IRN JANUARY-FEBRUARY 2015

13

ERA/

IRN

RENTALTRACKER

Gainingground?

After a downbeat third

quarter, sentiment picked up

to some extent in the final

threemonths of 2014, but

caution still reigns.

Thesurvey

In total approximately 120 companies in Europe

responded to the ERA/

IRN

RentalTracker survey

for the fourth quarter of 2014. The survey was

carried out at the end of December and start of

January.

Our thanks to all the companies who

participated and to the following organisations

which helped distribute the European survey to

theirmembers and contacts:

■

Assodimi (Italy)

■

ConfalQ (Spain)

■

ConstructionPlant-hireAssociation (CPA) (UK)

■

DanishRental Association

■

DLR (France)

■

TheAssociationof FinnishTechnical Traders

■

HireAssociationEurope (HAE) (UK)

■

NorwegianRental Association

■

RusRental (Russian rental consultant and

trainingorganisation)

■

VerhurendNederland (NetherlandsRental

Association)

The RentalTracker for Europe is a joint venture

between

IRN

magazine and the European Rental

Association (ERA). If you have suggestions about

how the survey could be improved, then please

contact the ERA on

or Helen

Wright,

IRN

Editor, at

year was 32.5%; demonstrating that fourth quarter

sentiment is still far off levels that we have seen in

the recent past.

Continuing the trend of previous quarters, the

UK consistently topped our charts or came a close

second on every survey question. This reflects the

generally better GDP growth performance of the

UK economy and an associated upturn in building

activity – particularly housing – that is having a

positive impact on the rentalmarket.

It is worth making the point that we get more

responses from the UK than any other country,

so positive results in the UK skew the results for

the whole of Europe. However, the proportion of

UK results in the total survey has not changed

significantly (UK respondents tend to represent

between 10% and 15% of overall survey responses),

so we are recording broadly like-for-like changes

betweenquarters.

The UK was joined by Nordic countries and

Germany in fairly consistentlybeating the European

average formost surveyquestions,while –generally

speaking – respondents from France, the Benelux,

multinational companies and Italy tended to

register below the European average for the fourth

quarter survey.

Q4Growth

Overall, 40% of all respondents reported year-on-

year growth in the fourthquarter, compared to 39%

in the third quarter. The UK came top with 77%, up

from 73% in the third quarter, followed by Germany

and the Benelux. The biggest faller, however,

was the multinational sector, where just 8% of

Optimism

PERCENTAGEFORECASTING

BUSINESSTOBE ‘BETTER’ OR

‘MUCHBETTER’ 12MONTHSAHEAD

(last quarter results inbrackets)

TABLE 1

UK

82%

(64%)

Nordic

67%

(56%)

Russia

50%

(NA)

Italy

44%

(14%)

Germany

43%

(75%)

All Europe

43%

(45%)

Spain

40%

(33%)

Benelux

37%

(56%)

Multinationals

34%

(45%)

France

15%

(32%)

Sponsored by:

respondents reported growth, down from 45% in

the third quarter.

In fact, sentiment from the multinational sector

slipped almost across the board compared to the

last survey, with only employment intentions and

utilisation trends showing improvements from the

thirdquarter, albeitmarginal.

Multinationals also remain among the least

optimistic looking ahead a year – only French

companies had fewer respondents forecasting

‘much better’ business conditions 12 months from

now.

French respondents were not only the most

downbeat on conditions in a year’s time, but at

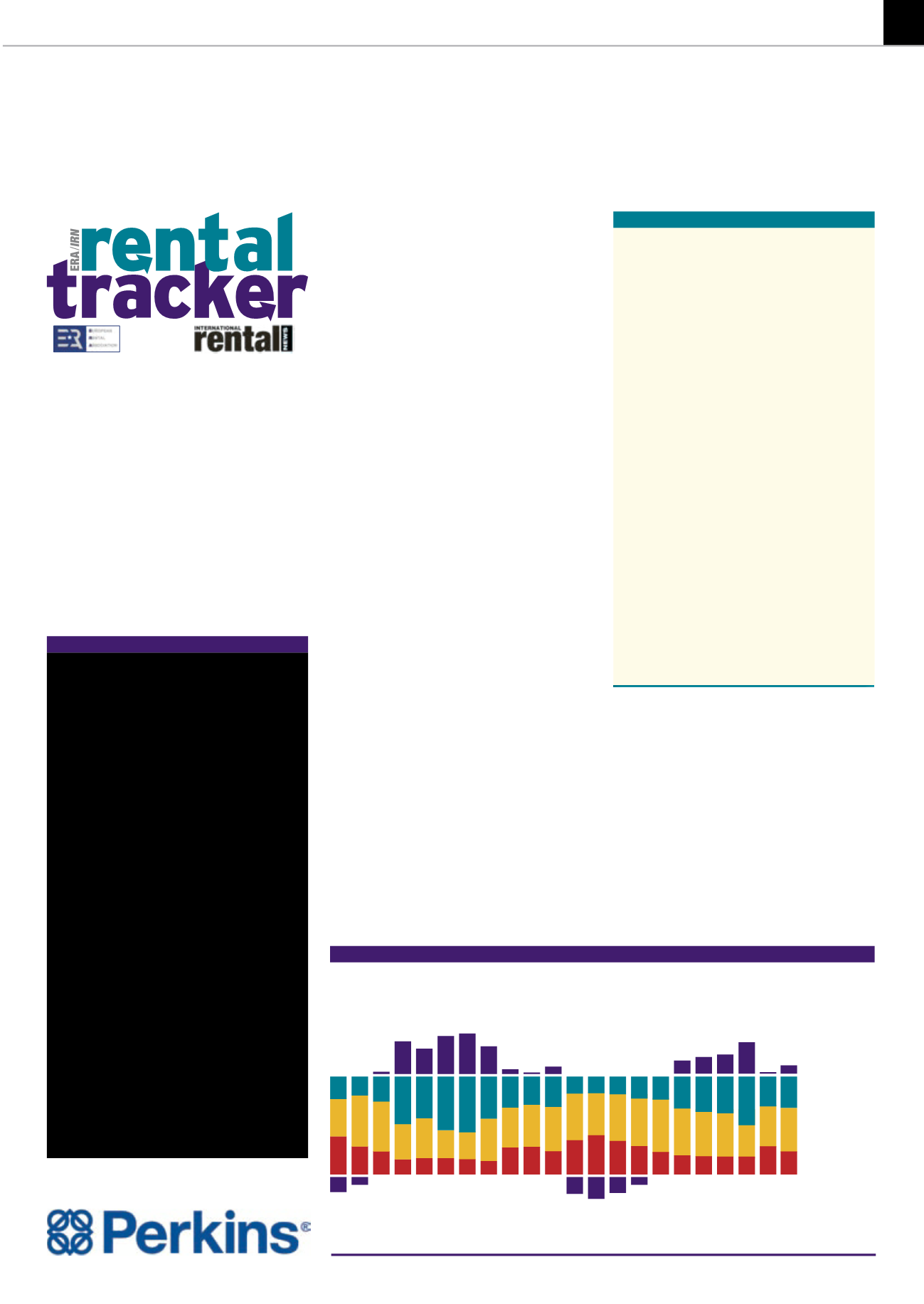

A

s far as current business conditions are

concerned, sentiment at first glance seemed

to have improved in the fourth quarter ERA/

IRN

RentalTracker survey. Indeed, 31.9% of overall

respondents reported improving conditions and

23.5% reported deteriorating conditions, resulting

in a positive balance of +8.4%of respondents.

While this is undoubtedly better than the +1.7%

balance at the end of the third quarter, the last

survey was notably more downbeat than the rest

of the year. This makes any improvement in fourth

quarter sentiment paint perhaps an unrealistically

rosy picture by comparison.

Indeed, thebalanceofopinion forcurrentbusiness

conditions at the end of the second quarter of last

¼

Deteriorating

Same

»

Improving

Balanceof opinion

Q4-14

+8.4%

»

32.0%

44.5%

¼

23.5%

FIGURE 1

Europe: Businessconditionsnow

Q3/

09

Q4/0

9

Q1/10

Q1/11

Q1/12

Q1/1

3

Q1/14

Q3/10

Q3/11

Q

3/12

Q3/13

Q2/10

Q2/11

Q2

/12

Q2/13

Q3/14

Q4/14

Q2/14

Q4/10

Q4/11

Q4

/12

Q4/13