41

IRN JANUARY-FEBRUARY 2015

RENTALMANAGEMENT

For a rental company,

being traded on a stock

exchange has advantages

and challenges – Jeff

Eisenberg fromClaremont

Consulting explains.

investors. An ex Hertz executive, Jose Peres started

the company with backing from the Mas family in

1990, with ahistory in construction.

The company grew during the 1990s and joined

with Neff, a Florida John Deere dealer, reaching

sufficient size for an NYSE IPO in 1998. Like many

rental companies, it suffered in the early 2000s

and the 2008 crisis and went through a three sets

of private equity investors (Odyssey, Lightyear and

Wayzata). Wayzata will be able to sell their shares

in Neff only after six months from the IPO date, a

common arrangement.

Disadvantages

Going to the stock market is complex, costs money

and time. Total costs for the Neff IPO according to

their prospectus were US$5.3 million (€4.5 million)

to raiseUS$146million (€124million).

The management must spend time every quarter

presenting and explaining results to investors

and analysts. A publicly traded company has to

take all necessary steps for health and safety,

environmental compliance, internal audit controls,

and others, with a larger more expensive board of

directors.

The Neff IPO share price target was US$20

(€17) per share, but on the day of the IPO a fraction

under US$15 (€12.7) was achieved. Calculating

from figures in the prospectus, this is equivalent

to an Enterprise Valuation of 6.66 x EBITDA

(Earnings Before Interest Tax Depreciation and

Amortisation).

This is certainly respectable compared to the 6 x

rule of thumb for rental company valuations, lower

than somehigher thanothers.

The share price Rollercoaster

Stock markets have gone up and down for many

reasons as investors buy and sell shares, trying

to predict what will happen next and stay one

step ahead.

Since the end November IPO date, the Neff share

price fell from US$14.8 (€12.5) to US$9.5 (€8) on 7

December, down 36%. United Rentals share price

fell 22% and Head and Enquist fell 41%. None of

these NYSE companies released any information

during that time, the implication being investors

are looking at macro factors such as the oil price

decline and fear of a slowdown.

A low (or volatile) share price makes it difficult

for these companies to raise money, and in

Neff’s case for their investor Wayzata to get their

investment back.

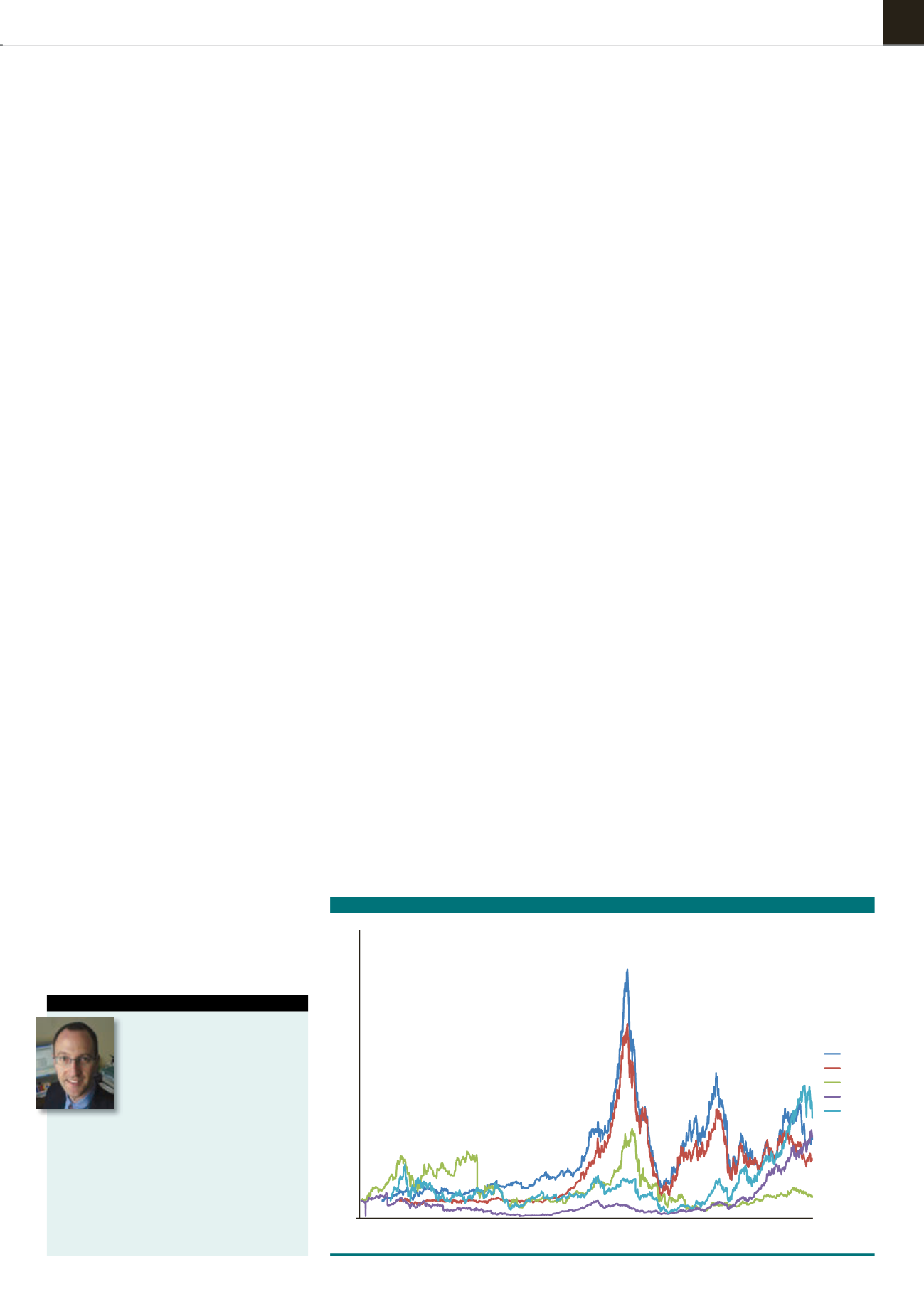

The graph shows the relative movements in the

share prices of United Rentals, UK based Lavendon

Group and Ashtead Group, and Europeans Ramirent

and Cramo since the mid-1990s. Some of these

prices have gone up and down 1000%, or ten times,

with investors rushing in and rushing out of the

industry.

Will rental companies keep using stock markets?

The Neff IPO was a success, despite the (probably)

temporarydecline inshareprice. Expect toseemore

IPOs, in theUS and elsewhere and subsequent share

issues as companies raise first time and additional

moneyon thesemarkets, partlyencouragedbyNeff.

Just United and Ashtead together have more

than US$17 billion of stock market investment (Jan

9), and the available investment for growth isworth

the cost and inconvenience of dealing with the

Rollercoaster.

IRN

Rentalcompanies

andstockmarkets

Jeff Eisenberg has spent 18

years in theequipment and rental

industry. He startedand ledGenie

Financial Services inEurope,

providing finance for largeand

small rental companiesall over the

world. Since2000hehasheld senior positions

inanumber of European rental companies, as

well asworkingwith startupsandacquisitions.

Henowprovides consulting services to financial

institutions, equipmentmanufacturers, and

rental companies.

Contacts tel: +447900916933 email

E

quipment rental companies used stock

markets to billions of US$ for investment

over several decades. In November, US based

Neff rentals had a successful Initial Public Offering

(IPO) of its shares on the New York Stock Exchange

(NYSE), the first for years. This was followed by HSS

Hire's move for an IPO in the UK as

IRN

went to

press. For a rental company, being tradedon a stock

exchange has advantages and challenges, but we

should expect to seemore IPOs in the coming years.

Why go to the stockmarket?

“That’s where the money is.” A quote from

Willie Sutton, when asked why he robbed banks,

last century. But the logic applies to the stock

markets, which are larger than the private equity

fundmarket.

The NYSE is capitalised at approximately US$25

trillion (€21 trillion), while the global private equity

market isperhapsUS$2 trillion (€1.7 trillion), thiscan

be “exit” to for private equityor company founders.

Company management generally has more

autonomy on a stock market compared to private

equity. Most investorsarepassiveand rarely require

a seat on theboard. Some stockmarket investorsdo

not require even an annual dividend.

Indeed, the IPO prospectus for Neff says, “We do

not intend to pay dividends … for the foreseeable

future.” Their investors are happy to see the

company grow in value, with a rising share price,

re-investing everything,

Is the stockmarketmoney “cheap

money?”

Once on a stock exchange, it is a straightforward

process to issue more shares, sell them on the

market, and use the proceeds for investments.

Before 2008, some rental companies did this

every year, and using the funds for acquisitions,

equipment and cashflow.

Neff’s history had rapid growth and a series of

0%

200%

400%

600%

800%

1000%

1200%

1400%

1600%

1800%

1996

1997

1997

1998

1998

1999

1999

2000

2000

2001

2001

2002

2002

2003

2003

2004

2004

2005

2005

2006

2006

2007

2007

2008

2008

2009

2009

2010

2010

2011

2011

2012

2012

2013

2013

2014

2014

Cramo

Ramirent

Lavendon

Ashtead

United

SHAREPRICES –RELATIVETO IPO (ORIGINALCURRENCY)