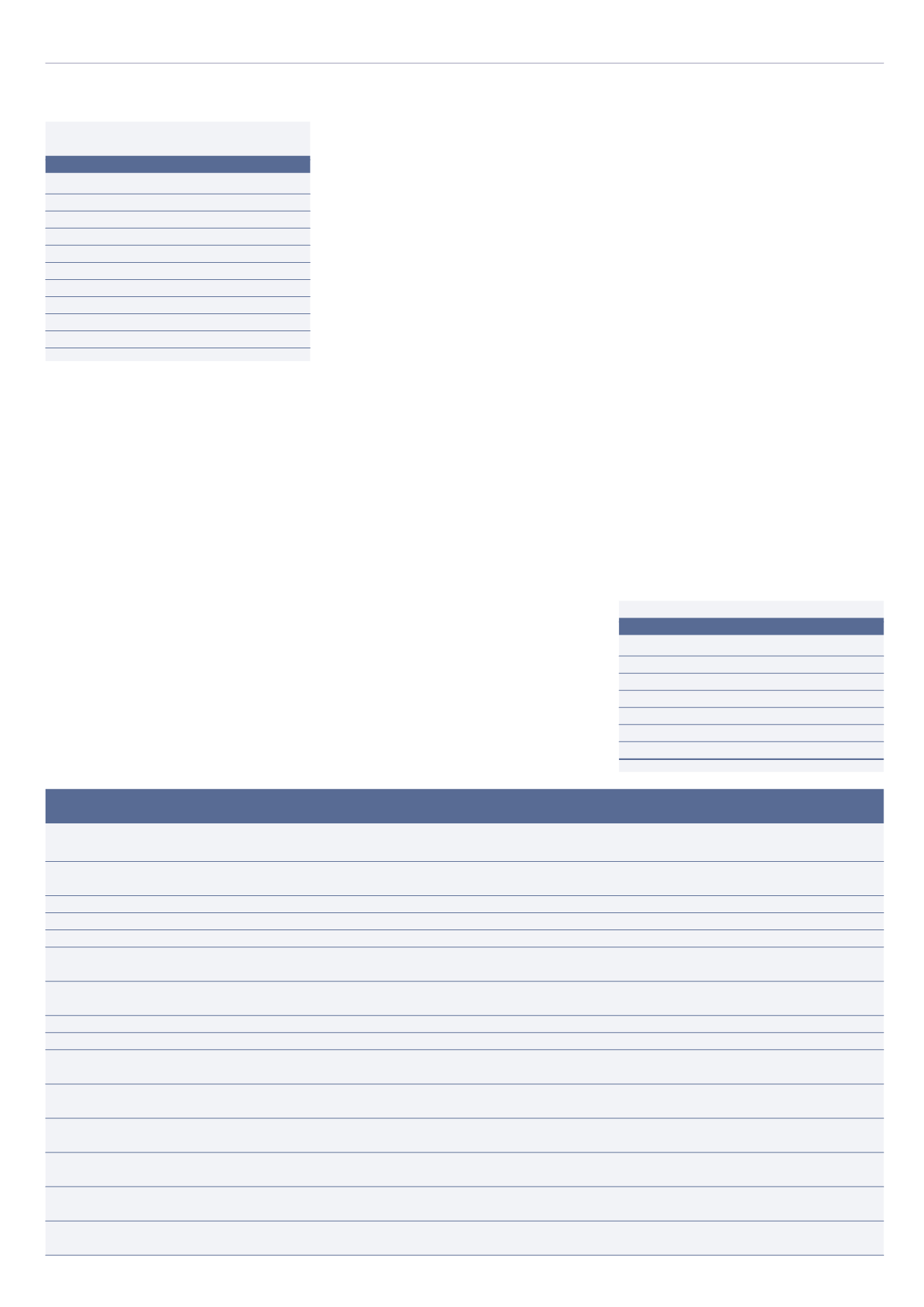

LARGEST % GROWTH

NEW ENTRIES

(Not including estimated entrees)

RANK COMPANY

% GROWTH

32

Simplex Equipment Rental

78

20

HSS Hire Services

59

9

Sunstate Equipment

32

44

Nacanco

24

30

Mills

23

24

AFI-Uplift (inc. Hi-Reach)

22

1

United Rentals

17

35

Salti

9

17

Nishio Rent All

7

18

ABKS PartnerLift

6

RANK COMPANY

16

TVH Group

40

Galmon

45

Kranpunkten i Båstad

47

A-Plant

48

Kimberly Group

50

Skyreach

52

Hämeen Rakennuskone

>

access

INTERNATIONAL

JULY-AUGUST 2013