41

BICES/IRC REPORT

IRN NOVEMBER-DECEMBER 2013

from customers. Many of the larger distributors

in China now have hundreds of low-hours, used

machines available. “That is why rental has become

such a hot topic for dealers,” she said.

These pressures are forcing local manufacturers

to make changes. In the case of Zoomlion, for

example, one answer is a shift to new markets, with

the company announcing at BICES that it aims to

be manufacturing agricultural machines and heavy

trucks in China within three to five years through

collaborations and joint ventures with western

manufacturers. The company has previously focused

almost entirely on construction equipment.

Another strategy is to continue to increase export

sales, something that Sany, for example, is now

focused on. The company’s Road Machinery division

told

IRN

that it will start to sell its motor graders

in North America next year as a first step into the

market, with compaction machines to follow. Three

models will be assembled at Sany’s plant in Atlanta.

Around 15% of Sany Road Machinery’s revenues are

generated by export sales, mainly to emerging South

America, Middle East and Asia Pacific.

Xie Zhixia, chairman of Sany Road Building, told

IRN

that the intention was to increase export sales to 30%

of the total within three years and 40% within five.

Much of this growth will be in developing markets, but

the move into North America is indicative of Sany’s

ambition to compete in mature construction markets.

Elsewhere at the show there was continued evidence

of the acquisitiveness of China’s manufacturers, with

Beijing Jingcheng Heavy Industry’s stand taken up

with machines from Italian aerial platform supplier

Airo Tigieffe – of which Jingcheng is now majority

owner – and Japan’s Nagano, acquired in late 2011.

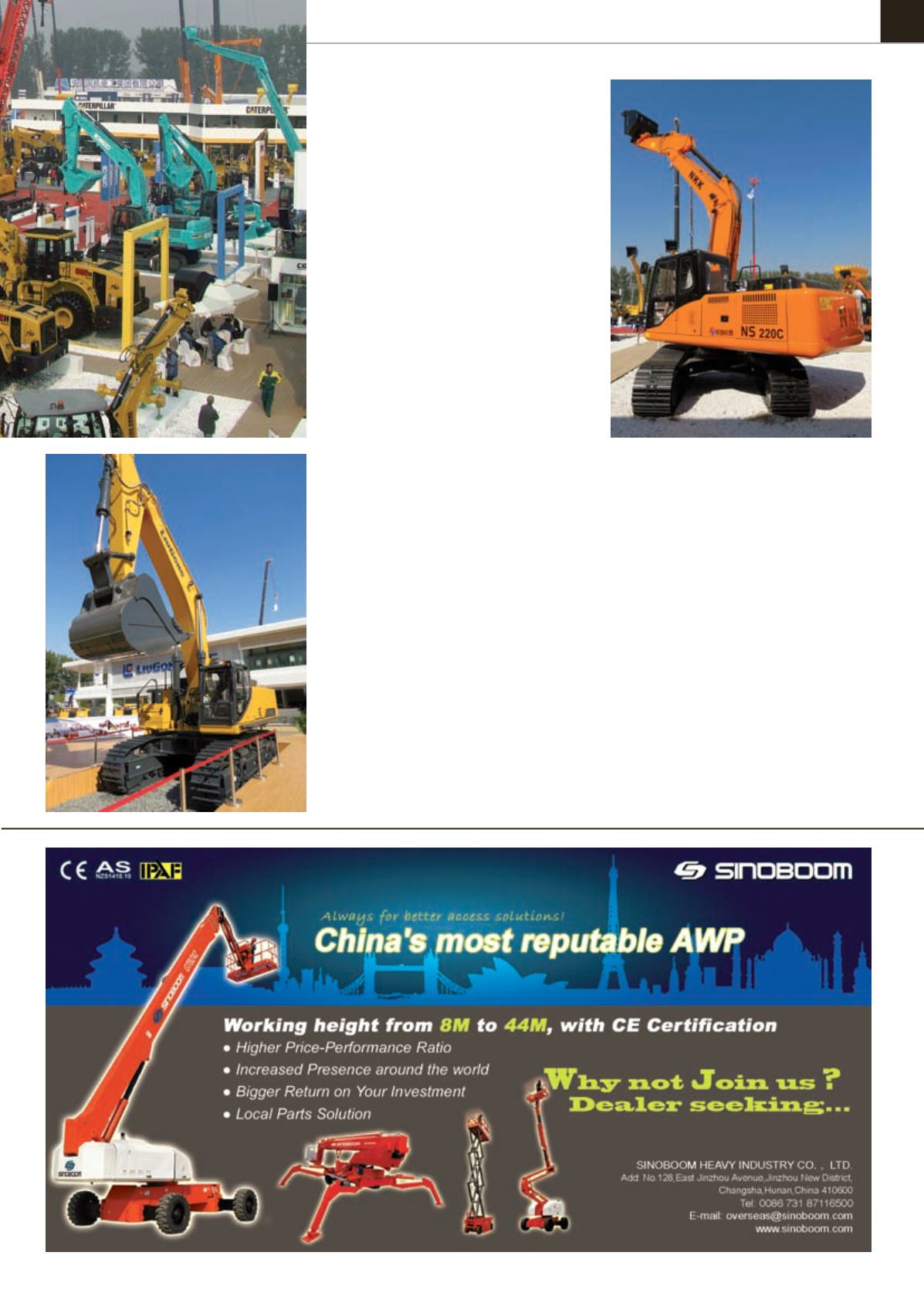

Jingcheng Nagano makes excavators in Beijing,

in addition to the Nagano-made sub-8 t excavators

produced in Japan (and sold as Hanix in Europe).

In China, where the business uses the NKK brand,

it is trying to expand its excavator sales and part of

the strategy is to expand upwards in sizes beyond

Nagano’s traditional 8 t limit. At BICES, it showed pre-

production 22 t and 30 t crawler excavators, and there

are plans for the range to go up to 45 t, eventually.

Also on the cards is a new series of mini excavators.

Aerial platforms were again much in evidence,

although there was no sign of the low-cost Genie

telescopic boom and scissor lift that Terex AWP

launched for Chinese markets last year.

Terex AWP says it has side-lined the lifts - the

12 m V1200 boom and 5 m push-around PS500 scissor

– because it found that Chinese customers were

looking for its existing products.

Chinese manufacturer Dingli launched its new

11.5 m working height AMWP81115 mast lift with jib at

the show, destined for delivery to dealers in western

Europe and Australia before the end of the year.

The AMWP81115 mast lift with jib is modelled on the

Toucan machines now produced by JLG.

Also new at BICES were scissors and vertical mast

products from US/Chinese manufacturer EHM, which

is targeting markets in the US, Europe and China.

Among its products is the all-electric, vertical mast

E12 Master, available 4.3 m and 5.5 m platform heights.

The focus next year turns to Shanghai, with the

return of the bigger Bauma China exhibition, taking

place on 25 – 28 November, 2014.

IRN

Jingcheng Nagano’s new 22 t NKK NS

220C excavator on show. A new 30 t

unit was also launched at BICES.

LiuGong Machinery used BICES

to introduce its largest ever

excavator, the 70 t 970E,

developed for large scale

quarrying and mining

operations.