IRN JANUARY-FEBRUARY 2015

16

LATAM40

IRN

and its LatinAmerican

sister publication

Construcción

Latinoamericana

have compiled

the LATAM40 ranking of the

largest 40 rental companies

in this growth industry.

CLA

editor

CristiánPeters

reports.

Adeeper lookat

LatinAmerica

It isa far fromexhaustive list, andwillbecomemore

representative in subsequent surveys, but certainly

provides a valuable snapshot of this market that

we plan to build on to create a truly comprehensive

ranking like the annual IRN

100

ranking of the

largest 100 rental companies in theworld –published

in theJune issueof

IRN

everyyear.

Brazil

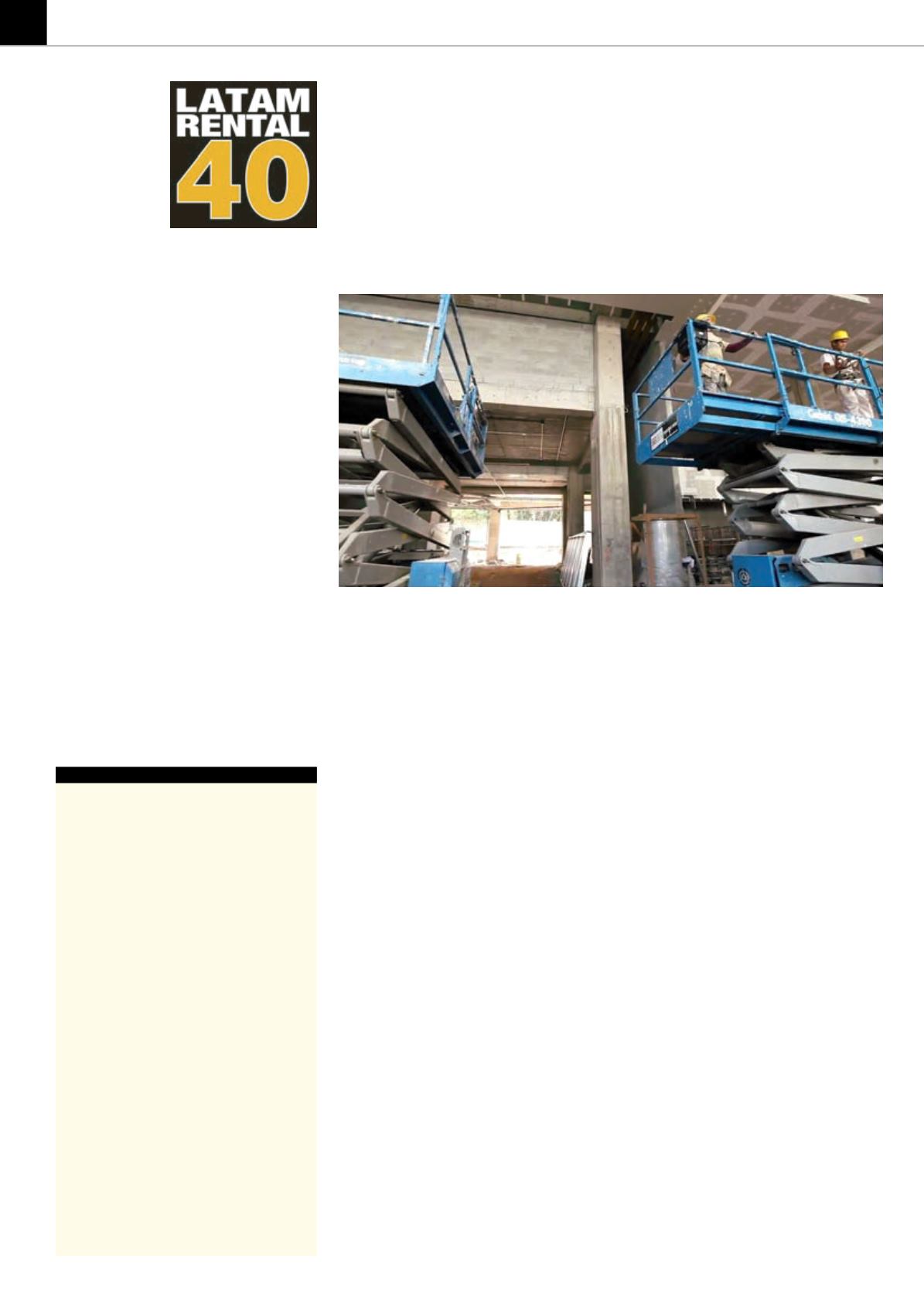

The rental industry is gaining ground in Latin

America, with Brazil emerging as a clear example. A

few decades ago, it was common that construction

companies owned 100% of their equipment fleets,

but today – according to estimates from rental

association the Associação dos Locadores de

Equipamentos para a Construção Civil (ALEC) – 30%

of themachines are rented.

And it is expect that this proportionwill reach 70%

in the future, according toFernandoForjaz, president

of the organisation. The executive was optimistic

about the performance of the rental market in 2014,

and said he expected to see growth of between 20%

and30%.

In fact, according to a recent study ran by ALEC,

48.6% of the companies surveyed experienced an

increase in revenue during the first half of 2014

compared to the secondhalf of 2013, andonly 22.9%

scored knockdowns.

Oneof the interesting aspects of the rentalmarket

is that the industry continues to grow whether

the construction sector is depressed or not. Latin

American construction companies are migrating

towards rental and this is a trend that appears to be

irreversible, as they are noticing the advantages of

nothavinga fixedassetorworryaboutmaintenance.

Mexico

An example of the above is Mexico, whose

construction industry showed declines during 2013,

but even then the three rental companies from this

country that supplied data for the LATAM40 showed

year-on-year increases in rental revenues.

Máquinas Diesel (Madisa) had revenues totalling

US$74million (€64million) thanks to a 6% increase;

Entergi had an increase of 9% and revenues of over

US$12 million (€10million) while GTC Construcciones

yEquiposexceededUS$3.5million (€3million) thanks

toa2% increase in sales.

But there isaneed tobecautious. Even if thevision

in relation to themarket is optimistic, it varies from

country to country. Colombia has been reactivating

infrastructure, coal mining and fuels projects, for

instance, while Chile and Peru on the other hand,

have felt the impactof lowerminingactivity recently.

Results

Latin American companies are generally reluctant

to provide financial information and therefore it

has proven difficult to provide a table that truly

represents the industry.

According to ALEC, it could be projected that the

rentalmarket inBrazil generates revenues of around

US$8 billion (€6.9 billion). Extrapolating this figure,

considering that Brazil represents about 40% of

the construction market in the region, it might be

estimated that the Latin America rental industry

moves about US$20billion (€17billion) annually.

However, it must be taken into consideration that

there are countries with very immature markets

such as Argentina. According to Biscayne Rent, this

country’s rental market could reach US$305 million

(€263million) by2017.

The 40 companies listed in the ranking produced

revenues totalling US$2.29 billion (€1.98 billion)

during 2013, therefore become a representative

sample of about 11% of the estimated industry

total. These 40 companies handle 430 warehouses

in the continent and employ over 15330 people. We

hope this gives some broad clarity in relation to the

market situation.

Notesand thanks

■

CLA

and

IRN

are grateful to all those

companies and individualswho contributed

information for this study, particularly

Caterpillar. If youhave any comments or

would like tobe includednext year, please

contact

CLA

editor, CristianPeters at cristian.

or

IRN

editor, HelenWright

at

.

■

The ranking is basedon rental revenues in

2013.

■

Entriesmarked (Est) have been estimatedby

CLA

and

IRN

.

■

* For international businesses, revenues in

the table relate to activities in LatinAmerica

only.

■

** Estimate basedon average statistical

relationshipbetween 'Crane Index' from

IC

50

survey in

International Cranes and Specialized

Transport

- a sister publication to

CLA

and

IRN

- aswell as and rental revenue data

collected from

IRN

's 2014 IRN100 survey

(where crane companies appear inboth

surveys)

.

■

Revenues have been convertedusing the

average value of the currency in 2013.

T

he Latin American rental market is growing

steadily. The region is still far from the levels

that can be found in markets such as Europe

orNorthAmerica, but certainly theequipment rental

concept is becoming increasingly common in the

region.

IRN

teamed up with its Latin American sister

publication

Construcción Latinoamericana

(

CLA

-

which is published in Spanish aswell as Portuguese)

to take adeeper look at this fast-movingmarket and

compile a ranking of the largest rental companies in

the region, basedon rental revenues for 2013.

Getting quality data and responses from this

fledgling market proved challenging, so this first

versionof the rankinghasbeendubbed theLATAM40

– data gathered on the 40 largest rental companies

in LatinAmerica.