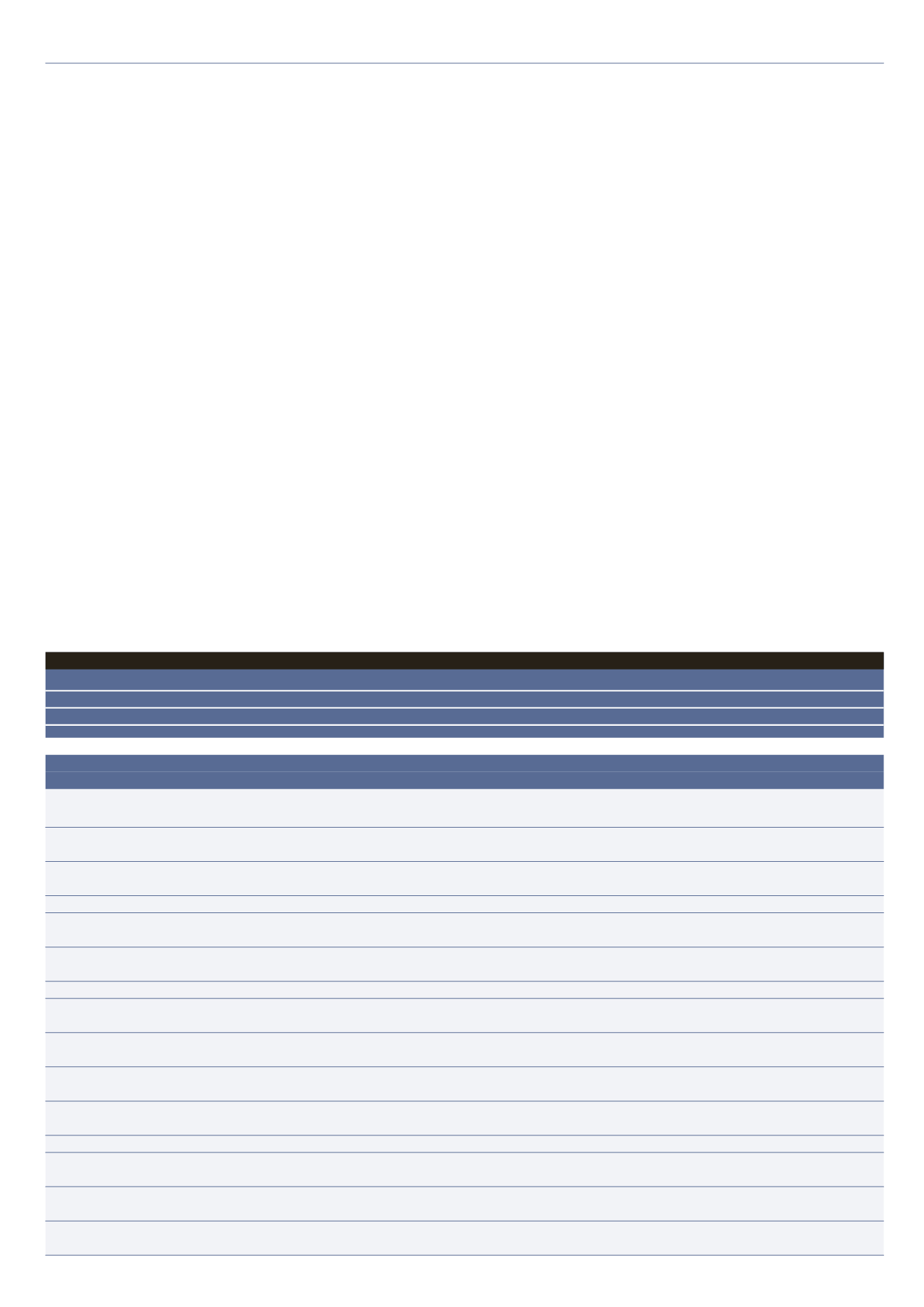

23

JULY-AUGUST 2013

access

INTERNATIONAL

access

50

1

1

United Rentals

105486

90000

17

S,B

830

USA, Canada,

USA

(est)

2

2

Sunbelt

40332

-

-

S,B,M,H

395

USA

USA

(formally listed as Ashtead Group)

3

4

HERC

20460

18600

10

S,B

345

US, Canada, Europe

USA

(Hertz Equipment Rental Co

)

(est)

(est)

4

3

Lavendon

19646

18889

4

S,B,T

79

Europe, Middle East

UK

5

5

Nikken Corp

18700

18000

4

S,B,T

234

Japan, US, Europe,

Japan

Thailand, UAE

6

7

Ahern rentals

15702

15000

5

S,B,H

75

USA

USA

(est)

7

6

NES Rentals

13300

15550 -14

S,B,T,M

76

USA

USA

8

9

H&E Equipment Services

13200

12800

3

S,B,T,H,M

65

USA

USA

(est)

(est)

9

16

Sunstate Equipment

12500

9500

32

S,B

53

USA

USA

Co LLC

10

11

Cramo

12250

12400

-1

S,B,T,M,H

400

Europe, inc. Eastern

Finland

Europe

11

12

Aktio Corp

12000

12000

0

S,B

280

Japan

Japan

(est)

(est)

12

8

Loxam

11975

13180

-9

S,B,T

607

Europe, Morocco

France

13

10

Riwal

11954

12702

-6

S,B,T

48

Europe, Middle East,

Netherlands

Brazil, India

14

14

Nishio Rent All

11293

10565

7

S,B,T,M

310

Japan, Malaysia,

Japan

Singapore, Thailand

15

NEW

TVH Group

11286

-

-

S,B,T

64

Germany, Poland,

Belgium

Luxembourg

Inching ahead

access

50

This year’s

access

50

list of the companies

with the world’s largest

powered access fleets

highlights worldwide

uncertainty. However,

there is growth overall.

AI

reports.

A

dding together all the rental fleets

of the top 50 companies in the 2013

access

50

, there is marginal growth

of 4.4%. It demonstrates the industry is

heading in the right direction, and is slighlty

down on the growth between the 2011 and

2012

access

50

lists, which stood at 5.5%.

Within this year’s figure, there are one

or two notable extremes. Towering over

the opposition is United Rentals, with its

impressive 105486 strong fleet.The figure

represents something of a landmark, as it is

the first time that a company has passed the

100,000 mark. United Rental’s acquisition

of fellow US giant RSC Holdings last year

certainly helped to swell its fleet, and the

company now takes about 15% of the US

access rental market.

United Rentals’ strong standing seems to

reflect a renewed confidence in the US, as

the country eases out of the tough economic

climate of the past few years. At the end of the

first quarter of 2013 the company said it would

increase its sales force by at least 10% this year

to capitalise on its planned US$1.5 billion

expenditure on its overall fleet.

Michael Kneeland, chief executive officer of

United Rentals, said the first quarter had seen

a strong start to what he called a “pivotal year.

Revenue, rates and time utilisation all met or

exceeded our expectations, and our adjusted

EBITDA margin of 41% was a first quarter

record for us. We remain solidly on track

for a year of disciplined growth, including a

rental rate increase of 4.5% on total revenue of

approximately $5 billion.”

This was the also the first time that Ashtead

Group split the fleet figures for its companies

RANK

FLEET SIZE

FLEET DETAILS

AREAS OF

HEAD

2013 COMPANY

2013 2012

%*

(SEE KEY) BRANCHES OPERATION

OFFICE

WEBSITE

2013

% CHANGE

2012

2011

2010

2009

2008

2007

2006

2005

TOP 5

204624

4

196656

165556

164237

173792

189850

179880

151178

140200

TOP 10

271576

2

265888

240113

238181

254424

270510

251700

207758

187975

TOP 50

481490

4.5

460758

434358

424853

449250

446956

402900

332700

283071

TOP 50 FLEET SIZES

>