IRN JANUARY-FEBRUARY 2015

14

ERA/

IRN

RENTALTRACKER

¼

Worse

Same

»

Better

Balanceof opinion

Q4-14

+29.5%

»

42.8%

43.8%

¼

13.4%

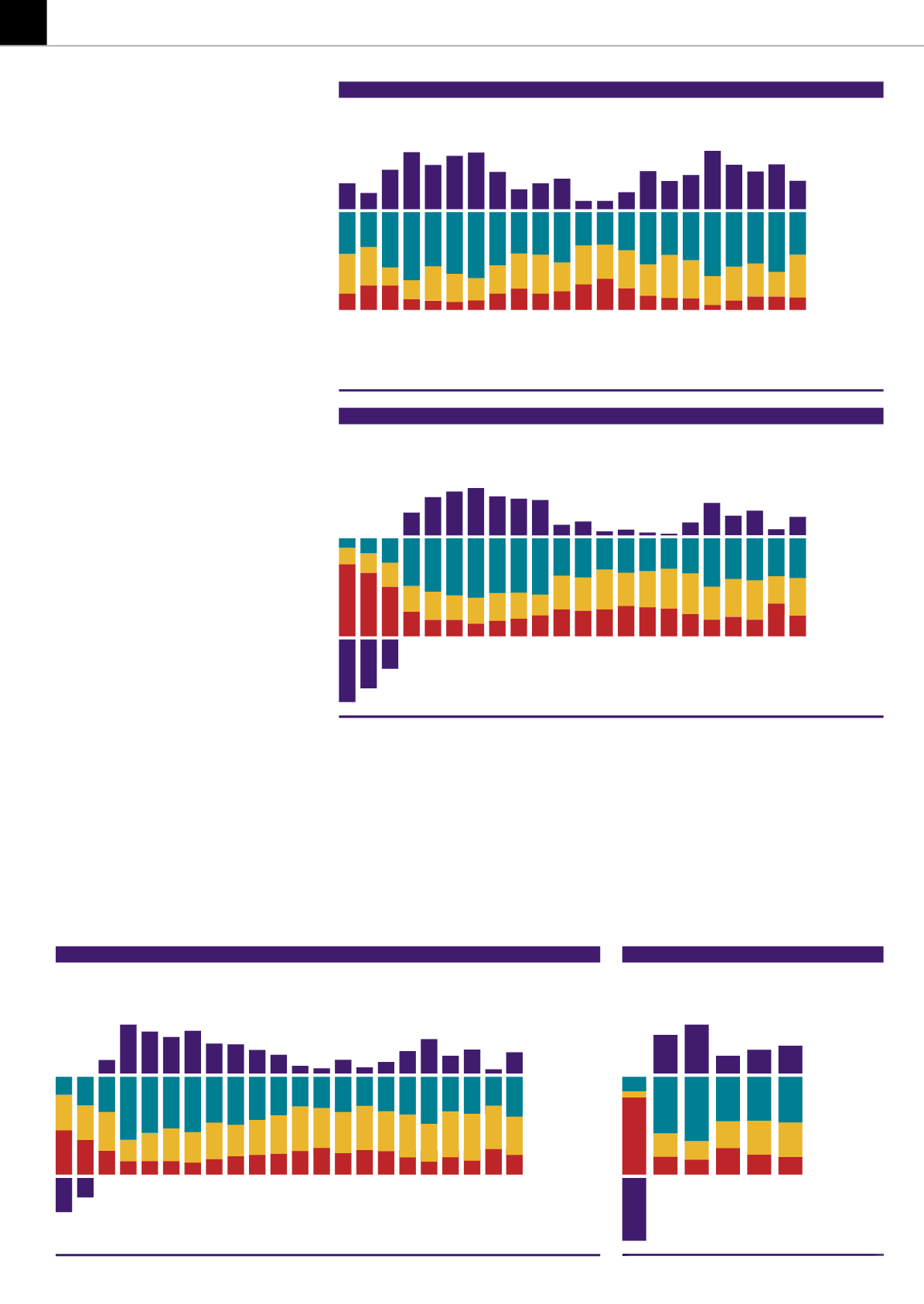

FIGURE 2

Europe: Expectations foryear fromnow

Q3/09

Q4/09

Q1/10

Q1/11

Q1/12

Q1/13

Q1/14

Q3/10

Q3/11

Q3/12

Q3/13

Q2/10

Q2/11

Q2/12

Q2/13

Q3/14

Q4/14

Q2/14

Q4/10

Q4/11

Q4/12

Q4/13

¼

Lower

Same

»

Higher

Balanceof opinion

Q4-14

+18.8%

»

40.2%

38.4%

¼

21.4%

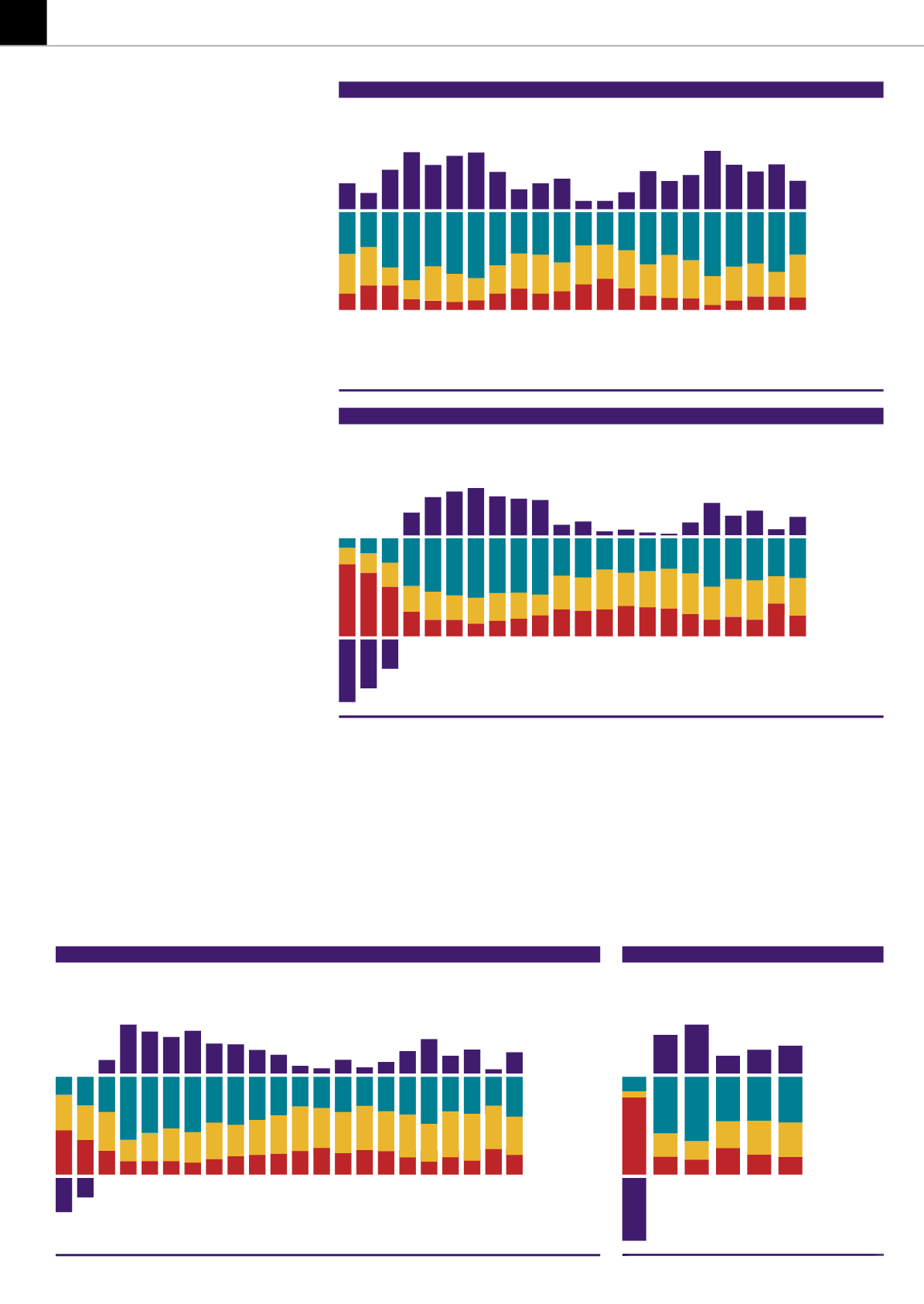

FIGURE 3

Europe: Quarterlyactivityyear-on-year

Q3/09

Q4/09

Q1/10

Q1/11

Q1/12

Q1/13

Q1/14

Q3/10

Q3/11

Q3/12

Q3/13

Q2/10

Q2/11

Q2/12

Q2/13

Q3/14

Q2/14

Q2/14

Q4/10

Q4/11

Q4/12

Q4/13

-62%, also scored the lowest balance of opinion on

current business conditions in the fourth quarter –

deeper than the balance of -40% seen in the third

quarter.

Investment

Meanwhile, therewere some strong gainers when it

came to investment sentiment – topping the table

of respondents expecting to increase investment by

over 10% in 2015 were Nordic companies, with 80%

stating that this was the case, a big rise compared

to the 38% in the thirdquarter.

TheUK came secondon thisquestion, with48%of

respondents planningonupping investment byover

10% in 2015 (after the higher levels of investment

already seen in 2014), while the European average

stood at 31%. Nevertheless, the overall positive

balance of respondents expecting to increase fleet

investment in 2015 stood at +10.6% – this is actually

its lowest level since the thirdquarter of 2013.

Looking at forecasts for 12 months’ time, the

most upbeat set of respondents came once again

from the UK, with 82% forecasting business to be

better or much better a year down the line. This

represented an improvement on last quarter’s 64%.

Nordic, Italian and German respondents also beat

the European average for this metric, which stood

at 43% for the fourth quarter, down slightly from

45% in the last survey.

Respondents from Southern European companies

also registered more positive sentiment than in

previous surveys. Spain and Italy reported some

improvements in the fourth quarter, particularly in

time utilisation trends (Spain) and forecasts for 12

months ahead (Spain and Italy).

However, the sample size for Spain remains

stubbornly low, so Spanish results should be

treatedwithadegreeof caution. And, of course, any

improvement in Spain and Italy has to be viewed in

the context of a downbeat wider economy.

Overall for Europe, the balance of opinion (the

difference in the proportions of respondents seeing

positive and negative trends) on time utilisation

stood at +22% at the end of the fourth quarter, a

big jump compared to the+3.2% thatwas registered

in the last survey, and the second highest level for

2014 as awhole.

Strong sentiment from Germany and the UK

skewed thismetric somewhat, with83%of Germany

respondents reporting increasing utilisation in the

fourthquarter, and81%of UK companies.

Employment intentions also recovered compared

to the downbeat third quarter, with an overall

balance of +14.6 of respondents saying they

expected to increase their number of employees in

the next quarter. However, thiswas still the second-

lowest balance of opinion on this question for the

year 2014 as awhole.

Russia

The fourth quarter survey also attracted enough

respondents from Russian rental companies to

warrant inclusion – albeit still a small sample that

should be treated with caution. When it came to

current business conditions, the balance of opinion

evened out at 0%, with asmany Russian companies

feeling conditionswere improving as those that felt

theywere deteriorating.

On other questions, 17% of Russian companies

reported year-on-year growth in the fourth quarter,

16% said fleet utilisation was increasing, 80% said

they would employ more staff in the next quarter,

50% felt business conditions would improve in

12 months’ time and 20% said they expected to

increase fleet capital expenditure by over 20% in

2015.

FIGURE5

Europe: Full-year

2009

2010

2011

2012

2013

2014

Q4-14

+28.8%

»

46.8%

35.2%

¼

18.0%

¼

Deteriorating

Same

»

Improving

Balanceof opinion

Q4-14

21.6%

»

41.2%

39.2%

¼

19.6%

FIGURE4

Europe: Timeutilisation trend

Q3/09

Q4

/09

Q1/10

Q1/11

Q1/12

Q1/13

Q1/14

Q3/10

Q3/11

Q3/12

Q3/13

Q2/10

Q2/11

Q2/12

Q2/13

Q3/14

Q4/14

Q2/14

Q4/10

Q4/11

Q4/12

Q4/13

NOTE:

Activity level compared toprevious year.